Federal Gift And Estate Taxes

The federal gift and estate tax is a tax that is imposed by the federal government on all qualifying gifts made by a taxpayer during his/her lifetime and all assets owned by the taxpayer at the time of death. For example, if you made gifts of assets during your lifetime valued at $8 million and you owned assets valued at $10 million at the time of your death, your estate would be subject to federal gift and estate taxes for the combined value of $18 million at a tax rate of 40 percent. Without any deductions, your estate would lose a shocking $7.2 million to federal gift and estate taxes. Any federal gift and estate taxes that are due from your estate must be paid during the probate of your estate after your death.

The good news is that every taxpayer is entitled to make use of the lifetime exemption to reduce the amount of gift and estate taxes owed by their estate. ATRA set the lifetime exemption amount at $5 million, to be adjusted for inflation each year. In 2018, the President signed tax legislation into law that changed the lifetime exemption amount for several years to come. Under the new law, the exemption amounts doubled. These exemption amounts are scheduled to increase with inflation each year until 2025. On January 1, 2026, the exemption amounts are scheduled to revert to the 2017 levels, adjusted for inflation.

Do I Have To Pay Income Tax In California

You are required to file a California tax return if you receive income from California, have income above a certain income threshold, and you fall into one of the following categories:

You are considered a resident if you are one of the following:

- You reside in California for other than a temporary time period

- You reside in California but are away for a temporary time period

How Your California Paycheck Works

Your job probably pays you either an hourly wage or an annual salary. But unless youre getting paid under the table, your actual take-home pay will be lower than the hourly or annual wage listed on your job contract. The reason for this discrepancy between your salary and your take-home pay has to do with the tax withholdings from your wages that happen before your employer pays you. There may also be contributions toward insurance coverage, retirement funds, and other optional contributions, all of which can lower your final paycheck.

When calculating your take-home pay, the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Your employer withholds a 6.2% Social Security tax and a 1.45% Medicare tax from your earnings after each pay period. If you earn over $200,000, youll also pay a 0.9% Medicare surtax. Your employer matches the 6.2% Social Security tax and the 1.45% Medicare tax in order to make up the full FICA taxes requirements. If you work for yourself, youll have to pay the self-employment tax, which is equal to the employee and employer portions of FICA taxes for a total of 15.3% of your pay.

