What Percentage Of Social Security Is Taxable

If you file as an individual, your Social Security is not taxable only if your total income for the year is below $25,000. Half of it is taxable if your income is between $25,000 and $34,000. If your income is higher than that, up to 85% of your benefits may be taxable.

If you and your spouse file jointly, you’ll owe taxes on half of your benefits if your joint income is between $32,000 and $44,000. If your income is above that, up to 85% is taxable income.

Deducting Your Home Improvements From The Home Sale Profit

Making substantial physical improvements to your house, no matter how long ago you made them, allows you to add the cost of that improvement to your tax basis.

Home improvements you can use include:

- adding a new bedroom, bathroom or garage

- installing new insulation, pipes or duct work or even replacing walls and floors

- installing a new heating and air conditioning system

- installing extensive new landscaping, such as new lawns, new fences or retaining walls

- adding a new porch, patio or deck

- replacing driveways and walkways

- installing a new roof, windows, doors or new carpeting

- installing new built-in appliances

Just remember that you cant use regular home repairs like cleaning the carpets in your list of home improvements.

Is My Second Home Exempt From Capital Gains Tax

In general, youre going to be on the hook for the capital gains tax of your second home however, some exclusions apply.

If you purchase a second home, and you start using it as your primary residence, youll need to meet the residency rule still to qualify for the exemption.

Now, you might be thinking that you could just split time between the two homes and then sell them both as your primary residence to avoid capital gains on the sale of a second home.

However, you have to prove that the second home is your primary residence.

You also cant get the exclusion if you have already sold a different house within 2 years of using the exclusion.

So, if your second home meets the 2 out of 5-year rule, then the amount of capital gains tax exclusion changes.

It will depend on the number of years you owned the house, and when the home became your primary residence.

It might be best to speak with a personal tax advisor to help figure out if you qualify for the exclusion on a second home before you sell it.

You May Like: When Is Tax Time 2021

Understanding Canadas Personal Income Tax Brackets

Tax rates apply to personal income earned between predetermined minimum and maximum amounts, also referred to as tax brackets.

Knowing where your income falls within the tax brackets can help you make decisions about when and how to claim certain deductions and credits. By understanding which tax bracket you are currently in, it can also help you understand changes in your income taxes if, for example, you start a side-gig or have other extra income that pushes you into the next bracket.

When youre preparing your income taxes this year, this could explain why you have taxes owing or your refund amount is different than what it was last year.

It is important to note that these rates apply to taxable income, which is your Total Income from Line 15000 less any deductions you may be entitled to.

Remember, all provinces and territories also have their own tax brackets. When using the tax brackets and your annual earnings to make contribution decisions, make sure to also consider the tax rates for the province where you reside.

How To Earn Over $100000 A Year And Pay Zero Taxes

First off, Money Wizard, your tables keep showing around $70k, not $100,000. And second, you havent actually explained how to pull this scheme of yours off.

Correct and correct. So, lets fix both of those.

As you remember from the table above, in the latest tax brackets, we can earn up to $77,200 per year without paying taxes. Which frankly, is already a ton of money, and equal to earning over 6 figures in pre-tax salary.

But heres the cherry on top. We havent discussed deductions yet. The tax reform introduced standard deductions of $12,000 per individual, and $24,000 for married couples.

In other words, you can make $101,200 per year, and as long as you keep those earned wages less than $24k, you wont owe a penny.

So, whats this mean for our final strategy?

You May Like: How To Calculate Paycheck After Taxes

The Catch Thats Not Really A Catch

Now, you might have also noticed, that these special tax brackets apply only to whats called qualified dividend income and long term capital gains.

Qualified Dividend Income:

You probably already know the basics behind a dividend theyre essentially checks paid out by companies every quarter or so, as a thank you for investing in their stock. Theyre extremely steady, and often return 2-5% of the share price annually.

How do we find out if those dividend payments are qualified dividends? We have to look towards IRS publication 550, which just might be the most boring publication ever published, even by IRS standards. Leave it to the IRS to explain over 20+ pages that qualified dividends are basically any dividends:

- Paid by a US corporation

- Paid by a stock that youve held for at least 60 days.

In other words, pretty much every single dividend ever received by a buy-and-hold investor.

Long Term Capital Gains:

Also defined in the most boring way possible by the IRS, is long-term capital gains. This one is even easier. In general, if you held a stock for more than one year before selling, those profits are classified as long-term capital gains.

As you can see, neither of these qualifications are much of a hurdle for an investor whos not trading stocks like a maniac.

So How Do I Report It

In most cases, side gig income is considered self-employment income and should be reported on the IRS Schedule C, Profit or Loss from Business. If you earned income from renting property, it should be reported on Schedule E. These forms should be filed along with your personal income tax return.

If you worked with a partner, you need to file Form 1065, a partnership tax return with the IRS.

