Michigan Earned Income Tax Credit

If you claim an EITC on your federal tax return, you can claim one on your Michigan income tax return as well. The Michigan EITC is equal to 6% of your federal credit.

The federal EITC income cap ranges from $21,430 to $57,414 depending on how you file and how many children or relative dependents you claim. The maximum federal EITC amount you can claim on your 2021 tax return is $6,728.

For example, if youâre eligible for $3,000 federally, you can claim $180 through the Michigan EITC.

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Taxes can really put a dent in your paycheck. But with a Savings or CD account, you can let your money work for you. Check out these deals below:

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Michigan Sales Tax Increase For Transportation Amendment Proposal 1

| Defeated d |

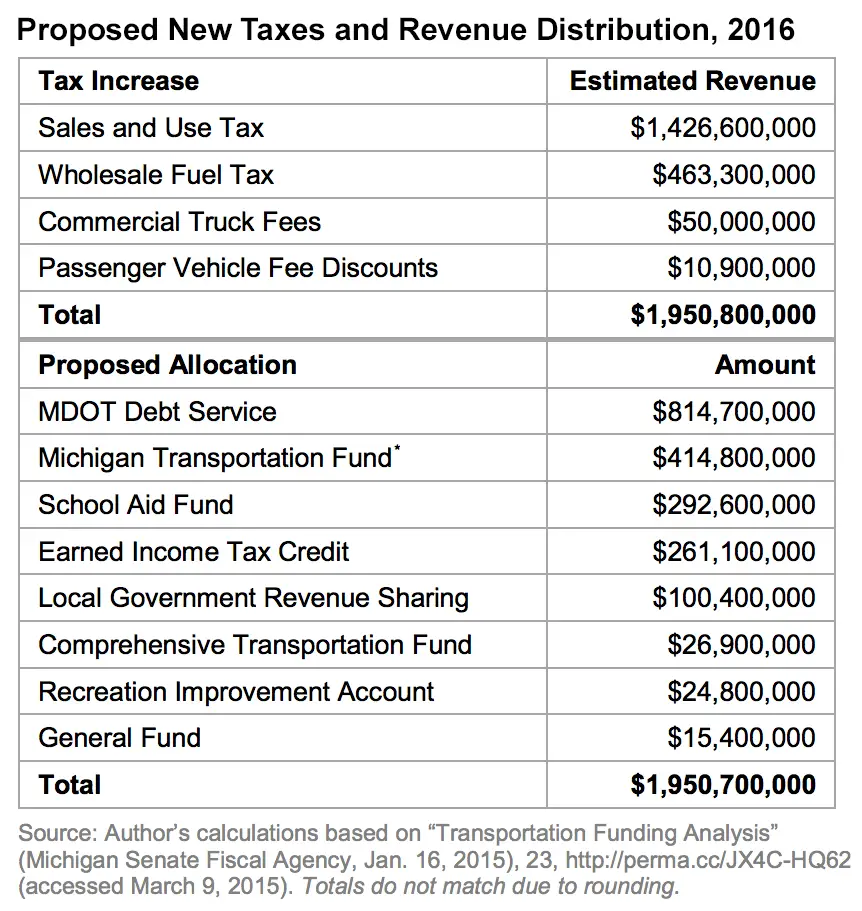

The Michigan Sales Tax Increase for Transportation Amendment, Proposal 1 was on the May 5, 2015 ballot in Michigan as a legislatively referred constitutional amendment, where it was defeated. The measure’s approval would have caused one constitutional amendment and 10 statutes to go into effect.

A breakdown of each bill is provided lower on this page. The following points briefly outline what the total bills would have done together:

