Tax Id Or Employer Identification Number

Before you file an estate income tax return, you need a tax identification number for the estate. An estate’s tax identification number, also called an employer identification number , comes in this format: 12-345678X. You can apply for this number online, by fax or by mail. See how to apply for an EIN. Use the tax ID number when filing Form 1041.

Exemptions And Tax Rates

| Year | |

|---|---|

| $12.06 million | 40% |

As noted above, a certain amount of each estate is exempted from taxation by the law. Below is a table of the amount of exemption by year an estate would expect. Estates above these amounts would be subject to estate tax, but only for the amount above the exemption.

For example, assume an estate of $3.5 million in 2006. There are two beneficiaries who will each receive equal shares of the estate. The maximum allowable credit is $2 million for that year, so the taxable value is therefore $1.5 million. Since it is 2006, the tax rate on that $1.5 million is 46%, so the total taxes paid would be $690,000. Each beneficiary will receive $1,000,000 of untaxed inheritance and $405,000 from the taxable portion of their inheritance for a total of $1,405,000. This means the estate would have paid a taxable rate of 19.7%.

On January 1, 2013, the American Taxpayer Relief Act of 2012 was passed which permanently establishes an exemption of $5 million per person for U.S. citizens and residents, with a maximum tax rate of 40% for the year 2013 and beyond.

The permanence of this regulation is not ensured: the fiscal year 2014 budget called for lowering the estate tax exclusion, the generation-skipping transfer tax and the gift-tax exemption back to levels of 2009 as of the year 2018. The exemption amounts of $11,180,000 in 2018 and $11,400,000 in 2019 are also currently scheduled to sunset 12/31/2025 .

Estate Tax Exemption Amount Goes Up For 2022

As the estate tax exemption amount increases, fewer estates are subject to the federal tax.

The federal estate tax exemption is going up again for 2022. The amount is adjusted each year for inflation, so that’s not a surprise. But it’s still a big deal when the new exemption is announced each year because there’s a lot at stake for certain high-income Americans.

Don’t Miss: How To Not Pay Taxes Legally

New York Estate Tax Exemption

The New York estate tax threshold is $5.92 million in 2021 and $6.11 million in 2022. That number will keep going up annually with inflation

This means that if a persons estate is worth less than $6.11 million and they die in 2022, the estate owes nothing to the state of New York. New York has a cliff that impacts very wealthy estates. If the estate exceeds the $6.11 million exemption by less than 5%, it only pays taxes on the amount that goes over the threshold. If the total value is more than 105% of exemptable amount, taxes are paid on the entire estate.

Heres an example of how that works: 105% of $6.11 million is $6,415,500 million. If your estate is worth between $6.11 million and $6,415,500 million, you only pay tax on the amount that exceeds $6.11 million. So if your estate is worth $6.26 million, your taxable estate is only $150,000. If your estate surpasses $6,415,500 million, all of your estate is taxable. If your total estate is $6.5 million, for example, you will pay estate taxes on all of that.

Inheritance Tax Vs Estate Tax: How They Differ

Americans assets dont escape taxes after death. Taxable property can be cash and securities, as well as real estate, insurance, trusts, annuities and business interests, according to the Internal Revenue Service .

The most common death taxes Americans might see are inheritance taxes and estate taxes, though both are different.

The main difference between an estate tax and an inheritance tax is that the former comes directly out of the deceased persons estate before that asset is distributed to its beneficiaries. Meanwhile, the beneficiary is responsible for paying the inheritance tax as soon as they receive those assets.

