Who Pays The Inheritance Tax

Lets just get the not-so-good news out of the way. If your loved one lived in one of the six states mentioned above, you might be on the hook for the inheritance tax. We say might because spouses, parents and children are exempt from paying inheritance taxes in Iowa, Kentucky, Maryland and New Jersey.2 In Nebraska, only spouses are fully exempt Pennsylvania exempts spouses and minor children.3

Cousins, nieces and nephews and other extended family members often have to pay the inheritance tax. Again, each state is different.

On the other hand, if your loved one lived in any of the other 44 states without inheritance taxes, you can, in most cases, collect your inheritance tax-freeeven if you live in one of the six states with the tax.

How Does Inheritance Work

Most people have several possessions when they die. They might own a house and have money in investments or savings. If they made a will, all of it goes to the beneficiaries listed in the will. If they did not make a will, their money and property will automatically go to their next of kin. This person is usually a child or a relative. Everything they owned is part of the inheritance they pass on to other people when they pass away.

How To Determine Your Taxable Estate

What makes up your taxable estate? Letâs take a look.

These are the same assets that make up your net worth. Every now and then, itâs a good idea to put a pen to paper and figure out exactly what that is.

When you die, your executor will need to file a form 706 reflecting how much money you had within your estate when you passed.

FREE Online Class:

Don’t Miss: How To Send Taxes By Mail

How Much Money Can You Inherit Before Paying Taxes

How much money can I inherit tax-free? We hear this question from many people who request our services. When you inherit a sum of money, you have many other things on your mind, too. You may still be mourning the loss of the loved one who left you the money, and you may have many issues to deal with related to your family and friends, too.

Researching the answer to your probate-related questions can take up your precious time. You want answers to your questions quickly, but first, you need to understand a few basic finance-related concepts.

Federal Gift Tax Annual Exemption

There is currently an annual exemption of $14,000 per person. This means that you can give up to $14,000 each year to as many people as you wish. A husband and wife can give up to $28,000 per year per person. So, if you wished, you could give away everything you own this year without incurring any tax liability, PROVIDED that you don’t give more than $14,000 to any one person . This exemption applies to each year, so you may give someone $14,000 this year, and $14,000 in each subsequent year, without incurring the tax. You can double that amount if you are married.

Read Also: When Is The Earliest You Can File Taxes 2021

How Are Smaller Annual Gifts Taxed

The current law allows you to gift up to $15,000 every year to a recipient, without having to pay any gift taxes.

That means a husband and wife could each give their children $15,000 per year without any gift tax issues.

But what if you give more than $15,000 to one person as a gift?

Interestingly, the gift and estate tax work together as one. If you give more than the annual gift tax exemption or $15,000 per person, per year, the excess will be counted against your estate tax exemption amount.

Letâs look at how this works with some real-life examples:

Scenario 1

Your widowed mother gives you $14,000. The amount falls under the $15,000 annual tax exclusion. There is no gift tax to worry about.

Scenario 2

Your widowed mother gifts you $25,000. That creates a gift tax issue for the $10,000 in excess of the $15,000 annual exclusion. The good news? No gift tax is owed by either you or your parent.

The $10,000 excess is simply counted against the lifetime gift/estate tax equivalent amount of $11,180,000.

This means your mother would have to file form 709 and make note of the gift using that against her lifetime exemption equivalent amount with no tax due. In this case, your mother will have used up $10,000 of her $1,180,000 gift/estate tax limit, leaving her with an exemption equivalent of $1,170,000 instead.

Scenario 3

If both parents are making gifts, they can give $30,000 to anybody they want.

Inheritance Tax Vs Estate Tax

Inheritance taxes and estate taxes are often lumped together. However, they are two distinct forms of taxation.

Both levies are based on the fair market value of a deceased person’s property, usually as of the date of death. But an estate tax is levied on the value of the decedent’s estate, and the estate pays it. In contrast, an inheritance tax is levied on the value of an inheritance received by the beneficiary, and it is the beneficiary who pays it.

