Chapter 6 Principal Residence

When you sell your home, you may realize a capital gain. If the property was solely your principal residence for every year you owned it, you do not have to pay tax on the gain. If at any time during the period you owned the property, it was not your principal residence, or solely your principal residence, you might not be able to benefit from the principal residence exemption on all or part of the capital gain that you have to report.

If you sold property in 2020 that was, at any time, your principal residence, you must report the sale on Schedule 3, Capital Gains in 2020 and Form T2091, Designation of a Property as a Principal Residence by an Individual . See Schedule 3 and Form T2091 for more information on reporting requirements.

The calculation of the principal residence exemption is limited to the number of tax years ending after the acquisition of the property during which the taxpayer was resident in Canada and the property is the taxpayers principal residence. If you sold your principal residence after October 2, 2016, and you were not a resident of Canada throughout the year in which you acquired it, different rules apply to this calculation. If you were not a resident of Canada for the entire time you owned the designated property, call 1-800-959-8281.

This chapter explains the meaning of a principal residence, how you designate a property as such, and what happens when you sell it. It also explains what to do in other special tax situations.

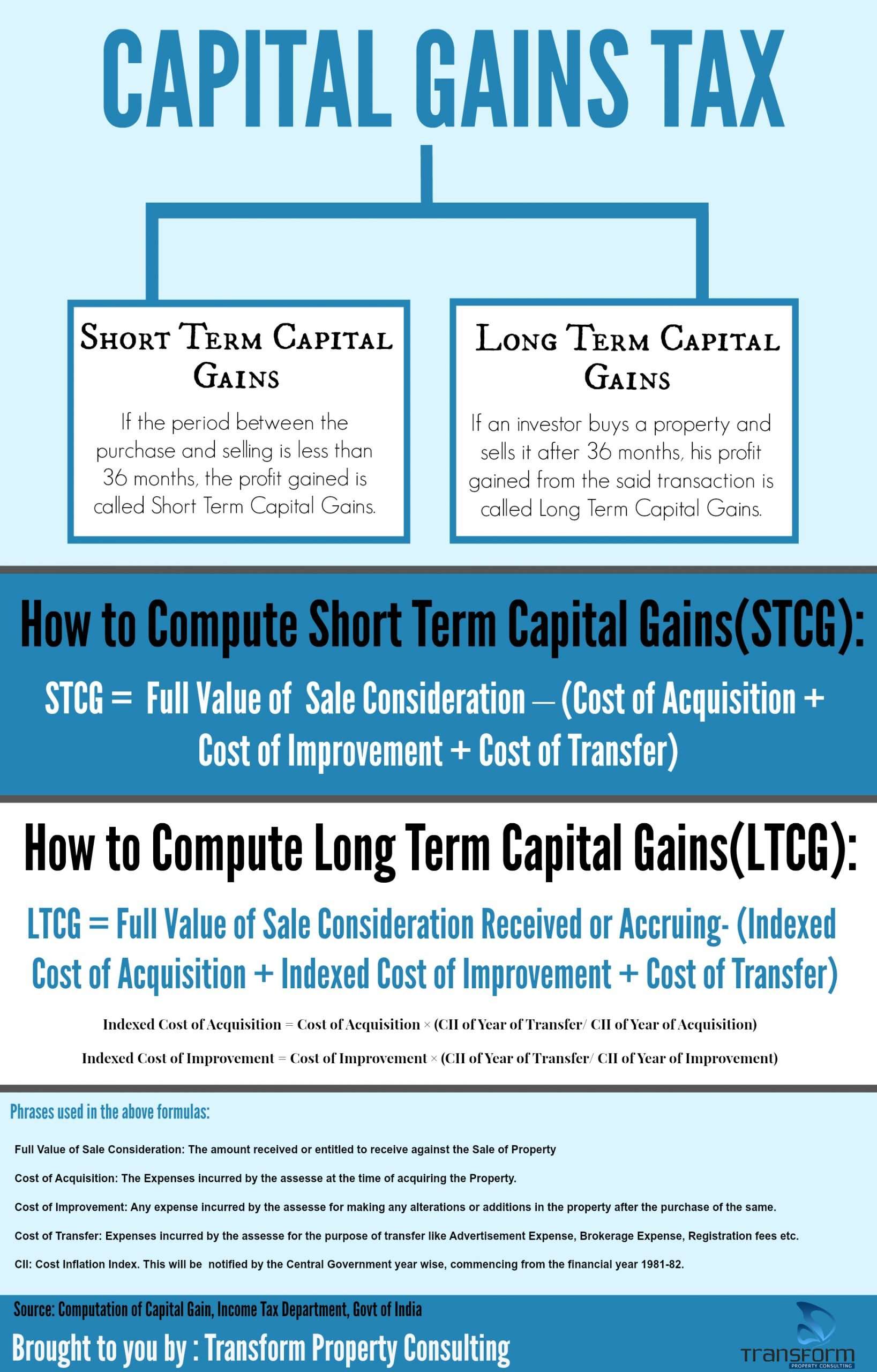

Whats Considered A Capital Gain

If you sell an asset for more than you paid for it, thats a capital gain. But much of what you own will experience depreciation over time, so the sale of most possessions will never be considered capital gains. However, youre still liable for capital gains taxes on anything you purchase and resell for a gain.

For example, if you sell artwork, a vintage car, a boat, or jewelry for more than you paid for it, thats considered a capital gain.

Property such as real estate and collectibles, including art and antiques, fall under special capital gains rules. These gains specify different and sometimes higher tax rates .

And dont forget that if youve sold cryptocurrency such as bitcoin for a gain, then youll also be liable for capital gains taxes.

Capital Gains Tax On Real Estate Example

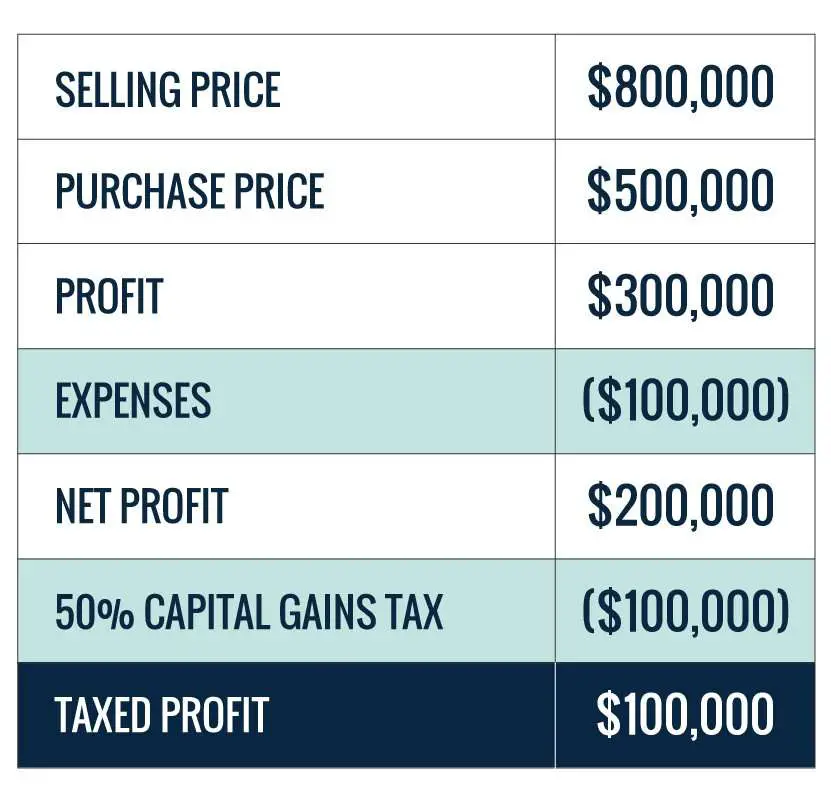

While weve explored what the capital gains tax rates of 2021 look like, lets further explore how these figures would be applied for an asset that would be classified as a capital gain. Theres nothing better than an example to help pull all of these concepts together.

