Long Term Capital Gains Tax Rates As Of :

Your capital gains tax rate as a single filer

- 0% if your income is between $0 and $40,000

- 15% if your income is between $40,0001 and $441,450

- 20% if your income exceeds $441,561

Your capital gains tax rate as a married couple, filing jointly

- 0% if the combined income is $0 $80,000

- 15% if the combined income is $80,001 to $496,600

- 20% if the combined income is $496,601 or more

You May Like: Amended Tax Return Online Free

How 2022 Sales Taxes Are Calculated In Tennessee

The state general sales tax rate of Tennessee is 7%. Cities and/or municipalities of Tennessee are allowed to collect their own rate that can get up to 2.75% in city sales tax.Every 2022 combined rates mentioned above are the results of Tennessee state rate , the county rate , the Tennessee cities rate . There is no special rate for Tennessee.The Tennessee’s tax rate may change depending of the type of purchase. Some of the Tennessee tax type are: Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.Please refer to the Tennessee website for more sales taxes information.

Sign Up For Kiplingers Free E

Profit and prosper with the best of Kiplingers expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of Kiplingers expert advice – straight to your e-mail.

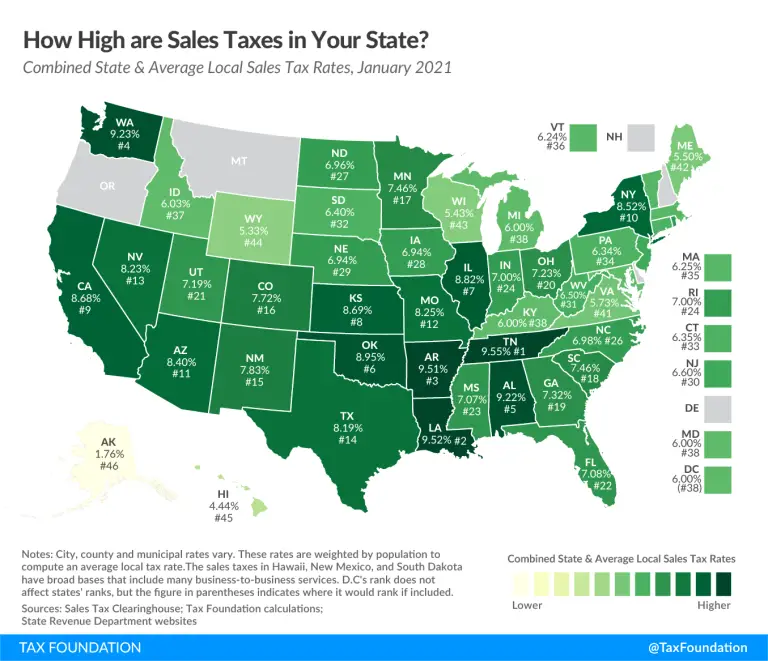

However, the state sticks it to you when you’re shopping with the second-highest average combined state and local sales tax rate in the nation. Fortunately, the low income and property taxes in Tennessee far outweigh the state’s high sales taxes for most residents

Read Also: What Is E Filing Of Income Tax Return

Tennessee General Business License

Some states have a general license requirement, which means all businesses operating in those states must have the license, regardless of what they do.

Although Tennessee doesnt have a general business license requirement, you do have to register with the Department of Revenue. Tennessee has a state Business Tax that applies to almost every company doing business in Tennessee.

You can review the Business Tax Manual from the Department of Revenue to see if your LLC is exempt from the business tax.

Tennessee Business Tax Registration

Almost every business operating in Tennessee must register for the Tennessee Business Tax.

The Tennessee Department of Revenues Registration and Licensing page will guide you through the process. The registration fee is $15.

Online Registration for Business Tax

All new businesses must register using TNTAP.

First, create a TNTAP username and password.

Then from the dashboard, click View Registration Links in the Registration/Exemption section.

On the next screen, click Register a New Business and complete the form.

Tips:

- You will need your LLC EIN Number to complete this registration.

- If you formed an LLC in Tennessee, your State of Original Charter/Certification will be Domestic.

- If you formed an LLC in another state and are registering it in Tennessee, youre a Foreign LLC.

The system will also allow you to register for a variety of other tax licenses from the Department of Revenue.

How High Are Sales Taxes In Tennessee

Tennessee has the second-highest state sales tax in the U.S. The state rate is 7% and that is supplemented by local rates that can be as high as 2.75%. On average, the total rate paid by Tennessee residents is 9.55%.

