Overview Of California Taxes

Californias overall property taxes are below the national average. The average effective property tax rate in California is 0.73%, compared to the national rate, which sits at 1.07%.

| Enter Your Location |

| of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property’s assessed value and the property tax rates based on your property’s address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county’s effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

…read more

How To Calculate Documentary Transfer Tax

For example, on a property valued at $21,100, the amount of the County’s Documentary Tax would be calculated by rounding up the amount to $21,500, dividing $21,500 by $500, and multiplying that number by $0.55 for a total of $23.65.

However, if the property in this example were located within the City of Los Angeles, an additional $4.50 per $1,000 valuation will be assessed and collected at the time of recording for a total of $96.75. County and City transfer tax must be listed separately.

The tax calculations are the responsibility of the document preparer and NOT the County Recorder. The following is the format that should be used for the tax declaration on the first page of the document:

| DOCUMENTARY TRANSFER TAX $ |

Los Angeles County California Sales Tax Exemptions

In most states, essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate.Los Angeles County doesn’t collect sales tax on purchases of most groceries. Certain purchases, including alcohol, cigarettes, and gasoline, may be subject to additional California state excise taxes in addition to the sales tax.

Note that in some areas, items like alcohol and prepared food are charged at a higher sales tax rate than general purchases. California’s sales tax rates for commonly exempted categories are listed below. Some rates might be different in Los Angeles County.

Groceries:

Don’t Miss: When Are Quarterly Estimated Taxes Due

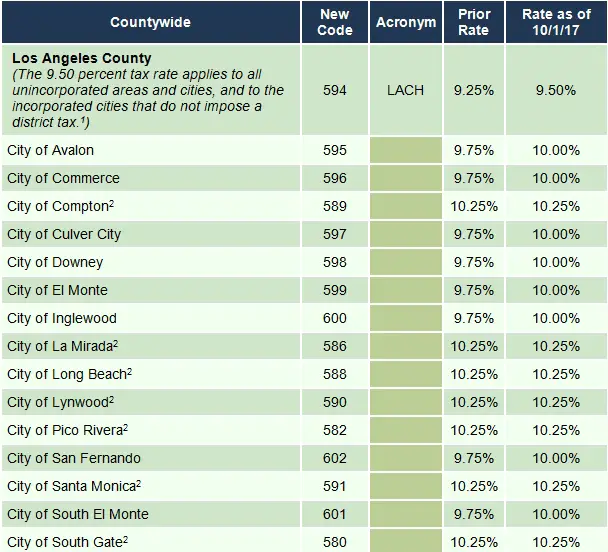

Los Angeles County California Sales Tax Rate2022

| 10.5% |

|---|

Components of the 10.5% Los Angeles County sales tax

The county-level sales tax rate in Los Angeles County is 0.25%, andall sales in Los Angeles County are also subject to the 6% California sales tax.Cities, towns, and special districts within Los Angeles County collect additional local sales taxes, with a maximum sales tax rate in Los Angeles County of 10.5%. The total sales tax rates for all 210 cities and towns within Los Angeles County are listed in the table below.

| City Name |

|---|

Cities or counties marked with the symbol have a local sales tax levied by that municipality

Car Sales Tax For Trade

Those who trade in a vehicle will still have to pay sales tax. California state sales tax applies to the full price of the new vehicle.

In essence, their sales tax does not consider whether or not you traded in your vehicle.

For example, if you traded in a vehicle for $7,000 and applied that credit to a new vehicle purchase of $15,000, you will pay sales tax for the $15,000 full purchase price.

Don’t Miss: How Much Should You Take Out For Taxes

Software Electronically Transmitted To Customers

According to Regulation 1502, the sale of noncustom software to customers who download the software from a server is generally not subject to sales tax because the transaction does not involve tangible personal property. However, if the customer is provided a copy of the software on a physical storage medium such as a CD-ROM or a DVD, the entire transaction is generally subject to sales tax. Thus, a customer can generally avoid sales tax liability by purchasing a downloadable version of software instead of a physical version.