Recommended Reading: What Does Payroll Tax Pay For

A Guide To Estate Taxes

If you’re responsible for the estate of someone who died, you may need to file an estate tax return. If the estate is worth less than $1,000,000, you don’t need to file a return or pay an estate tax. Massachusetts estate tax returns are required if the gross estate, plus adjusted taxable gifts, computed using the Internal Revenue Code in effect on December 31, 2000, exceeds $1,000,000.This guide is not designed to address all questions which may arise nor to address complex issues in detail. Nothing contained herein supersedes, alters or otherwise changes any provision of the Massachusetts General Laws, Massachusetts Department of Revenue Regulations, Department rulings or any other sources of the law.Updated: May 11, 2022

How Much Can You Inherit From Your Parents Without Paying Taxes

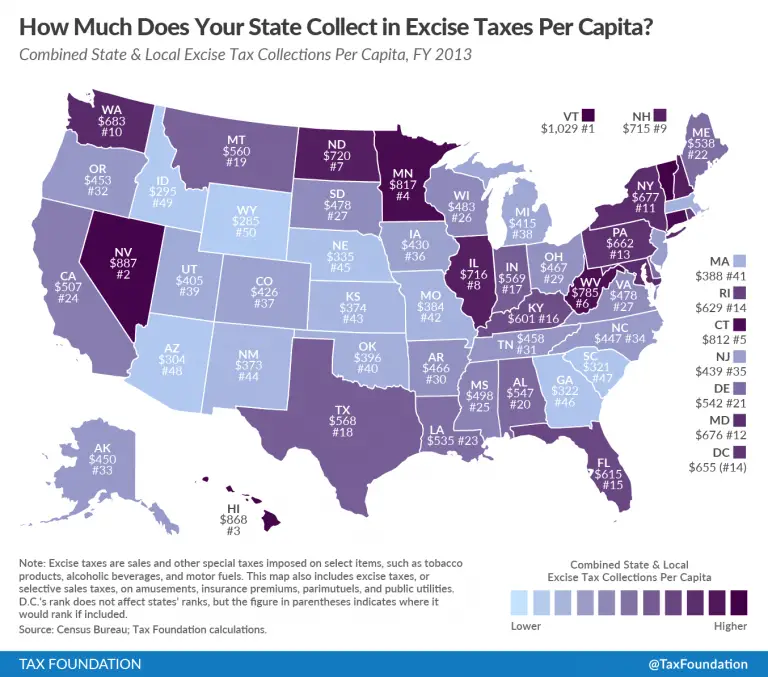

An estate’s tax liability will vary depending on where the estate is located. The IRS threshold for estate values is $12.06 million for 2022, increasing to $12.92 million in 2023. Anything below this amount is not subject to estate taxes. Additionally, different states have different threshold tax amounts and tax percentages for state excise taxes.

Don’t Miss: What Percentage Of Taxes Do The Rich Pay

The History Of The Estate Tax

Estate taxes in the U.S. are tied to the history of war. The first tax resembling an estate tax was levied in the 1790s to help raise funds for fighting an undeclared naval war with the new French Republic. Rather than taxing an estates assets directly, it was a tax on wills and probate forms. This tax was only temporary, though.

In the 1860s, the Civil War prompted a new estate tax, again to raise money for the war effort. The tax eventually lapsed again, though it was officially revived in the 1890s. The goals of this estate tax were to tax some of the money being made by wealthy industrialists who were getting off easy under the old tax system and to raise money for the Spanish-American War.

What we now think of as federal estate taxes became law in 1916. Again, World War I created an urgent need for more government revenue. Since then, estate taxes have been a source of political controversy. This is despite the small percentage of households affected by what opponents of estate taxes call death taxes.

Massachusetts Estate Tax Exemption

The Massachusetts estate tax exemption is $1 million. This means that if your estate is worth more than $1 million when you die, money will be owed to the state before its disbursed to your heirs. However, if its smaller than $1 million, then no state estate taxes will be owed.

Unlike many other state-level estate taxes, the Massachusetts estate tax applies to the entire estate, not just the amount above the exemption. This means if your estate is worth $1.5 million, the tax applies to all $1.5 million, not just the $500,000 above the exemption.

The Massachusetts estate tax exemption is not portable between spouses. When the second of two spouses dies, the exemption is still only $1 million.

Read Also: Can Students File Taxes For Free

Are There State Estate Taxes Too

In addition to federal estate tax, your assets may be subject to state estate tax if you reside in a state that imposes this tax. Keep in mind that your assets could be subject to state estate tax even if your estate isnt worth the current federal estate tax filing limit of $12.06 million at the time of your death.

