How Are Property Values Established

Property assessments are based on property characteristics and current activity in the real estate market. Each year appraisers physically inspect one-sixth of the county and a large number of sale transactions to update characteristics about the buildings and land. In addition, property assessments are updated annually using Mass Appraisal procedures endorsed by the International Association of Assessing Officers. Thurston Countys property assessments are certified each year for tax purposes and this information becomes part of the official property records. Assessed values determine how the property tax obligation is distributed among property owners.

Property Tax And Sales Tax

Seattle does not collect property tax.

- Pay property tax to the county, not to the City of Seattle. To learn more about paying property taxes on land or buildings in Seattle, visit the King County website.

Seattle does not collect sales tax.

- Customers pay retail sales taxes when they make a purchase, and Seattle businesses collect that tax. Businesses then report that sales tax to the state, not to the City of Seattle. To learn more about retail sales tax, visit the Washington State Department of Revenue website.

Property Assessment In Washington Dc

The assessed value of a property is the amount to which taxes are applied. In Washington, D.C. residential property is assessed at its full market value. That means the assessed value of a home should equal the amount it would sell for on the open market.

Washington, D.C.s Office of Tax and Revenue is responsible for property assessments, which it completes on an annual basis. These usually do not involve a physical inspection of the property or a full appraisal. Instead, the OTR uses mass appraisal techniques that rely on market data and other factors to reassess many properties at the same time.

While the results of a mass appraisal are generally accurate, on a given property they can be incorrect. Homeowners should review their annual reassessment notice and confirm that their assessed value is roughly equal to the expected sales price of the property.

Homeowners who believe their house has been over-assessed can file an appeal with the Real Property Tax Administration. Appeals must be filed by April 1 to be considered. Homeowners who file an appeal should be prepared to offer evidence in support of their position. Evidence may include sales prices of nearby, comparable homes or property features that the assessor failed to consider.

Looking to calculate your potential monthly mortgage payment? Check out our mortgage calculator.

Recommended Reading: How To Compute Sales Tax

Paying Your King County Property Taxes

Wondering how much you owe in property taxes? You should receive a bill in the mail in February. In the meantime, you can view your property tax bill online by visiting kingcounty.gov and entering your tax account number for your real or personal property . If you havent received a bill by March 1 , you may need to request a statement online or by calling the Treasury Operations Property Tax Office.

If you have questions about your property tax bill and the way the county assessed the value of your property, you can email or call the County Assessor. To appeal your property appraisal, you can file a petition with the local Board of Equalization.

In King County, property taxes are usually paid in two installments. First-half taxes must be postmarked by April 30. Second-half taxes must be paid or postmarked by October 31. If you miss these deadlines, your property taxes become delinquent the following day.

For every month that your payment is late, youll be charged interest equal to 1% of the amount thats due. You could also get hit with a 3% penalty if you dont pay the full amount of your first installment by June 1 and an 8% penalty if you dont pay all of your second-half property taxes by December 1.

When youre ready to pay your property tax bill, you can do so online with a check or credit card. You can also either mail in your payment or pay it in person at the King County Treasury Operations Office.

Are There Limits On Levies

Yes. State law sets statutory limits for each type of taxing district. Initiative 747 also provides limits on the increases in regular levy collections to 1% a year or the amount of inflation, whichever is less. This limit applies to a taxing districts budget, not to the assessed value of an individual property. A district can bank the difference between the amount budgeted and their statutory limit and use the savings at a later time.

However, a taxing district can seek voter approval to increase its highest lawful levy by more than 1% for a special purpose and/or for a specific time period. This is called a levy lid lift and will result in a higher tax rate.

Recommended Reading: What Is E File Taxes

Overview Of District Of Columbia Taxes

Homeowners in the nations capital pay some of the lowest property tax rates in the country. In Washington, D.C., the average effective property tax rate is 0.55%. However, the median real estate property tax payment is $3,699, which is higher than the national average.

| Enter Your Location |

| of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property’s assessed value and the property tax rates based on your property’s address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county’s effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

…read more

Use Your Bill Pay Option

Check with your financial institution to see if any fees are charged for bill pay services. To add Washington County Taxpayer Services to your list of bill pay payees, use the following:

Biller/Payee Name: Washington County Taxpayer Services

Account Number: Property ID number from your tax statement. Only enter one account number. A new bill pay payment must be set up to make a payment for an additional parcel.

Address: 14949 62nd St. N. P.O. Box 200, Stillwater, MN 55082-0200

Read Also: How To Avoid Property Tax

Sign Up For Kiplingers Free E

Profit and prosper with the best of Kiplingers expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of Kiplingers expert advice – straight to your e-mail.

