Taxes Deductions And Benefits

Pay statements are broken up into different sections, including pay details, earnings, deductions, taxes, paid time off, and more. The way a statement is formatted may vary depending on the provider your company uses for pay roll, but they will all generally include the same kind of information.

In this diagram, you can find where to look for each piece of information on your paycheck. Youll notice the Fed Med/EE tax is listed under the Taxes section.

A pay statement example without monetary value this shows the different categories included on a basic statement, like pay details, earnings, deductions, taxes, paid time off, and pay summary. Fed Med/EE tax will always be under the Taxes section on your paycheck. This is a federal withholding.

Pay Details This includes your basic information that pertains to your job, like your full name, address, employer number, social security number, job title pay rate, etc.

Earnings This section highlights what you have earned during a pay period, as well as things like holiday pay, vacation time, and overtime.

Deductions Depending on what you contribute to and what your company offers, deductions on your pay statement will include things like your 401 , childcare, stock, work uniforms/supplies, and food/beverage purchased while at work.

If you are enrolled in an insurance and/or health savings plan through your employer, you will see those benefits show up on your pay stub, as well.

- Medical Insurance

What Is The Medicare Tax Rate For 2021

The Medicare tax rate is 1.45%. But the Federal Insurance Contributions Act tax combines two rates. FICA taxes include both the Social Security Administration tax rate of 6.2% and the Medicare tax rate.

Thus, the total FICA tax rate is 7.65%. The maximum Social Security tax amount for both employees and employers is $8,239.80. For self-employed people, the maximum Social Security tax is $16,479.60. Anyone who earns wages over $200,000 will need to pay an extra 0.9% Medicare tax.

Employers arent responsible for this additional fee. The charge is withheld from the employees wages only. The self-employment tax rate is slightly higher, at 15.3%. Both the Social Security tax rate of 12.4% and the 2.9% Medicare tax rate contribute to this figure.

What If Too Much Tax Is Withheld From Your Bonus

Are you worried that too much tax might be taken from your bonuses? Well, it is possible for you to be over-taxed, although it’s easily resolvable if you know what you’re doing! If you prepare your tax return and notice that your withheld bonus amount is way too much based on your end-of-year tax rate on your taxable income, you should receive a refund.The IRS will work out how much tax you have paid, and if it’s above the flat rate of 22% of your overall income, you’ll get issued a refund. Want to know how the IRS checks your tax is correct? They’ll check your Form 1040 tax return, as this will show an overpayment of taxes if you have indeed been paying too much.The IRS will then refund any difference between the balance you paid in over the year and what your tax return determined that you should have paid.

Recommended Reading: How Can I Make Payments For My Taxes

Social Security And Fica

Most employees and employers each pay Social Security and Medicare taxes on Social Security and Medicare covered wages. These taxes comprise FICA .

Social Security Portion of FICA

- The Social Security portion of FICA is 6.2% of the maximum taxable wages.

- If you reach the maximum payment, you do not pay any more Social Security tax until the next calendar year.

- The maximum taxable wage for Social Security is adjusted each year. Visit Social Security Administration site to learn more about your Social Security Contribution and Benefit Base.

Medicare Portion of FICA

- The Medicare portion of FICA is 1.45% for wages up to 200,000 and 2.35% for wages above $200,000.

- There is no cap on wages for the Medicare portion of FICA.

FICA Refunds

Find out about FICA Refunds as a result of the Doctors Council v. NYCERS court decision.

Federal Income Tax Withholding

Withhold federal income tax from each wage payment or supplemental unemployment compensation plan benefit payment according to the employee’s Form W-4 and the correct withholding table in Pub. 15-T. If you’re paying supplemental wages to an employee, see section 7. If you have nonresident alien employees, see Withholding income taxes on the wages of nonresident alien employees in section 9.

See section 8 of Pub. 15-A, Employers Supplemental Tax Guide, for information about withholding on pensions , annuities, and individual retirement arrangements .

Employer Responsibilities

| Employer Responsibilities: The following list provides a brief summary of your basic responsibilities. Because the individual circumstances for each employer can vary greatly, responsibilities for withholding, depositing, and reporting employment taxes can differ. Each item in this list has a page reference to a more detailed discussion in this publication. |

You May Like: How Much Taxes Do You Pay On Slot Machine Winnings

How To Reduce Tax Payments

Now, don’t get your hopes up – you can’t avoid paying your taxes, and you can’t reduce them entirely. However, there are a few ways you can reduce how much you own in taxes. All it takes is a bit of know-how! Using your bonus funds to invest in your 401 or IRA can be a wise and completely legal way of reducing your tax on bonuses.Alternatively, if you’re expecting a pay cut in the next year , you could ask your employer to defer your bonus until the following tax year. This way, you’ll still receive your bonus however, you won’t be charged as much tax – you just have to wait a little longer to receive your money.