The distinction between an estate tax and an inheritance tax with identical rates and exemptions might make no difference to a sole heir. But in some rare situations, an inheritance could be subject to both estate and inheritance taxes.

According to the Internal Revenue Service , federal estate tax returns are only required for estates with values exceeding $11.7 million in 2021 and $12.06 million in 2022. If the estate passes to the spouse of the deceased person, no estate tax is assessed.

If a person inherits an estate large enough to trigger the federal estate tax, the decedent lived or owned property in a state with an inheritance tax, and the bequest is not fully exempt under that state’s law, the beneficiary faces the federal estate tax as well as a state inheritance tax. The estate is taxed before it is distributed, and the inheritance is then taxed at the state level.

Read Also: What Is Ohio Sales Tax

What Is Your Tax Rate On An Inherited Ira

An inherited IRA is considered part of a deceased person’s estate. That means that if the estate is large enough, it’s possible it will owe estate taxes on the value of an IRA. Estate taxes are assessed on the federal level only on very large estates, but some states impose estate taxes at lower levels. The estate pays estate taxes, and rates vary depending on the size of the estate.

Those who inherit an IRA and who take distributions from it are taxed on the withdrawn income at their ordinary tax rate, regardless of whether the estate was subject to estate tax or not. However, when you take distributions, you may be entitled to an income tax deduction for estate taxes paid on the IRA, which can offset some of the IRA income and lower your tax bill.

Comparison With Estate Tax

The key difference between estate and inheritance taxes lies in who is responsible for paying it.

- An estate tax is levied on the total value of a deceased person’s money and property and is paid out of the decedents assets before any distribution to beneficiaries.

- However, before an inheritance tax is due, the value of the assets must exceed certain thresholds that change each year, but generally its at least $1 million. Because of this threshold, only about 2% of taxpayers will ever encounter this tax.

Read Also: How Much Is Tax In Washington State

The Largest Estates Consist Mostly Of Unrealized Capital Gains That Have Never Been Taxed

Much of the money that wealthy heirs inherit would never face any taxation were it not for the estate tax. In fact, thats one reason why policymakers created the estate tax in 1916: to serve as a backstop to the income tax, taxing the income of wealthy taxpayers that would otherwise go completely untaxed.

Under the current tax system, capital gains tax is due on the appreciation of assets, such as real estate, stock, or an art collection, only when the owner realizes the gain . Therefore, the increase in the value of an asset is never subject to income tax if the owner holds on to the asset until death.

These unrealized capital gains account for a significant proportion of the assets held by estates ranging from 32 percent for estates worth between $5 million and $10 million to as much as about 55 percent of the value of estates worth more than $100 million.

The estate tax also serves as a modest corrective to other tax rules that provide massive tax benefits to income from wealth, such as the fact that capital gains are taxed at lower rates than wages and salaries. The top 0.1 percent of taxpayers those with incomes above $3.1 million will receive 56 percent of the benefit of the preferential capital gains rates in 2017, worth more than $600,000 apiece. Other tax rules allow part of the income of the very wealthiest to go completely untaxed, even with the estate tax.

Historical Estate Tax Exemption Amounts

Since the federal estate tax was reformed in 1976, the estate tax exemption has only gone up . In most cases, the increase is modest, such as a simple adjustment for inflation. However, at times, the exemption amount has jumped considerably. For example, it shot up from $675,000 to $1 million in 2002, from $1 million to $5 million in 2011, and from $5.49 million to $11.18 million in 2018.

But that pattern is scheduled to change. The 2018 estate tax examption increase is only temporary, so the base exemption amount is set to drop back down to $5 million in 2026.

| Period |

| $12,060,000 |

Also Check: Do You Have To Report Roth Ira On Taxes

Pennsylvania Inheritance Tax Rate

You will pay a flat tax rate of 4.5% if you are a decedents lineal relative grandfather, grandmother, father, mother, non-minor child, grandchild, un-remarried spouse, or widow of a child. Siblings of a decedent pay a tax worth 12% of their inherited assets. All other beneficiaries will pay a flat rate of 15% on their inheritance.