Also Check: How To Collect Sales Tax

How Much Is Gas Prices In California

State Gas Price Averages

| $4.226 |

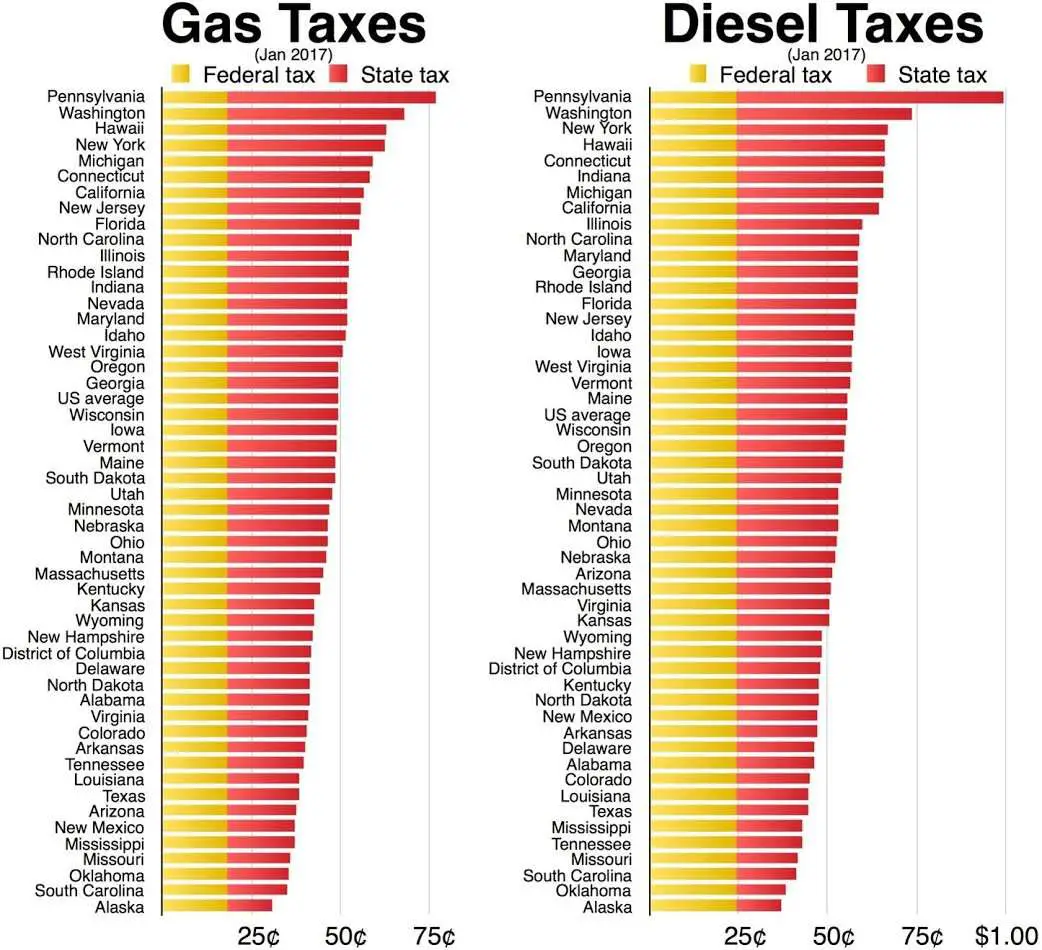

What state has the most gas taxes?

New York has the highest gas tax, Alaska has the lowest But on top of that, each state levies its own individual gas taxes to fund state and local transportation spending. This varies fairly widely from state to state. New York has the highest state and local taxes at 50.50 per gallon.

What is the current gas tax?

The current federal gasoline tax is 18.4 cents per gallon, according to the U.S. Energy Information Administration. The duty rises to 24.4 cents per gallon for diesel. Congress has not raised the federal gas tax since 1993.

Sales Tax Takers And Leavers

If you’re a consumer, you’ll want to consider that all but four states Oregon, New Hampshire, Montana and Delaware rely on sales tax for revenue.

Of these, Alaska also has no income tax, thanks to the severance tax it levies on oil and natural gas production. 37 states, including Alaska and Montana, allow local municipalities to impose a sales tax, which can add up. Lake Providence, Louisiana has the dubious distinction of most expensive sales tax city in the country in 2021, with a combined state and city rate of 11.45%.

Factoring the combination of state and average local sales tax, the top five highest total sales tax states as ranked by the Tax Foundation for 2021 are:

- Tennessee 9.55%

Residents of these states pay the least in sales taxes overall:

- New Hampshire 0%

Don’t Miss: How To File Federal Tax Return

When Is This Bill Effective

Senate Bill 113 is effective for the tax year beginning on or after Jan 1, 2022. This allows other state tax credits to be used before the pass through entity tax credit. This bill also ends the temporary suspension of net operating losses, and it also takes away the five million dollar business credit limit enacted under Bill 85.

For taxable years after Jan 1, 2019, Senate Bill 113 excludes gross income any amount received from federal restaurant revitalization adopts and grants. Businesses that consider making a pass through tax entity election could see significant tax benefits.

It is very important to note that making the decision to elect pass through entity requires modeling and analysis of your business. In order to do that, you may want to reach out to a reputable tax advisor to help you sort through this new bill to see if it will benefit you and your business.

Does California Impose An Inheritance Tax

As of 2020, only six states impose an inheritance tax and California is not one of them. Be careful, however, if you inherited property located in another state. If that state levies an inheritance tax, you could be responsible for paying the tax even though you are not a resident of that state. Always check with an experienced probate attorney if you inherit property to ensure that you understand what taxes, if any, must be paid on the inheritance.

