How Do I Register For A Georgia Resale Certificate

Anyone who qualifies as a dealer under Georgia law is required to register for a sales and use tax number, regardless of the manner in which sales are made or whether the sales are taxable or exempt. Registration is done online at the Georgia Tax Center. You will be required to enter a corporate officers social security number, because officers are personally liable for any unpaid sales tax. Once youve completed your application, your sales tax account number will be sent via email within 15 minutes.

The Georgia Tax Center has an excellent set of instructional videos to assist businesses with registration and other activities. for the video that walks you through their registration process.

See the Georgia Department of Revenue or the Georgia Tax Center to:

- Register to file and remit taxes.

- Register a 3rd party filer.

- Submit documentation.

- Make a quick payment.

Georgias website prevents us from linking directly to the internal pages. So to do any of the above tasks, go to and from the three links under the photograph of the city, choose Business. Then select the appropriate link in the section below.

Do You Have Nexus In Georgia

The word ânexusâ refers to a commercial connection in the state. Nexus determines the following questions for a state tax agency: Do you do business here, what kind, and how much? And when you do have nexus, that means youâre obligated to collect tax on your sales there.

So the first question for you to answer is whether you have nexus in Georgia.

You probably have nexus in Georgia if any of the following points describe your business:

- A physical presence in Georgia: a store, an office, a warehouse or distribution center, storage space, you, an employee, a representative, etc.

- Any affiliate businesses or individuals in the Georgia, which generate sales.

- Online ads or links on a Georgia-based website, which channels potential customers and new business.

- A significant amount of sales in Georgia within twelve months. *

* This is called an economic nexus, a sales tax nexus determined by economic activity, i.e. – the amount of sales you make in a particular state. Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount.

The threshold in Georgia is $250,000 in annual sales or 200 separate sales transactions, whichever your business reaches first. To learn more about how this works, check out the Ultimate Guide to US Economic Nexus.

Are Other Forms Of Retirement Income Taxable In Georgia

Yes, but there is a significant tax exclusion available to seniors on all retirement income. For anyone age 62 to 64, the exclusion is $35,000 per person. For age 65 or older, the exclusion is $65,000 per person. That applies to all income from retirement accounts and pensions.

If you have less than $65,000 in retirement income, you will not pay taxes. Up to $4,000 of that can be applied to earned income . Retirement income above that ceiling will be combined with other sources of income and taxed at Georgias personal income tax rates, shown in the table below.

Don’t Miss: Which State Has The Lowest Tax Rate

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Georgia Sales Tax Nexus In Georgia

If you have nexus in Georgia, then you are required to collect sales tax on applicable sales, and file and remit that tax to the state. Nexus is simply defined as a significant connection to a state. Specifically in Georgia, the following activities give rise to economic nexus:

- Maintains a retail sales location, office, warehouse, distribution center, or other place of business within the state

- Posesses tangible personal property for retail sale, use, consumption, distribution, or storage

- Solicits business via an employee or other representative

- Has Georgia-based affiliates who earn commission by referring sales, sometimes known as a click-through nexus

Amazon sellers should note that there are Fulfillment by Amazon warehouses in the state of Georgia, and that storing goods for sale through FBA in Georgia warehouses gives rise to nexus and therefore sales tax resposibilities.

Please refer to the state of Georgia for a complete and up-to-date list.

Read Also: When Can You File Your Taxes

Other Georgia Tax Facts

The Georgia Department of Revenue has entered into an agreement with several software companies to offer free electronic filing of state returns for qualified Georgia taxpayers.

Georgia taxpayers can check the status of their refunds online.

For more information, go to the Georgia Department of Revenue website.

To download tax forms on this site, you will need to install a free copy of Adobe Acrobat Reader. Click here for instructions.

Related Links:

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Also Check: When Was Income Tax Started

How Often Should You File

How often you need to file depends upon the total amount of sales tax your business collects.

- Annual filing:;If your business collects less than $50.00 in sales tax per month then your business should file returns on an annual basis.