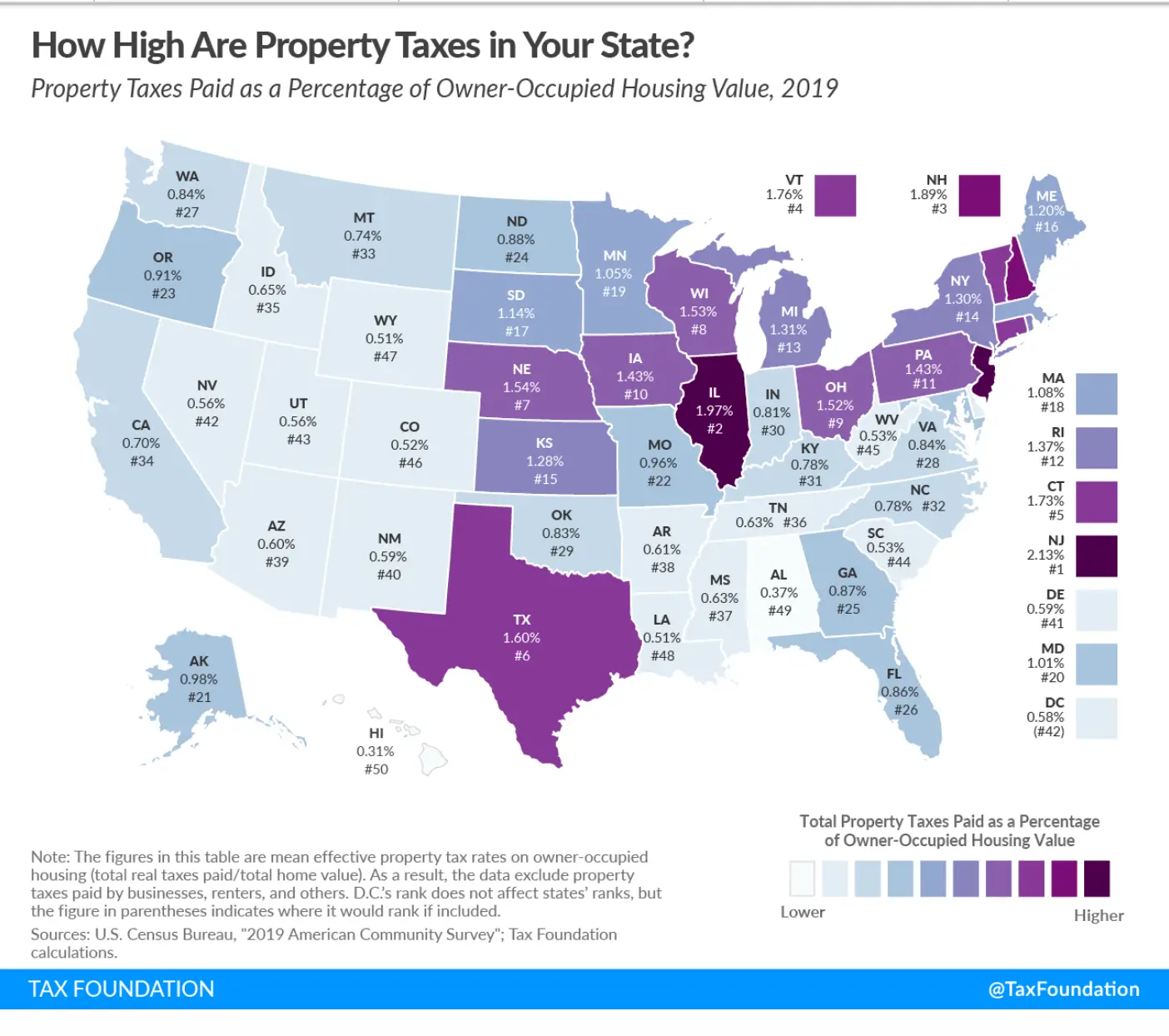

Property taxes in Washington are more reasonable, though. In fact, the median property tax rate is close to the national average.

