Car Tax Rates For Cars First Registered Before 1 April 2017

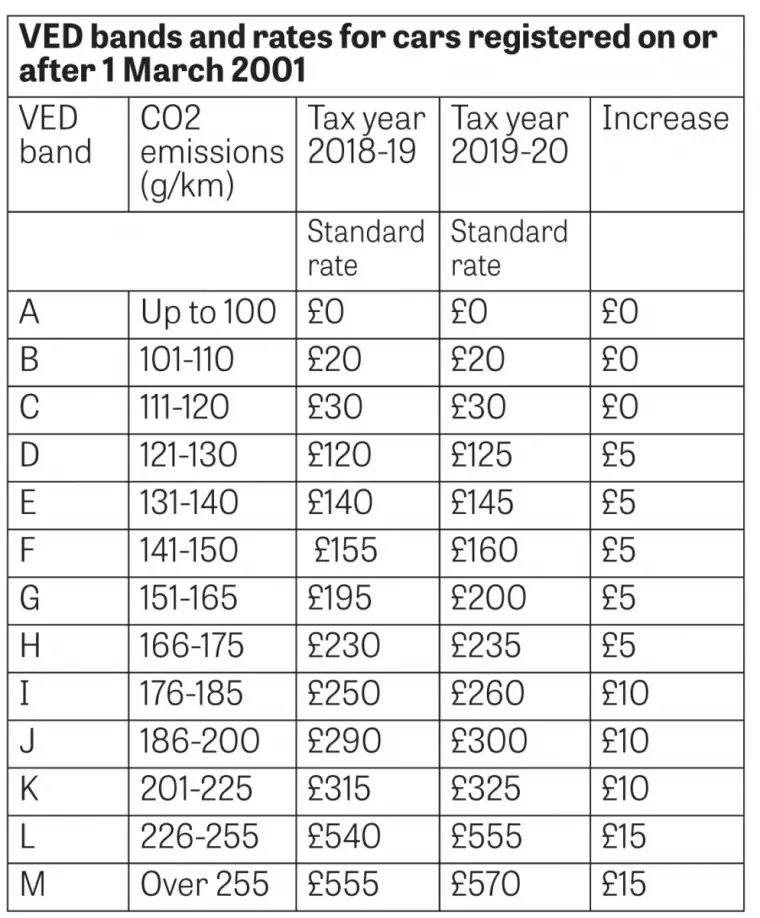

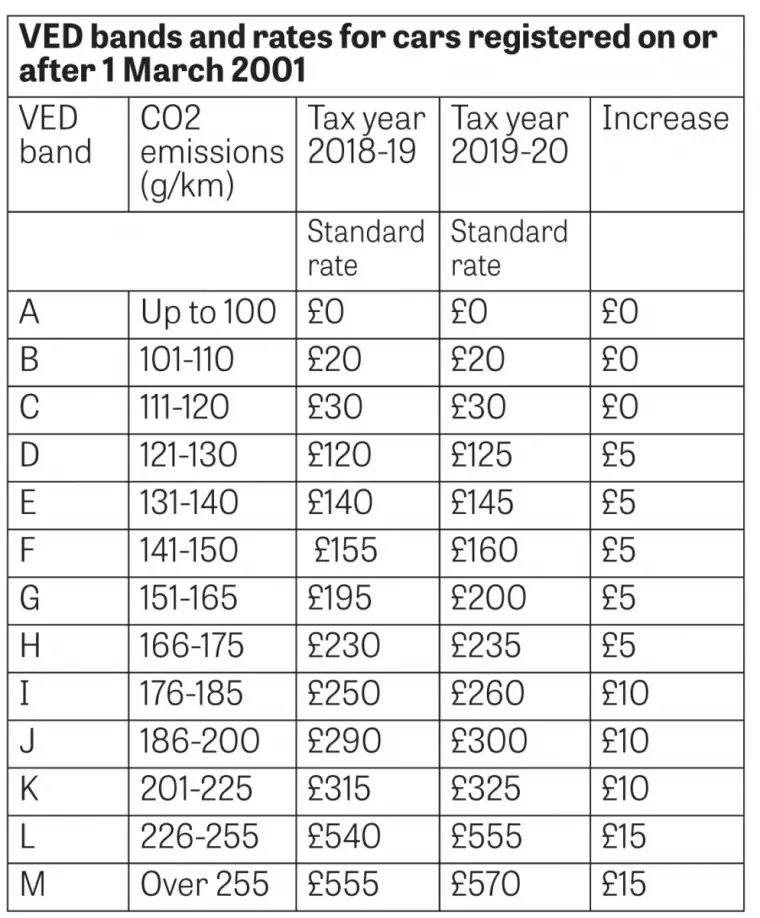

Any cars first registered as new after 1 March 2001, but before 1 April 2017, continue to be taxed at their previous, respective rates. These are based on official CO2 emissions.

The amount of CO2 your car produces puts it into one of 13 bands, which are assigned letters A to M. Cars in band A emit the least amount of CO2, and are currently exempt from paying any car tax throughout the life of the car.

The rates below show the current rates, assuming you choose to make a single payment for the year.

Electric Car Rates From 1 April 2025

What electric car owners will pay from 2025 depends on the car’s age.

Electric cars first registered on or after 1 April 2025: will pay the lowest rate of tax , which is currently £10.

From the second year onward, the standard rate kicks in and electric car owners will then need to pay £165 per year – the same rate that petrol and diesel owners pay today .

If the electric car costs £40,000 or more when new, the expensive car supplement will be added to the standard rate, for five years.

As it adds to the standard rate, you will pay a supplementary rate during years 2-6 of ownership. Based on on todays rates, that would mean electric car owners would pay an extra £355 on top of the standard rate of £165, to spend a total of £520 per year, for years 2-6 of ownership, before dropping back down to the standard rate from year 7 of ownership and on.

Electric cars first registered between 1 April 2017 and 31 March 2025: will also pay £165 per year from April 2025 onwards.

The £40,000 expensive car supplement is not being backdated, so an electric car first registered in 2024, for example, will not currently have to pay the supplementary rate of £355 on top of the standard rate from April 2025.

Electric cars first registered between 1 March 2001 and 31 March 2017: in effect, electric cars started coming to the mainstream market around 2010.

How Is Tax Monitored