Also Check: Does Puerto Rico Pay Taxes

Recommended Reading: How Does Inheritance Tax Work

California Alcohol Cigarette And Gas Taxes

Products that face separate tax rates include alcoholic beverages, tobacco products and gasoline. For alcohol and cigarettes, rates are assessed based on the quantity of the product purchased. Wine, for example, faces a rate of 20 cents per gallon. For regular gasoline, there is a 51.10 cent per gallon excise tax.

What Is The Federal Inheritance Tax Rate

There is no federal inheritance taxthat is, a tax on the sum of assets an individual receives from a deceased person. However, a federal estate tax applies to estates larger than $11.7 million for 2021 and $12.06 million for 2022. The tax is assessed only on the portion of an estate that exceeds those amounts. The rate is on a sliding scale, from 18% to 40%.

Also Check: Who Pays The Most Taxes In America

California State Income Tax: A Guide For 2022

California is a beautiful place to live, but living in the Golden state comes with a complicated income tax system. In fact, Californias tax system varies significantly from the federal tax system in many different ways. For example, this state has its own deductions and credits that you may benefit from, especially with the new Senate Bill 113 and California AB 150.

If you want to learn more about how you can reduce your tax liability or if you need to pay state taxes, continue reading below. This brief California state income tax guide will walk you through what you can expect for this tax year.

Contents

What Is The Gas Price In California

State Gas Price Averages

| $0.18 |

How much is gas per gallon in California?

The average price for a gallon of regular unleaded gasoline is $4.54 in California, which is about $1.16 higher than the national average, according to data from AAA.

How much is gas going up in California?

The average price has increased 17 consecutive days and 22 of the past 23. California is the state with the highest average cost for regular grade gas at $4.54 per gallon according to AAA.

Recommended Reading: How To Pay Off Back Taxes Fast

Inheritance Tax In California

While an estate tax is charged against the deceased persons estate, regardless of who inherits what, states with an inheritance tax assess it on the beneficiary . California also does not have an inheritance tax.

In fact, just six states do Iowa, Kentucky, Maryland, Nebraska, New Jersey and Pennsylvania. Notably, only Maryland has both an estate and an inheritance tax.

The federal government does not assess an inheritance tax.

Donât Miss: How Do You Have To Make To File Taxes

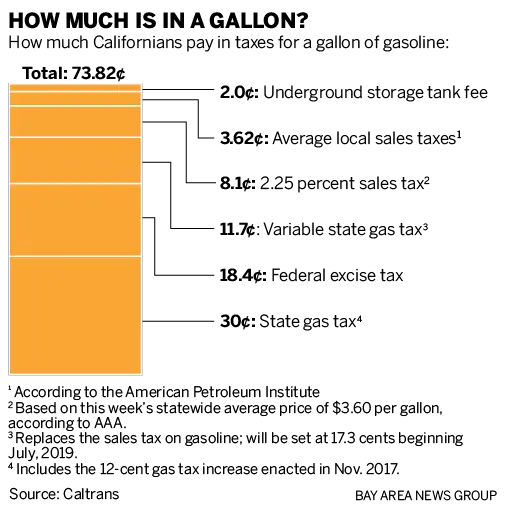

Taxes Fees Make Up $118 Per Gallon Of Gas In California

With the price of gasoline setting record high prices in California, some are wondering where their money goes.

Taxes and fees make up a portion of the cost of the states sky high gas prices, which are also highest in the nation.

Earlier this year, an analysis by Irvine based researchers Stillwater Associates found Californians were paying at least $1.18 cents per gallon in taxes and fees alone. That number fluctuates by a few cents depending on sales tax calculations, which vary by city.

Here is a full breakdown of the added cost:

- Taxes:Federal Excise Tax: 18 cents per gallonState Excise Tax: 51 cents per gallonSales Tax : 10 cents per gallon

- Fees:Low Carbon Gas Programs: 22 cents per gallonGreenhouse Gas Programs: 15 cents per gallonUnderground Tank Storage: 2 cents per gallon

California has the highest gas prices in the nation, according to AAA.

In the Southern California region: the average price per gallon stood at $4.672 in the Los Angeles Long Beach area, followed by $4.654 in Ventura, $4.635 in Orange County, $4.629 in San Diego, $4.621 in the Santa Barbara area and $4.613 in San Bernardino and $4.591 in Riverside.