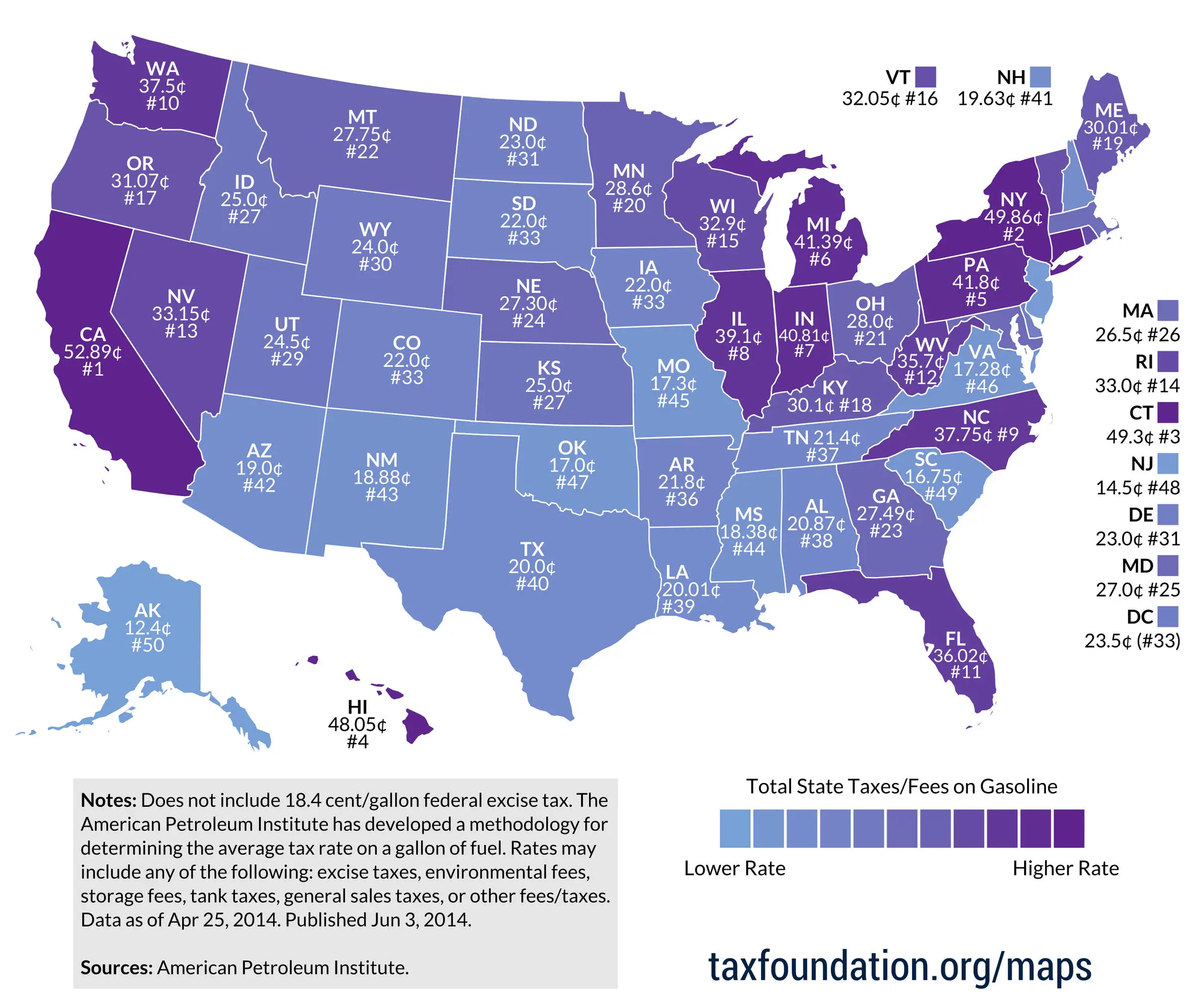

First, Proposal 1 would have increased revenue for transportation funding by increasing the fuel tax to 41.7 cents or 14.9 percent of a gallon of fuel’s base value, whichever is greater. It would have also required revenue from the fuel tax to be allocated to the transportation fund, eliminated registration fee discounts, increased heavy commercial vehicle registration fees and created an electric vehicle surcharge.

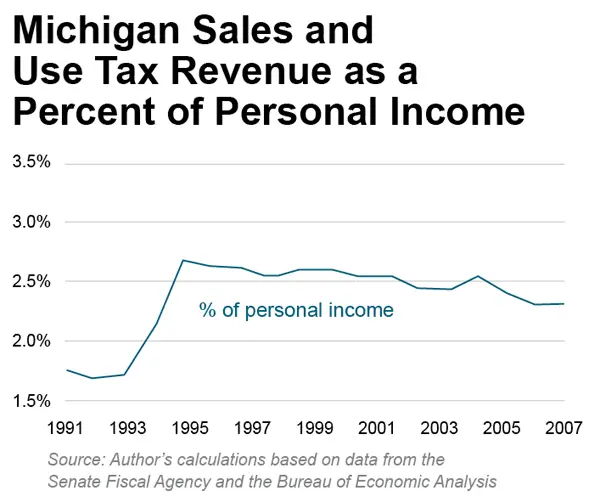

Second, Proposal 1 would have eliminated the sales and use tax on fuel for vehicles altogether. This would have offset some of the increases in fuel prices caused by a higher fuel tax.

Third, Proposal 1 would have increased the sales and use tax on non-fuel items from 6 percent to 7 percent. Since the sales tax on fuel provides a significant portion of sales tax revenue, this increase was designed to offset revenue losses to schools and municipalities, which depend on sales and use tax revenue.

Fifth, Proposal 1 would have increased the state’s Earned Income Tax Credit from 6 percent to 20 percent.

You May Like: Is Aarp Doing Taxes In 2021

Car Sales Tax For Trade

You dont have to pay sales tax on trade-ins in Michigan. In other words, be sure to subtract the trade-in amount from the car price before calculating sales tax.

