How You Can Affect Your Nevada Paycheck

One option that Nevadans have to shelter more of their paycheck from Uncle Sam is to put more money into pre-tax retirement accounts, such as a 401 or 403. The money that you put into these accounts is taken out of your paycheck before taxes are applied, helping you to lower your taxable income, which leads to tax savings.

For the same reason, you can consider making use of a health savings account or flexible spending account , if your employer offers them. Just keep in mind that FSAs only allow $500 to roll over form year to year. So if you do not use the money you put in, you chance losing it.

Specific Nevada Tax Benefits

Nevadas tax benefits are great for families, businesses, and retirees. Heres why:

- Zero No Nevada State Income Tax

- No Nevada Inheritance Tax after 3 years of residency

- Theres No Corporate Income Tax

- No Inventory Tax

- Theres No Franchise Tax

- Property Tax In Southern Nevada is about 1% or less of the propertys value.

- Nevadas average Property Tax is .77% National average is 1.19%

- The sales tax In Las Vegas is 8.375%

Besides tax items listed above, there is a sales tax in Las Vegas for candy, medical supplies, and over-the-counter medicine for people.

Las Vegas Sales Tax Final Thoughts

For most people, sales taxes in the United States are a part of life, and Las Vegas, Nevada is no different. When budgeting for a trip to Las Vegas its important to take sales taxes into account by remembering that the Las Vegas sales tax rate of 8.375% will be added to the majority of your purchases.

If youd like some help budgeting for your Vegas trip, be sure to take a look at our article here to find out How Much Money You Should Take to Las Vegas

Recommended Reading: How Do I Estimate Taxes For Self Employment

Exceptions To The Rules

Casinos are not required to withhold taxes or issue a W2-G to players who win large sums at certain table games, such as blackjack, craps, and roulette, all of which are categorized as games of skill rather than games of chance.

It is not clear why the IRS has differentiated the requirements this way. Slot machines are games of chance, while table games are seen as requiring a level of skill.

In any case, when you cash in your chips from a table game, the casino cannot determine with certainty how much money you started with.

This does not absolve you of the obligation to report what you won to the IRS. You simply do it yourself when you file your taxes for the year rather than at the casino when you claim your winnings.

And make sure you kept good records of your gambling activities, losses as well as gains. If you spent $2,000 to win $2,000, you might be able to avoid paying taxes.

In 2018 the Supreme Court gave U.S. states permission to legalize sports betting if they wish to do so. It is still fully illegal in 17 states, including California, Massachusetts, and Texas. In 4 other states, there is some form of pending legislation.

How Much Is Hotel Tax In Las Vegas

Every state, county, and city may levy its own local tax on all purchases, including hotel and restaurant checks and airline tickets. These taxes will not appear on price tags. The sales tax in Las Vegas is 8.25% and is added to food and drink bills. Hotel rooms both on the Strip and Downtown come with a 13.35% tax.

Also Check: How Much Tax Deduction For Car Donation

Las Vegas Hotel Resort Fees 2022 Guide

Unfortunately, most Las Vegas hotels now charge resorts fees. They are not part of the final total listed on your reservation and collected directly by the hotel at check-out. Resort fees often cover features you will want to have, such as wireless internet access, 800 number calls, fitness center access, newspapers, bottled water, hotel pool access, etc. The fees are charged nightly per room and are not dependent on the number of guests staying.

You cannot opt-out of paying them, even if you dont want any of the added perks they provide. The amount of a resort fee is the same if you book directly with the hotel, or through a discount travel site. Below is a list of hotel resort fees and what it includes. In addition, there is a 12.5 percent tax on the fees. For your convenience, we also have a list of the best hotels that dont charge resort fees. We try our best to keep things updated, but please be aware that fees can change without notice.

Is It Expensive To Live In Las Vegas

As a resident, you likely wont be spending money the same way you would as a tourist. But, even if you dont spend your days gambling up and down the Strip or seeing a show every night, youll be spending a bit more to live in Vegas.

The cost of living in Las Vegas is 11.6% higher than the national average. However, compared to other cities in Nevada such as Henderson or Boulder City, Las Vegas offers more affordable housing and a lower cost of living.