While prescription drugs are fully exempted in Tennessee, groceries are not. Tennessee charges a lower tax rate for groceries, but it is still one of just a handful of states that taxes grocery purchases. The sales tax rate for groceries is 4%.

Don’t Miss: Who Needs To File Taxes

Sales Tax On Shipping Charges In Tennessee

Tennessee does apply sales tax to shipping costs. The rule of thumb is that if what youâre selling is subject to tax, then the shipping charges are also subject to tax.

If you happen to be shipping products that are both taxable and nontaxable, then shipping charges for the entire shipment are subject to tax.

How Much Sales Tax For A Car In Tennessee

Whether you buy a new or used car in Tennessee, you must pay sales tax on the purchase unless it is exempt. Vehicle sales are subject to the Tennessee state sales tax and an additional single-article tax depending on the sales price of the vehicle. Since the sales tax also includes county or city taxes, the overall rate varies depending on where in the state you buy your vehicle. Most counties have an online calculator to help you understand the taxes you owe on your purchase.

Also Check: How Long Should We Keep Tax Records

Tennessee Business License Faqs

If your business has to get an occupational license or municipal permit, the fees are hard to predict. Depending on your LLCs location, and what type of business or industry youre in, the fee varies.

And you might not need a business license at all!

Unfortunately, we cant say what your LLCs business license costs would be, because it depends on several factors and the cost of Tennessee licenses varies.

An LLC is a type of business structure created by filing a document with the state government.

And a business license is a document that gives a person, or a company, the right to transact business. It doesnt create an LLC.

Even if youre just trying out a business idea as a Sole Proprietorship, you may still be subject to license requirements at the state and municipal levels. It just depends on what you will be doing, and where you will be operating your business.

For more information, or to determine if there is a Tennessee business license cost for your business, we recommend contacting the Tennessee Department of Commerce and Insurance and/or your local government agency. For example, your local county or city government will have information about any local licenses.

Tennessee Sales Tax Guide

Tennessees state sales and use tax rate is 7 percent. The state also has discretionary taxes at the county and city levels. Tennessee taxes sales of tangible personal property, some services, certain digital products, amusements, computer software, telecommunications, and installation and repair of tangible personal property. Warranty contracts for tangible personal property and software maintenance contracts are also taxed.

This guide does not fully describe all of Tennessees laws and regulations regarding taxes. Businesses should contact a business attorney or visit the Tennessee Department of Revenue website to learn more about the rules, regulations, tax laws and tax information associated with their industries and the types of taxes due.

Also Check: How Do Business Tax Write Offs Work

Capital Gains On Selling A Home In Tennessee

Felix Homes

Whether you invest in real estate or the stock market, youll need to keep capital gains taxes front and center of your mind so you do not get hit with any tax surprises when you file your return. Taxes are confusing, and theres no shortage of confusion when it comes to discussing capital gains taxes. If you live in Tennessee and youre interested in learning about capital gains taxes, this article is perfect for you. Were here to clear the air and keep you informed on everything you need to know regarding capital gains tax.

Recommended Reading: How Do I Protest My Property Taxes In Harris County

How Much Is The Car Sales Tax In Tennessee

The state sales tax on a car purchase in Tennesee is 7%. Therefore, you will be required to pay an additional 7% on top of the purchase price of the vehicle.

However, this does not include any potential local or county taxes. The average local tax rate in Tennessee is 2.614%, which brings the total average rate to 9.614%.

As an example, if you were to purchase a new truck at a purchase price of $50,000, then you will have to pay an additional $3,500 in sales tax.

Read Also: Where Can I File 2017 Taxes Online

How To File Taxes In Tennessee

When tax time rolls around in Tennessee, whether itâs monthly or annually, you must do three things:

Tennessee requires that any seller with a sales tax permit file a sales tax return on your due date, even if you donât have any sales tax to report or pay. Even if you didnât make a single sale in Tennessee during the reporting period, you should must do a âzero tax filing.â

The 10 Basics Every Tennessee Business Should Know About Sales Tax

What is the Sales Tax Rate in Tennessee?

The general sales tax rate for most tangible personal property and taxable services is 7%. Local tax jurisdictions can add up to 2.75% to the total rate.

What is Sales Tax in Tennessee?

Tennessee sales tax applies to the retail sale, lease or rental of tangible personal property and selected services.

Are All Goods and Services Taxable?

How Do I Know Whats Taxable and Whats Not?