- Quarterly filing:;If your business collects between $50.00 and $200.00 in sales tax per month then your business should file returns on a quarterly basis.

- Monthly filing:;If your business collects more than $200.00 in sales tax per month then your business should file returns on a monthly basis.

Note:;Georgia;requires;you to file a sales tax return even if you have no sales tax to report.

What Is A Title Ad Valorem Tax

The Title Ad Valorem Tax is imposed when a title is given to a vehicle in Georgia, according to Sapling. This tax is made only once and is in lieu of the sales tax that would otherwise be applied to a vehicle purchase. It also replaces the Annual Ad Valorem Tax for motor vehicles. The TAVT is required to be paid each time someone transfers vehicle ownership to a Georgia resident or when a vehicle is registered for the first time in the state.

You May Like: How To Calculate Net Income After Taxes

Georgia State Taxes: Everything You Need To Know

Learn about Georgia sales tax and more. Taxes 101

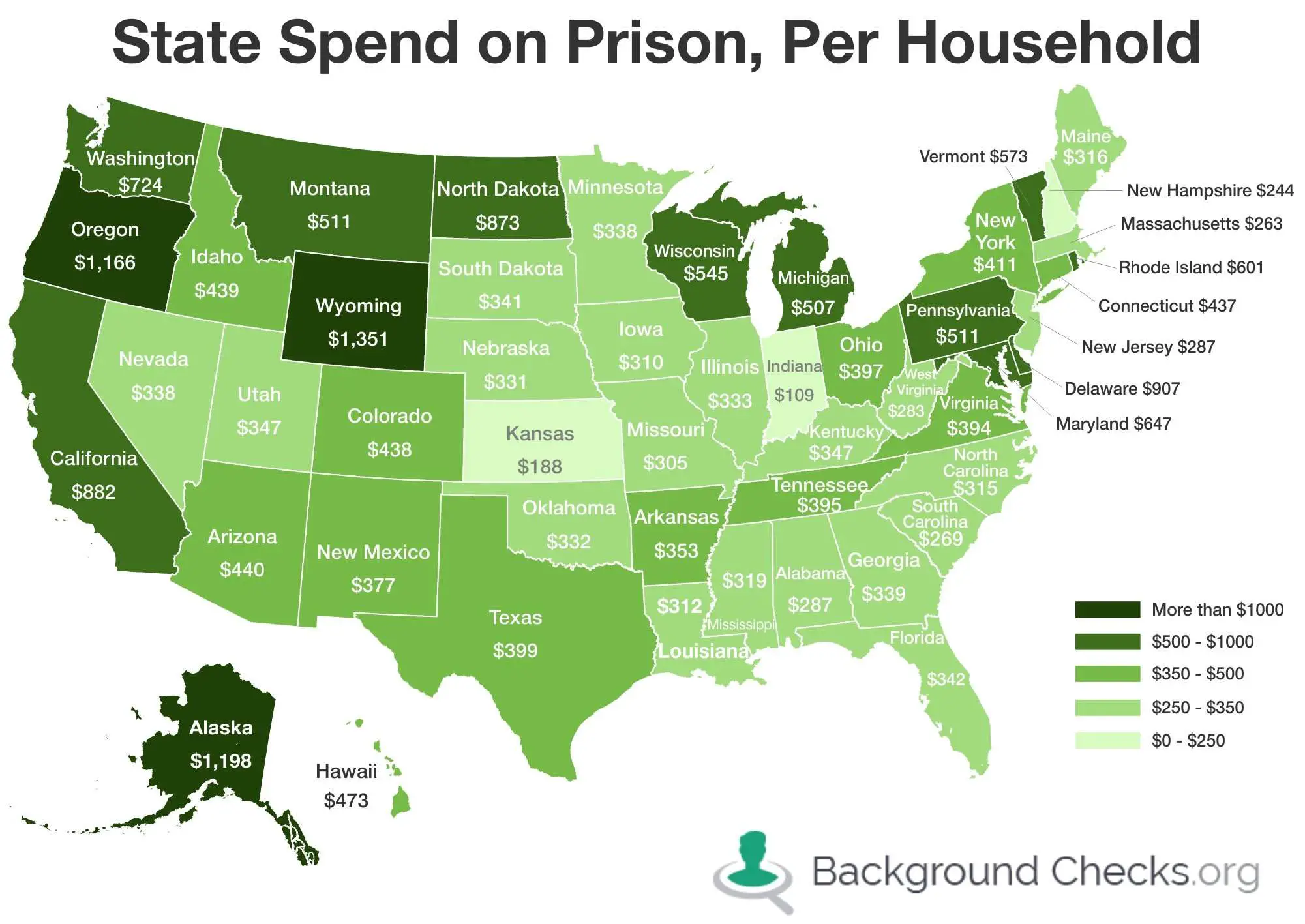

Almost no one feels peachy about paying taxes, but residents of Georgia have a relatively low burden to shoulder compared to many other American states. The typical Georgian ends up paying over $9,500 a year in taxes, over half of which is going to federal income taxes. Just over $4,000 of that bill is Georgia state tax, including whats effectively a flat tax on income, an average sales tax rate of 7.15 percent and an effective property tax rate just under 1 percent.

Heres a closer look at everything you need to know about state taxes in Georgia.

| Georgia State Taxes | |

| State Sales Tax Rate Range | 6% to 8.9% |

| State Income Tax Rate Range | 1% to 6% |

| N/A |

What Is The Sales Tax Rate In Georgia

Georgia sales tax varies by location. There is a state sales tax as well as local tax in many counties. Georgias statewide sales tax rate is 4%, but local rates typically vary from 7-8% . The city of Atlanta charges a 1.9% local tax rate, for a total rate of 8.9%. Sales tax is due for the retail sale of certain services, and for storage, use and consumption of all tangible personal property.

You May Like: Where’s My Tax Refund Ga