Learn More About Medicare Enrollment

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

You May Like: How Does H& r Block Charge

How Fica Tax Or Withholding Tax Are Calculated

The amount of tax your employer withholds from your check largely depends on what you put on your Form W-4, which you probably filled out when you started your job. Here are some things to know:

-

Form W-4 asks about your marital status, dependents and other factors to help you calculate how much to withhold. The less you withhold, the less tax comes out of your paycheck.

-

What you put on your W-4 then gets funneled through something called withholding tables, which your employer’s payroll department uses to calculate exactly how much federal and state income tax to withhold.

-

You can change your W-4 any time. Just , fill it out and give it to your human resources or payroll team.

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual’s Medicare wages that exceed a threshold amount based on the taxpayer’s filing status. Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual’s wages paid in excess of $200,000 in a calendar year, without regard to filing status. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee and continue to withhold it each pay period until the end of the calendar year. There’s no employer match for Additional Medicare Tax. For more information, see the Instructions for Form 8959 and Questions and Answers for the Additional Medicare Tax.

Don’t Miss: How Can I Make Payments For My Taxes

Fed Med/ee On Your Paycheck & Other Withholdings

Most people get their pay statement and do a quick scan until they find how much money will go straight into their pocket from the week. However, if you take the time to look through all of the taxes and withholdings, you may be surprised at how many items are listed that you are not familiar with. This is likely because many pay statements use the formal names for these taxes, rather than simply stating Medicare.

In this video from Paxton Patterson College Career Prep, youll learn exactly how to read your paycheck and understand those statement withholdings that once seemed confusing.

Okay, now that you have the gist of the main withholdings you will find on your weekly, biweekly, or monthly paycheck, lets break down whats in the video a bit more and discuss how exactly you should be reading your paycheck.

Fica Tax: Wage Base Limits

A wage base limit applies to employees who pay Social Security taxes. This means that gross income above a certain threshold is exempt from this tax. The wage limit changes almost every year based on inflation. For 2019, it was $132,900. For 2020, its $137,700. This income ceiling is also the maximum amount of money thats considered when calculating the size of Social Security benefits.

Medicare taxes, on the other hand, dont have a wage limit. But theres an Additional Medicare Tax that high-income individuals must pay. That has been the case since January 1, 2013.