Don’t Miss: How To Find W2 Tax Return

No State Of Nevada Income Tax Equals More Money For You

Las Vegas tax rates and the Las Vegas Property Tax rates are significant benefits of living in Nevada. The good news is that there is no state income tax in Nevada, no matter where you live. Nevada has no state income tax because tourists pay most of the states taxes. They do this with the hotel room tax and the tax on the casinos revenue. Also, the State of Nevada receives a percentage of sales tax and property tax revenue.

Is Nevada A Tax Haven

The state of Nevada has been increasingly marketed as a tax haven for businesses and individuals. The state does not have a personal income tax or corporate income tax it also has some of the most forgiving laws in the country regarding asset protection and estate planning.

Many people believe that Nevada is the perfect place to avoid paying taxes. Its important o remember that lunch is never free. While Nevada may offer some tax advantages, it is not a completely tax-free state.

There is a sales taxes on most purchases, and the government assesses property taxes on real estate and other assets. In addition, several other taxes apply to businesses operating in Nevada, including payroll taxes and business licensing fees. So while Nevada may be a good choice for some people looking to minimize their tax liability, it is not a true tax haven.

You May Like: When Will Unemployment Taxes Be Refunded

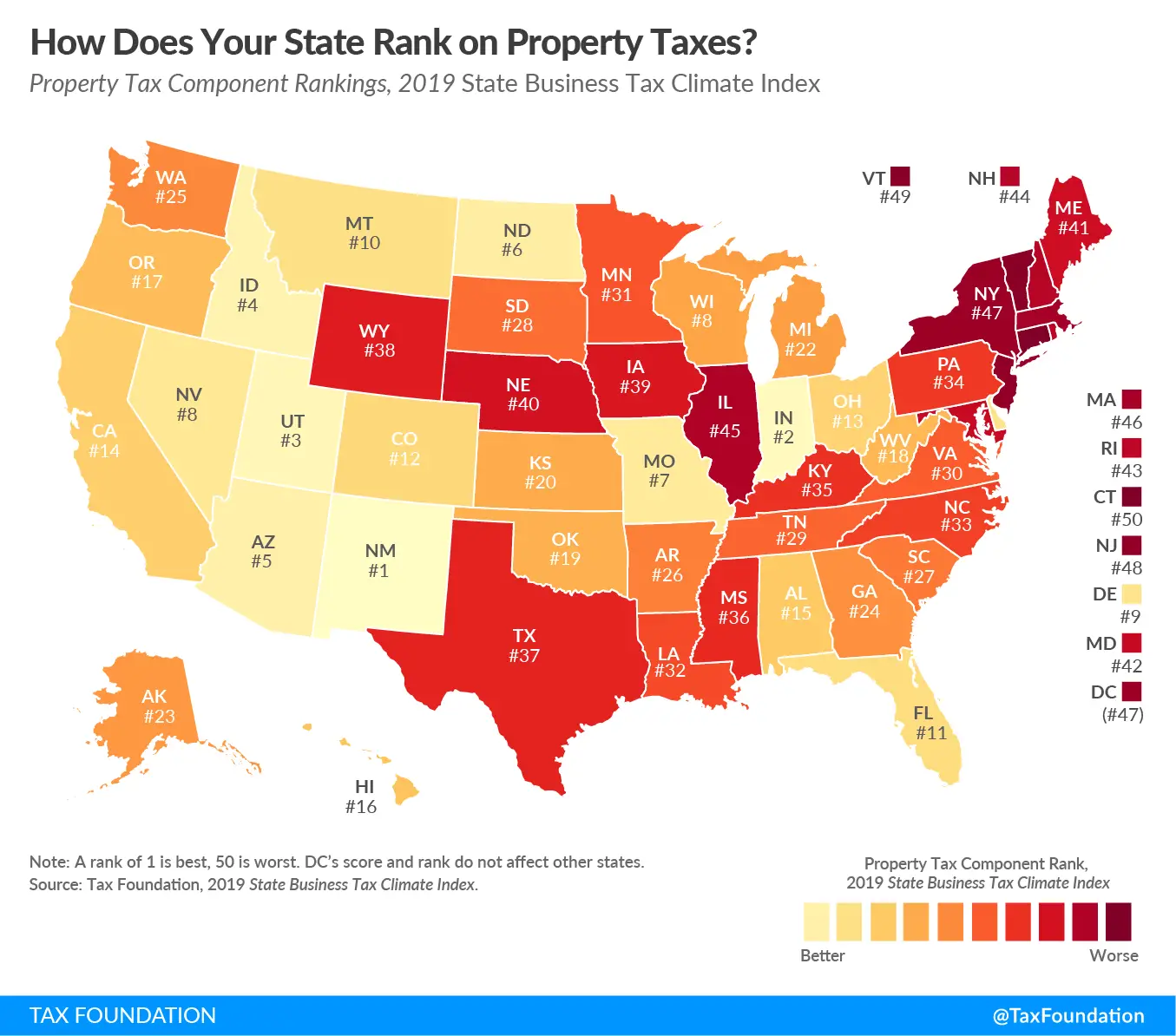

How High Are Property Taxes In Las Vegas

If you own a house in Las Vegas or plan to own one, its important to know how much you should be paying for taxes and ensure that you are being charged for the correct amount annually. Heres what you can expect to pay and how to correct your taxes, if you find that youre being charged incorrectly.

This article was last updated in May 2022. Please be sure to verify with the Clark County Assessor to verify any data regarding your personal property before taking any action.

Contents

Nevada Property Tax Rules

Property taxes in Nevada are based on the market value of a property, as well as the replacement cost of any structures on a property. County Assessors in each county are required to reappraise all property at least once every five years.

The taxable value of a property is calculated as the cash value of the land , and the replacement cost of all buildings minus depreciation of 1.5% per year since construction.

Assessed value is equal to 35% of that taxable value. Thus, if your County Assessor determines your homes taxable value is $100,000, your assessed value will be $35,000. Tax rates apply to that amount.

Nevadas tax abatement law protects homeowners from sudden spikes in their property taxes. The law limits increases in property taxes on primary residences to 3% per year. Thus, even if home values increase by 10%, property taxes will increase by no more than 3%.

Also Check: How Much Tax Do You Pay On Social Security

Property Tax Rates In Las Vegas