What Are Georgias Sales Tax Deadlines

Georgia sales tax returns and remittances are due on the following schedule.

Monthly

Returns for monthly filers are due on the 20th of the following month. If the 20th falls on a weekend, legal holiday, or any day when the Federal Reserve Bank is closed, the return and payment will be due on the following business day.

| Period |

|---|

How 2021 Sales Taxes Are Calculated In Georgia

The state general sales tax rate of Georgia is 4%. Cities and/or municipalities of Georgia are allowed to collect their own rate that can get up to 1.5% in city sales tax.Every 2021 combined rates mentioned above are the results of Georgia state rate , the county rate , the Georgia cities rate , and in some case, special rate . The Georgia’s tax rate may change depending of the type of purchase. Some of the Georgia tax type are: Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.Please refer to the Georgia website for more sales taxes information.

Read Also: How To File Federal Taxes For Free

Choose How To Make Your Payment

You can pay your estimated tax electronically with DOR, by mail, or in person.

How Much State Tax Do I Pay In Georgia

Also asked, what is the Georgia state tax rate for 2020?

Georgia income tax ratetaxGeorgia state2020income tax rate2020

One may also ask, what is the Georgia state income tax rate for 2019?

Do I have to file state taxes in Georgia?

fileGeorgiataxhaveGeorgiataxtaxGeorgia’s

At what age do you stop paying state taxes in Georgia?

Also Check: How Much Percent Is Tax

Getting Your Georgia Tax Refund

If your state tax witholdings are greater then the amount of income tax you owe the state of Georgia, you will receive an income tax refund check from the government to make up the difference.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. E-filing your return and filing early can help ensure your refund check gets sent as quickly as possible.

Once you’ve filed your tax return, all you have to do is wait for your refund to arrive. If you want to check the status of your Georgia tax refund, you can visit the Georgia Income Tax Refund page.

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.

