Tips For Filing Taxes

- A financial advisor can help you develop a tax strategy to benefit your investing and retirement goals. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you dont know whether youre better off with the standard deduction versus itemized, you might want to read up on it and do some math. Educating yourself before the tax return deadline could save you a significant amount of money.

- Figure out whether youll be getting a refund or will owe the government money so you can plan your household budget accordingly. SmartAssets tax return calculator can help you figure this out.

New York Is Casting A Much Bigger Net Fishing For Remote Taxpayers Under The Office Of Convenience Rule

In recent months, New York has started issuing desk audit notices, basically as soon as returns are filed, to taxpayers who have claimed a change of residency or who have reported less income attributable to New York sources than in prior years. New York is issuing desk audit notices, assigning taxpayers case numbers, and requiring a response. Failure to respond promptly with sufficient information will result in an assessment of additional tax along with associated penalties and interest.

Taxpayers receiving these notices related to a reduction in income allocated to New York State will be required to prove that any days allocated outside of New York were for their employers necessity to the Departments satisfaction. The Department will assess additional tax under the Office of Convenience Rule if the taxpayer is unable to substantiate to the Departments satisfaction that the days worked outside New York was not for the individuals convenience. Please note that the Department is taking the position that any day worked from home due to COVID is for the employees convenience and not the employers necessity.

Taxpayers receiving notices related to a claimed residence change will be required to prove to the Departments satisfaction that they:

What Is Sales And Use Tax

When you read about sales tax in New York, youll see talk of Sales and Use Tax. What is use tax and why do you have to pay it?

As you might know, sales tax applies to goods and services you buy within a state. Use tax is an equivalent tax that you pay on items that you purchase outside of the state. It ensures that out-of-state retailers dont benefit just because they dont have to pay the in-state sales tax. The use tax in New York is the same as the sales tax. The two taxes are also mutually exclusive so if you pay one of them, you wont have to pay the other.

Lets look at an example to show how use tax works: Imagine youre a New York resident and you buy a computer somewhere within the state. The seller will collect the regular New York sales tax. But if you buy a computer from New Hampshire, the seller wont collect the New York sales tax. That means you can get the computer without paying the full tax on it. So New York collects a use tax. New York requires residents to report their out-of-state spending in their New York income taxes.

Don’t Miss: Where Do I File My Federal Tax Return

Top Earners And Corporations Get A Tax Increase

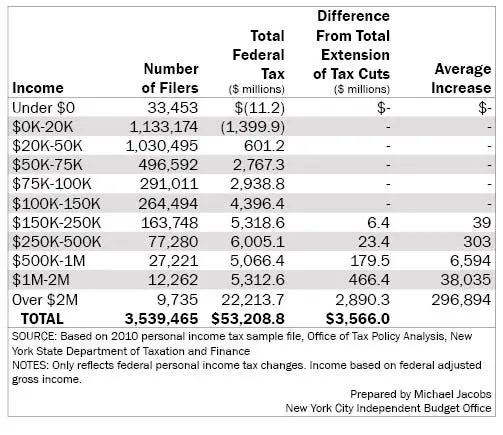

Under the plan, individuals making more than $1 million annually and couples who make more than $2 million per year will see their income tax rate increase to 9.65% from 8.82%.

The bill will also create two new tax brackets aimed at the highest earners.

Those who make more than $5 million per year will see their personal income tax rate grow to 10.3%, and those who are bringing in more than $25 million annually will see a rate of 10.9%.

The budget would also increase taxes on corporations, boosting the business income tax rate to 7.25% from 6.5% for three years through tax year 2023 for those with business income greater than $5 million, according to the plan.

Combined with the personal income tax hikes, the increased levies are estimated to raise about $4.3 billion annually.

The Nyc School Tax Credit

The New York City School Tax Credit is available to New York City residents or part-year residents who can’t be claimed as dependents on another taxpayer’s federal income tax return.

You can take a refundable credit of $125 if you’re married, file a joint return, and have an income of $250,000 or less. All other taxpayers with incomes of $250,000 or less can receive a refundable credit of up to $63.

No credit is allowed for taxpayers with incomes of more than $250,000.

Don’t Miss: How To Find Property Tax Records

New York Does Tax Unemployment Income Excluded Under The Federal American Rescue Plan Act

The New York Department of Taxation and Finance has issued a bulletin explaining the states treatment of the federal American Rescue Plan Act of 2021s $10,200 unemployment compensation exclusion. Because New York decoupled its personal income tax laws from any changes to the Internal Revenue Code as of March 1, 2020, the State does not permit this exclusion for purposes of New York income tax. Therefore, taxpayers must add back this unemployment compensation on their New York income tax return, which is excludable for federal income tax purposes. Taxpayers that have already filed their 2020 personal income tax returns and did not add back the excluded income must file an amended New York State tax return by using IT-558 Form, New York State Adjustments due to Decoupling from the IRC.