Since October 2014, when the DVLA consigned the tax disc to the history books, motorists are no longer required to display a paper disc in the windscreen.

Instead, VED is handled by an electronic database, as the government continues to digitise public services.

Today, instead of physically checking the tax disc, the police and other law enforcement agencies use a network of Automatic Number Plate Recognition cameras.

These cameras might be situated at the roadside, or located in a police vehicle.

The ANPR system exchanges data with the DVLA database which keeps a record of all taxed and untaxed vehicles.

You May Like: How Do I Submit My Tax Return Online

Vehicle Title Tax Insurance & Registration Costs

When you buy a new or used vehicle, youre always going to pay more than the sticker price. Thats because your state government sees a vehicle purchase as a great opportunity to squeeze some money out of you.

The basic DMV fees, like the title, license plate, and registration fees, are no biggie. But the car dealer may charge their own fees, too. Then, theres the vehicle sales tax and yes, this applies to private-party sales too. Some states charge extra on top of that, calling it a wheelage tax, personal property tax, use fee, excise tax, privilege tax or an ad valorem tax.

Well go through all the costs to be aware of when purchasing a new or used vehicle. Remember that many states also require proof of auto insurance coverage when youre registering your car. Need help finding the best deal on coverage? We can help you find the cheapest rates on car insurance.

Find the best insurance for your budget in just a few minutes!

Commercial Vehicle Emissions Scheme For Private Hire Buses Registered From 1 April 2021 To 31 March 2023

Under the CVES, vehicles are classified into Bands A, B, or C by their worst-performing pollutant among the following: carbon dioxide , hydrocarbons , carbon monoxide , nitrogen oxides and particulate matter . For example, if your vehicle has a CO2 emission of 300g/km, but no emission for all other pollutants, i.e. HC, CO and NOx and PM , it would be classified as Band C, as its worst-performing pollutants of CO2 puts it in Band C.