Correcting Misinformation About The Estate Tax

Conservatives misleadingly imply that every American will have to pay the estate tax when he or she dies. But this is pure propaganda only 1 out of every 700 deaths results in paying estate taxes.

Conservatives claim that many small, family-owned farms and businesses must be sold to pay estate taxes. But in the entire country just 20 small, family-owned farms and businesses owe any estate tax a year. Virtually none of them get sold to pay the estate tax.

Conservatives claim that the estate tax constitutes double taxation because it applies to assets that already have been taxed once as income. But large estates consist mostly of unrealized capital gains that have never been taxed, like income from Wall Street investments and from real estate.

Don’t Miss: How To Get My Tax Return Transcript

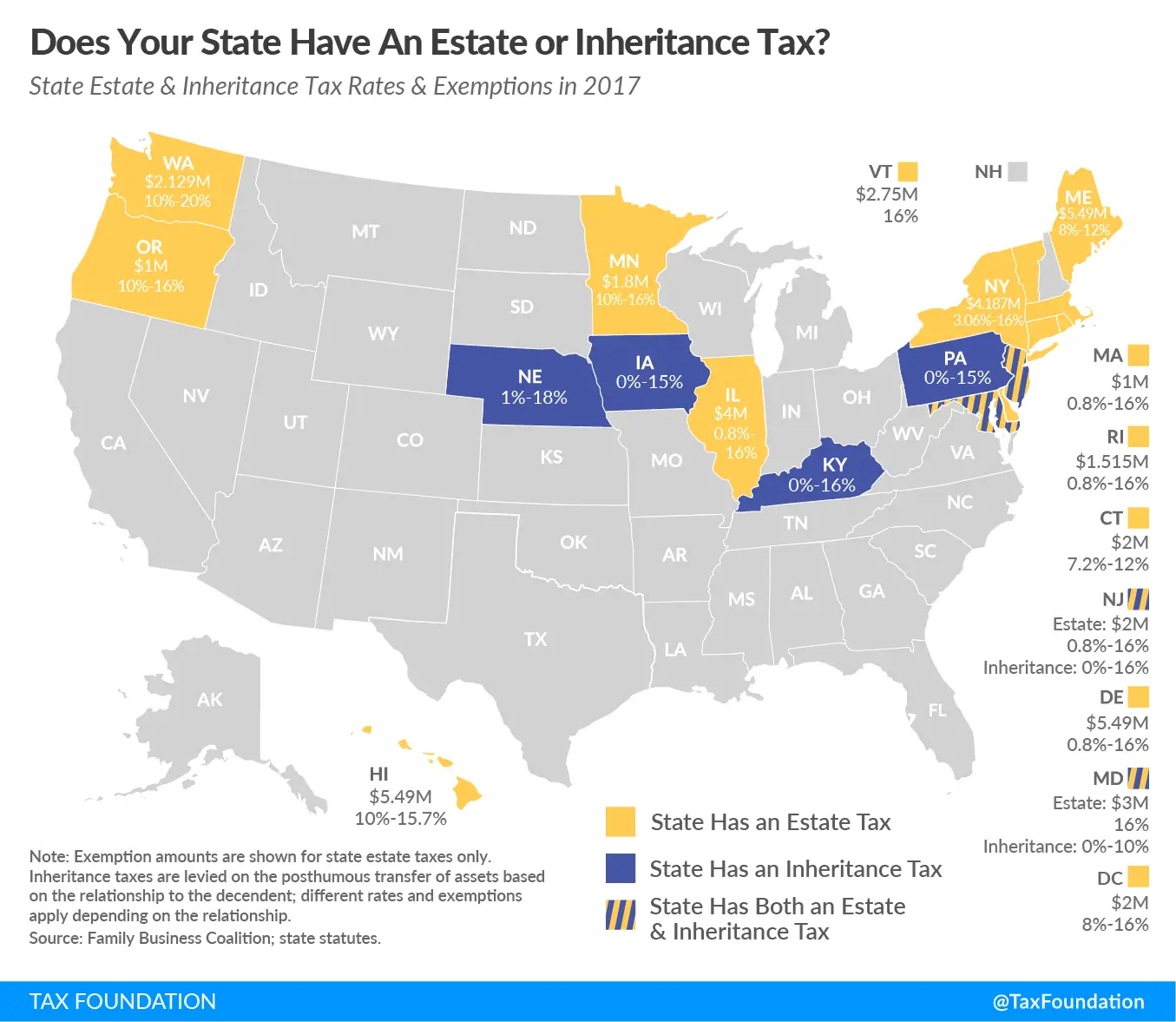

