Prizes Valued At Less Than $600

In Washington State, winning a lottery prize of $600 or less means you can go to any in-state lottery retailer to claim your prize. You also have the option to claim your prize by mail by sending your signed winning ticket to the Washington Lottery Headquarters.

Winnings less than $600 dont have to be reported to the IRS. That means you dont owe any taxes on these small winnings at either the state or federal level.

Washington State Taxes: Everything You Need To Know

Find out Washington state sales tax, estate tax and more. Taxes 101

In Washington state, taxes are levied on sales by both the state and local municipality, on property and on an estate when someone dies, but it doesnt charge any;income tax. Heres everything you need to know about;Washington;tax rates and how they could affect you.

| Washington State Taxes |

Find Out:;How Much Money Gets Taken Out of Paychecks in Every State

Coming In 202: New Wa State Payroll Tax For Long

A substantial new WA State tax on wages will go into effect Jan. 1, 2022 that most people are not aware of. This is something were starting to discuss with clients because the tax is not capped: it is 0.58% annually on ALL work income reported on W-2s, including income from stock options, RSUs and other types of equity comp.;

How this came about: On May 13, 2019 Governor Jay Inslee signed into law the creation of the nations 1st Long-Term Care Trust Fund. The Fund will raise money through payroll taxes to provide benefits for eligible WA residents. Its quite possible that other states will look into implementing their own Long-Term Care Trust Fund at some point and perhaps the federal government will also get involved.

The reason: Across the US, some 10,000 people a day are currently entering retirement, and many have no way to pay for the care they will need in old age. Medicare and Social Security do not cover any of the costs of long-term care. Therefore, Medicaid, the joint federal and state program for low-income Americans, is the largest payor for long-term care services, putting increasing strains on state budgets. Here in Washington State, spending on Medicaid long-term care expenses is about $4 billion annually.;

THE IMPACT ON HIGHER-INCOME HOUSEHOLDS;

POTENTIAL TO OPT OUT

STRATEGIES

Taxes changes at the federal level could also happen in the coming year, especially for higher-income households. Find out what is likely from LNWMs Kristi Mathisen.;

Also Check: Who Can I Call About My Tax Refund

How Do I Pay The Tax

If you sell spirits, you will collect the spirits sales tax from your customer and remit it to the Department of Revenue on your excise tax return. You are to remit the tax monthly and file it electronically using;My DOR. If you have a waiver to file a paper return, report the sales on the Spirits Sales Tax Addendum.

What Is The Washtington State Long Term Care Tax

In 2021, House Bill 1323 was passed which creates the Long-Term Services and Supports Trust Program also called the LTSS Program or WA Cares Fund. The program imposes a 0.58% premium assessment on all Washinton employee wages. The new Fund paid for by Washington employees provides long-term care benefits to those that require financial assistance and meet the qualification requirements.

To be eligible to receive long term care benefits under the WA Care Fund, an individual must meet one of the following contribution requirements:

Once youre vested, youre insured against long-term care up to $36,500 over your lifetime.

You May Like: How Fast Can You Get Your Tax Refund

Wa Enacts Capital Gains Tax

Washington State Governor Jay Inslee has signed legislation that imposes a tax on the sale or exchange of certain long-term capital assets by individuals at a rate of 7.0%.;The first $250,000 of capital gains are excluded from the tax, which is adjusted annually for inflation. To avoid taxing the same sale or exchange under both the business and occupation tax and capital gains tax, a credit is allowed against the B&O tax for any capital gains tax owed on the sale or exchange of the capital asset. There are several defined items that the capital gains tax does not apply to, including: real estate transferred by deed, real estate contract, judgment, or other lawful instruments that transfer title to real property; an interest in a privately held entity only to the extent that any long-term capital gain or loss from such sale or exchange is directly attributable to the real estate owned directly by such entity; assets held under a specified retirement/deferred compensation accounts; and more. For further information, please see L. 2021, S5096 .

May 7, 2021

New Payroll Tax In Washington State

by Geoffrey Curran | Apr 23, 2021 | Geoff Curran, Life & Disability Insurance, News, Wealth Preservation

Do you work at Amazon, Microsoft, Facebook, F5 Networks, or any of the other large tech employers in Washington State? Do you earn over $300,000 a year? If so, read this!