In addition, if you register an electric or plug-in hybrid private hire bus, fossil fuels will need to be burnt to generate the electricity to charge your vehicle. Burning of fossil fuels generates CO2. As such, you will need to add these additional CO2 emissions, before referring to the table below. Your total CO2 emissions would be the CO2 emissions for the vehicle plus the CO2 generated from electricity consumption.

You May Like: Where Can I Get Tax Forms

States With Tax & Tag Charts Only

The following states provideTAX CHARTS& INFORMATION to help you determine sales and/or registration taxes:

Generally, these lists/charts will be organized and broken down by:

- Vehicle model years and weight classes.

- Sales tax percentages.

- Titling procedures.

- Duration of the registration.

If you need help interpreting your state’s chart or have questions about which category your vehicle will fall under,please contact your state’s DMV, MVD, MVA, DOR, SOS, or county clerk’s office directly.

Vehicular Emissions Scheme For Cars Registered From 1 January 2018 To 31 December 2020

VES is based on a vehicles carbon dioxide emission, plus emissions of 4 pollutants hydrocarbons , carbon monoxide , nitrogen oxides and particulate matter .

The pollutant with the highest emission value determines your vehicles band and its corresponding VES rebate or surcharge. If your car uses a port-fuel injection engine, and it does not have a PM value, it will be automatically assigned the maximum VES surcharge band . This is regardless of the cars emissions of the other 4 pollutants.

If you register an electric or plug-in hybrid car, an emission factor of 0.4g CO2/Wh will be applied to its electricity energy consumption to rate its carbon emission.

Don’t Miss: What If You Forgot To File Taxes Last Year

Services Received For Property Taxes

Richmond Hill property owners receive services provided by Richmond Hill, the Regional Municipality of York or local school boards.

| Richmond Hill |

| Some of the services provided by the City include garbage pick-up, snow removal, water supply, water treatment, solid waste facilities, arterial roads, planning and growth management, parks and recreation, fire protection and public libraries. |

| York Region |

| Some of the Regional services include community health programs, social and children’s services, policing and emergency response services. |

| School Boards |

| The School Boards provide elementary and high school education. |

The property tax bill Richmond Hill issues helps to cover some of these costs. Richmond Hill administers the collection for the Region of York and the local school board and forwards your portion of the payment to them on your behalf.

Car Owners Exempt From Car Tax

Don’t need to tax your car?

If you dont need to tax your vehicle youll still need to tell the DVLA at GOV.UK and it must be renewed on an annual basis even if your rate of tax is £0. You can do it online with the vehicle tax rates calculator on GOV.UK

The following types of car owners pay no car tax:

- owners of brand new cars that produce 0 grams of carbon dioxide emissions and have a price of less than £40,000

- owners of a car registered between 1 March 2001 and before 1 April 2017 that produces up to 100 grams of CO2 per kilometre driven.

If you have a disability, you might be entitled to free car tax if you:

- have an invalid carriage, such as a mobility scooter

- receive War Pensioners Mobility Supplement

- receive the Enhanced Mobility Component of Personal Independence Payment.

You dont have to pay car tax on historic vehicles meaning a vehicle thats 40 or more years old.

Find out what other vehicles are exempt from tax on the GOV.UK website

Also Check: How Do I Claim My Stimulus Check On My Taxes

Car Tax Calculator: Your Questions Answered

Q: What is car tax and why is it so important? A: Car tax is something that all vehicle owners pay in order to allow them to park and drive their cars on roads in the United Kingdom.

Q: Why do I have to pay car tax? A: UK drivers are legally required to purchase car tax annually. It was introduced to help maintain road surfaces and originally all monies collected could not be spent on anything but road maintenance. But Winston Churchill changed all that, enabling the use of the VED pot to be spent on other things. .

Q: What happens if I get caught with an untaxed car?A: If you are caught on the road in an untaxed vehicle, you could be fined up to £1,000. The DVLA can order untaxed vehicles on the street to be clamped and will impound them in some cases. When DVLA clamps an untaxed vehicle, the owner will be charged a £100 release fee. If you can’t show that the vehicle has been taxed at the time its released, you will have to pay a surety fee of £160 but you get that back if you can show the vehicle has been taxed within 15 days.

Q: Is my car taxed? How to check online A: You can check vehicle tax easily and online by going to the DVLA website and entering the vehicle registration number.