As an example, lets say you are purchasing a new SUV for $25,000 and your trade-in is worth $5,000. You will subtract the trade-in value by the purchase price and get $20,000. Therefore, your car sales tax will be based on the $20,000 amount.

It’s important to note that the maximum tax credit you can get for a trade-in is $8,000 as of January 1st, 2022. For example, if you traded in a car that is valued at $10,000 you can only deduct up to $8,000 from the purchase price when calculating sales tax. This amount will increase every year until it hits a maximum of $14,000.

Other Taxes And Duties For Your Llc

Depending on what industry your business operates in, you may be liable for other taxes and duties. For example, if you sell gasoline, you may need to pay a tax on any fuel you sell. Likewise, if you import or export goods, you may need to pay certain duties.Speak to your accountant about any other taxes or duties you may need to pay.

Read Also: What Do You Need To Do Tax Return

Michigan Sales Tax Software

In recent years Michigan sales tax has become much more complicated, especially if you are an out of state seller. It is recommended that you work with sales tax calculator software like AccurateTax TaxTools to ensure you accurately record, collect, and pay the sales tax due regularly to the state. Our tool offers detailed data review and sorting tools to help you ensure you pay the right sales tax rates everywhere you do business. It can work with existing e-commerce website tools all from a single interface. To learn more about TaxTools, contact us today. You can also signup for a free trial to get started.

Other Taxes And Fees Applicable To Michigan Car Purchases

In addition to state and local sales taxes, there are a number of additional taxes and fees Michigan car buyers may encounter. These fees are separate from the sales tax, and will likely be collected by the Michigan Department of Motor Vehicles and not the Michigan Department of Treasury.

Title Fee: Registration Fee: Plate Transfer Fee:

Average DMV fees in Michigan on a new-car purchase add up to $2301, which includes the title, registration, and plate fees shown above.

You May Like: When Is The Due Date To File Taxes

Penalties And Interest For Late Payments

If you fail to pay your sales tax due on time, you will be subject to a penalty. This penalty will be 5% of the unpaid tax over the first two months. After those two months, the number increases monthly with a maximum penalty of 25% of the total tax owed. There are other more extreme charges if it is deemed that fraud is being committed or if sales tax is regularly underpaid or paid late. Michigan requires even zero returns to be paid on time each filing period.

Michigan Sales Tax Registration

If you are deemed to have sales tax nexus in Michigan, you must register to collect sales tax in the state to ensure sales tax compliance. The registration process for a sales tax license is easier thanks to Michigans One Stop Website for businesses. To get started, you will need all your personal and business identification materials, a list of locations of your offices, and a specific rundown of the major business activity you perform in the state.

There is no fee to register for sales and use tax collection in Michigan. The process is completed, and your certificate is provided 7-10 days after registering

You May Like: How Do I Get My Tax Id Number

Who Needs A Sales Tax License

Who is required to have a sales tax license? – Individuals or businesses that sell tangible personal property to the final consumer need a sales tax license. An application for a sales tax license may be obtained on our web site. In order to register for sales tax, please follow the application process.

Follow us

State Of The State Address

| Starting at 19 minutes, Governor Snyder in his 2015 State of the State Address talks about Proposal 1 and calls on voters to support it. |

Gov. Rick Snyder was accused by Jason Gillman, a tea party activist and former Grand Traverse County commissioner, of violating campaign finance laws during his State of the State Address. During his speech, Gov. Snyder called on voters to support Proposal 1, saying “vote yes” six times. Gillman said, in a written complaint, that state campaign finance laws forbade the use of public resources to support or oppose a ballot measure. He elaborated, saying Snyder “did not simply attempt to talk about the benefits, or educate, but expressly asked for a yes vote. … his was in a publicly paid for and controlled forum.”

A spokesperson for the Secretary of State, Fred Woodhams, contended that Snyder had not broken any campaign finance laws. He said, “Consistent with the First Amendment, the law makes an exemption for elected officials offering their opinion, including about how to vote on ballot questions.”

Greg McNeilly, a Republican political strategist, said that Snyder’s call for voters to support Proposal 1 during his speech was “inappropriate,” and he concluded that “using government resources to advocate on what is a political issue should be regulated by the Michigan Campaign Finance Act.”

You May Like: What Is The Last Date You Can File Your Taxes

What Is Eligible For Sales Tax In Michigan

The State of Michigan has a detailed list of what is subject to state sales tax collection in the state. For the vast majority of tangible personal property tax is collected. There are, however, exceptions, which include:

- Services Most services are exempt from sales tax, but those that involve creating a product, manufacturing goods, or consulting on the development of a physical good may require sales tax collection.

- Wholesale Sales at wholesale are not generally subject to sales and use tax in Michigan. Anything purchased for resale is not considered a retail sale and therefore is not taxed.