Currently, 12 states and the District of Columbia charge estate taxes, which are paid in addition to any federal estate tax. The exemption levels vary and range from $1 million to $9.1 million. The state estate tax is generally charged based on the state an individual resides in at the time of their death. However, other factors, such as owning physical assets outside of your home state, could give rise to additional state estate tax liability.

History Of Estate Tax Exemption Rates

Estate tax exemptions began with the Revenue Act of 1916, which imposed a transfer of wealth tax on the estate of any deceased U.S. citizen valued above $50,000 at the time of death. The exemption remained at $50,000 until 1926, when it was raised to $100,000. In 1932, the exemption dropped back to $50,000. The lowest exemption in U.S. estate tax history was $40,000, from 1935 to 1942.

From 1916 to 2007, the estate tax exemption gradually rose until it reached $2 million in 2007. Then, under the Economic Growth and Tax Relief Reconciliation Act of 2001, the estate tax exemption gradually increased until it stood at $3.5 million in 2009. By this time, only 5,700 estates paid a transfer of wealth tax, and that number has been lower ever since, no doubt in part because the exemption amount has gone upmost notably with the passage of the Tax Cuts and Jobs Act in 2017 that doubled the exemption to $11.18 million in 2018 .

This changelike most changes in that legislationcame with an expiration date. In this case, on Jan. 1, 2026, the estate tax exemption is set to drop back to what it was before 2018: $5 million .

The current $12.06 million estate tax exemption, annually adjusted for inflation, is set to roll back to pre-2018 amounts in 2026.

You May Like: What Is Income Tax In New York

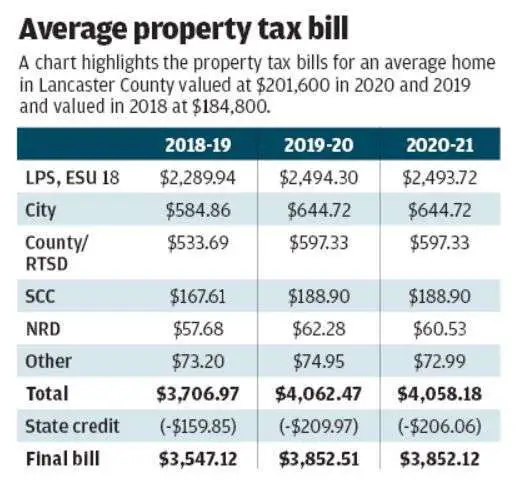

Overview Of Property Taxes

Property taxes in America are collected by local governments and are usually based on the value of a property. The money collected is generally used to support community safety, schools, infrastructure and other public projects. Use SmartAsset’s tools to better understand the average cost of property taxes in your state and county.

| Enter Your Location |

| of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property’s assessed value and the property tax rates based on your property’s address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county’s effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

…read more

New York Estate Tax Rate

The estate tax rate for New York is graduated. It starts at 3.06% and goes up to 16%. The taxable estate is the value of the estate above the $6.11 million exemption . Heres how to figure out what youll be paying: First, figure out what your taxable estate is. If your total estate is worth less than $6,415,500 million, the taxable estate is the total amount minus $6.11 million. So if your estate is worth $5.35 million, the taxable amount is $100,000.

Next, find your taxable estate bracket in the chart below. The base taxes amount in the second column is what you owe on money that falls below your tax bracket. Then figure out by how much your estate exceeds the lower limit of your bracket and multiply that number by the marginal rate. Add that number to your base and you should know what you owe.

Heres an example: Lets say your total estate is worth $7 million. That exceeds the cliff, so all of it is taxable. Next, we find where that number falls on the chart. The base tax for the bracket is $522,800. The bottom of the threshold is $6.1 million, so we subtract that from $7 million and get $900,000. That amount multiplied by the marginal rate of 12.8 is $115,200. When we add that number to the base rate, we get a total tax of $638,000 on a $6 million estate.

| NEW YORK ESTATE TAX RATES |

| Taxable Estate* |

Recommended Reading: When Can You Stop Filing Taxes

The Amazon Effect: In Fort Myers A $411000 Windfall In Revenue

In Fort Myers, this years proposed tax bill on is more than $411,000.

