When A Dependent May Need To File A Tax Return

Taxpayers who are claimed as a dependent on someone’s tax return are subject to different IRS filing requirements, regardless of whether they are children or adults. A tax return is necessary when their earned income is more than their standard deduction.

The standard deduction for single dependents who are under age 65 and not blind is the greater of:

- Or the sum of $400 + the person’s earned income, up to the standard deduction for an unclaimed single taxpayer which is $12,950 in 2022.

A dependent’s income can be “unearned” when it comes from sources such as dividends and interest. When a dependent’s unearned income is greater than $1,150 in 2022, the dependent must file a tax return.

Taxation Of Social Security Benefits

Many older Americans are surprised to learn they might have to pay tax on part of the Social Security income they receive. Whether you have to pay such taxes will depend on how much overall retirement income you and your spouse receive, and whether you file joint or separate tax returns.

Check the base income amounts in IRS Publication 915, Social Security and Equivalent Railroad Retirement Benefits. Generally, the higher that total income amount, the greater the taxable part of your benefits. This can range from 50 to 85 percent depending on your income. There is no tax break at all if you’re married and file separate returns.

The IRS also provides worksheets you can use to figure out what’s taxable and how much you might owe in taxes on your retirement income. You can find these worksheets in IRS Publication 554, Tax Guide for Seniors.

How Much Do You Have To Make If You’re A Dependent

You may still have to file a tax return even if you’re being claimed as a dependent, depending on a number of factors. There’s the earned income you make, the unearned income you make , and your gross income, and the minimums for all of these will be determined by either your age or whether or not you are blind.

Don’t Miss: How Do Charity Tax Deductions Work

How Much Of Your Social Security Is Taxable

Its possible and perfectly legal to avoid paying taxes on your Social Security check. In fact, only about 40 percent of recipients pay any federal tax on their benefit.

But heres the caveat: To receive tax-free Social Security, your annual combined, or provisional, income must be under certain thresholds:

- $25,000, if youre filing as an individual

- $32,000, if youre married filing jointly

For married filing separately, the Social Security Administration simply says that youll probably pay taxes on your benefits.

Your combined income consists of three parts:

- Your adjusted gross income, not including Social Security income

- Tax-exempt interest

- 50 percent of your Social Security income

Add those amounts up and if youre under the threshold for your filing status, you wont be paying federal taxes on your benefit.

Even if youre above this threshold, however, you may not have to pay tax on your full benefit. You may pay taxes on only 50 percent of your benefit or on up to 85 percent of it, depending on your combined income.

- For individual filers:

- Combined income between $25,000 and $34,000, up to 50 percent of your benefit is taxable

- Combined income above $34,000, up to 85 percent of your benefit is taxable

Dont Miss: Paying Taxes On Doordash

Irs Rules Regarding Your Age

As the table above indicates, individuals younger than age 65 must file if they make certain amounts. The earnings threshold amounts go up a bit for individuals 65 and up.

For married couples that file separate tax returns, the earnings target is based on the age of the older spouse.

In most situations, your age for tax purposes depends on how old you were on the last day of the year. But when it comes to determining whether you have to file a return, the IRS says that if you turned 65 on New Years Day, you are considered to be 65 at the end of the previous tax year. The one-day grace period allows you to use the higher-income thresholds to determine whether you must file a tax return.

Also Check: Do I File Taxes For Unemployment

Reporting Savings Interest To The Irs

Tracking and reporting savings interest to the IRS becomes even more important with a high-yield savings account , which is most likely going to generate a lot more money in interest.

For example, if you put $10,000 into an HYSA with a 0.40% APY and didnt make any monthly contributions, youd accumulate $40 in interest, assuming the variable APY didnt change. If you put more in say $25,000 you would rack up $100 in interest.

While this wont bump you up into the next tax bracket, its still better than what youd get in a standard checking account.

How Much Can You Pay An Employee Before Paying Taxes

For a single adult under 65 the threshold limit is $12,000. If the taxpayer earned no more than that, no taxes are due. This situation is only slightly different for other taxpayer brackets, such as for single taxpayers over 65, who have a gross income threshold of $13,600.

How much can you pay someone without paying taxes?