Are you considering moving to Las Vegas, Nevada? Before you relocate, its important to understand the current property tax rates in the urban and suburban areas surrounding Las Vegas.

Las Vegass county seat is Clark County, with a population of 2,292,476. While Sin City is best known for the glitzy and glamorous Vegas Strip, it offers much more to locals, including job growth, high marks for quality of living, and no state income taxes.

Moving To Southern Nevada Perks

Many new residents are surprised after moving to Nevada how many State Parks are in the area with numerous outdoor activities. Besides homes with low home prices, areas are beautiful. Another one of the benefits of living in Nevada is a healthy lifestyle.

Personally, my favorite thing about living in Nevada is the friends Ive made. I think that people arent surrounded by old friends and family, so they have more time to socialize. Going to events and shows with people we know are wonderful memories.

Weigh the pros and cons of living in a city vs. county area of the Valley. We find that the difference is minuscule. Most people choose to live where it suits their lifestyle. Las Vegas tax rates are usually not determining factors.

Don’t Miss: What Is The Income Tax Rate In California

How Can I Lower My Taxes In Las Vegas

There are a few ways that you can lower your taxes in Las Vegas. You may be eligible for a property tax exemption if you are a senior or disabled veteran.

You can also deduct some of your expenses, such as medical expenses or charitable donations. Finally, you may be able to lower your tax bill by taking advantage of tax credits, where applicable.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Don’t Miss: Do I Need To File Taxes Irs

Do Casinos Report Gambling Earnings To The Irs

Yes, but there are certain thresholds that must be eclipsed to trigger a casino to report winnings. The threshold at which gambling winnings must be reported to the IRS varies based on the type of game.

At a horse racing track, winnings that exceed either $600 or 300 times your initial wager must be reported. For slot machines and bingo, all winnings in excess of $1,200 must be reported. In a poker tournament, the level is $5,000.

What Is A Gas Tax Exactly

A gas tax is a tax levied on the purchase of gasoline. The tax is usually a percentage of the price of the gallon of gasoline. In the United States, the federal gas tax is 18.3 cents per gallon. The gas tax is one of the few excise taxes that is not applied evenly across all states.

Some states, such as Alaska, do not have much of a state gas tax. Other states, such as California, have a state gas tax that is much higher than the federal gas tax. The gas tax helps fund transportation projects, such as road construction and maintenance.

The gas tax also funds public transit projects, such as buses and trains. In recent years, there has been a growing movement to increase the gas tax in order to fund these projects. Critics of the gas tax argue that it disproportionately affects low-income families and individuals who rely on cars to get around.