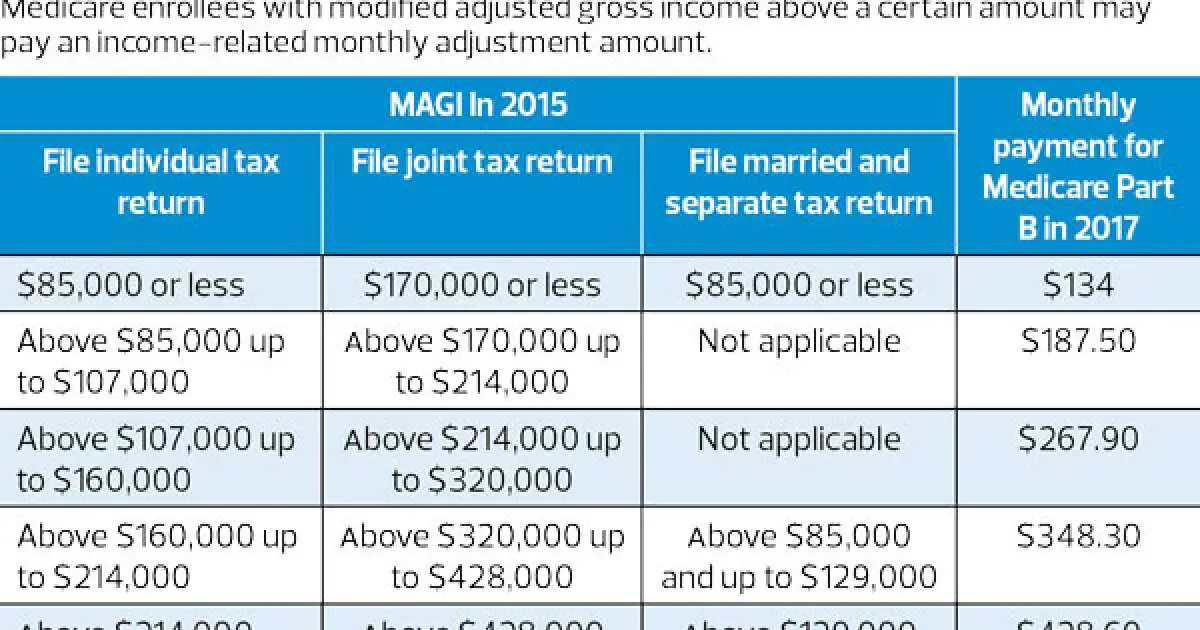

The Additional Medicare Tax rate is 0.90% and it applies to employees wages, salaries and tips. So any part of your income that exceeds a certain amount gets taxed for Medicare at a total rate of 2.35% . That income ceiling for 2020 is $200,000 for single filers, qualifying widows and anyone with the head of household filing status $250,000 for married couples filing joint tax returns and $125,000 for couples filing separate tax returns. You can calculate how much you owe using Form 8959.

You May Like: Do You Have To Report Your Roth Ira On Your Taxes

Medicare Payroll Tax Example:

To calculate Medicare withholding, multiply your employees gross pay for the current pay period by the current Medicare rate .

Employee A gross pay for the current pay period X current Medicare tax

rate = Medicare tax to be deducted from employees paycheck

$2,000 X .0145 = $29

and an equal amount to be contributed by the employer

Unlike the Social Security withholding, there is no wage base limit for Medicare taxable wages. Rather, the employees are taxed an additional 0.9% after an employee earns a certain wage. This additional Medicare tax is based on the filing status of the employees.

Single: $200,000

This will lead to a deduction of 1.45% plus the 0.9% additional Medicare tax in case the employees reach the above-mentioned limits. Employers are exempted from contributing to the additional Medicare tax.

Ordering Employer Tax Forms Instructions And Publications

You can view, download, or print most of the forms, instructions, and publications you may need at IRS.gov/Forms. Otherwise, you can go to IRS.gov/OrderForms to place an order and have them mailed to you. The IRS will process your order as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms, instructions, and publications faster online.

Instead of ordering paper Forms W-2 and W-3, consider filing them electronically using the SSA’s free e-file service. Visit the SSA’s Employer W-2 Filing Instructions & Information webpage at SSA.gov/employer to register for Business Services Online. Youll be able to create Forms W-2 online and submit them to the SSA by typing your wage information into easy-to-use fill-in fields. In addition, you can print out completed copies of Forms W-2 to file with state or local governments, distribute to your employees, and keep for your records. Form W-3 will be created for you based on your Forms W-2.

Also Check: Form 5498 H& r Block

Niit And Additional Medicare Tax Are Different

The Net Investment Income Tax is from the Additional Medicare Tax, which also went into effect on January 1, 2013. You may be subject to both taxes, but not on the same type of income. The 0.9 percent Additional Medicare Tax applies to individuals wages, compensation, and self-employment income over certain thresholds, but it does not apply to income items included in Net Investment Income.

In the below example, the individual has earned a net investment income of $26,868 from dividends and interest and has a modified adjusted gross income of $252,494.

The IRS states that the amount subject to the net investment income tax is the SMALLER of the net investment income or the difference between MAGI and the threshold .

Therefore, $26,868 is subject to an additional 3.8% tax, or $1,021. The individual has already paid roughly $50,000 in federal income taxes , along with an additional $14,000 in California state income taxes already.

What Is Fica Tax

Medicare tax falls under a larger payroll tax called the Federal Insurance Contributions Act tax. So those automatic deductions from your paycheck for Medicare, along with the Social Security tax, make up the FICA tax.

Just like your Medicare taxes, Social Security taxes are based on gross earnings , and you and your employer will split the total contribution down the middle. While the Medicare tax is 1.45% for each of you, the Social Security tax is 6.2% apiece .4

That brings your total FICA tax to 7.65%. And, of course, if you cross any of those high-dollar income thresholds, add 0.9% for Additional Medicare tax. Heres what this looks like.

You May Like: How To Buy Tax Lien Properties In California

What Is Included In Medicare Wages

These include medical, vision, and dental insurance premiums, Flexible Spending Account Health Care, and Flexible Spending Account Dependent Care. Employers are required to withhold Medicare tax on employees Medicare wages. This is a flat rate of 1.45%, with employers contributing a matching amount.

How Are Medicare Taxes Calculated

To calculate FICA tax contribution for an employee, multiply their gross pay by the Social Security and Medicare tax rates. For example, if an employees taxable wages are $700 for the week, their social security contribution would be: $700.00 x 6.2% = $43.40. These are also the amounts the employer would pay.