Washington State passed a new tax on employees to fund the first public-operated, long-term care insurance program. Effective January 1, 2022, Washingtonians who are W-2 employees will be subject to a 0.58% payroll tax on all compensation. Said differently: You will pay $580 of additional tax per every $100,000 of compensation with no income cap.

Good news: You can opt-out and become exempt from this tax and program by having your own individual long-term care insurance policy in place before the deadline. Apart from the annual savings, the benefits of an individual policy are far superior to those offered through the states LTC insurance program.

Q&A on Washingtons Long-Term Care Trust Act:

What is long-term care? What is long-term care insurance?

Long-term care includes services designed to meet a persons health or personal needs as they age and need additional help completing their daily activities. This care is provided through three stages: independent living, assisted living, and skilled nursing.

Why is Washington state adding this program now?

What benefits does this program provide?

Other considerations:

Who is subject to this new tax?

Should I get my own LTC insurance policy?

You May Like: How To Buy Gold Without Paying Sales Tax

Washington State Vda Program Is Temporarily Expanded

Washington State on a provisional basis has expanded the eligibly for its Voluntary Disclosure Agreement program. The program is expanded to businesses whose most recent enforcement contact was prior to July 1, 2019. Further, the program is expanded for businesses that previously registered, as long it had closed its department registration account or was placed on Active Non-Reporting status prior to Jan. 1, 2020, including those that previously filed tax returns. This expanded eligibility is effective July 15 through November 30, 2020. Refer to the Department of Revenues guidance for additional details on the expanded program.

New State Employee Payroll Tax Law For Long

PurposeThis bulletin provides hospitals and health systems information about House Bill 1087, passed in 2019, which creates the Long-Term Services and Supports Trust Program . This also provides information about House Bill 1323, passed in 2021, which modifies a few provisions of the LTSS Program. In summary,

- Starting January 1, 2022, a 0.58% premium assessment will be imposed on all Washington employee wages.There are no specific exemptions for hospital or health system employees. However, an;employee has a one-time opportunity to opt-out if they have comparable private long-term care insurance .

- Starting January 1, 2025, proceeds of this premium assessment will be used to provide long-term services and supports benefits to Washington State residents who have paid into the LTSS Program for a specific amount of time and who need a certain amount of assistance with activities of daily living.

Applicability / ScopeThe LTSS Program will be funded by premium assessments. Starting January 1, 2022, all Washington employee wages are subject to a 0.58% premium assessment .

This is not a tax on employers, but employers are required to collect premiums through employee payroll deductions and remit proceeds to the Employment Security Department . This agency will deposit funds in a trust for the individual until they qualify for the benefit.

All qualifying employees are subject to the premium assessment, with the following exceptions:

Recommendations / Next Steps

References

Don’t Miss: How Much Income To File Taxes

What Is The Purpose Of The Wa Cares Fund

Medicare doesnt cover long-term care , and Medicaid covers long-term care only for qualified individuals who cannot afford the cost of the care.

The Medicaid program is jointly funded by the federal government and states. The federal government pays states for a specified percentage of program expenditures, called the Federal Medical Assistance Percentage .

According to the WA Cares Fund website, long-term care is expensive and not covered by Medicare. Most will not have the savings to pay for it. Seven in ten Washingtonians will need long-term care during their lifetimes, and most older adults today end up relying on family members to care for them or impoverishing themselves to qualify for Medicaid.

The WA Cares Fund provides choices about how to receive care and a way to pay for it.