Then you and your partner would each report your share of the partnerships income and deductions on your personal income tax return, Hearn says.

You May Like: Do You Have To Claim Social Security On Taxes

If Youre Like Most People You Probably Have At Least One Hobby

Unless your hobbys mining for cryptocurrencies, you may not profit much from it. But you could still have at least a little hobby income coming in. If you do, youre probably wondering: How is hobby income taxed?

The answer: You must pay taxes on any money your hobby makes, even if its just a few dollars. The good news is, if you incurred hobby expenses, you might be able to deduct them. Its important to know how to declare hobby income, how to deduct hobby expenses and how to know if your hobbys a business. You can find out about the rules right here.

How To Calculate Capital Gains Tax On The Sale Of Property

In Canada, you only pay tax on 50% of any capital gains you realize. This means that half of the profit you earn from selling an asset is taxed, and the other half is yours to keep tax-free.

To calculate your capital gain or loss, simply subtract your adjusted base cost from your selling price. Divide that number in half and that amount will be taxed according to your income tax bracket, the province you live in, and your personal living situation.

Your adjusted base cost is your purchase price: what you paid for the property plus other costs incurred in the purchase such as commissions, legal fees and additions or improvements to the property.

Heres an example. Lets say that years ago you paid $250,000 for a house in Ontario. At that time, you paid $7,000 in taxes and closing fees plus another $28,000 on additions and renovations to the property. In this case, you would add all those expenses together to arrive at an adjusted base cost of $285,000. See the breakdown below:

| Original purchase price |

|---|

| $165,000 | $82,500 |

Your taxable profit on the sale is $82,500, which would be added to the rest of your income and taxed accordingly by the CRA based on your personal circumstances. While the same rules apply to all gains and losses from real estate sales, the rate at which gains are taxed is ultimately based on the income tax bracket you fall into. The other half of your capital gains also $82,500 can be pocketed tax-free.

Don’t Miss: How To File Past Years Taxes

The Loophole: Investment Income

You see, if your money happens to arrive in your bank account through the stocks that you own, rather than the labor you traded to an employer, your tax rates are much more favorable.

Just check out the new tax bracket for investment income, which has its whole own table with the 2018 tax reform:

Source: Corporate Monkey, CPA

Did you see it? Up there at the top, is our sweet spot. As a married couple, we can earn up to $77,200 of investment income and pay ZERO taxes.

You might be tempted to think this is just a recent policy change that will be revoked as soon as the current businessman is out of the oval office. Not so. Check out the tax brackets from the old tax law:

In 2017, you could earn up to $75,900 in married investment income and still qualify for a 0% tax rate. Source: Motley Fool

We could keep going, but for nearly all of the recent history, a married couple could earn some serious coin from investments while staying in the 0% investment income bracket.

How To Avoid Paying Taxes

OK, so all of that sounds terrible is there a way around it?

Well, you can avoid paying any tax whatsoever so long as you use your RRSP money on one of two major investments and only if you repay the money years down the line.

First-time homebuyers can take advantage of the federal Home Buyers Plan. You can withdraw up to $35,000 to put toward the down payment on your new homestead.

The Canada Revenue Agency considers you a first-time buyer so long as you havent occupied a home that you or your current partner owned in the last four years.

The money you take out isnt added to your income, and theres no withholding tax. Repayment starts two years after the money is withdrawn, and you have 15 years to pay the full balance back into the RRSP. Any missed payments get taxed as income.

Alternatively, the Lifelong Learning Plan allows you to use money from your RRSP on education or training, either for you or your spouse.

The program needs to occupy at least 10 hours of your time per week, last at least three months and take place at a designated institution, like a university.

You can withdraw up to $10,000 per year, but the lifetime maximum is $20,000. Again, this money isnt taxed so long as its repaid within a 10-year period, starting 5 years after the money is withdrawn.

You May Like: How To Determine Taxes On Paycheck

Not All Income Gets Treated The Same

Beautiful young girl teacher writing mathematics formulas on blackboard.

- Print icon

- Resize icon

The question of how much can we earn without paying federal income taxes is relatively easy to answer for most people.

The standard deduction for a married couple is $24,400 in 2019 , and the top of the 0% capital-gains tax bracket is $78,750. So we can make a total of $103,150 a year, provided that our ordinary income stays below the standard deduction and the rest comes from long-term capital gains and/or qualified dividends.

Those who arent married should halve these dollar amounts. Note that the IRS is increasing these numbers slightly for 2020.

With our daughter, we also qualify for the child tax credit , so we could actually generate another $13,333 per year in dividends or capital gains, taxed at 15%. The tax liability of $2,000 exactly offsets the tax credit, for a federal tax bill of zero.

Once people file for Social Security benefits, though, things become a bit more complicated. Thats due to the convoluted formula used to determine how much of your Social Security is taxable income. So calculating and plotting the tax-free income limits is more complex.