Lets say that you are an individual who is filing single this year. Your annual salary is $65,000, which puts you at a tax rate of 22%. You just sold your first home for $15,000 more than the original purchase price.

If you owned the home for less than one year, then youd be subject to short-term capital gains tax. If you recall, the short-term capital gains tax rate is the same as your income tax rate. At 22%, your capital gains tax on this real estate sale would be $3,300.

If you owned the home for one year or longer, then youd be liable for the long-term capital gains tax rate. Your income and filing status make your capital gains tax rate on real estate 15%. Therefore, you would owe $2,250.

Don’t Miss: How Can I Make Payments For My Taxes

How Much Is The Capital Gains Tax On A Rental Property

If you own a rental property, the rent you collect is considered regular income, and youll pay taxes on it like a normal paycheck. But if you decide to sell the property, youll owe capital gains taxes on your profit. And since a rental is not your primary residence, you wont be able to exclude a portion of your profit.

So if you owned the property for less than a year, youll pay short-term capital gains taxes at your normal income tax rate. If you owned the property over a year, youll pay long-term capital gains taxes at a rate of 0%, 15% or 20% depending on your income.

Chapter 1 General Information

This chapter provides the general information you need to report a capital gain or loss.

Generally, when you dispose of a property and end up with a gain or a loss, it may be treated in one of 2 ways:

- as a capital gain or loss

- as an income gain or loss

When you dispose of a property, you need to determine if the transaction is a capital transaction or an income transaction. The facts surrounding the transaction determine the nature of the gain or loss.

For more information on the difference between capital and income transactions, see the following archived interpretation bulletins:

For information on how to report income transactions, see Guide T4002, Self-employed Business, Professional, Commission, Farming, and Fishing Income.

Recommended Reading: Does Door Dash Tax

Do You Only Pay Capital Gains Tax On Buy

You dont only pay Capital Gains Tax on buy-to-let properties. You pay Capital Gains Tax on the capital gain you receive from the sale of other properties that arent your main residence, including:

- Buy-to-let properties

- a self-employed sole trader

- an individual in a business partnership

You dont pay Capital Gains Tax on property owned and sold by a limited company you pay Corporation Tax which currently stands at 19% and is due to rise to a maximum of 25% from April 2023. This is because any property you own is viewed as part of your business, not a personal investment.

What If I Have Used My Home For My Business

A lot of people run their businesses from home. If you do, you need to look at how you have used your home when you sell or dispose of it before you can work out if there is any CGT to pay.

If you have been a foster carer or shared lives carer, the private residence relief on the proportion of any gain which relates to part of the property which had been set aside for the use of children or adults in your care is unrestricted.

What if I use rooms for both business and personal purposes?

If you use a room in your home for both business and private purposes for example, you use a room as an office, but you also use it as a guest bedroom this will not impact availability of relief from CGT.

What if I use a room solely for business purposes?

If you use any part of your home exclusively for business purposes for example part of your home is used as a workshop for your business that part will not qualify for main residence relief. But you will still get the relief on the part used as your main home. This means that if you sell your home at a profit, you have to work out the amount of relief due and work out if there is any CGT to pay.

Example: Ailsa home used as business premises

Ailsa uses 30% of her home exclusively as business premises and the other 70% is used as the area where she lives. When she later sells her home, she makes a gain of £120,000.

Ailsa is entitled to private residence relief of £84,000 on the part used as her home .

You May Like: 1099 Nec Doordash

What Are The Cgt Rates On Property

When it comes to property sales, CGT is charged at 18% for standard rate taxpayers and 28% for higher rate taxpayers. This is payable on any profit earned on the property minus your CGT allowance.