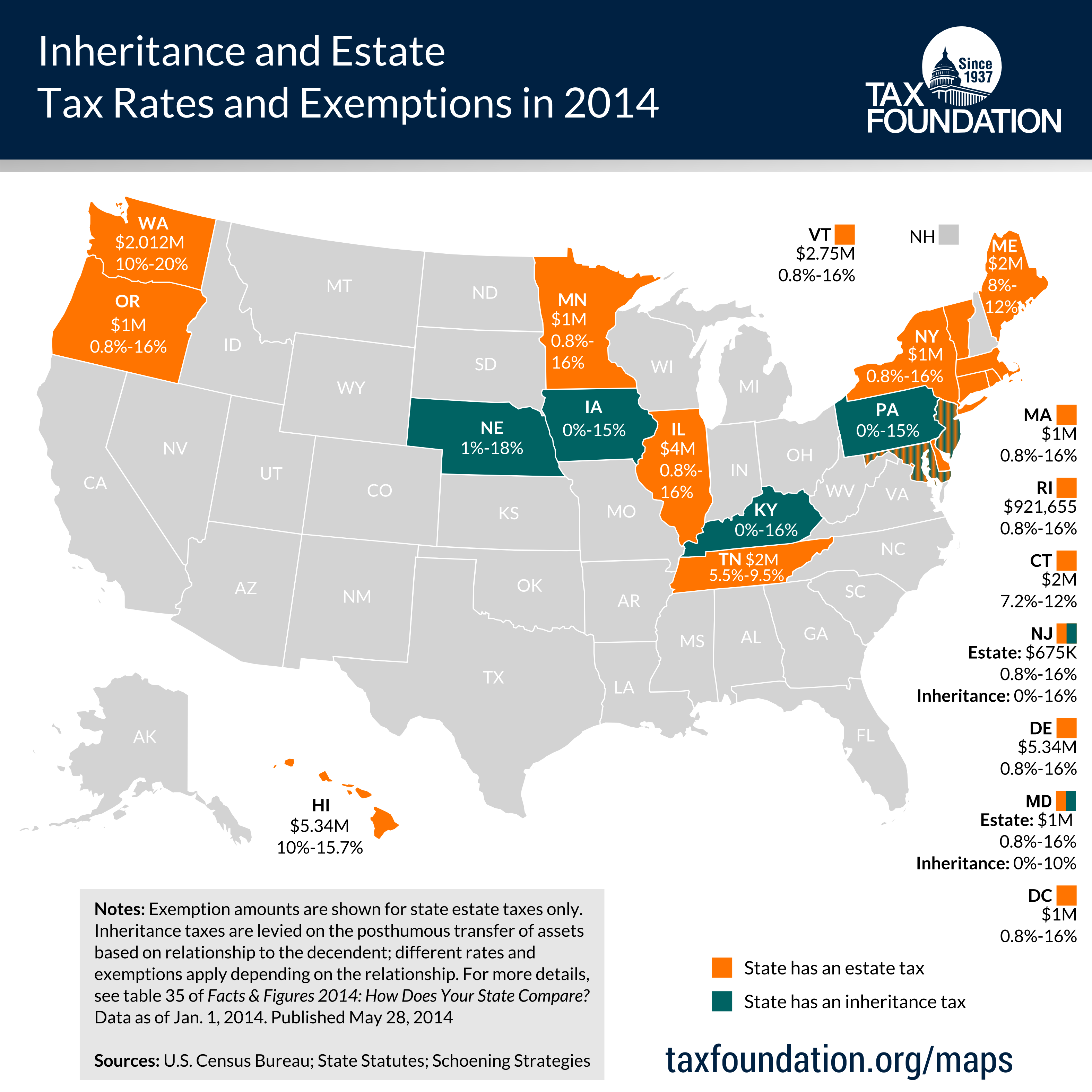

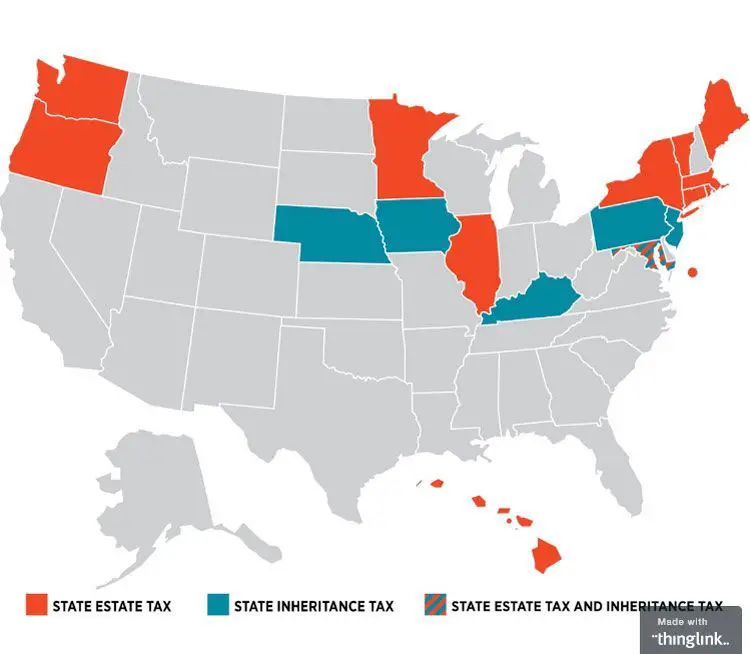

Which States Levy An Estate Tax

If you die in certain parts of the country, your estate may also be subject to a state estate tax. As of 2022, Washington, Oregon, Minnesota, Illinois, Maryland, Vermont, Connecticut, New York, Rhode Island, Massachusetts, Maine, Hawaii and Washington, D.C. all levy state estate taxes. That means that the estates of people who live in these states may face estate taxes at both the federal and state levels.

The aforementioned states estate tax thresholds range from $1 million in Oregon and Massachusetts to $7.1 million in Connecticut. Rates also vary, so be sure to check your states website to see what youll pay.

Nebraska Inheritance Tax Rates

If you were the decedents parent, grandparent, sibling, child, other lineal descendant, or the spouse of one of those people, the first $40,000 you inherit is exempt but the value of your inheritance above $40,000 is taxed at 1%.

Assets passed to an aunt, uncle, niece, nephew, any lineal descendant of such persons or their spouses are taxed at 13% with the first $15,000 exempt.

All other beneficiaries will pay an inheritance tax rate of 18% with the first $10,000 of value exempt from taxation.

Read Also: How Do I Know If My Taxes Were Filed

Estate Tax Exemption For 2022

The estate tax exemption in 2022 is approximately $12,000,000. Each U.S. citizen may exempt, during their life or after death, this amount of assets from estate taxation. The exemption increases with inflation.

The federal estate tax law provides that a decedents estate tax exemption may be applied against both lifetime gifts and after-death bequests by will or trust. The amount of credit used to shield lifetime gifts from taxation is deducted from the credit available at the taxpayers death.