Recommended Reading: Where Can I Find My Tax Return From Last Year

What Is The Georgia Homestead Exemption

The Georgia homestead exemption is available to every homeowner who occupies his or her home as a primary, permanent residence. It exempts the first $2,000 in assessed value from property taxes. Seniors age 65 or older may be eligible for a double homestead exemption. To qualify, the applicants total household income, not including Social Security and pension income, cannot exceed $10,000 annually.

Other forms of property tax relief for retirees in Georgia include an exemption of all property value accumulated after the base year in which a senior age 62 or older applies.

So if your home is worth $80,000 when you apply and the value grows to $100,000 the next year, you will only pay property taxes on that first $80,000. If the property value grows to $150,000 over the course of the next seven years, you will still only pay taxes on the first $80,000. To qualify, household income must not exceed $30,000.

What Is The Percentage Of The State General Sales Tax Rate In Georgia

According to CarsDirect, Georgia has a state general sales tax rate of 4%. However, this retail sales tax does not apply to cars that are bought in Georgia. Instead, the state enforces an auto sales tax known as the Ad Valorem Tax for vehicle purchases. The exception to this is if you buy a vehicle outside of the state, in which case you would be required to pay the state sales tax of 4%.

You May Like: Do I Have To Pay Taxes On Social Security Income

How Your Georgia Paycheck Works

As is the case in every U.S. state, employers in Georgia withhold a certain amount of federal and FICA taxes from each of your paychecks to send to the IRS. The IRS puts federal taxes toward your annual income taxes, and FICA taxes go to Medicare and Social Security.

Your employer withholds 1.45% of your wages for Medicare taxes and 6.2% for Social Security taxes every pay period. Your employer then matches those Medicare and Social Security taxes in order to pay the full FICA taxes, which are actually total 2.9% and 12.4%, respectively, of your wages. There is also an additional 0.9% Medicare surtax on earnings that exceed $200,000. Your employer does not match the surtax. If youre self-employed, you have to pay the full FICA taxes on your own. Luckily, there are deductions to help you recoup some of that during tax season.

The rate at which federal taxes are withheld from your paycheck depends on the information you provide on your Form W-4. Whenever you start a new job or experience a major life event like welcoming a child into your family, you will need to fill out a new W-4. Other factors that affect the taxes withheld are your marital status and what pre-tax contributions you make.

Georgia Payroll Tax Resources:

Just in case you want to learn even more about Georgia payroll taxes, here are a few helpful links.

Georgia Department of Revenue: To put it simply: your new best friend.

Register as an Employer: Or call 232-3301 for more information.

The Department of Labor: Basically the almanac of payroll taxes for all Georgia employers.

Answers to your Questions: Unemployment Insurance and laws and regulationsall the things you need to know.

Read Also: How To Pay Federal And State Taxes

Georgia State Income Tax

Income tax rates in Georgia do have graduated tax brackets, but the tiers are concentrated among the lowest incomes, making the Georgia tax rate a practically a flat tax of 6 percent for individuals earning more than $7,000 a year and married couples filing jointly after $10,000.

| Georgia Income Tax Rates | |

| $10,000 or more | 6% |

The average Georgian ends up paying $2,734.22 a year in state income tax, but that can be much lower or even completely eliminated for retirees or the permanently disabled by a retirement income exclusion that overlooks the first $35,000 of income for those aged 62-64 and $65,000 for those 65 and older. This is part of why Georgia is one of the more tax-friendly states to retirees.

Find Out:;How Much Money Gets Taken Out of Paychecks in Every State

Georgia New Car Sales Tax Calculator

When purchasing a new vehicle in Georgia, it’s important to be familiar with the various taxes that you may be required to pay. Two common vehicle taxes implemented in this state are the Title Ad Valorem Tax and the Annual Ad Valorem Tax.

When purchasing a new vehicle in Georgia, it’s important to be familiar with the various taxes that you may be required to pay. Two common vehicle taxes implemented in this state are the Title Ad Valorem Tax and the Annual Ad Valorem Tax. Let’s take a look at how these taxes work and what you can expect when buying or transferring a car in Georgia.

Also Check: How Much Can You Get Back In Taxes