Tax specialists point out that CGT is only charged at 18% on the amount a seller has available in the basic rate band. Given the size of property value increases in Wimbledon Village, the basic rate band is often used up and most of the gain ends up taxed at 28% even if the taxpayer is a basic rate payer for income tax. Therefore, the rate you will pay depends on the size of the gain and your other taxable income and not just whether you are a basic rate taxpayer.

When Is Capital Gains Tax On Property Due

For UK properties sold on or after 27 October 2021, you’ll need to pay the tax owed within 60 days of the completion of the sale or disposal.

You’ll do this by submitting a ‘residential property return’ and making a payment on account.

For property sales made between 6 April 2020 and 26 October 2021, the window to pay your CGT bill was 30 days.

The government announced it was extending the deadline for people to report and pay CGT on property from 30 days to 60 days in the . This was by recommendation of the Office of Tax Simplification which said in May 2021 that the 30-day deadline was challenging for taxpayers.

Read Also: Reverse Ein Lookup Irs

How Much Is The Capital Gains Tax On Real Estate

11 Min Read | Mar 1, 2022

So you sold your home and just left the closing attorneys office with a fat check. Not just a big checkbut the biggest check youve ever held in your sweaty palm.

After the excitement fades and you recover from your celebratory steak dinner, you might be wondering: Do you have to pay taxes on a home sale? The answer is maybe.

The IRS calls profits from the sale of a home or another investment capital gains. And capital gains are taxed at different rates depending on whether the investment you made was short-term or long-term . The rates also vary depending on your income.

But, hey, dont lose hope just yet. The great news about selling a home is that the profit is often exempt from capital gains taxes. Thats right! Tax-free, baby. But just like anything tax-related, there are some hoops to jump through.

State Taxes On Capital Gains

Some states also levy taxes on capital gains. Most states tax capital gains according to the same tax rates they use for regular income. So, if you’re lucky enough to live somewhere with no state income tax, you won’t have to worry about capital gains taxes at the state level.

New Hampshire and Tennessee don’t tax income but do tax dividends and interest. The usual high-income tax suspects have high taxes on capital gains, too. A good capital gains calculator, like ours, takes both federal and state taxation into account.

Also Check: Can I Write Off Mileage For Doordash

When Do You Report A Capital Gain Or Loss

Report the disposition of capital property in the calendar year you sell, or are considered to have sold, the property.

Note

Regardless of whether or not the sale of a capital property results in a capital gain or loss, you have to file an income tax and benefit return to report the transaction . This rule also applies when you report the taxable part of any capital gains reserve you deducted in 2019.

Do you own a business?

If you own a business that has a fiscal year end other than December 31, you still report the sale of a capital property in the calendar year the sale takes place.

Example

Milos owns a small business. The fiscal year end for his business is June 30, 2020. In August 2020, he sold a capital property that he used in his business. As a result of the sale, he had a capital gain. Milos has to report the capital gain on his income tax and benefit return for 2020. He does this even though the sale took place after his business’s fiscal year end date of June 30.

Are you a member of a partnership?

If you are a member of a partnership, it is possible that your partnership has a fiscal year end other than December 31. If the partnership sells capital property during its fiscal year, you generally report your share of any capital gain or loss in the calendar year in which that fiscal year ends.

When Is A Home Sale Fully Taxable

Not everyone can take advantage of the capital gains exclusions. Gains from a home sale are fully taxable when:

- The home is not the sellers principal residence

- The property was acquired through a 1031 exchange within five years

- The seller is subject to expatriate taxes

- The property was not owned and used as the sellers principal residence for at least two of the last five years prior to the sale

- The seller sold another home within two years from the date of the sale and used the capital gains exclusion for that sale

Read Also: How Do I Pay Taxes For Doordash

What Is Capital Gains Tax And When Do I Pay It

Capital gains tax is payable when you sell an asset that has increased in value since you bought it.