Some gas stations KTLA visited in the Los Angeles area had prices over $5 per gallon Monday.

This segment aired Monday, Nov. 15, 2021.

Also Check: Will Tax Deadline Be Extended In 2021

States With The Lowest Personal Income Tax Rates

Only eight states have no personal income tax:

In addition, New Hampshire limits its tax to interest and dividend income, not income from wages.

Among the states that tax income, Pennsylvania’s 3.07% flat tax ranks the Keystone State as the 10th lowest in the nation for 2021.

Low personal income tax rates can be misleading a lack of available tax deductions, for example, can raise the effective rate you pay. The Retirement Living Information Center states that figuring your total tax burden, including sales and property taxes, can give you a more accurate reading on affordability, especially if you’re on a fixed income. However, these states with the lowest taxes on income can be a good place to start looking for a more affordable location.

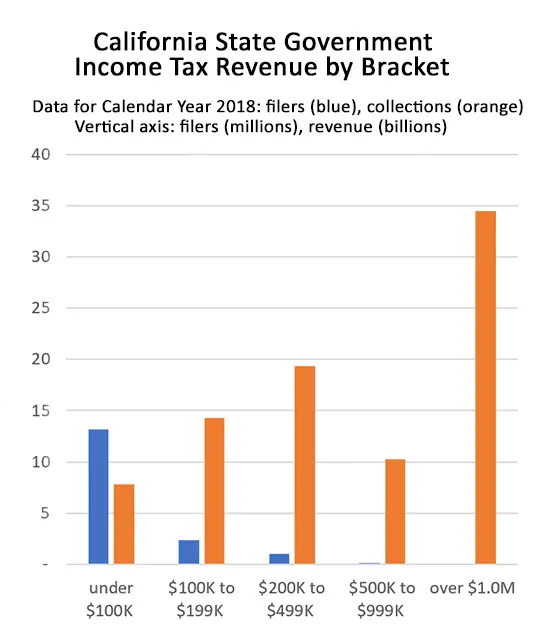

Californias Sales And Excise Taxes Are Regressive Asking The Most From Those With The Least Ability To Pay

In contrast to the personal income tax, the sales and use tax is regressive. This is because people with lower incomes need to spend larger shares of their income to cover basic needs, so sales taxes take up larger shares of low-income households budgets. The sales and use tax is the states second-largest revenue source.

Excise taxes, which are taxes on specific goods including gasoline, alcohol, and tobacco, are also highly regressive. Like sales taxes, excise taxes hit people with lower incomes hardest since any money they spend on items subject to excises taxes will generally make up a larger share of their overall budgets compared to high-income people. In addition, since excise taxes are generally based on the volume of the purchase rather than the price, people at all income levels pay the same tax on a given amount of a product, whether they buy an economical brand or a more expensive brand.Meg Wiehe et al., Who Pays: A Distributional Analysis of the Tax Systems in All Fifty States , 19-20, .

The 20% of California families with the lowest incomes pay 7.4% of their incomes in combined state and local sales and excise taxes, compared to 0.8% for the richest 1%. Again, because Black, Latinx, and many other Californians of color are more likely to have low incomes than white Californians, regressive taxes like sales and excise taxes exacerbate racial inequity.

Read Also: How Does Debt Settlement Affect Taxes

Total Federal Taxes Paid By State

California has the largest population of any state, and those residents earn a relatively high average income. When you combine those two factors, its no surprise that California residents pay more federal taxes than those of any other state.

Vermont pays the least. Total federal income taxes in Vermont are about $2.5 billion. Thats due to the combination of having the second-smallest adult population of any state and a below-average per capita income.

Here are the top 10 states in terms of total federal income taxes paid:

| $44,245,528 |

Recent Statewide Sales Tax Increases

Recent temporary statewide sales tax increases include:

- From April 1, 2009 until June 30, 2011, the state sales and use tax increased by 1% from 7.25% to 8.25% as a result of the 2008-2009 California budget crisis.