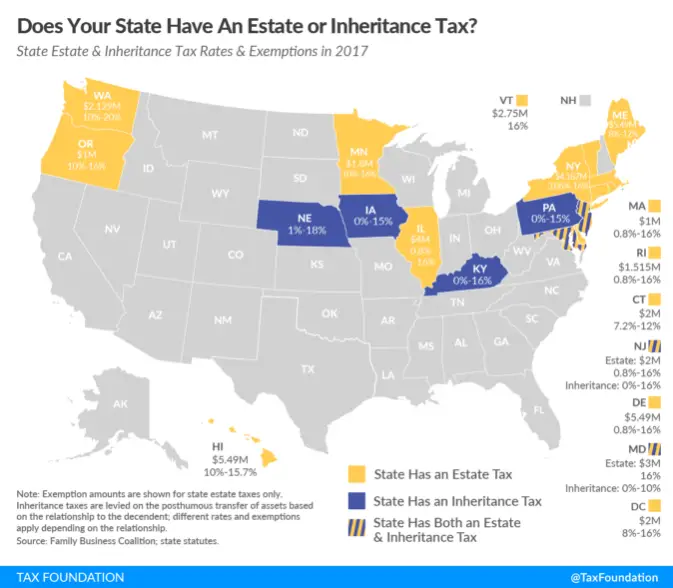

Washington is also one of a handful of states with an estate tax.

Washington Median Household Income

| 2010 | $55,631 |

Tax Day is a lot less painful for Washingtonians than for workers in many other parts of the country. Thats because the Evergreen State does not levy income taxes at the state level. Lawmakers have considered introducing a state income tax in recent years, but no attempt has been successful thus far. While local sales taxes in Seattle, Tacoma and some other metro areas are significantly higher than the national average, all areas in Washington are devoid of local income taxes.

A financial advisor in Washington can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

Recommended Reading: Is The Solar Tax Credit Going Away

What County In Washington State Has The Lowest Property Taxes

If youre looking for the lowest property tax rates in Washington State, look no further than Skamania County in the middle of the picturesque Columbia Gorge. The county seat, Stevenson, enjoys some of the Pacific Northwests most beautiful scenery and Washington States lowest property tax rate at 0.61%.

Treasury Services Are Currently Available Online By Phone Email Or Us Mail:

- Phone: Real Property Tax 206-263-2890

- Real Property Email:

- Phone: Mobile Homes and Personal Property Commercial Property Tax 206-263-2844

- Personal Property Email:

- Mail: King County Treasury Operations, 201 S. Jackson Street, Suite 710, Seattle, WA 98104 NOTE NEW MAILING ADDRESS

- Secure drop box: on side of 2nd Ave nearer to S Jackson St.

I know my parcel/account number

Need additional information? Check our Frequently Asked Questions .

Also Check: How To Calculate 1099 Taxes

Washington Property Tax Rates

Property taxes are collected on a county level, and each county in Washington has its own method of assessing and collecting taxes. As a result, it’s not possible to provide a single property tax rate that applies uniformly to all properties in Washington.

Instead, Tax-Rates.org provides property tax statistics based on the taxes owed on millions of properties across Washington. These statistics allow you to easily compare relative property taxes across different areas, and see how your property taxes compare to taxes on similar houses in Washington.

The statistics provided here are state-wide. For more localized statistics, you can find your county in the Washington property tax map or county list found on this page.

While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free Washington Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across Washington.

If you would like to get a more accurate property tax estimation, choose the county your property is located in from the list on the left. Property tax averages from this county will then be used to determine your estimated property tax.

Keep in mind that assessments are done on a property-by-property basis, and our calculators cannot take into account any specific features of your property that could result in property taxes that deviate from the average in your area.

Washington State Sales Tax

The flip-side of the states income tax-free status is its high sales taxes. The states base sales tax rate is 6.5%. But since cities and counties collect additional sales taxes on top of that rate, rates are typically at least 8%, and sometimes higher than 10%. The table below shows sales tax rates for all of the counties and the largest cities in Washington.

You May Like: Do You File Unemployment On Your Taxes

Special Considerations Relating To Levy Rate Limitations

What if the sum of the levy rates imposed by the various taxing authorities goes over the limit?

Its complicated. First, there are two limits:

- One is the 1% constitutional limit.

- The other is the $5.90 limit on cities, counties and junior taxing districts.

If either of those limits are exceeded, then the junior taxing district levies involved must be reduced through prorationing. See RCW 84.52.010.

Which levies are lowered in prorationing, by how much and in what order, depends upon whether the $5.90 limit or the 1% limit has been exceeded. The Department of Revenue Property Tax Levies Operations Manual and WAC 458-19-075 include step by step instructions for calculating prorationing. The Department of Revenue has developed Prorationing Worksheets for both the $5.90 Aggregate Limit and the 1% Aggregate Limit to help in making these calculations.

Can a county raise its regular general fund levy rate above $1.80?