The rate varies based on a number of factors, such as your income and size of gain. Capital gains tax on residential property may be 18% or 28% of the gain .

Usually, when you sell your main home you dont have to pay any capital gains tax . However, in some circumstances you may have to pay some. For example:

- The home includes a lot of land/additional buildings

- Youve sub-let part of it

- Part of your home is exclusively business premises

- You bought it just to make a gain

- You have another home that could be considered your main residence

Some of these points may be open to interpretation and dispute, so if you are in any doubt it is sensible to seek advice. An independent financial/ tax adviser can give you their unbiased view on whether your home will be exempt from CGT.

Find a local independent financial/ tax adviser through our partners at unbiased. Click the button below and complete a short form to be connected with local advisers

Offset Gains With Losses

One of the simplest ways to reduce your exposure to the capital gains tax is to offset the profits made from selling a home with losses that have been realized from another investment. While the Internal Revenue Service taxes profits made from investments, investors can deduct losses from their taxable income. Otherwise known as tax-loss harvesting, this particular strategy reduces exposure to taxes levied on gains. By accounting for both gains and losses, investors can reduce the capital gains they are taxed on.

Recommended Reading: Grieved Taxes

This Guide Has Been Produced For Information Purposes Only As A Mortgage Broker We’re Not Able To Offer Tax Advice

How much Capital Gains Tax will you have to pay? It depends. In this guide, well explain how Capital Gains Tax works on UK property and prepare you for when you decide to sell.

Not everyone has to pay Capital Gains Tax on UK property but you might and it may be more than you think. You can avoid the shock of any unforeseen tax bills by calculating how much youre liable to pay. Sadly, this isnt always easy to figure out. Well explain everything in a bit more detail, show you how to calculate Capital Gains Tax on property and guide you through the process of paying it.

Reducing Your Capital Gains Tax Liabilitytop

There are a number of legitimate ways to reduce your tax burden:

Reporting losses

Allowable losses are deducted from any gains made in the same tax year

Remember our piece of artwork? If you sold a second in the same tax year for a £3,500 loss, your gains would be £15,000 from the first piece of art minus £3,500 = £11,500, which is under the £12,300 tax-free allowance

You can also deduct unused losses from previous years if your total gain is still above the tax-free allowance

You dont have to report losses straightaway you can claim up to four years after the end of the tax year in which you disposed of the asset

BUT: you cant claim losses against assets that you give or sell to your spouse, as you dont normally pay CGT on these anyway

Sharing and gifting assets

Assets transferred or gifted between spouses or civil partners are exempt from CGT, meaning you could take advantage of both of your CGT-free allowances £24,600 in all when disposing of items.

You can also transfer partial ownership, which is useful if you are on a higher income tax rate than your partner, as this will cut the CGT rate.

Spreading the gains

Instead of selling all your assets in one year you could spread them across two tax years, effectively doubling your tax-free allowance.

Property

You can deduct certain legitimate costs from your gain such as broker fees, stamp duty, improvements to the property while you owned it , and VAT, unless you can reclaim it.

Entrepreneurs relief

Recommended Reading: Do You Pay Taxes On Donating Plasma

Carry Over Losses To The Next Year

Remember capital losses offset capital gains. If you have both capital gains and capital losses in the same tax year, you must use them to offset the capital gain. However, if you only have a capital loss, or you don’t have capital gains from the prior 3 years that you could amend and offset, you can carry those capital losses forward to offset future capital gains. You might need to consult a tax professional to follow the proper steps to do this.

Article Contents11 min read

Do I Pay Capital Gains Tax On My Second Home

If HRMC decides that a property is not your main home, you will have to pay GCT.

If you use more than one home, you can nominate which one is your primary residence it makes sense to choose the one you expect will make the biggest gain when you sell it. Married couples and civil partners can only have one main residence between them. Unmarried couples can each nominate a different home.

Recommended Reading: Do You Pay Taxes On Plasma Donations