Earned Income Tax Credit: The Caleitc Or Yctc Tax Credits

You can claim the California Earned Income Tax Credit if you work and have low income , both credits are a refundable credit. The amount of the credit ranges from $243 to $3,027. You can also qualify for the Young Child Tax Credit if you have a qualifying child under the age of 6. If you qualify for the young child tax credit, you may receive up to $1,000.

Also Check: Where Do I Find My Tax Id Number

California First With Law Protecting Childrens Online Privacy

A new law in California will require companies that provide online services to protect childrens privacy

To be eligible, residents must have filed their 2020 tax returns by Oct. 15, 2021, lived in the state for six months or more in 2020 and could not be claimed as a dependent in 2020. Recipients must also be a California resident on the date the payment is issued. Payments are automatic if you qualify residents do not need to apply.

Individuals whose adjusted gross income in 2020 was up to $75,000 will receive a $350 refund, which doubles to $700 for joint filers earning as much as $150,000. Households will receive another $350 if they claimed any dependents, for a maximum of $1,050.

Single filers who earn up to $125,000 will receive $250, doubling to $500 for joint filers earning as much as $250,000. Households with dependents will get an additional $250, making families in this income bracket eligible for as much as $750.

Individuals earning up to $250,000 will get $200, and joint filers with income up to $500,000 will receive $400. Dependents will qualify taxpayers in this bracket for another $200, for a maximum payment of $600.

Individual or separate filers who made $250,000 or more are ineligible, as are heads of household or joint filers making $500,000 or more.

The Franchise Tax Board has launched a Middle Class Tax Refund Estimator for residents to check how much money they could be eligible for.

Times staff writer Taryn Luna contributed to this report.

How Does La County Calculate Property Tax

General Tax Levy This tax amount is the general one percent tax rate levied against every property in the County. The calculation is 1 percent multiplied by the Net Taxable Value. Effective with tax bills issued after August 2013, the PIN may contain all alpha, all numeric, or alpha/numeric characters.

Recommended Reading: When Can We File Taxes 2021

Los Angeles Sales Tax Calculator

Invoicing clients or selling to customers and need to know how much sales tax to charge? Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Input the amount and the sales tax rate, select whether to include or exclude sales tax, and the calculator will do the rest. If you dont know the rate, download the free lookup tool on this page to find the right combined Los Angeles rate.

Other Taxes On Corporations

Stamp duty

Documentary stamp taxes may be imposed at the state level. “Stamp” taxes also may be imposed on items such as alcohol and tobacco.

Social security

Social security taxes are comprised of old age, survivors and disability insurance , and hospital insurance . The taxes generally are borne equally by the employer and the employee, with the employer responsible for remitting each employees portion to the federal government. The OASDI tax is imposed on the first USD 118,500 of wages, at the combined rate of 12.4%. The Medicare tax is imposed on total wages, at the combined rate of 2.9% .

Other

The federal government imposes a variety of excise taxes, in addition to the social security taxes on wages described above. In

Transfer tax

Tax generally is imposed by the local governments at various rates.

Payroll tax

The employer must withhold federal, state and local income taxes from employee wages and must remit these taxes to the respective government agencies. The employer also must pay federal and state unemployment taxes and, as noted below, social security taxes. The federal unemployment insurance rate is 6% on the first USD 7,000 of each employees wages. State unemployment insurance, mandatory in all 50 states and the District of Columbia, varies widely. The employer receives a credit, up to a maximum of 5.4% , against the federal tax for amounts paid to state unemployment insurance funds.

Also Check: What Is Federal And State Tax

The Los Angeles Transfer Tax

Transfer taxes are a levy imposed by both Los Angeles County and the city when the propertys title is transferred. This seemingly straightforward concept is not as clear-cut as it seems, though. A layer of complexity is added since different municipalities charge different rates. There is also confusion regarding who pays the tax.

You cannot do much to avoid the tax, but at least you will have forewarning in order to prepare yourself.

Los Angeles County Sales Tax Calculator

All merchants operating in Los Angeles County must automatically calculate the sales tax due on each purchase made and include it in separately in the receipt. Goods bought for resale or other business use may be exempted from the sales tax. If you purchase goods online or through the mail and do not pay any sales tax, you are expected to pay use tax to the California Franchise Tax Board. For more details, see the California sales tax.

