The Canada Employment Amount: Another Tax Credit

You can claim the Canada employment amount if you reported employment income for the year . This amount is designed to help Canadians with some of their work-related expenses such as uniforms, home computers, and supplies they needed to do their job.

In 2020, youll be able to claim $1,245 or the total of the employment income that you reported on your return . If youre a resident of the Yukon and youre eligible for the federal amount, you can also claim an additional $1,245 against your taxes!

Keep in mind, you wont be able to claim this credit if youre only reporting self-employment income. Youll need to report income from a T4 slip to be eligible for the Canada employment amount.

Proof Of Timely Filing

How To Authorize A Representative

An individual with proper authorization for the business may consent to the release of confidential information about account with TRA to a specific representative a firm and/or individual also known as a third-party organization.

An individual with proper authorization for the business includes a:

- owner

- trustee of an estate

- individual with delegated authority

If your representative is not enrolled as a Third-party organization with TRA, you must complete the Alberta Consent Form Corporate Income Tax and submit to TRA.

You May Like: What Does Locality Mean On Taxes

When It Pays To File

For those few who dont legally have to file, it pays sometimes to send in a return anyway.

This is the case for individuals who dont earn much but might be eligible for the earned income tax credit. This benefit is available to qualified individuals even if they owe no tax, meaning they would get money back from the federal government. Many people think the credit is available only to parents. Its not. But the credit amount is greater for eligible low-wage taxpayers with children.

Plus, the IRS says that most individual taxpayers are due a tax refund. But those taxpayers must send in a Form 1040, Form 1040A or Form 1040EZ to get that cash.

You can check out the filing requirements section of IRS Publication 17 for more details.

Once youve determined that you need to file taxes, your next question is likely to be when do I have to file taxes? This year, the deadline for filing your 2020 tax return is Thursday, April 15, 2021. If youre still not sure whether you must file a tax return, ask a tax professional, call the IRS at 829-1040 or make an appointment at your nearest IRS Taxpayer Assistance Center.

What If I Only Receive Social Security Benefits

In most cases, if you only receive Social Security benefits you wouldn’t have any taxable income and wouldn’t need to file a tax return.

One catch with Social Security benefits is if you are married but file a separate tax return from your spouse who you lived with during the year. Then you will always have to include at least some of your Social Security benefits in your taxable income to see if it is greater than your standard deduction.

Also Check: Where Is My Federal Tax Refund Ga

How Can I Reduce My Taxable Income

One way to reduce taxable income is by topping up your retirement savings with traditional IRAs and 401s, up to the maximum allowable contribution.

Contributions to Health Savings Accounts and Flexible Spending Accounts are another way to shrink your taxable income.

You could potentially earn thousands of dollars before paying taxes. However, even when your income falls below the cut-off level and you do not have to pay taxes, you need to file to taxes to get a refund check.

RELATED ARTICLES

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: How Can I Make Payments For My Taxes

What Are Other Reasons You May Be Required To File

There may be other situations in which youre required to file. The IRS specifically calls these out in the 1040 instructions.

- Special taxes If youll owe the alternative minimum tax, tax on a retirement plan, household employment taxes, Social Security or Medicare taxes on income you didnt report, write-in taxes , or you have to repay a tax credit you received in a previous year

- You received distributions from a health savings account, Archer MSA or Medicare Advantage MSA

- Youre self-employed and had net earnings from self-employment of $400 or more

- A church or qualified church-controlled organization paid you wages of $108.28 or more

- You, your spouse or a dependent were enrolled in a marketplace insurance plan and you received advance payments of the tax credit intended to help pay your premiums

- You, your spouse or a dependent received an advance payment of the health coverage tax credit

- Income under section 965, which deals with foreign income

B Which Income To Report

A nonresident alien’s income that is subject to U.S. income tax must generally be divided into two categories:

- Income that is Effectively Connected with a trade or business in the United States

- U.S. source income that is Fixed, Determinable, Annual, or Periodical

Effectively Connected Income, after allowable deductions, is taxed at graduated rates. These are the same rates that apply to U.S. citizens and residents. Effectively Connected Income should be reported on page one of Form 1040-NR, U.S. Nonresident Alien Income Tax Return. FDAP income is taxed at a flat 30 percent and no deductions are allowed against such income. FDAP income should be reported on page four of Form 1040-NR.

Also Check: What Does H& r Block Charge

What Is A Child’s Income Tax Rate

The Tax Cuts and Jobs Act changed the rates for the kiddie taxes. During 2018 through 2025 all net unearned income was to be taxed using the brackets and rates for trusts and estates instead of parent’s individual rates. The new rates were as high as 37% on only $12,070 of income. This change proved so unpopular it was rescinded in 2020 and the old rules put back in place. Starting in 2020, income tax on unearned income over the annual threshold must be paid at the parent’s maximum tax income tax rate, not the rates for trusts and estates. For 2019 and 2018, parents have the option of using either their individual rates or the trust and estates rates. For details, see the article “The Kiddie Tax.”