Recommended Reading: Do I Have To Report Roth Ira Contributions On My Taxes

Whether To File Form 8959

Beginning with the 2013 tax year, you have to file Form 8959 if the Medicare wages or RRTA reported exceed $200,000 for single filers or $250,000 for joint filers

If you have self-employment income, you file form 8959 if the sum of your self-employment earnings and wages or the RRTA compensation you receive is more than the threshold amount for your filing status.

Medicare Tax Statistics For 2021

- Fed Med/EE stands for Federal Medicare Employer-Employee tax, which is currently a total of 2.9%, split evenly by an employee and employer.

- There is no income limit for Medicare tax, unlike Social Security tax.

- Medicare is likely to cover nearly 18% of federal government spending by 2028, MedicareResources.org

- The program currently provides insurance for nearly 60.6 million Americans, MedicareResources.org

- When Medicare first rolled out, it was a total of 0.7%, split by the employee and employer, Smartasset.com

Don’t Miss: How To Look Up Employer Tax Id Number

Medicare Taxes And The Affordable Care Act

The Affordable Care Act was passed in 2010 to help make health insurance available to more Americans.

To aid in this effort, the ACA added an additional Medicare tax for high income earners. This raised the tax from 1.45 percent to 2.34 percent for people with an earned annual income of more than $200,000 .1

The additional tax is the sole responsibility of the employee and is not split between the employee and employer.

If you make more than $200,000 per year in 2021, the 0.9 percent surtax only applies to the amount you make that is over $200,000. For instance, if you make $300,000 per year, you and your employer each pay the standard 1.45 percent Medicare tax for the first $200,000 you make, and you pay the additional 0.9 percent Medicare tax on the $100,000 that is left.

How Can I Lower Medicare Costs

The Medicare Savings Program helps low-income beneficiaries pay Original Medicare premiums, copays, and deductibles. The Medicare Extra Help program assists low-income beneficiaries with prescription drug coverage.

Some Medicare beneficiaries are also eligible for Medicaid, the federal-and-state-funded health insurance program for low-income Americans. Eligibility varies by state â you can see our state-by-state guide to Medicaid here to find out if youâre eligible, and read more about Medicare vs Medicaid.

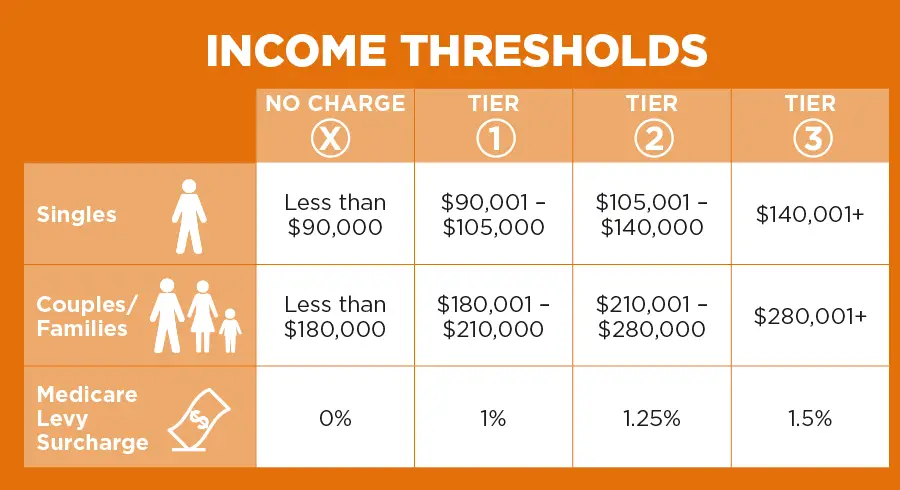

Beyond that, cost-saving comes down to finding the best plan and program structure for you. Some people may be looking for different Medicare benefits and more robust coverage than others. As weâve discussed, these elections and their costs will vary, depending on whatâs offered by your state and your income level.

Read Also: What Does H& r Block Charge

Medicare Taxes For The Self

Even if you are self-employed, the 2.9% Medicare tax applies.

Typically, people who are self-employed pay a self-employment tax of 15.3% total which includes the 2.9% Medicare tax on the first $142,800 of net income in 2021.2

The self-employed tax consists of two parts:

- 12.4% for Social Security

- 2.9% for Medicare

You can deduct the employer-equivalent portion of your self-employment tax in figuring your adjusted gross income. If youre unsure of how to do this, a tax professional may be able to help.