Also Check: What Are The Different Tax Brackets

Recent Statewide Sales Tax Increases

Recent temporary statewide sales tax increases include:

- From April 1, 2009 until June 30, 2011, the state sales and use tax increased by 1% from 7.25% to 8.25% as a result of the 2008-2009 California budget crisis.

- Effective January 1, 2013, the state sales and use tax increased by 0.25% from 7.25% to 7.50% as a result of Proposition 30 passed by California voters in the November 6, 2012 election. The change was a four-year temporary tax increase that expired on December 31, 2016.

California Sales Tax Lookup By Zip Code

Look up sales tax rates in California by ZIP code with the tool below.Note that ZIP codes in California may cross multiple local sales tax jurisdictions.

Sales-Taxes.com last updated the California and Bell Gardens, Los Angeles, Azusa, Avalon, Carson, Covina, Downey, Norwalk, Bellflower, Duarte, Los Angeles Tourism Marketing District, Lomita, Malibu, Pomona, La Verne, San Fernando, Santa Monica Tourism Marketing District, Walnut, Arcadia, Artesia, Burbank Tourism Business Improvement District, Compton, Lynwood, Gardena, Vernon, Santa Clarita Tourism Marketing District, Santa Fe Springs, Calabasas, Glendale, Alhambra, Pasadena Tourism Business Improvement District, El Monte, Glendora, Lakewood, Lawndale, Manhattan Beach, Monrovia, Palmdale, Rosemead, Montebello, Torrance Tourism Business Improvement District, Whittier, Hawthorne, Inglewood, La Mirada, La Puente, Lancaster Tourism Business Improvement District, Long Beach, Signal Hill, Long Beach Tourism Bia, San Marino, Cudahy, Culver City, Commerce, Huntington Park, West Hollywood Tourism Improvement District, Pico Rivera, San Gabriel, West Covina, Agoura Hills, Sierra Madre, Beverly Hills, Hermosa Beach, Monterey Park, South El Monte, South Pasadena, El Segundo, Industry, Thousand Oaks And La Canada Flintridge sales tax rate in September 2022 from the California Board of Equalization

Please verify all rates with your state’s Department of Revenue before making any financial or tax decisions.

Also Check: What Day Are The Taxes Due

Local Sales Taxes Subject To Voter Approval Under Proposition 218

All local sales taxes are subject to voter approval under Proposition 218 which California voters approved in November 1996. Whether simple majority voter approval or two-thirds voter approval is required depends upon the type of sales tax levied and the type of local government imposing the sales tax.

Unrestricted general sales taxes are subject to majority vote approval by local voters. General sales taxes can be spent by local politicians for any general governmental purpose, including public employee salaries and benefits. General sales tax spending decisions are made after the tax election by local politicians as part of the regular annual local government budget process. Some local governments may engage in general sales tax abuses in an effort to evade the two-thirds vote requirement applicable to special sales taxes.

Special sales taxes dedicated for one or more specific purposes are subject to two-thirds voter approval by local voters. Any sales tax imposed by a local government other than a city or a county must be a special tax subject to two-thirds voter approval by local voters.

Proposition 218 does not legally authorize any local government to levy a sales tax. The legal authority to levy a local sales tax must come from a state statute. A two-thirds vote of all members of the legislative body of the local government is usually required before a local sales tax measure may be presented to voters at an election.

County transportation sales taxes

Los Angeles County Property Tax Assessor

The Los Angeles County Tax Assessor is responsible for assessing the fair market value of properties within Los Angeles County and determining the property tax rate that will apply. The Tax Assessor’s office can also provide property tax history or property tax records for a property. These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal.

Most county assessors’ offices are located in or near the county courthouse or the local county administration building. You can look up the Los Angeles County Assessor’s contact information here .

Don’t Miss: How Much Is Sales Tax In Ny

Los Angeles County Property Tax Deduction

You can usually deduct 100% of your Los Angeles County property taxes from your taxable income on your Federal Income Tax Return as an itemized deduction. California may also let you deduct some or all of your Los Angeles County property taxes on your California income tax return.