For federal income tax purposes, the income a child receives for his or her personal services is the child’s, even if, under state law, the parent is entitled to and receives that income. Thus, dependent children pay income tax on their earned income at their own individual tax rates.

For more on tax rules for children, see IRS Publication 929, Tax Rules for Children and Dependents.

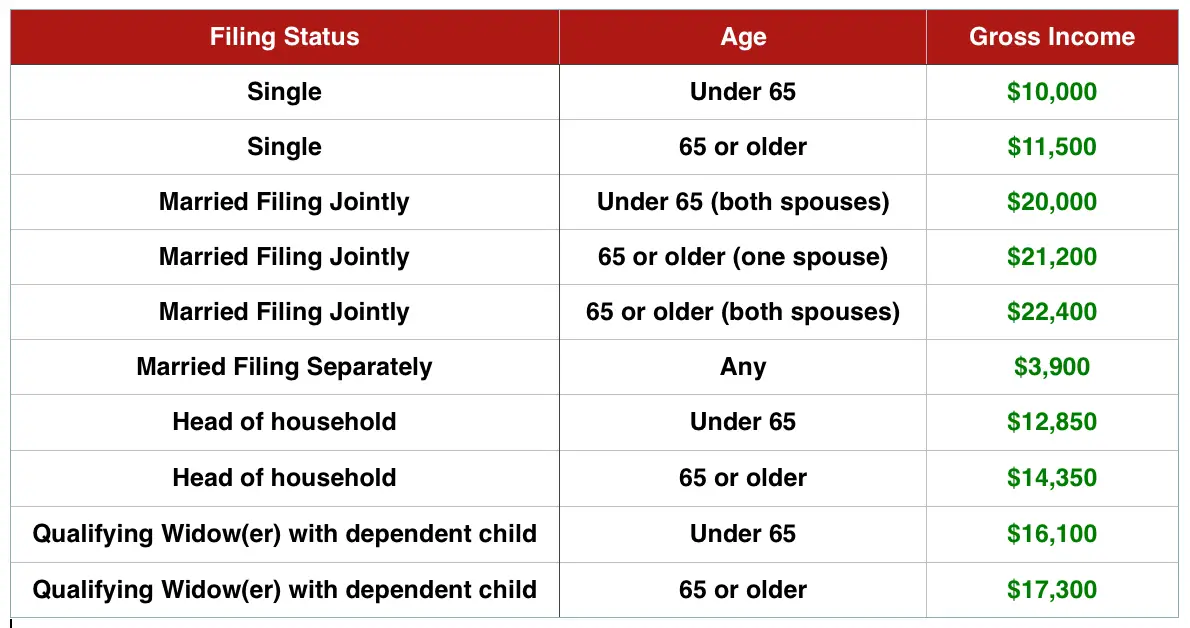

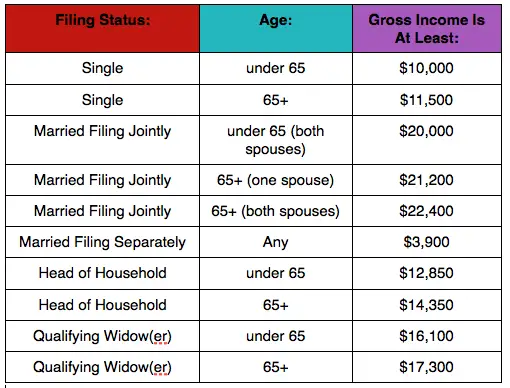

How Much You Have To Make Based On Filing Status

So are you planning on filing single , married filing jointly, married filing separately or head of household? Let’s break them all down.

Single: If you are single and under the age of 65, the minimum amount of annual gross income you can make that requires filing a tax return is $12,200. If you’re 65 or older and plan on filing single, that minimum goes up to $13,850.

How much you have to make if you’re married and filing jointly will depend on the age of both you and your spouse, generally coming out to double what someone filing single would require. If both spouses are under 65, you need to make at least $24,400. If both spouses are 65 or older, you will have to make a minimum of $27,000. If just one of you is 65 or older, split the difference you need to make $25,700.

Qualifying Widower: If you are a qualifying widower with a dependent child, you are also able to file as married filing jointly, and the age disparity still applies: at least $24,400 if you’re under 65, at least $25,700 if you’re 65 or older.

Those who are married and filing separately, interestingly, only require a gross income of $5 to have to file a tax return.

Head of household: If you qualify for head of the household status and look to file as such, you have to file a tax return if you make $18,350 or more under the age of 65. If you are 65 or older, that number is $20,000 in gross income.

You May Like: How Much Does H & R Block Charge To Do Taxes

Should I File A Tax Return Even If Im Not Technically Required To

There are some cases where its advisable to file a tax return anyway, even if you could legally decline.