Gift Tax Limit: Annual The annual gift tax exclusion is $15,000 for the 2021 tax year. This is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax. You never have to pay taxes on gifts that are equal to or less than the annual exclusion limit.

How much can you pay someone without a 1099 in 2021?

$600The general rule is that business owners must issue a Form 1099-NEC to each person to whom they have paid at least $600 in rents, services , prizes and awards, or other income payments. You dont need to issue 1099s for payment made for personal purposes.

Read Also: How To Subtract Taxes From Paycheck

When Is Social Security Income Taxable

To determine when Social Security income is taxable, youll first need to calculate your total income. Generally, the formula for total income for this purpose is: your adjusted gross income, including any nontaxable interest, plus half of your Social Security benefits.

If youre married and filing jointly with your spouse, your combined incomes and social security benefits are used to figure your total income.

Then youll compare your total income with the base amounts for your filing status to find out how much of your Social Security income is taxable, if any.

Youll see that you fall into one of three categories. If your total income is:

- Below the base amount, your Social Security benefits are not taxable.

- Between the base and maximum amount, your Social Security income is taxable up to 50%.

- Above the maximum amount, your Social Security benefits are taxable up to 85%.

Should I File Taxes Even If I Dont Have To

If youre not required to file taxes, you may still want to consider filing a tax return. Just because you dont owe taxes, you may still be entitled to a tax refund. There are certain situations where the IRS may owe you money, even if youre not required to file a tax return and if you didnt file, you would miss out on that tax refund.

If youre not sure whether you should file taxes, talk to a tax professional they can advise you on tax preparationand whether filing taxes is the right choice for you .

Read Also: When Is The Deadline To File Your Taxes

Tax Credits Worth Filing For

Here are some of the credits youâll probably want to do your taxes for, even when you arenât required to file:

| Tax credit | |

|---|---|

| Child and dependent care expenses credits | $4,000 $8,000 |

Just make sure you double-check your eligibility before claiming a refundable credit on your return. Falsely claiming credits can count as tax fraud, and can be a criminal offense.

Knowing when and when not to file taxes can be tricky, and the answer will be different for everybody. But unless youâre certain you donât have to file, itâs generally better to be on the safe side and send in that return.

The last thing you want is to realize after the deadline that you were supposed to file â after all, being late on your taxes is no laughing matter.

Timothy Sheardy, MS, BBA

My name is Timothy Sheardy and I am tax and accounting professional from the Metro Detroit area. I have completed my Masters of Science in Taxation specializing in small business and self-employed and Bachelors of Arts in Accounting. As of 2020, I have been preparing taxes for 9 years and also have 10 years accounting experience with 6 of the using QuickBooks both desktop and online and 9 using Sage Peachtree I pride my business on working with clients. I believe a knowledgeable client will make better business decisions. The success of them and their business is most important.

Find write-offs.

How To Calculate Your Social Security Income Taxes

If your Social Security income is taxable, the amount you pay will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income.

Again, if you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2022. For the 2022 tax year , single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either:

- half of your annual Social Security benefits OR

- half of the difference between your combined income and the IRS base amount

The example above is for someone whos paying taxes on 50% of their Social Security benefits. Things get more complex if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

You May Like: Can You Refile Your Taxes

Types Of Investment Taxes

It’s a lesson you probably learned early in your working life: When you make money, you usually owe taxes.

This is also true of money you make on your investments. Some taxes are due only when you sell investments at a profit, while other taxes are due when your investments pay you a distribution.

One of the benefits of retirement and college accountslike IRAs and 529 accounts is that the tax treatment of the money you earn is a little different. In many cases, you won’t owe taxes on earnings until you take the money out of the accountor, depending on the type of account, ever.