Has this page helped you? Let us know!

Supplementary Local Sales Taxes

Supplementary local sales taxes may be added by cities, counties, service authorities, and various special districts. Local county sales taxes for transportation purposes are especially popular in California. Additional local sales taxes levied by counties and municipalities are formally called “District Taxes.”

The effect from local sales taxes is that sales tax rates vary in California from 7.25% to 10.75% . For example, the city of Sacramento, the state capital, has a combined 8.75% sales tax rate, and Los Angeles, the largest city in California, has a combined 9.50% sales tax rate.

Local sales tax rate cap

The combined tax rate of all local sales taxes in any county is generally not allowed to exceed 2.00 percent. However, this is a statutory restriction and the California Legislature routinely allows some local governments, through the adoption of separate legislation, to exceed the 2.00 percent local tax rate cap. The 2.00 percent local tax rate cap is exceeded in any city with a combined sales tax rate in excess of 9.25% .

As of July 1, 2022, the following 140 California local jurisdictions have a combined sales tax rate in excess of the 2.00 percent local tax rate cap:

| CITY |

|---|

| SAN MATEO |

SB 566 and the rise in local sales tax increases

Local jurisdictions with at least 10.00% combined sales tax rates

As of July 1, 2022, the following 68 California local jurisdictions have a combined sales tax rate of at least 10.00%:

| CITY |

|---|

| SUTTER |

Recommended Reading: How Do I File My Taxes With Turbotax

How To Calculate California Restaurant Tax

Related

California state regulation of businesses of all kinds is notoriously detailed. Tax regulation of restaurants is no exception and includes some provisions that make figuring out how much you owe the state even a little more laborious. Here’s some basic California restaurant-related tax information.

Where The Trouble Begins

The trouble for restaurant owners begins with a relatively uncomplicated-seeming statement in the California tax code: “Sales of food for human consumption are generally exempt from tax unless….”

The trouble begins at the phrase “generally exempt” and continues after “unless” with the provided list of exceptions along with the exceptions to the exceptions.

The exceptions to the exemption from the tax are:

- food sold in a heated condition

- food consumed at or near the seller’s facilities

- soft drinks and alcoholic beverages

- food sold for consumption where there’s an admission charge

This is already mildly confusing but wait, there’s more and it only gets worse.

Also Check: How To File Taxes In The Military

How To Calculate California Sales Tax On A Car

To calculate the sales tax on your vehicle, find the total sales tax fee for the city. The minimum is 7.25%. Multiply the vehicle price by the sales tax fee.

For example, imagine you are purchasing a vehicle for $20,000 with the state sales tax of 7.25%. $20,000 X .0725 = $1,450. $1,450 is how much you would need to pay in sales tax for the vehicle, regardless of if it was used, purchased with trade-in credit, or included an incentive.

Remember that the total amount you pay for a car not only includes sales tax, but also registration, and dealership fees.

Secured Property Taxes Terms

Annual Secured Property Tax BillThe annual bill, which includes the General Tax Levy, Voted Indebtedness, and Direct Assessments, that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1, due in two installments.

Adjusted Annual Secured Property Tax BillA bill that replaces the Annual Secured Property Tax Bill due to the following reasons: a change or correction to the assessed value of the property the allowance of an exemption that was previously omitted the correction of a Direct Assessment placed on the property from a municipality or special district or the inclusion of a penalty for failure to comply with certain requirements of the Office of the Assessor prescribed by law .

Ad ValoremAccording to the value Based on value. For example, the Office of the Assessor calculates property taxes based on the assessed value of a property.

Non-Ad Valorem Not according to the value.

AssessmentThe rate or value of a property for taxation purposes.

Assessors Identification Number A 10-digit number that identifies each piece of real property for property tax purposes, e.g., 1234-567-890.

California Relay ServiceA telecommunications relay service that provides full telephone accessibility to people who are deaf, hard of hearing, or speech impaired.

Current YearThe current fiscal tax year in which the Department of Treasurer and Tax Collector issues an Annual Secured Property Tax Bill.

Testate

Don’t Miss: How Long Does It Take For Taxes To Be Processed