You May Like: Why Do I Have To Mail My Tax Return

How Is Hotel Tax Calculated

To get the hotel tax rate, a percentage, divide the tax per night by the cost of the room before taxes. Multiply the answer by 100 to get the rate. For example, the total cost of a nights stay is $134.50, with the rooms pre-tax cost at $115. Your tax per night would be $19.50.

How Gambling Winnings Are Taxed

If you win a substantial amount of money in any legally operated game of chance, the payer of your winnings will deduct 24% of the total for taxes and will give you a copy of IRS Form W-G2 to record the transaction.

What is “a substantial amount of money” in gambling? It depends on the game. It’s $1,200 or more in winnings at slot machines or bingo games, but $1,500 for keno. It’s $5,000 for sweepstakes, wagering pools, and lotteries.

In any case, 24% of the amount won will be deducted from your payout and sent directly to the IRS, with Form W-G2 as the documentation. That 24% is an estimated tax. You might get some of it back, or owe more.

Taxes on winnings at games of skill like blackjack are not immediately withheld but you still are required to report the income and pay taxes on it.

Read Also: Where To Send Kentucky State Tax Return

Does Nevada Have A Hotel Tax

Lodging Tax on Hotels & Motels etc The tax imposed on room rental is Lodging Tax. In Nevada, transient lodging tax and exemptions are set at the city/county level and varies by county. Any specific questions regarding exemptions and rates should be addressed to the city/county where the hotel is located.

Stages Of This Initiative

- Robert Hollowood filed this initiative with the Nevada Secretary of State on January 13, 2020.

- In February, the Nevada Resort Association challenged the petition language submitted by initiative petitioners in a lawsuit.

- On March 13, Judge James Wilson ruled in favor of the Nevada Resort Association requiring initiative petitioners to resubmit the petition language.

- Sponsors submitted amended petition language on March 30, 2020.

- Proponents reported submitting over 200,000 signatures to county election officials on November 17, 2020.

- On December 15, 2020, county officials verified 148,605 of the 201,935 submitted signatures for the petition, about a 73.6% validity rate. The initiative was considered during the 2021 legislative session, which was set to begin February 1, 2021, and adjourn July 31, 2021.

- The measure was certified for the ballot after the Nevada State Legislature did not choose to vote on the indirect initiative prior to the March 12, 2021 deadline.

- On June 28, 2022, the Nevada Supreme Court ruled to remove the initiative from the ballot.

You May Like: How To Calculate Taxes From Your Paycheck

How 2022 Sales Taxes Are Calculated In Las Vegas

The Las Vegas, Nevada, general sales tax rate is 4.6%. Depending on the zipcode, the sales tax rate of Las Vegas may vary from 8.25% to 8.375%Every 2022 combined rates mentioned above are the results of Nevada state rate , the county rate . There is no city sale tax for Las Vegas. There is no special rate for Las Vegas.The Las Vegas’s tax rate may change depending of the type of purchase.Please refer to the Nevada website for more sales taxes information.

Do All Hotels Charge A Resort Fee

Look for resort fee information on the hotels website. Some hotels include this information and explain what the resort fee covers. Other hotel websites do not mention resort fees at all. In fact, the resort fee might not be included on the reservation page, even though room rates and taxes are displayed.

Also Check: Can You Refile Your Taxes From Previous Years

Las Vegas Cost Of Living Stats

Even though Las Vegas is the largest Nevada city, other large Nevada cities and towns also have very similar skewed cost-of-living and crime rates. Large tourist cities in Nevada, like Laughlin, South Lake Tahoe, and our Biggest Little City, Reno, also get hit particularly hard.

The Nevada tax rates are certainly attractive. However, theres a team spirit that makes us want to stay and be a part of this incredible energy. Calling Las Vegas home for over 30 years has shown us a lot of exciting changes and growth. What makes us proud of the community are the creative problem-solving companies and people that also call Southern Nevada home.

This blog was written by Kurt Grosse. Kurt is a 26+ year Las Vegas Top-Producing Realtor and former Nevada Building Engineer, a PE, CE. Kurt is known by his clients as The Protector. With how quickly homes are built in Southern Nevada, his services can be invaluable. If youre thinking about a Las Vegas or Southern Nevada move, give Kurt a call

Overview Of Nevada Taxes

Nevada is one of a handful of states that does not have a state income tax. In addition, no cities in Nevada have local income taxes. However, residents still have to pay federal taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Recommended Reading: How To Do Taxes Freelance