New York Releases Advisory Opinion On Sales For Solar Energy Systems

The New York Department of Taxation and Finance issued an Advisory Opinion on the application of sales and use tax on the sale and installation of residential and commercial solar energy systems. Petitionerstwo partnerssold commercial and residential solar energy systems to customers primarily located in upstate New York. One partner procured and provided components required for the installation of the solar energy systems, and the other partner was responsible for the transportation and installation at customers sites. The Department concluded that retail sales and installations of both residential and commercial solar energy systems were exempt from sales tax but are exempt from local tax only if the locality has enacted the exemption. Please see New York Advisory Opinion No. TSB-A-20S for further discussion.

Also Check: How To Find Real Estate Taxes Paid

New York City Sales Tax Calculator

Invoicing clients or selling to customers and need to know how much sales tax to charge? Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Input the amount and the sales tax rate, select whether to include or exclude sales tax, and the calculator will do the rest. If you dont know the rate, download the free lookup tool on this page to find the right combined NYC rate.

Earned Income Tax Credit

You can claim the earned income tax credit in New York if you have a qualifying child and can also claim the federal earned income tax credit. You are not entitled to this credit if you claimed the Noncustodial Parent New York State Earned Income Tax Credit . The credit equals to 30% of your allowable federal earned income tax credit minus your household credit.

Don’t Miss: How Are Qualified Dividends Taxed

New York Issues Guidance On The Application Of Tax Credits On Combined Returns

New Jersey has indicated that with respect to combined returns, tax credits belong to the taxable member that earned them unless a specific statute authorizes the tax credit to be earned or awarded at the group level. Any credit carryover available for future use belongs to the taxable member that originally earned the credit. If a member leaves the group, that member takes with them any tax credit/carryforward they generated. Any carryforward must be reduced by the amount that is used by the group and/or member. For specific details, please consult New Jersey Division of Taxation Technical Bulletin TB-90 .

New York Releases Details Of Pending Marijuana Law

New York state lawmakers released details of the new law legalizing recreational marijuana, which recently passed the state Senate. The legislation provides licensing requirements for marijuana producers, distributors, and retailers. It creates a social and economic equity program to assist individuals disproportionately impacted by cannabis enforcement that want to participate in the industry. The law provides for a 9% state excise tax and 4% local excise tax rate on the retail sales price of marijuana. Dispensaries may be allowed to open as early as 2022.

Distributors will be required to collect an excise tax based on the potency of the amount of THC, the active ingredient in cannabis. The law plans to tax raw flowers at 0.5 cents per milligram of THC, cannabis concentrate at 0.8 cents per milligram, and edibles at 3 cents per milligram.

The bill establishes the Office of Cannabis Management to put in place a framework that would cover medical, adult-use, and cannabinoid hemp. The tax revenue generated will be used to operate the state cannabis program and related social programs.

Read Also: How To File New Jersey State Tax Extension

New York Ptet Election Due Date Relief

New York may be providing some limited relief for the New York Pass-through entity tax election that is due today, October 15, 2021. Per New Yorks website as updated today, it explains that if you cannot opt-in by the October 15 deadline for one of the below three reasons, to submit a question to the NY PTET support team .

- Youre waiting for us to process a Form CT-6, Election by a Federal S Corporation to be Treated As a New York S Corporation, you submitted on or before October 15

- Youre experiencing difficulties creating or logging in to your Business Online Services account or

- Youre receiving an error message, such as We cannot confirm your eligibility as a New York S corporation or partnership, when you try to opt-in through your account.

The website explains when you submit the question, you must explain why you could not opt-in on time. You must also retain documentation to show you attempted to make an election prior to the October 15 deadline and make this documentation available to the department upon request. Once your issue is resolved, New York will contact the taxpayer to assist in completing the election after the deadline.

If you are unable to make the PTET election by October 15 and you do not submit a question with an explanation proving you have one of the issues listed above by October 15, you cannot elect into PTET for the 2021 taxable year.

New York And California Release Revised Regulations On Pl 86

The New York Department of Taxation and the California Franchise Tax Board have issued a technical memorandum and a draft regulation respectively. The documents put out by the states revise their interpretation of P.L. 86-272.P.L. 86-272 prohibits states and localities from imposing income taxes on remote businesses if their only activity with the state is soliciting sales of tangible personal property. The Multistate Tax Commission recently reinterpreted P.L. 86-272, stating that businesses interacting with customers via a website or an app are engaging in unprotected business activities within the customers state in a variety of scenarios, and thus no longer qualify for P.L. 86-272 protection. Both California and New York are using this reinterpretation of P.L. 86-272 to modify their respective stances on when businesses can claim P.L. 86-272 protection. Furthermore, California has indicated that its revised interpretation of P.L. 86-272 can be applied retroactively. New York is also considering a retroactive application of its revised interpretation of P.L. 86-272. For more information, please see New Yorks Draft Regulation and Californias Technical Memorandum. If you have questions about whether your business may still be protected under P.L. 86-272, please contact a member of the Withum SALT Team.

