How To Calculate Nyc Sales Tax

To calculate the amount of sales tax to charge in New York City, use this simple formula:

Sales tax = total amount of sale x sales tax rate .

Or to make things even easier, input the NYC minimum combined sales tax rate into the calculator at the top of the page, along with the total sale amount, to get all the detail you need.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Estimate Your Check Amount

To estimate the amount you’ll receive, you’ll need information from your 2021 New York State income tax return . If you dont have a copy of your return, log in to the software you used to file to view a copy, or request the information from your tax preparer .

Note: To protect your information, our Contact Center representatives cannot provide amounts from a return you filed.

Empire State child credit additional payment computation table

| If your line 19a amount is | your payment based on your 2021 Empire State child credit is | |

|---|---|---|

| equal to or greater than | but less than | |

| 100% of the credit amount you received. | ||

| $10,000 | 75% of the credit amount you received. | |

| $25,000 | 50% of the credit amount you received. | |

| $50,000 | N/A | 25% of the credit amount you received. |

Example: On Taxpayer B’s return, the line 19a amount is $18,000 and the line 63 amount is $333:

Recommended Reading: How Much Is Sales Tax In Wisconsin

New York Taxes On $5000 Lottery Winnings And More

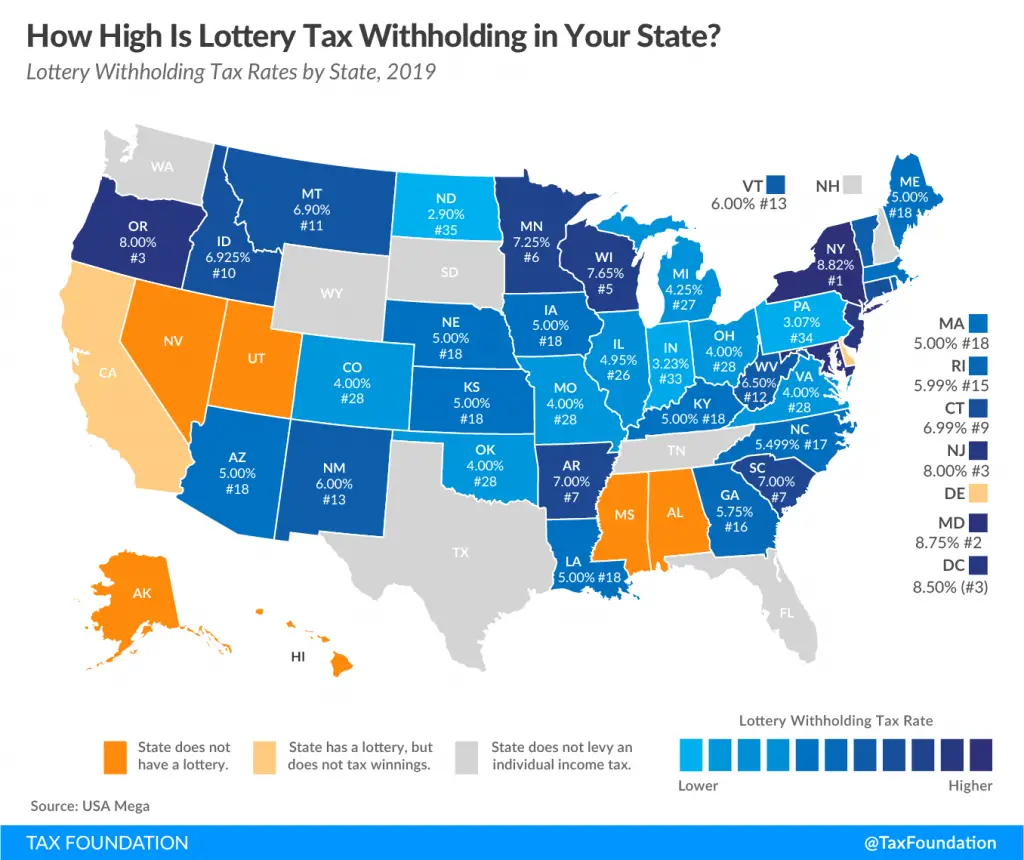

Winnings from the New York State Lottery are subject to federal and state income tax. If you are a resident of New York City or Yonkers, your prize payment is also subject to city income taxes. Other important information about New York State Lottery winnings:

- Any prize exceeding $5,000 is subject to automatic withholding of federal and state taxes . Federal withholding is 24%.The lottery will withhold state tax using the highest tax rates in effect, which is currently 8.82%.