First, if you had federal income tax withheld from your pay, or if you made estimated tax payments, you should file in order to get any surplus withholding refunded back to you.

Second, there are a few tax that can give you a refund even if you didnt make enough income to file. These are called refundable credits. Nonrefundable credits can only apply against taxes you owe.

- Earned Income Tax Credit You could qualify for the EIC if you worked but didnt earn a lot of money. Your credit amount will depend on income level, filing status and how many dependents you claim.

- Additional Child Tax Credit This credit could be available if you have at least one qualifying child and you didnt receive the full amount from the Child Tax Credit.

- American Opportunity Credit The maximum credit for this education credit per student is $2,500 for the first four years of postsecondary education. Up to $1,000 of the credit can be refundable.

With these credits, you have to file in order to receive the benefit.

Does Everyone Need To File An Income Tax Return

OVERVIEW

Not everyone is required to file an income tax return each year. Generally, if your total income for the year doesn’t exceed certain thresholds, then you don’t need to file a federal tax return. The amount of income that you can earn before you are required to file a tax return also depends on the type of income, your age and your filing status.

Apple Podcasts | Spotify | iHeartRadio

Also Check: How Can I Make Payments For My Taxes

Consider Your Gross Income Thresholds

Most taxpayers are eligible to take the standard deduction. The standard tax deduction amounts that you’re eligible for are primarily determined by your age and filing status. These amounts are set by the government before the tax filing season and generally increase for inflation each year.

The standard deduction, along with other available deductions, reduces your income to determine how much of your income is taxable. As long as you don’t have a type of income that requires you to file a return for other reasons, like self-employment income, generally you don’t need to file a return as long as your income is less than your standard deduction.

For example, in 2020, you don’t need to file a tax return if all of the following are true for you:

- Under age 65

- Don’t have any special circumstances that require you to file

- Earn less than $12,400

What To Do In The Event Of Dispute

Inevitably, clients and tax accountants might disagree over the appropriate price of tax preparation services. Treasury Department regulations protect you in fee disputes. You’re entitled to receive your original tax documents back from the accountant even if you haven’t paid the fee.

Accountants can keep any forms, schedules, and documents that they’ve preparedthey don’t have to turn these over to you without compensation.

Recommended Reading: Can You Change Your Taxes After Filing

How Much Can A Small Business Make Before Paying Taxes

If you operate a small business, you must pay taxes on the income, regardless of the profit and loss. The tax return you must file depends on how your business is structured. For example, if you have a sole proprietorship youll file the schedule C with your personal tax return.

If youre a freelancer, you must also pay self-employment taxes for income more than $400. These taxes cover Medicare and social security taxes.

Sole proprietors must file IRS Form 1040, Schedule C and Schedule SE if your net income is greater than $400. If you have an employee, you will need to withhold federal and state income taxes and Social Security and Medicare taxes for each employee.

Should I File A Return Anyway

Even if youre not required to file, sometimes its in your own best interest to do so anyways, for the following reasons

- You want to claim a refund.

- Entries on your tax return determine if youre eligible for certain federal and provincial benefit programs. Even if you had no income, you still may qualify for the GST/HST Credit, or provincial benefits such as the Ontario Trillium Benefit. You can find a complete list of provincial benefit programshere.

- Your RRSP contribution limit starts growing as soon as you earn any income. Even if youre not expecting a refund, the more RRSP contribution room, the better.

- If you want to claim the Canada Workers Benefit or if you want to continue receiving your Canada Child Benefit

- If you attended school and have eligible tuition fees, you must declare the amounts on your tax return, even if you are not using them. You might not need to use the credits this year, but in order to carryforward or transfer them, they must be reported on your current year tax return.

- If you or your spouse want to continue to receive Guaranteed Income Supplement on your Old Age Security payments.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Recommended Reading: How Can I Make Payments For My Taxes

Do I Need To File Even If Im Not Required To By Filing Status Age And Income Level

In some cases, yesyou will still need to le a tax return if any of the following apply:

- You owe any taxes, such as alternative minimum tax, taxes on a retirement plan distribution, household employment taxes, and Social Security and Medicare taxes that were not withheld from income.

- You received a distribution from a health savings account, Archer MSA, or Medicare Advantage MSA.

- You had at least $400 in self-employment income.

- You earned $108.28 or more from a church or qualified church-controlled organization that is exempt from employer Social Security and Medicare taxes.

- You received an advance payment of the Premium Tax Credit for health insurance bought from a health insurance marketplace. You should receive Form 1095-A with the amount of the advance payments.

- Advance payments of the health coverage tax credit were made for you, your spouse or a dependent. You should receive Form 1099-H with the amount of the advance payments. Note: For tax year 2020, any excess amount of advance premium tax credit payments received doesnt have to be repaid, according to the American Rescue Plan .

- You were required to file Form 965 for a triggering event or Form 965-A for an elected installment payment.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: How Much Does H& r Block Charge To Do Taxes