Tax-free income limits without Social Security

Tax-free limits with Social Security

Taxable Social Security = F1

Tax = F2

Lets look at the results:

Same data, sliced differently

Final Step: Enjoy Your Tax Free Life

From a tax perspective, investment income has always blown wage income out of the water. This has been the case since the dawn of tax code, and frankly, Im shocked more people dont devote their working careers towards building up enough savings to take advantage of this.

If a comfortable retirement is the training wheels goal of the average American, then a nest egg capable of spitting out 100% tax free investment income is the turbo charged motorcycle for the savvy investor.

Knock on wood, but its unlikely this will change anytime soon, either. While the highest tax brackets will always be a target for increased rates, increasing investment tax rates on the bottom brackets only serves to keep the average American from saving their way to wealth.

Whats this mean? For those few brave souls willing to put the brakes on societys never enough attitude, the lawmakers have paved a path tailor-made for you to live like a king on over $100,000 per year, tax free.

Enjoy!

You May Like: Does Contributing To Roth Ira Reduce Taxes

How Do I Determine If My Social Security Is Taxable

Add up your gross income for the year, including Social Security. If you have little or no income in addition to your Social Security, you won’t owe taxes on it. If you’re an individual filer and had at least $25,000 in gross income including Social Security for the year, up to 50% of your Social Security benefits may be taxable. For a couple filing jointly, the minimum is $32,000. If your gross income is $34,000 or more, up to 85% may be taxable. The minimum for a couple is $44,000.

What Youre Required To Pay As A Self

Okay, with all of that knowledge in your head now, lets talk about what youre on the hook to pay to the government come tax time. When youre self-employed, and youre operating your business as a sole proprietorship, you must pay:

- Personal income tax on your business earnings minus business expenses

- Contributions to the Canada Pension Plan

- Contributions to Employment Insurance voluntary

Don’t Miss: What’s The Sales Tax In Florida

What Is Capital Gains Tax

The capital gains tax is essentially a tax on any gains you realize after the sale of an asset, like real estate, bonds, jewelry, coin collections, or stocks.

There are a few ways you could end up paying this tax on your home.

For instance, if you decide to sell your primary residence less than a year after moving in, you would be subject to a capital gains tax.

And there are also ways to avoid this tax for example, if you sell your home after 2 years.

Some exclusions also allow you to avoid being taxed up to a certain amount.

How Can I Reduce Capital Gains Tax On A Property Sale

If your property isnt exempt from capital gains tax, there are a few strategies to minimize the amount you have to pay or possibly eliminate it altogether.

1. Use capital losses to axe your capital gains

A capital loss occurs when you lose money because your home decreases in value. As with capital gains, the loss is realized when you sell your home and unrealized if you continue to hold onto it. The CRA allows you to use your capital losses to offset your capital gains down to zero.

CRA rules allow you to offset your capital gains tax by the amount of your capital losses, which can be very useful when trying to lower you tax bill.

Even more conveniently, if you dont have any capital gains to offset in the same year that you earned a capital loss, you have 2 options:

- Apply your capital losses to any capital gains you earned in the the past 3 years and amend your prior tax bill.

- Carry forward your capital losses to reduce capital gains in the future. Conditions apply, so see a tax professional and check out the Government of Canada website for more details.

For example, lets say you sold an asset and earned a capital gain of $25,000. Ordinarily, youd take 50% of this amount $12,500 and declare that as your taxable income.

Keep track of your assets, and consider selling off any that have declined in value. Doing so could provide a double benefit: you could improve your financial portfolio and decrease your tax bill at the same time.

Read Also: How Much Do I Owe In Property Taxes

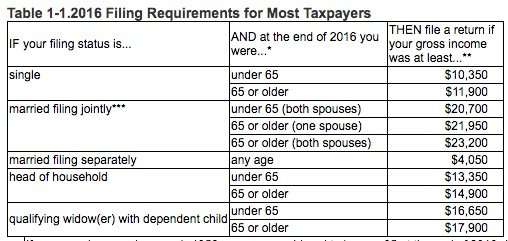

Maximum Earnings Before Paying Taxes

The most significant help to seniors is the fact that unearned income is taxed a little different than earned income. Unearned income covers your Social Security payments, any pension payouts and other money you already have coming. Earned income includes the money you make at a present job if, say, youre working part-time to bring in additional money.

If the income you bring in is solely unearned, you may not need to file at all. The key is finding out if your earnings exceed the limit. A good rule of thumb is to add half of your Social Security income to the amount you acquired from other sources, your work earnings and earned income, including non-taxable interest. If this limit tops the IRSs maximum for the year in question, also called a base amount, you are required to file. If you are 65 and older and filing as single, you can earn up to $11,950 in work-related income before filing. If a couple that is married and filing jointly, the earned income maximum is $23,300 if both are over 65 or older and $22,050 if only one of you is 65.