Retail Sales And Use Tax

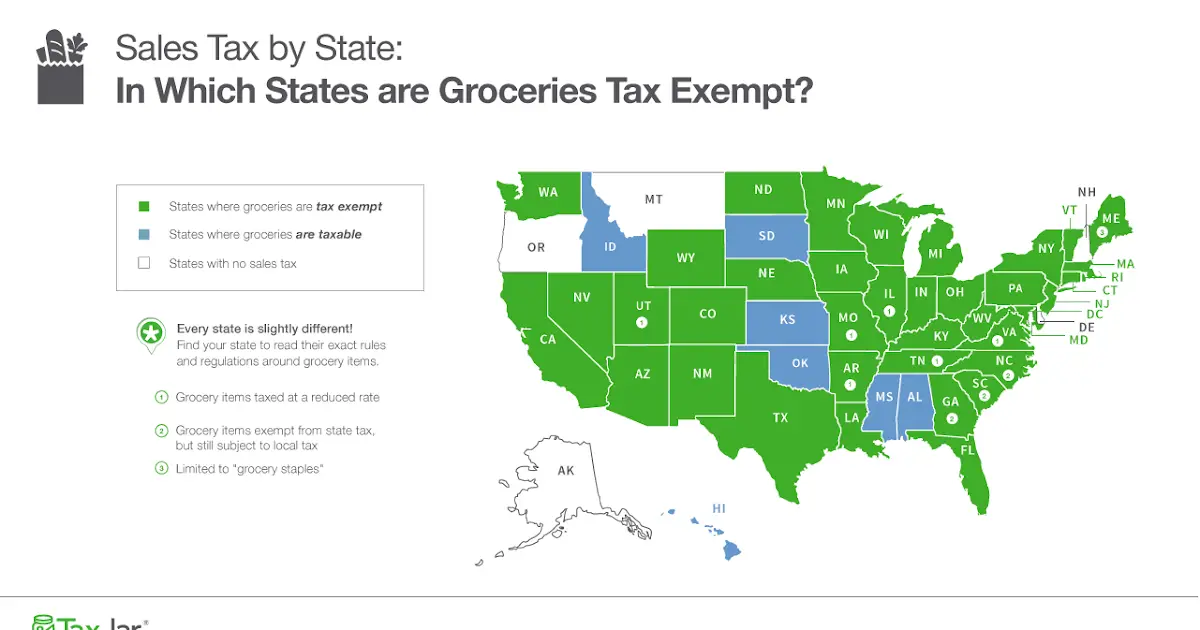

The Sales and Use Tax is Washingtons principal revenue source. It is comprised of a state component at 6.5% and a local component at 1.2% 3.8%; total 7.7% 10.3%. Businesses making retail sales in Washington collect sales tax from their customer. A retail sale is the sale of tangible personal property. It is also the sale of services such as installation, repair, cleaning, altering, improving, construction, and decorating. Major exemptions to the sales tax include purchases for resale, groceries and prescription drugs, interstate and foreign sales, and manufacturing/processing equipment. The Use Tax is applied on taxable items purchased in another state and brought to Washington if that state did not collect sales tax. Use Tax rates are the same as Sales Tax.

Complete information on the Sales and Use Tax can be found through the;Department of Revenue.

Recommended Reading: How To Pay Llc Taxes

What Is The Spirits Sales Tax Rate

The tax rate for sales to;consumers;is 20.5 percent

The tax rate for;on-premises retailers;such as restaurants, bars, etc., is 13.7 percent.

Since spirits purchases made by licensed on-premises retailers are for resale, their wholesale spirits purchases have a lower spirits sales tax rate.

Note:;The regular retail sales tax does not apply to sales of spirits unopened in the original container; however, it does apply to sales of spirits by the drink .;RCW 82.08.150

Washington State Income Tax Calculator

Although the Washington state;income tax rate is 0%, we have provided you with various scenarios of the tax you will pay on your income as a resident of Washington .

The following Washington state income tax calculator should be used for approximation purposes and does not represent legal authority, or the exact amount of Washington state income tax that you will be liable for it is a guide based on information from the IRS, the State of Washington Department of Revenue, and other sources.

The range we have provided in the Washington state income tax calculator is from $1,200 per month or $14,400 per year to $12,000 per month, or $144,000 per year. The gross monthly wage of $2,340 or $28,080 per year in the table represents the Washington state minimum wage of $13.50 per hour. A standard full-time position in the US typically includes a 40-hour workweek that translates to 2,080 hours worked in a year .

Finally, while the state has no income tax, what is also beneficial to residents of Washington , is that it does not impose any local income tax as some other states do. This means that once youve finished your federal tax return, youre done with your taxes for the year.

Here is the Washington state income tax calculator

| Monthly Gross Wage |

|---|

| $107,711.04 |

Recommended Reading: How Do Tax Liens Work

Washington State Sales Tax

When a resident makes a purchase in Washington state, they will be charged sales tax. The state sales tax rate is 6.5 percent. The local county or city can add an additional sales tax. In Seattle, for example, the total sales tax is 10.1 percent. The average combined state and local sales tax rate in Washington state is 9.18 percent.