Q: How do I tax my new car? A: If you buy a brand-new car, the dealer will usually arrange for it to be registered, and will obtain a reference number from which you can get your car taxed.

Vehicle Personal Property Tax

The tax rate for most vehicles is $4.57 per $100 of assessed value.

For properties included in a special subclass, the tax rate is $0.01 per $100 of assessed value. This special subclass includes the following:

- privately-owned vans used for van pools

- vehicles belonging to volunteer fire and rescue squad members

- vehicles specifically equipped for the handicapped

- automobiles and pick-up trucks owned by certain qualifying seniors and people with disabilities

- vehicles owned by qualified disabled veterans

- vehicles owned by auxiliary police officers

- vehicles owned by auxiliary deputy sheriffs

- certain property owned by homeowners’ associations

Recommended Reading: Is Credit Karma Safe For Taxes

Reduced Rate Motor Vehicle Tax For Vans

Do you use van for your business? A reduced rate applies to vans that meet specific layout requirements , and if:

- you are an entrepreneur for the purposes of turnover tax

- the van is registered in your name or your companyâs name and

- more than 10% of the distance you drive is for business purposes.

Car Tax Band Guide: How Much Is Car Tax And How Is It Calculated

Owning and running a car can be expensive, and car tax is often one of those forgotten costs that can be overlooked. How much you pay in car tax is also complicated by the type of vehicle you drive and how old it is. Let us take you through the ins and outs of car tax, how its calculated and how to work out your car tax band.

You May Like: How Much Medicare Tax Is Withheld

What Happens To Your Car Tax When You Sell Your Car

Dont be caught out by the changes to the system when buying a new car, introduced in October 2014.

Since then, it has not been possible to transfer any unexpired tax to the new registered keeper, meaning a new owner must tax the car before driving away.

Similarly, if youre selling the vehicle, be sure to let the DVLA know. Any remaining tax will be refunded to you.

Vehicular Emissions Scheme For Taxis Registered From 1 January 2018 To 31 December 2020

VES is based on a vehicles carbon dioxide emissions, plus emissions of 4 pollutants hydrocarbons , carbon monoxide , nitrogen oxides and particulate matter .

The pollutant with the highest emission level determines your vehicles band and its corresponding VES rebate or surcharge. If your taxi uses a port-fuel injection engine, and it does not have a PM value, it will be automatically assigned the maximum VES surcharge band . This is regardless of the taxis emissions of the other 4 pollutants.

If you register an electric or plug-in hybrid taxi, an emission factor of 0.4g CO2/Wh will be applied to its electricity energy consumption to rate its carbon emission.

You May Like: Where Do I Send My Tax Return From Florida

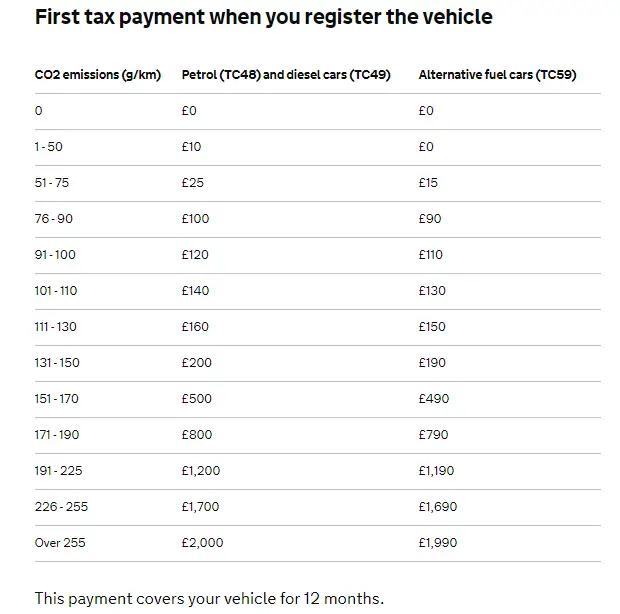

First Tax Payment When You Register The Vehicle

Youll pay a rate based on a vehicles CO2 emissions the first time its registered.

This also applies to some motorhomes.