- The New York State Lottery is required to report to the IRS all prizes in which the proceeds from the wager are greater than $600 and at least 300 times the amount of the wager. Form W-2G, which indicates the total winnings and amount of tax withheld, will be issued to you.

- The New York State Lottery does not withhold taxes or report winnings on any prizes worth $600 or less.

How To Claim And Report Ny Gambling Winnings For Taxes

Winnings that surpass a specific threshold will automatically trigger notification to the IRS. The W-2G Form is filled out by the payor and indicates the amount won and how much tax, if any, was withheld from the payout. Bettors should expect to receive a W-2G Form if gambling winnings exceeded any of these minimum thresholds during the previous calendar year:

- $5,000 or more from poker tournaments .

- $1,200 or more from slot machines or bingo.

- $600 or more from sports betting or any pari-mutuel event , provided the payout was at least 300 times the wager amount.

- $600 or more from daily fantasy sports.

If the winnings were non-cash prizes, such as a vehicle or boat, the fair market value of each prize should be reported.

New Yorkers with winnings in New Jersey or other states may be required to file a non-resident return if gambling winnings exceeded $5,000. Even if that threshold wasnt met, include the winnings on your federal and NY income tax returns. Report your total gambling winnings as Other Income on Form 1040, Schedule 1, Line 8.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

Why Is The Sales Tax On Cars In New York So High

New York has significantly higher car sales taxes than most other states in the nation. In fact, some states, such as Alaska and New Hampshire, don’t even tax car owners. According to Blunt Money, a primary reason for the high car sales tax in New York is related to politics and the revenue requirements of the state. Additional reasons why sales taxes are high in New York include:

- A deficiency in the overall budget of New York State

- The price of maintenance to repair roads after winter months

- Expenses of removing snow

- Higher cost of living overall

Child And Dependent Care Credit

You qualify for the child and dependent care credit if you are eligible for the federal child and dependent care credit, whether you claim it or not on your tax return. The is determined by the number of your qualifying children and the amount of child care expenses paid during the year. The credit is worth up to $2,310 for the tax year 2020. If the credit is more than the amount you owe in taxes, you can receive a tax refund.

Also Check: Are Goodwill Donations Tax Deductible

New York State Income Tax

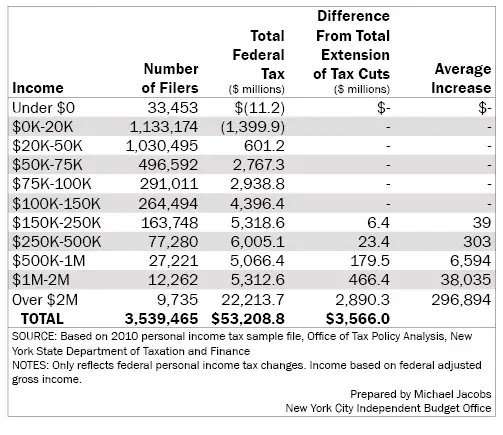

Personal income tax in New York is on a progressive system with eight brackets ranging from 4 percent up to 8.82 percent, which is only paid by people earning more than $1 million a year.

| New York State Income Tax | |

| 2018 Estimated Income Taxes | |

| $1,077,550 up | 8.82% |

New York state income tax is also notable for the addition of a separate bracket for top earners that started with a 2009 bill, which created whats now known as the millionaires tax that boosts rates to close to 9 percent for top earners.

Find Out: How Much Money You Would Have If You Never Paid Taxes

S In Using Earthodyssey Sales Tax Calculator For New York

EarthOdyssey is a great resource for calculating the vehicle sales tax in New York. Use the following steps when inputting your information into EarthOdyssey:

Don’t Miss: Are Nonprofit Organizations Tax Exempt

Sims 4 Child Support Mod Download

merit badge university 2023

The NewYorkSalaryCalculator is a good calculator for calculating your total salary deductions each year, this includes Federal Income Tax Rates and Thresholds in 2022 and NewYork State Income Tax Rates and Thresholds in 2022..