A county can raise its general fund levy rate up to $2.475 per $1,000 AV, provided the total of the levy rates for the general fund and road fund do not exceed $4.05 per $1,000 AV and the increase in the general fund levy does not result in a reduction in the levy of any other taxing district through prorationing. See RCW 84.52.043.

What if my city has a firefighters’ pension fund?

What if my city belongs to a fire and/or library district?

If no one in your city hall knows what rate the special districts are currently levying, your county assessor can help you.

Regular Levy Rate Limits

The Washington State Constitution limits the annual rate of property taxes that may be imposed on an individual parcel of property to 1% of its true and fair value. Since tax rates are stated in terms of dollars per $1,000 of value, the 1% limit is the same as $10 per $1,000 and is often referred to as the $10 limit. Taxes imposed under this limit are termed “regular” levies, while those outside the limit are “excess” or “special”levies.

The following chart shows how the $10 limit is allocated. The aggregate limit for cities, counties and most special districts is $5.90 per $1,000 assessed value.

Don’t Miss: When Is Sales Tax Due

Overview Of King County Wa Taxes

King County, Washingtons average effective property tax rate is 1.05%. Thats higher than the state of Washingtons overall average effective property tax rate of 0.84%.

| Enter Your Location |

| of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property’s assessed value and the property tax rates based on your property’s address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county’s effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

…read more

Washington Dc Property Tax Deductions And Credits

Homeowners in D.C. benefit from a number of property tax deductions and credits that greatly reduce their overall tax bill. A deduction does this indirectly, by reducing the assessed value of a property, while a credit directly reduces the taxes a homeowner has to pay. The major deductions and credits available to homeowners in Washington, D.C. are described below.

The Homestead Deduction is available for homeowners living in a principal residence that consists of no more than five units. It reduces assessed value by $75,700.

The Senior Citizen or Disabled Property Owner Tax Relief program reduces the property tax bill of eligible homeowners by 50%. Eligible homeowners must be at least 65 years old or disabled. The property in question must be their primary residence and have no more than five units. They cannot have a total federal adjusted gross income of greater than $125,000 either.

The First-Time Homebuyer Individual Income Tax Credit is a tax credit available to new homeowners in Washington, D.C. It is generally equal to the lesser of $5,000 or the purchase price of a home. It is an income tax credit, so new homeowners should apply for it when completing their income taxes.

The Assessment Cap Credit protects homeowners from rapid increases in house prices. The credit limits increases in assessed values to 10% per year. Increases beyond that amount will reduce the taxable assessed value of your home.

Read Also: How To Remove Tax Pro Review From H& r Block

Property Tax Exemptions And Deferrals

Note: These programs are only available to individuals whose primary residence is located in the State of Washington

- Property tax assistance program for widows or widowers of veterans

-

Available To:A widow or widower of a veteran who died as a result of a service-connected disability OR was rated 100% disabled by VA for 10 years prior to death OR was a former POW and rated 100% disabled for 1 year prior to death OR died in active duty or training status. The widow/widower must be at least sixty-two years of age by December 31 of the year the taxes are due OR be retired from regular gainful employment by reason of disability. The widow/widower must not have remarried.

Program Benefits: The qualifying applicant receives assistance for payment of property taxes in the form of a grant. The assistance amount is based on the applicants income, the value of the residence, and the local levy rates. The grant does not have to be repaid as long as the applicant continues to live in the residence until at least December 15 in the year a grant is received.

Qualifying Activity:Own and occupy a primary residence in the State of Washington have combined disposable income of $40,000 or less

Reporting/Documentation Requirements:

How You Can Affect Your Washington Paycheck

While you dont have to worry about paying state or local income taxes in Washington, theres no escaping federal income tax. However, there are certain steps you may be able to take to reduce the taxes coming out of your paychecks.

The simplest way to change the size of your paycheck is to adjust your withholding. Your paychecks will be smaller but youll pay your taxes more accurately throughout the year. You can also specify a dollar amount for your employer to withhold. There is a line on the W-4 that allows you to specify how much you want withheld. Use the paycheck calculator to figure out how much to put.

Another thing you can do is put more of your salary in accounts like a 401, HSA or FSA. If you contribute more money to accounts like these, your take-home pay will be less but you may still save on taxes. These accounts take pre-tax money, which means the money comes out of your paycheck before income taxes are removed. This reduces your taxable income. Payments you make for most employer-sponsored health and life insurance plans also pre-tax.

With no state or local income taxes, you might have an easier time saving up for a down payment for a home in Washington. If youre looking to make the move, take a look at our guide to Washington mortgage rates and getting a mortgage in Washington.

Also Check: Is 529 Federal Tax Deductible