See the tax treatment of:

How A Negative Tax Bill Could Turn Into A Refund

Consider this example of a woman who doesn’t owe federal income tax and will likely end up with a refund:

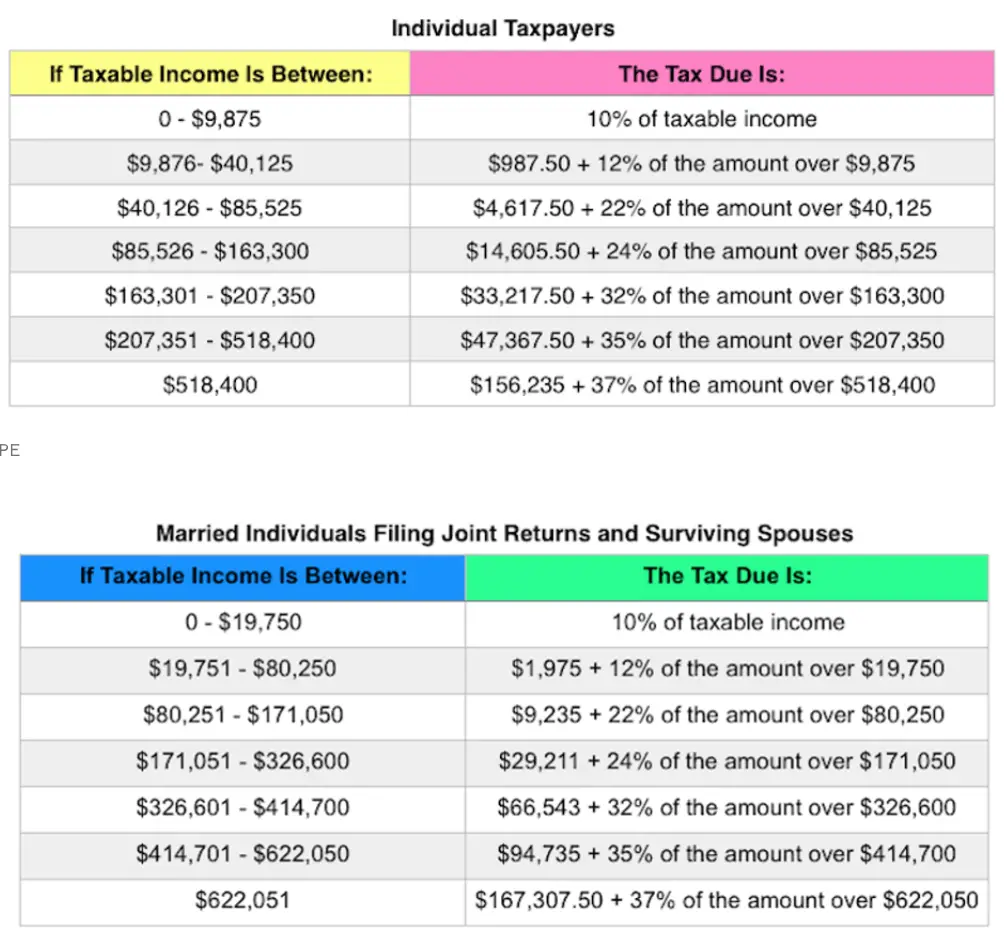

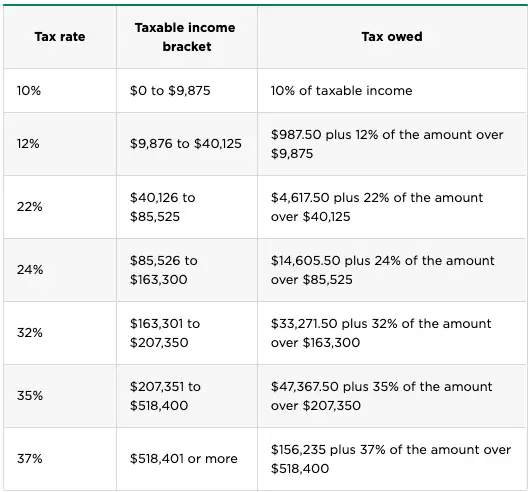

Amy is a single mother who earned $20,000 in 2021. The standard deduction for a head of household filer of $18,800 reduces her taxable income to $1,200, which places her in the 10% tax bracket . Her tax bill comes out to $120.

If she qualifies for the earned income tax credit , a subsidy for low-income working families, she can reduce her tax bill by up to $3,618, the maximum for a family with one child in the 2021 tax year. She may also claim the child tax credit , which allows her to apply a credit of up to $1,500 or $1,800 to her tax bill, depending on the age of her child, assuming she collected the six advance payments in 2021.

Amy will end up with a negative final tax bill, and since EITC and CTC are refundable, she’ll receive the credits as cash.