Don’t Miss: How Much Tax Is Taken Out Of Paycheck In Texas

The Nyc Household Credit

You might qualify for the New York City Household Credit if you can’t be claimed as a dependent on another taxpayer’s federal income tax return. This credit is available to resident and part-year residents of New York City.

The amount of the credit is determined by your income and filing status. Credit amounts range from $15 to $30, with an additional $10 to $30 for each additional exemption claimed on your federal return.

Imposed Sales Tax On Vapor Products

Effective December 1, 2019, a new 20% supplemental sales tax will apply to retail sales of vapor products in New York, which should be collected by a vapor products dealer. Any business that intends to sell vapor products must be registered as a vapor products dealer before making sales of vapor products. The Tax Department is developing an online registration process. In addition, if a taxpayer has debit blocks on their bank account, even if the taxpayer has already authorized sales tax payments to the Tax Department, the taxpayer must communicate with their bank to authorize their vapor products registration payment.

You May Like: How To Calculate Pay After Taxes

What Is Exempt From New York Sales Tax

Like most states, New York sales tax doesnt extend to everything. Plenty of basic necessities like food thats not prepackaged or served at a restaurant and utilities are not subject to sales tax, whereas most other products you buy at the store would be. Some services are specifically subject to New York City sales tax as well, most of which include beauty or spa treatments like massages, electrolysis, manicures and pedicures, tanning and health salons.

Check Out: Tax-Free Weekends in Every State

Publication 873 Sales Tax Collection Charts For Qualified Motor Fuel Or Diesel Motor Fuel Sold At Retail

Publication 873 provides charts that show the amount of the local sales tax in the pump price of a gallon of automotive fuel. The charts in this publication apply only to jurisdictions that continue to impose sales tax on automotive fuels using a percentage sales tax rate. The charts in this publication are for use in verifying the sales tax due, not to establish pump prices.

Note: A Tax Bulletin is an informational document designed to provide general guidance in simplified language on a topic of interest to taxpayers. It is accurate as of the date issued. However, taxpayers should be aware that subsequent changes in the Tax Law or its interpretation may affect the accuracy of a Tax Bulletin. The information provided in this document does not cover every situation and is not intended to replace the law or change its meaning.

Read Also: How To Reduce Effective Tax Rate

New York City Income Tax Credits

Tax credits reduce the amount of income tax that you owe. They come directly off any tax you owe to the taxing authority. Some credits are refundableyou’ll receive a refund of any portion of the credit that’s left over after reducing your tax liability to zero.

New York City offers several tax credits. They can offset what you owe the city, but they won’t affect the amount of New York State income tax you might owe.

New York Real Property Taxes

In New York, the median property tax rate is $1,720 per $100,000 of assessed home value.

New York Property Tax Breaks for Retirees

New York State law gives local governments and public-school districts the option of granting a reduction on the amount of property taxes paid by qualifying senior citizens by reducing the assessed value of residential property owned by seniors by 50%. To qualify, seniors must be 65 or older and meet certain income limitations and other requirements. For the 50% exemption, the law allows each county, city, town, village or school district to set the maximum income limit between $3,000 and $50,000. Under the so-called sliding-scale option, localities may also grant an exemption of less than 50% to senior citizens with yearly incomes over $50,000 but less than $58,400.

There is also an Enhanced STAR program for seniors. The Enhanced STAR exemption is available for the primary residences of senior citizens with annual household incomes not exceeding the statewide standard. Combined income must be $92,000 or less for 2022 benefits . For qualifying senior citizens, the Enhanced STAR program exempts part of the value of their home from school property taxes.

Also Check: How Much To Withhold For Taxes

New York Holds Purchase And Lease Of Picasso Painting Was Not A Sale For Resale

An LLC taxpayer-owned by two family trustspurchased a one-half interest in a Picasso painting. The other 50-percent purchaser was the father of the two sons in whose name the trusts were established. Sales tax was paid on the transaction by both purchasers. A few years latersubsequent to a lease of the painting structured between the LLC and the fatherthe LLC sought a refund for the sales tax it paid on its original purchase of the painting on the grounds the purchase was a sale for resale. Retroactively going back and using the lease as a basis for sale for resale argument was not successful. New York reasoned that in order to be a sale for resale, the taxpayer would have needed to show its sole purpose for purchasing the painting was to lease it. Here, however, the additional purpose for purchasing the painting was because it was an investment and added to the taxpayers art collection.