You have to pay a higher rate for diesel cars that do not meet the Real Driving Emissions 2 standard for nitrogen oxide emissions. You can ask your cars manufacturer if your car meets the RDE2 standard.

| CO2 emissions | Diesel cars that meet the RDE2 standard and petrol cars | All other diesel cars | Alternative fuel cars |

|---|

This payment covers your vehicle for 12 months.

Checks Started Arriving On October 7

Funds began arriving on Friday, Vigliotti noted, with people receiving either a debit card in the mail or a direct deposit to their bank account.

But it could take a few days or weeks for the money to arrive. Still, about 90% of people who receive direct deposits will get their payments by the end of October, according to the California Franchise Tax Board.

On social media, some people said they had received their checks via direct deposit on Friday, while others said they were still waiting.

Read Also: Where To File My 1040 Tax Return

Don’t Miss: How To Pay Tax Uber Driver

How Much Is My Car Tax

The price of car tax depends on the CO2 emissions and the fuel type of your vehicle. The rate you will pay for your car tax is based on the CO2 emissions given off when the car was first registered. You can either pay your tax on a monthly basis via direct debit, or you can also pay your car tax per annum. To find out how much the tax will be for your vehicle, please click on the button below.

Recommended Reading: How Much Taxes Will Be Taken Out

When Are The Tax Rates Available Each Year

The budgets for Richmond Hill, York Region and the Provincial Government are usually approved by May 30 each year. Tax rates are finalized after this date.

Keep in mind that reassessment is just one part of the tax calculation for the upcoming four taxation years. Tax rates are also based on budget changes for Richmond Hill, York Region and the Provincial Government.

Recommended Reading: Does Quickbooks Calculate Sales Tax

Car Sales Tax For Trade

Those who trade in a vehicle will still have to pay sales tax. California state sales tax applies to the full price of the new vehicle.

In essence, their sales tax does not consider whether or not you traded in your vehicle.

For example, if you traded in a vehicle for $7,000 and applied that credit to a new vehicle purchase of $15,000, you will pay sales tax for the $15,000 full purchase price.

Also Check: How To File Prior Year Taxes Online

Cars Registered Between 2001 And 2017

Not too long ago, the tax system was a lot simpler, cars were charged according to their CO2 and you paid the same rate every year. Sure, there were parallel charging structures one for petrols and diesels, the other for ‘alternatively’ fuelled cars but that was as complicated as it got.It was less stringent than the current system with cars that produced 100g/km or less qualifying for free road tax so a tiny city car would pay no more than an electric model like the Nissan Leaf. Even gas guzzlers got off comparatively lightly, paying no more than £630 a year, slightly more if you decided to break up the payment in monthly instalments.

All of this changed on 17 November when Band A was abolished as part of the Autumn Statement 2022. In future, these cars will be moved into Band B and their owners will be asked to pay at least £20 per year for road tax.

Read Also: Do You Have To Pay To File Taxes

Make Way For This Black Toyota Camry How Much Is Pm Anwar’s Official Car Without Tax

Hans · Nov 29, 2022 10:07 AM

While previous Prime Minister Ismail Sabri and his predecessor Muhyiddin Yassin travelled in a Toyota Alphard and Toyota Vellfire respectively, newly appointed Prime Minister Datuk Seri Anwar Ibrahim has decided that he only needs a Toyota Camry to carry out his duties.

In case you’re wondering, the BMW 740 Le used during his election campaign was loaned to him by a supporter , and has since been returned.

Speaking to the media outside PKRâs headquarters yesterday, Anwar pointed to his Camry and said âIt’s okay, right?,â adding that he had cancelled the booking for a Mercedes S600 made by the previous prime minister.

The S600 is yet to be delivered and upon checking, the Prime Minister said it was still possible to cancel the booking and that was what he did.

Anwar later said in his Facebook post that the Camry was not a new purchase, and that he will use any car that is already in the Prime Minister Officeâs fleet.

âThe move is taken because I donât want any additional expenses to be made,â said Anwar, who as his first task as Prime Minister, chaired the 2022 National Action Council on Cost of Living Special Meeting, and is giving civil servants 2 weeks to come up with a better targeted subsidy mechanism.

The black Camry is the latest facelift model, launched by UMW Toyota Motor earlier in February 2022.