- Effective January 1, 2013, the state sales and use tax increased by 0.25% from 7.25% to 7.50% as a result of Proposition 30 passed by California voters in the November 6, 2012 election. The change was a four-year temporary tax increase that expired on December 31, 2016.

Recommended Reading: How Do Employers Pay Social Security Tax

Workshop: California State Income Tax Filing

Attend of the workshop during March or April to learn about the California state’s filing requirements. A member of the California Franchise Tax Board will present these workshops to assist you with filing any required state tax forms. We recommend completing your federal tax return before attending one of these workshops. Students or scholars who are considered nonresidents for California state tax filing will complete and file California Tax Form 540NR those who are considered residents for California state tax filing will complete and file California Tax Form 540.

The 2022 workshops have concluded. The next-year workshop information will be posted here in the beginning of 2023.

How Can Employers Avoid Payroll Tax Penalties

Employers who proactively manage their payroll taxes are more likely to avoid penalties than those who dont. Here are some preventive tips:

- Classify employees correctlyMisclassifying employees as independent contractors to avoid paying FICA and FUTA taxes is illegal.

- Withhold and pay taxes on time Using payroll funds to pay another creditor instead of the IRS is an example of willful disregard and may result in a TFRP.

- File tax reports using the proper forms Employers must file amended returns if they make a mistake or use the wrong form.

- Stay up-to-date with tax law changes Payroll tax rates and wage base limits are subject to change by federal, state and local governments.

- Partner with a qualified payroll service providerPayroll software automates FICA calculations, deductions and payments to help ensure accuracy.

Recommended Reading: What Is Massachusetts Sales Tax

How States Plan To Spend Millionaire Tax Revenue

While the proposed taxes sound similar, there are differences in how each state plans to use the revenue.

In Massachusetts, assuming voters pass the measure, the tax is expected to generate about $1.3 billion of revenue in 2023, according to a Tufts University analysis. The state aims to use the revenue to fund public education, roads, bridges and public transportation.

Californias tax is projected to bring in $3.5 billion to $5 billion annually should it pass, and the state plans to use the revenue to pay for zero-emissions vehicle programs and wildfire response and prevention.

Whether voters support higher income taxes or not, revenue plans often affect the results on Election Day, experts say.

Weve seen voters reject income tax increases on high earners, even when it applies to relatively few people, said Jared Walczak, vice president of state projects at the Tax Foundation. And weve seen them embrace income tax changes that would affect many.

Weve seen voters reject income tax increases on high earners, even when it applies to relatively few people.Jared WalczakVice president of state projects at the Tax Foundation

Overall, theres one clear trend with state tax ballots: Voters care about the plans for the money, he said.

How To Elect Ab 150

During the tax years of 2021 to 2025, qualified entities can make this election annually on their original and timely filed returns. Once they do that, they can pay the tax on their share of the net income of their qualified entity.

Qualified entities for this bill are limited liability companies with multiple members, S corporations, and partnerships. Any pass-through entities with partnerships or a disregarded entity as an owner of a public traded partnership are disqualified from this bill. Any entities that must be in a combined reporting group also do not qualify for this bill.

Read Also: Is The Tax Assessment The Value Of The Property

Californias State And Local Tax System Could Be More Progressive

The overall impact of the state and local tax system on Californians is determined by the combination of the progressive personal income tax and regressive sales and excise taxes, as well as other taxes levied by the state and localities most notably local property taxes and corporate income taxes. The combined impact is a state and local tax system that is regressive for people with lower incomes and progressive for people with very high incomes. The richest 1% of California tax filers pay the largest share of their income in state and local taxes , but the 20% of filers with the lowest incomes pay the next highest share . While the richest Californians pay a smaller portion of their income in sales, excise, and property taxes than any other group, it is made up for by the larger share of their income that goes to income taxes. Conversely, while the bottom 20% of Californians on average get money back from the personal income tax system via refundable tax credits, this is not enough to make up for paying larger shares of their income in sales, excise, and property taxes.

Recommended Reading: Are Mortgage Interest Tax Deductible