The following links can help you determine what is taxable and what isnt in Tennessee. Goods | Services

Who Pays Sales Tax?

Consumers pay sales tax. Merchants do not pay sales tax out of their own pockets. Its commonly referred to as a pass through tax.

What Am I Responsible For?

You are required to collect sales tax, hold it secure and send it to the State on-time and in-full.

When Is My Sales Tax Payment Due in Tennessee?

Tennessee Sales Tax is due on the 20th of the month following the reporting period. Filing frequency is determined by the state. .

How Do I Know How Much Sales Tax to Charge?

The Tennessee state sales tax rate is 7%. Local tax jurisdictions can add up to 2.75% to the total tax rate. Find more information here. The final and definitive answer is always the sales tax rate posted on the State Department of Revenue website. Rates posted on the web are often not up-to-date and incorrect. Its always the merchants responsibility to charge the correct sales tax rate.

Who Gets the Sales Tax Money?

How Do I Manage Tax Exempt Sales?

Read Also: How To Pay Estimated Taxes

Terminating Tennessee Sales Tax Collection

A common question regarding Tennessee sales tax collection from remote sellers is whether you must indefinitely collect sales tax after initially surpassing the economic nexus threshold. The answer is no.See Sales and Use Tax Account – Closing an Account

|

EXAMPLE: You terminated your Tennessee sales tax collection obligation, then sales picked up, and you realize that your total sales for the period of January 1, 2021, through December 31, 2021, exceed $100,000. You may stop collecting for the period below the threshold but must resume when the threshold is exceeded. If, during the period of July 1, 2020, through June 30, 2021, a remote seller’s total Tennessee revenue exceeds $500,000, the remote seller needs to obtain a permit and begin collecting the appropriate tax no later than October 1, 2021. |

Its also important to note that just because you terminate your Tennessee sales tax collection doesn’t mean you’re 100% off the hook. Tennessee still requires you to comply with its recordkeeping requirements, and you are still subject to its sales tax audits.

Filing Your Tennessee Sales Tax Return

Tennessee requires all sales and use tax returns and payments to be filed and paid electronically. This is done through the Tennessee Taxpayer Access Point . First-time filers must register for an account to file their return and make payments. After that, filers log in with their username and password to file future taxes.

A helpful video about filing your sales and use tax return through TNTAP can be found here.

Read Also: Do I Qualify For Child Tax Credit 2020

What Is The Sales Tax Rate In Tennessee

Tennessee sales tax varies by location. There is a state sales tax of 7% and local tax imposed by city, county, or school districts, no higher than 2.75%. Groceries are taxed at 5% , and some services have a different tax rate. The lowest total tax rate in Tennessee is 8.5%. The average sales tax rate across all counties and municipalities is 9.614%.

Tennessee also has a state single article rate of 2.75% on any single item sold in excess of $1,600 but not more than $3,200.

Are Other Forms Of Retirement Income Taxable In Tennessee

The only forms of taxable income in Tennessee are interest and dividend income, and this law is being phased out in 2021 and beyond. However, regardless of this tax, it does not cover interest or dividends earned by retirement accounts, such as a 401 or an IRA. The state does not tax retirement account income at all. Likewise, pension income, whether a government pension or private pension, is not taxable.

You May Like: Buying Tax Liens California

You May Like: How Does Contributing To Ira Reduce Taxes

How Much Is Sales Tax In Downtown Nashville

9.25%.

But wait, the tax man has a little surprise. Downtown Nashville businesses are also required to pay a 0.50% fee on most sales, in addition to sales taxes.

This means that downtown business owners pay an additional 50 cents for every $100 in sales.

All this talk about taxes has us cueing up The Whos classic Success Story

Away for the weekend

I’ve gotta play some one-night stands

Six for the tax man, and one for the band

The fee is imposed on retailers in the Central Business Improvement District , an area generally bounded by the Cumberland River, Lafayette Street, Rosa L. Parks Boulevard and Dr. Martin Luther King, Jr. Boulevard. The fee is used for recruiting major conventions, cleanliness and security in the district.

The CBID fee is administered in the same manner as the state sales tax. However, the following are not subject to the CBID fee:

- Sales exempt from TN state sales tax

- Hotel-motel lodging

- Sporting and live ticketed events and

- Wine, spirits and high gravity beer sold by the drink.

This means that the CBID fee must be paid on all those long-neck beers sold down on Lower Broad. But not on frozen whiskey margaritas generously poured for visiting bachelorettes.