For married couples, any part of the $12 million credit not used by the first spouse to die may be carried over to the surviving spouse. The carried-over credit is referred to as the Deceased Spousal Unused Exclusion . Therefore, a married couple may exempt approximately $24 million of assets from federal estate taxation when their assets are passed to their children and other heirs. Few Florida residents are concerned about estate tax liability because few families have a net worth of more than $24 million.

To take advantage of the DSUE, the surviving spouse must file a federal estate tax returnForm 706upon the first spouses death and properly elect DSUE on the form. Preparing a Form 706 is complicated even for smaller estates, and families should expect to pay legal and accounting fees.

What If Theres More Than $1118 Million Left In My Estate

If this is the case, hereâs exactly what will happen. The federal tax return form 706 will be filed and the estate tax owed by the estate will be calculated.

Any amount over $11,180,000 is subject to a 40% federal estate tax.

It is important to remember that it is the estate that is taxed, NOT the person inheriting the money.

If you know how to do the math yourself, you can run the numbers on how much the estate will owe in taxes.

To make it easier, here are the equations youâll need to use.

The estateâs executor is responsible for paying the estate tax using the assets within the estate. The tax collector only accepts cash.

This means assets often have to be sold to raise the cash to pay the tax. These assets include:

Imagine a large family farm thatâs been in the same family for a century.

Say itâs valued at $20,000,000. The estate tax calculation is x 40% = $3,528,000 estate tax due.

In this case, the family may have to sell the farm to pay the $3.5 million tax bill.

Nobody wants to be confronted with that sad scenario, especially if there are many family memories attached to that farm.

Itâs a good thing there are ways around it.

Read Also: How Much Tax Do You Pay On Cryptocurrency

Create A His And Her Marital Bypass Trust

If you are married, this can be a great way to avoid the 40% estate tax. This advanced legal planning strategy involves dividing a coupleâs living estate between two retractable trusts. Each trust can pass up to the $11.18 million dollars to heirs tax-free.

Done correctly, this effectively doubles the amount a couple can pass on to their heirs without the hitch of the federal estate tax.

This strategy was very popular when the estate tax exemption equivalent was much lower and the estate tax impacted more people.

Other Types Of Taxes On Inheritance

Many people who inherit money from a loved one receive their bequest in a form other than cash. For example, you may have stock options or real estate. In these cases, to gain the value of the stock or property, youll need to sell it off and pay capital gains taxes. These earnings are subject to capital gains taxes on a sliding scale, so the more you inherit, the more youll pay.

Read Also: What Day Do You Have To File Taxes By

How Much Money Can You Have Before Probate

The short answer is that you can inherit a significant sum of money without paying state or federal income taxes. The federal government does not have an inheritance tax, but half a dozen states do:

Even these states vary when it comes to the implementation of the inheritance tax. The amount of taxes the estate pays before the inheritors receive their money may also rise and fall based on the estates worth.

The Estate Tax Is The Most Progressive Part Of The Us Tax Code

Because it affects only those who are most able to pay, the estate tax is the most progressive component of a tax code that overall is only modestly progressive, particularly when regressive state and local taxes are taken into account. It is also the nations most effective tax policy tool to mitigate the negative effects of inheritances, which account for about 40 percent of household wealth and are extremely concentrated at the top. Because they are correlated with the parents economic outcomes and provide an alternative to earned income, inheritances likely limit intergenerational mobility.

It is appropriate that people who have prospered the most in this society help to preserve it for future generations through tax revenues that derive from their estates. As President Theodore Roosevelt stated in 1906, the man of great wealth owes a particular obligation to the State because he derives special advantages from the mere existence of government.

Don’t Miss: What State Has The Lowest Property Taxes

Scheduled Changes To Estate And Gift Taxes

The 2017 tax act doubled the exemption amount for the estate tax through the end of 2025. CBO projects that the exemption amount will drop to $6.4 million in 2026 under current law.8 People who make gifts before 2026, and estates that transfer the unused exemption to the surviving spouse before 2026, will be able to keep the tax benefit of the higher exemption amount.