New York collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. Like the Federal Income Tax, New York’s income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.. New York’s maximum marginal income tax rate is the 1st highest in the United States, ranking directly.

Summary. If you make $55,000 a year living in the region of New York, USA, you will be taxed $11,959. That means that your net pay will be $43,041 per year, or $3,587 per month. Your average tax rate is 21.7% and your marginal tax rate is 36.0%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Things To Do In Kitty Hawk

revival sermon outlines baptist

How are capital gains taxed in New York State? Taxes capital gains as income and the rate reaches a maximum of 9.85%. New Jersey taxes. This is a property tax calculator for New York City tax class 1 homes for the current tax roll. Nearby homes similar to 436 New York Ln have recently sold between $410K to $605K at an average of $240 per square.

NIIT income thresholds are $200k for single filers, $125k for married individuals who file separately, and $250k for married filing jointly. NewYork State marginal tax rates are between 4% and 8.82%. NewYork City has four tax brackets ranging from 3.078% to 3.876%. You can use our NewYork Sales TaxCalculator to look up sales tax rates in NewYork by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. NewYork has a 4% statewide sales tax rate , but also has 640 local tax jurisdictions.

Calculate your NewYork net pay or take home pay by entering your per-period or annual salary along with the pertinent federal, state, and local W4 information into this free NewYork paycheck calculator. Switch to NewYork hourly calculator. State & Date State NewYork. Change state Check Date General Gross Pay Gross Pay Method Gross Pay YTD.

Don’t Miss: When Is The Due Date For Taxes

Other New York Tax Facts

At New Yorks Online Tax Center, taxpayers can view and pay tax bills, including estimated taxes view and reconcile estimated income tax accounts file a state sales tax no-tax-due return and upload wage reporting.

New York taxpayers can check the status of their refunds by using the New York State Department of Taxation and Finances online refund tracker.

New York taxpayers can learn about their rights in Publication 131.

For more information, visit the website of the New York Department of Taxation and Finance.

The Lost Symbol How Many Episodes

king thirain rapport lost ark

The average monthly net salary in New Zealand is around 3 117 NZD, with a minimum income of 2 157 NZD per month. This places New Zealand on the 22nd place in the International Labour Organisation statistics for 2012. Employers in New Zealand usually deduct the relevant amount of tax from the salary through a pay-as-you-earn system..

To calculate the amount of sales tax to charge in NewYork City, use this simple formula: Sales tax = total amount of sale x sales tax rate . Or to make things even easier, input the NYC minimum combined sales tax rate into the calculator at the top of the page, along with the total sale amount, to get all the detail you need.

NewYork City income tax rates are 3.078%, 3.762%, 3.819%, and 3.876%, depending on which bracket you are in. Where you fall within these brackets depends on your filing status and how much you earn annually. Below are the NYC tax rates for Tax Year 2021, which you’ll pay on the tax return you file by April 2022.

2022-8-12·The average rebate payment is $970 outside of the city. Of the three million households eligible for these checks, two million are outside of NYC. The amount of stimulus checks that New Yorkers will receive varies depending on a number of factors, including income and the school tax relief program.

Don’t Miss: How Much Does It Cost To File Taxes

What You Need To Know About New York State Taxes

The state of New York requires you to pay taxes if you are a resident or nonresident that receives income from a New York source. The state income tax rate ranges from 4% to 8.82%, and the sales tax rate is 4%.

New York state offers tax deductions and credits to reduce your tax liability, including a standard deduction, itemized deduction, the earned income tax credit, child and dependent care credit, college access credit, and more.

Whats Taxed And What Isnt

The majority of retail sales are subject to sales and use tax in New York. Some things, like cars and other motor vehicles, are taxed on the residence of the buyer and not the place where you actually buy the vehicle.