Of course, those frozen whiskey margaritas are instead taxed an additional 15% for the liquor-by-the-drink tax, imposed on the sale of wine, spirits and high gravity beer sold by the glass.

See this publication from Revenue for more information.

Tax On Rebates & Dealer Incentives

You do have to pay tax on dealer rebates and incentives. In other words, do not subtract the incentive/rebate amount from the car price before calculating sales tax.

As an example, if you are purchasing a new car for $50,000 with a $5,000 rebate, you will pay sales tax on the full $50,000 final cost of the car.

Don’t Miss: Do You Have To Pay To File Taxes

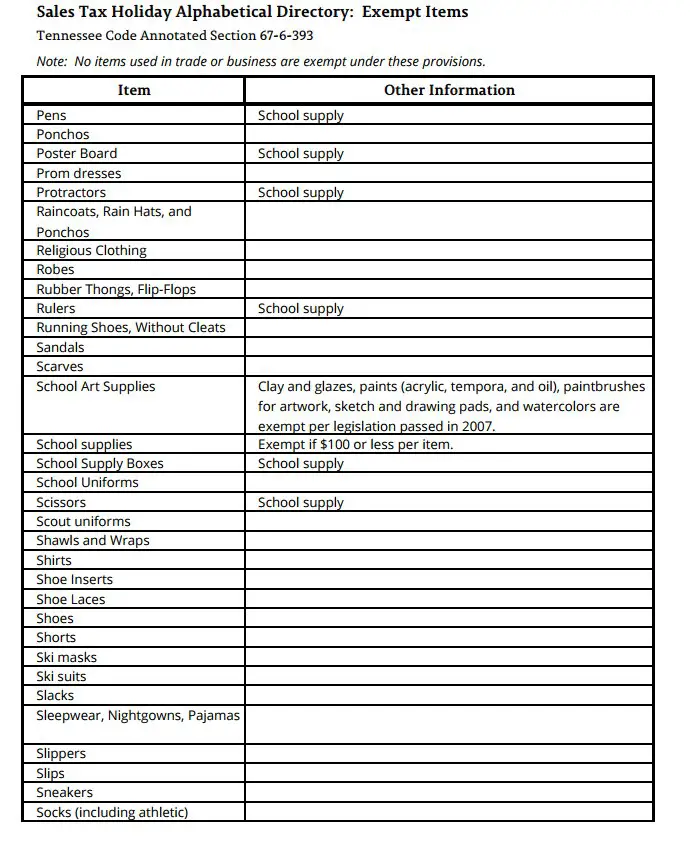

When Sales Tax Is Exempt In Tennessee

Tennessee does offer quite a few exemptions when it comes to sales tax on cars, including the following:

- Sales to members of the armed forces

- Sales or transfers between spouses or siblings, parents, grandparents, children, and grandchildren

- Sales to nonresidents of Tennessee who plan to leave the state with the vehicle within three days of buying it

- Sales to nonprofit organizations or government entities only for organizational or governmental use

- Any vehicles given as gifts

- Vehicles transferred personally from a sole proprietor’s business to the sole proprietor

- Vehicles converted by an individual for use at their sole proprietor business

- Vehicles owned by two individuals who get the vehicle’s title issued in only one of their names

- Vehicles given as a gift in which the giver receives no benefit

- Vehicles given to a Tennessee qualified nonprofit

- Vehicles given to the federal government, the state of Tennessee, a Tennessee county or municipality, or an agency of these governments

Knoxville Tennessee Sales Tax Rate

knoxville Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Knoxville, Tennessee?

The minimum combined 2022 sales tax rate for Knoxville, Tennessee is . This is the total of state, county and city sales tax rates. The Tennessee sales tax rate is currently %. The County sales tax rate is %. The Knoxville sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Tennessee?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Tennessee, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Knoxville?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Knoxville. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

You May Like: How To Get My Unemployment Tax Form

Tennessee Sales Tax Software

While calculating sales tax in Tennessee is easier than in many destination-based states, retailers may find that sales tax software helps them streamline the process and avoid the kinds of mistakes that lead to audits. Our TaxTools software is the answer. It pinpoints the right sales tax for every US address, and applies the appropriate sales tax to each order placed on your site. Then when youre ready to file your return, our reports make the process simple. Configuring sales tax on your ecommerce store has never been easier. Contact us for more information or register for a free trial of AccurateTaxs TaxTools software.

You can also use our free sales tax calculator to look up the rate for any Tennessee address.