When you look at what that means in terms of just the school district alone, its like $160,000. Off of that single piece of property, said Matt Simmons, a managing partner at Southwest Florida-based real estate appraisal firm Maxwell, Hendry & Simmons.

Thats out of the gate, he said, as it hit the tax roll for the first time this year.

East of Naples, Amazons smaller last-mile distribution center has an estimated tax bill of more than $188,500 for this year. The project went into a building that sat unfinished, significantly increasing the value.

These projects on an annual basis throw a tremendous amount of resources in at the various taxing districts, regardless of anything else that is created by the jobs themselves, Simmons said.

Amazon vs. Publix:

What Is The Estate Tax

The estate tax is levied against certain estates after a person has died, but before the money has been passed on to their heirs. It only applies to estates that have reached a certain threshold of wealth, which varies based on which state government is levying the tax. Therefore Massachusetts has its own set of unique tax brackets compared to other states. Then, there is also a federal estate tax.

The estate tax is different from the inheritance tax. This is instead paid by the decedents heirs after they receive their inheritance from the estate.

Also Check: Can You Do Your Own Taxes Online

What Is The Current Estate Tax Limit Rate And Exemption

ljubaphoto / Getty Images

The estate tax is a tax on an individual’s right to transfer property upon your death. And to find the amount due, the fair market values of all the decedents’ assets as of death are added up.

The 2021 tax year limit, or the amount limit in 2022 after adjusting for inflation, is $12.06 million, up from $11.7 million in 2021. Any funds after that will be taxed as they pass on to heirs, at a rate that varies by the amount being passed on.

Learn how the estate tax has changed over time, the impact it has, and how it can impact you in the 2021 tax season.

How Can I Avoid Estate Taxes

Keeping your estate under the threshold is one way to avoid paying taxes. Other methods include setting up trusts, such as an intentionally defective grantor trust, which separates income tax from estate tax treatment, transferring your life insurance policy, so it won’t be counted as part of your estate, and making strategic use of gifting.

Read Also: What Are Payroll Taxes Used For

Key Actions For Filing And Payment Information

|

16.0 |

10,040,000 |

*The “adjusted taxable estate” used in determining the allowable credit for state death taxes in the above table is the federal taxable estate less $60,000.

No credit for state death taxes is allowable if the “adjusted taxable estate” is $40,000 or less.

Facts. A decedent dies in 2021 with a gross estate of $1,580,000. The decedent

- had not made any gifts during his lifetime and

- did not own any property outside of Massachusetts.

The deductions of the estate are $80,000. The taxable estate is $1,500,000 .

Computation of the credit for state death taxes for Massachusetts estate tax purposes. The maximum federal credit for state death taxes is $64,400. The computation is as follows:

The Massachusetts estate tax is equal to the amount of the maximum credit for state death taxes. It is computed using the Internal Revenue Code Section 2011 in effect on December 31, 2000.

Example 2

Facts. A decedent dies in 2021 with a gross estate of $1,100,000. The decedent

How Can I Reduce The Amount Of Tax Paid

Trying to reduce how much IHT is due on an estate is complicated. But, in short, you can reduce how much tax is paid by:

- leaving a legacy to charity

- putting your assets into a trust for your heirs

- leaving your estate to your spouse or civil partner

- paying into a pension instead of a savings account

- regularly giving away up to £3,000 a year in gifts.

You May Like: How To Have Less Taxes Taken Out Of Paycheck

Property Taxes By State

Overall, homeowners pay the most property taxes in New Jersey, which has some of the highest effective tax rates in the country. The states average effective rate is 2.42% of a home’s value, compared to the national average of 1.07%.

With an average effective rate of 0.28%, the least expensive state for property taxes is Hawaii, surprisingly. Despite its reputation as a costly place to live, Hawaii has generous homeowners exemptions for primary residents that lower taxable values considerably. The tax break generally helps those who live in Hawaii full-time, rather than those who own a second home there.

Also of note are Colorado and Oregons property tax laws, which voters put in place to limit large taxable value increases. Many states dont have caps on how much property taxes can change annually, but those two are examples of state governments that put laws in place because of taxpayer concern.