Sales tax in Washington state is not charged on:

- Food

- Sales to Indians or Indian tribes

- Manufacturers machinery and equipment

Sales tax is charged on the sale of tangible personal property, and also on services such as repair, cleaning, installation, construction and so on. It is also charged on the sale of digital products such as downloaded or streaming movies or music. It is the responsibility of the seller to collect the sales tax from the buyer and remit it to the state.

Retailers who ship or deliver goods into Washington state are required to collect Washington state sales tax based on the location to which the item is delivered. Since the sales tax can vary from county to county, this so-called destination-based sales tax can even affect local businesses like furniture stores and pizza shops that might deliver outside the county they are located in.

Check Out These:;States With No Sales Tax

Who Is Subject To Tax

The tax is imposed on net long-term capital gains recognized by individuals and allocated to Washington by provisions of the law. The tax does not apply to legal entities , but individuals may be subject to the tax on gains recognized by passthrough entities in which a taxpayer has an ownership interest.

Capital gains from the sale of intangible property such as stocks, bonds, and other investment instruments are subject to tax if the individual is domiciled in Washington at the time of sale. Domicile, although not defined in the capital gains tax law, is generally understood as the place a person considers their permanent residence and home, and in which they have the majority of their legal, professional, and personal ties.

Gains from sales of tangible personal property are generally allocated to Washington if the property was located in Washington at the time of sale. However, gains from the sale of tangible property located outside Washington may be subject to tax if the seller is a resident of Washington at the time of the sale, and the property was present in Washington at any time during the year of sale or the preceding year. A person is considered a resident for purposes of the tax if they are domiciled in Washington or maintain a place of abode in the state and are physically present for more than 183 days during the calendar year.

Recommended Reading: Can You Claim Rent On Your Taxes

Alcohol Tax By State 2021

Alcoholic drinks contain ethanol, an alcohol made through fermentation. Beer and wine are fermented drinks, while spirits go through an additional process called distillation.

In the United States, “a drink” has 0.6 ounces of pure alcohol in it. “One drink” is:

- 12 ounces of beer

- 8 ounces of malt liquor

- 5 ounces of wine

- 1.5 ounces of 80-proof distilled spirits or liquor

Alcohol is a regulated drug. The legal drinking age in the United States is 21. While it plays an important social role in many cultures, drinking alcohol can slow down motor functions and reaction times and slur speech. Additionally, excessive alcohol consumption over time can cause several health problems, including heart problems, liver disease, and cancers such as liver, neck, and esophageal cancer.

Wa Adopts Marketplace Facilitator Rule For Sales Tax Purposes

Effective July 2, 2021, the Washington Department of Revenue has adopted Wash. Admin. Code;§;458-20-282, to provide guidance on the taxation of marketplace facilitators. The rule provides applicable definitions, examples of persons who are considered marketplace facilitators and discusses the tax collection responsibilities of facilitators. Liability relief, the provision of information to marketplace facilitators and audits are also discussed. For more information, please visit the Washington Department of Revenue website.

May 13, 2021

You May Like: When Can You File Your Taxes

Tax Penalty Relief Measures For Businesses Affected By Coronavirus

The Governor of Washington State announced that the Department of Revenue is implementing tax penalty relief measures for businesses affected by COVID-19. Emergency provisions have been put in place providing for a waiver of financial penalties, which a business may have incurred for filing their tax reports late or cannot pay their taxes on time due to the outbreak. Businesses can request an extension or penalty waiver by sending an email through their My DOR account or by calling the Department of Revenues customer service line. In addition, businesses can request to reschedule planned audits, extension of time to file a business license or registration renewal, or obtain an extension of an expiring resellers permit.

Disclaimer: Please note this is the information that is readily available at this time, it is subject to change so please consult your Withum tax advisor.

What Is The Washington State Vehicle Sales Tax

Washington State vehicle sales tax is the tax due on the majority of purchases or acquisitions of motor vehicles in Washington State. Before you choose to purchase a vehicle, it’s important to be aware of the ins and outs of vehicle sales tax and everything associated with it.

Washington State vehicle sales tax is the tax due on the majority of purchases or acquisitions of motor vehicles in Washington State. Before you choose to purchase a vehicle, it’s important to be aware of the ins and outs of vehicle sales tax and everything associated with it.

Also Check: Where Can I Find My Agi On My Tax Return