Not “losing” a portion of your paycheck to taxes may sound nice to some, but it’s not a luxury. Millions of Americans don’t owe taxes on their income and aren’t required to file a tax return because they don’t earn enough money.

Those who hold a job are still subject to payroll taxes, which support Social Security, Medicare, and unemployment insurance. And some taxes are certain for everyone, regardless of income, including sales taxes, excise taxes, and property taxes.

Read Also: When Can I File 2021 Taxes

How Much Money Can I Earn Before My Social Security Is Taxable

When you receive your Social Security benefits, you do not have to pay FICA taxes on the amount you receive, but you may have to include the benefits as part of your taxable income for the year when you file your federal income tax return. Knowing how much you can make before having to pay taxes helps you plan your income for the year to avoid the taxes or to budget for the income taxes on your benefits.

Better Ways To Earn Interest

If you truly have a stash of money sitting in your bank account doing nothing for you, this should be a wake-up call about checking account interest rates. The fact is that if youre storing enough money in your checking account to even be disappointed about a low interest rate, youre probably doing something wrong.

Here are some alternatives to start producing more interest from your hard-earned money.

Recommended Reading: What To Bring To The Tax Preparer

What Is Combined Income And How Is It Calculated

Its your adjusted gross income or AGI plus your nontaxable interest plus one-half of your Social Security benefits.

Now the thing about these taxes is this: No one should really be surprised by them. These taxes on Social Security have been with us since the Greenspan Commission created them in 1983, according to David Freitag, a financial planning consultant with MassMutual.

But you might be surprised by the following details:

The thresholds are not indexed for inflation. So as income in retirement has increased, more and more people are paying more and more income tax on their Social Security benefits, Freitag explains.

Others see the same trend. Because the thresholds that determine whether or not Social Security benefits are taxable were never adjusted for inflation, it is pretty hard today to avoid paying taxes on Social Security benefits, says Elaine Floyd, director of retirement and life planning at Horsesmouth.

You May Like: How Do Doordash Drivers Pay Taxes

State Taxes On Social Security Benefits

Everything weve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes.

There are 12 states that collect taxes on at least some Social Security income. Two of those states follow the same taxation rules as the federal government. So if you live in one of those two states then you will pay the states regular income tax rates on all of your taxable benefits .

The other states also follow the federal rules but offer deductions or exemptions based on your age or income. So in those nine states, you likely wont pay tax on the full taxable amount.

The other 38 states do not tax Social Security income.

| State Taxes on Social Security Benefits | |

| Taxed According to Federal Rules | Minnesota, Utah |

Don’t Miss: Can I Still File My Taxes 2021

Minimum Gross Income Thresholds For Taxes

The thresholds begin with your gross incomeanything you receive in the form of payment that’s not tax-exempt. Gross income can include money, services, property, or goods.

The thresholds cited here apply to income earned in 2022, which you report when you file your 2022 tax return in 2023. They’re equal to the years standard deduction because you would deduct this amount from your gross income and only pay tax on the difference.

For example, you would owe no tax and would not be required to file a tax return if youre single and earned up to $12,950 in 2022, because this is the amount of the 2022 standard deduction. Subtracting it would reduce your taxable income to $0. However, you would have to file a tax return if you earned $12,951 because youd have to pay income tax on that additional dollar of income.

As of the 2022 tax year, the minimum gross income requirements are:

- Single and under age 65: $12,950

- Single and age 65 or older: $14,700

- Head of household and under age 65: $19,400

- Head of household and age 65 or older: $20,800

- Qualifying widow under age 65: $25,900

- Qualifying widower age 65 or older: $27,300

How Much You Have To Make To File Taxes

Your first consideration is: Does my level of earnings mean I must file taxes? If your gross income for 2021 is above the thresholds for your age and filing status, you must file a federal tax return. See the table below.

Income requirements for filing a tax return| Filing status |

|---|

| $5 | $5 |

In addition to federal taxes, you may also have to pay state taxes. Currently, nine states dont tax income at all, while two other states only tax investment income. You can find out if you owe state income taxes by going to your states revenue, finance or taxation offices website. The IRS also has a link to every states tax office.

Also Check: What’s The Best Way To Claim Taxes