There are also a number of things that are exempt from sales tax. Some common examples are groceries, newspapers, laundering and dry cleaning, prescription drugs and feminine hygiene products. Clothing and footwear are not taxable if they are less than $110. If they are over $110, they are subject to regular sales tax rates. Any water delivered through mains and pipes is not taxable. However, public utilities like gas, electricity and telephone service are subject to sales tax.

Renting a car gets expensive in New York. If you rent a passenger car, New York state charges a sales tax of 6%. There is also a 5% supplemental tax if you rent the car within the metropolitan commuter transportation district . If you pay for any parking services , you will pay the New York sales tax of 4% plus any local sales taxes.

You can find a more complete breakdown of taxable goods and services with New York States Quick Reference Guide for Taxable and Exempt Property and Services.

Also Check: When Can I File 2021 Taxes

Do I Have To Pay New York State Income Tax

Generally, you have to file a New York state tax return if:

-

Youre a New York resident and youre required to file a federal tax return or your federal gross income plus New York additions was more than $4,000 .

-

Youre not a New York resident but got income from a source in New York during the tax year.

If youre not a resident of New York but your primary workplace is there, your days telecommuting during the pandemic are still considered days worked in New York unless your employer established an office at your telecommuting location. Generally, you will continue to owe New York State income tax on income earned while telecommuting.

» MORE: Track the status of your state tax refund

RESIDENT STATUS RULES

In general, youre a resident of New York for tax purposes if your permanent home is there , or if you leased or owned a place there and spent 184 days or more in New York state during the tax year.

-

New York considers your permanent home the place you intend to return to after things like vacations, business trips, military assignments or the end of a college semester.

-

There are special rules for people who were in a foreign country for at least 450 of 548 consecutive days.

-

Where you vote, where your drivers license and registration are issued or where your will is are not primary factors in establishing domicile. Its more about where your stuff is and where you spend your time.

PART-YEAR RESIDENT STATUS RULES

NONRESIDENT STATUS RULES

New York Sales Tax Rates By City

The state sales tax rate in New York is 4.000%. With local taxes, the total sales tax rate is between 4.000% and 8.875%.

New York has recent rate changes .

Select the New York city from the list of popular cities below to see its current sales tax rate.

Sales tax data for New York was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Recommended Reading: When Are Taxes Due 2021

New York Income Taxes

New York States top marginal income tax rate of 10.9% is one of the highest in the country, but very few taxpayers pay that amount. The state applies taxes progressively , with higher earners paying higher rates. For your 2020 taxes , only individuals making more than $25,000,000 pay the top rate, and earners in the next bracket pay 0.6% less. Joint filers face the same rates, with brackets approximately double those of single filers. For example, the upper limit of the first bracket goes up from $8,500 to to $17,150 if youre married and filing jointly.

How Much Are Ny Documentation Fees

Dealerships often charge buyers something known as documentation or doc fees in addition to taxes. These fees account for the costs incurred by the dealership when preparing and filing the necessary documentation for the purchase of a vehicle. The average documentation fee is $75 in the state of New York.

Read Also: Do You Have To File Taxes With Uber

New York Median Household Income

| Year | |

|---|---|

| 2011 | $55,246 |

What your tax burden looks like in New York depends on where in the state you live. If you live in New York City, you’re going to face a heavier tax burden compared to taxpayers who live elsewhere. Thats because NYC imposes an additional local income tax.

New York States progressive income tax system is structured similarly to the federal income tax system. There are eight tax brackets that vary based on income level and filing status. Wealthier individuals pay higher tax rates than lower-income individuals. New Yorks income tax rates range from 4% to 10.9%. The top tax rate is one of the highest in the country, though only taxpayers whose taxable income exceeds $25,000,000 pay that rate.

Taxpayers in New York City have to pay local income taxes in addition to state taxes. Like the states tax system, NYCs local tax rates are progressive and based on income level and filing status. There are four tax brackets starting at 3.078% on taxable income up to $12,000 for single filers and married people filing separately. The top rate for individual taxpayers is 3.876% on income over $50,000. The rates are the same for couples filing jointly and heads of households, but the income levels are different.

Yonkers also levies local income tax. Residents pay 16.75% of their net state tax, while non-residents pay 0.5% of wages.