May 2, 2020

Whats Taxed And What Isnt

The majority of retail sales are subject to sales and use tax in New York. Some things, like cars and other motor vehicles, are taxed on the residence of the buyer and not the place where you actually buy the vehicle.

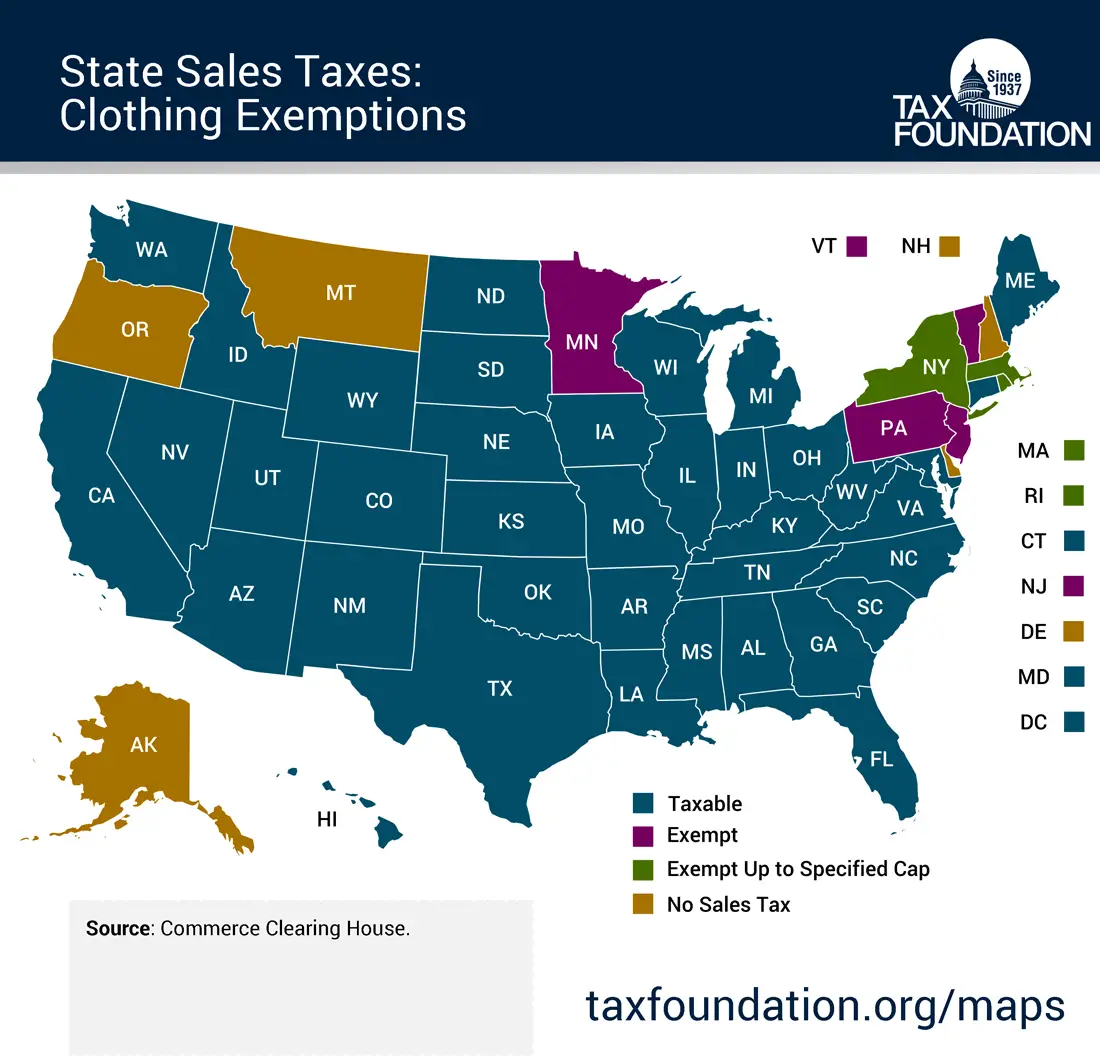

There are also a number of things that are exempt from sales tax. Some common examples are groceries, newspapers, laundering and dry cleaning, prescription drugs and feminine hygiene products. Clothing and footwear are not taxable if they are less than $110. If they are over $110, they are subject to regular sales tax rates. Any water delivered through mains and pipes is not taxable. However, public utilities like gas, electricity and telephone service are subject to sales tax.

Renting a car gets expensive in New York. If you rent a passenger car, New York state charges a sales tax of 6%. There is also a 5% supplemental tax if you rent the car within the metropolitan commuter transportation district . If you pay for any parking services , you will pay the New York sales tax of 4% plus any local sales taxes.

You can find a more complete breakdown of taxable goods and services with New York States Quick Reference Guide for Taxable and Exempt Property and Services.

Read Also: Can I File 2020 Taxes Now