- Industrial Processing If something is consumed in transformation, alteration, modification, or change of form, it is not subject to sales tax under many conditions. This does not apply to property for use in real estate, office supplies, public highway vehicles, or food or beverage preparation for retail sale. There are several specific exemptions here you can review more on Michigans 3372 Sales and Use Tax Certificate of Exemption.

- Specific Organizations Sales to churches, hospitals, schools, and government are exempt from sales tax.

Because of the complexity of the Michigan sales tax rules and the specificity of the exemptions, it is recommended you review the full list provided by the State before adjusting any business practices in the state.

Michigan Sales Tax Handbook

Nov 30, 2022 | Knowledge Hub,

None

What are the taxable goods and services?

The first step in sales tax compliance is determining if the items or services your firm offers are taxable in Michigan.

Traditional Products and Services

Physical property, such as furniture, household appliances, and automobiles, is subject to sales tax in Michigan.

Groceries, prescription medications, and fuel are all free from sales tax.

In Michigan, several services are subject to sales tax. View the Overview of Use Tax from the Michigan Department of Treasury for a complete list of taxable services.

Digital Products and Services

A digital item or service is anything that is supplied electronically, such as a music downloaded from iTunes or a movie bought from Amazon.

Businesses in Michigan are not required to collect sales tax on the sale of digital products or services.

Michigan, however, has one exemption to this restriction. Businesses are required to collect sales tax on pre-written computer software offered online.

How to Register for Sales Tax in Michigan

If you have concluded that you must charge sales tax on part or all of the products and services that your company sells, the next step is to apply for a sellers licence.

This enables your company to collect sales tax on behalf of the municipal and state governments.

You will need the following information to register:

A Resale Certificate might help you save money.

Sales Tax Collection

Retail SalesOut-of-State Purchases

Don’t Miss: How Do You Calculate Tax

Tax Cuts Come With Budget Tradeoffs

When the Michigan Legislature approved a plan in March that would have cut state income tax revenue by $2.5 billion annually, Governor Whitmer vetoed the bill calling it fiscally irresponsible. Our March analysis of the legislative plan illustrated her concerns. It showed that one-time revenue surpluses were sufficient to cover the resulting revenue loss in FY2023, but that the plan would require a permanent $1.3 billion cut to the states General Fund budget starting in FY2024. That equates to roughly 10 percent of all current General Fund spending.

As tax relief discussions are revived, budget writers and the general public should have a clear view of how any resulting budget shortfalls will be addressed before decisions are finalized on an amount. To be clear, state taxes should be no higher than they need to be. Our tax system should generate sufficient revenue to provide necessary public services in an efficient and effective manner. If the state is providing services that arent necessary, then those services can properly be eliminated allowing revenue savings to be returned to taxpayers. The challenge is that what constitutes a necessary public service is inherently shaped by ones ideological and political views.

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.

Don’t Miss: Can You Submit Taxes Late

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

How To Register For Sales Tax In Michigan

Okay, so you have nexus! Now what?

The next crucial step in complying with Michigan sales tax is to register for a sales tax permit. Itâs actually illegal to collect tax without a permit. So to get all your ducks in a row, start with tax registration first.

You can find directions about how to register in Michigan on their Department of Revenue website.

When registering for sales tax, you should have at least the following information at hand:

- Your personal contact info

- Social security number or Employer Identification Number

- Business entity

- Bank account info where youâll deposit the collected sales tax

Recommended Reading: How To Get Tax Transcript

Michigan Ev Rebates & Incentives

There is no current EV rebate in the state of Michigan. However, there is a recent proposal to allow a $2,000 rebate on EV sales.

In addition, EVs purchased in the state are eligible for the $7,500 federal EV rebate.

Tax information and rates are subject to change, please be sure to verify with your local DMV.

Michigan Sales Tax Rates By City

The state sales tax rate in Michigan is 6.000%. There are no local taxes beyond the state rate.

Select the Michigan city from the list of popular cities below to see its current sales tax rate.

Sales tax data for Michigan was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Don’t Miss: How To Avoid Taxes On Rmd

Ann Arbor Michigan Sales Tax Rate

ann arbor Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Ann Arbor, Michigan?

The minimum combined 2022 sales tax rate for Ann Arbor, Michigan is . This is the total of state, county and city sales tax rates. The Michigan sales tax rate is currently %. The County sales tax rate is %. The Ann Arbor sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Michigan?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Michigan, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Ann Arbor?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Ann Arbor. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Overview Of Michigan Taxes

Michigan has a flat income tax rate across the state, but some cities do charge an additional rate. Sales taxes are relatively low for the region, and there are no additional local sales taxes. Michigan has some of the highest average effective property taxes in the nation.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

Don’t Miss: How To Submit Tax Forms