Do You Know Why Money Gets Taken Out Of Your Paycheck

If you don’t, you’re not alone. Nearly 64 million people are perplexed by their pay stubs, including half of younger workers, according to a recent study from Kronos Incorporated.

Knowing where your hard-earned money goes can empower you to make smart decisions about taxes, retirement savings, health care and even potential paycheck errors.

Best Free Paycheck And Salary Calculators

If youve ever had a job before, you know that your gross pay is significantly more than your net pay, the number you deposit in your bank account. So, how can you figure out how much money you’ll take home when you get paid? What will you net after taxes and other deductions are taken out of your paycheck?

What Is Federal Income Tax Withholding

Every time you get a paycheck, your employer withholds, or sets aside, taxes based on the information you provided on your Form W-4 when you first started your job.

Your Form W-4, also known as your Employees Withholding Certificate, provides financial details that allow your employer to deduct the correct amount of federal income tax from your pay.

If not enough federal tax is withheld, youll owe the IRS money and may have to pay a penalty, depending on the size of the shortfall. If too much is deducted, youll be owed a tax refund.

When any big changes happen in your life you get married, have a child, or get a big raise, for example you will need to update and resubmit your W-4 to your employer so your paychecks can be adjusted accordingly.

The IRS recently redesigned Form W-4, and the changes could mean that your refund will be smaller than expected this year. Even if your financial situation stayed the same in 2019, H& R Block recommends that you review your W-4 to see how youve been affected.

Some of the changes to Form W-4 include the elimination of withholding allowances, one new blank for you to include income that doesnt come from jobs, and another that allows you to factor in likely deductions.

You May Like: How Much Does H& r Block Charge To Do Taxes

What Is The Payroll Tax

Employers and employees both pay taxes to help fund programs like Social Security and Medicare. Under the new deferral, introduced by a presidential memorandum in August, usual Social Security taxes would not be taken out of employees paychecks.

Normally, 6.2% of an employees gross pay is taken out for this purpose and another 6.2% is paid by the employer. During the deferral period, lasting through December 31, 2020, this tax isnt taken out of the paychecks of employees at companies that have decided to participate in the deferral, which is not mandatory.

Overview Of Texas Taxes

Texas has no state income tax, which means your salary is only subject to federal income taxes if you live and work in Texas. There are no cities in Texas that impose a local income tax.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Don’t Miss: Www Aztaxes Net

What Are Tax Withholdings

The law says your employer must take money out of your paycheck for taxes. You can choose how much money to withhold from or take out of your paycheck. When you have a big change in your life, you might owe more or less money in taxes than before. To have the right amount of money come out of your paycheck for taxes, you change your withholdings.

What Is A Paycheck

A paycheck is how businesses compensate employees for their work. The most common delivery schedules are bi-weekly and semi-monthly, though this varies based on employer preferences and applicable state laws and regulations. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency.

Don’t Miss: How Does H& r Block Charge

How To Calculate Fica Payroll Tax

Social Security withholding

To calculate Social Security withholding, multiply your employeeâs gross pay for the current pay period by the current Social Security tax rate .

This is the amount you will deduct from your employeeâs paycheck and remit along with your payroll taxes.

Example Social Security withholding calculation:

$5,000 x .062 = $310

Medicare withholding

To calculate Medicare withholding, multiply your employeeâs gross pay by the current Medicare tax rate .

Example Medicare withholding calculation:

$5,000 x .0145 = $72.50 (Medicare tax to be deducted from employeeâs paycheck

Employer matching

As an employer, you are responsible for matching what your employees pay in FICA taxes. So in this case, you would also remit $310 for Social Security tax and $72.50 for Medicare tax.

Calculating Withholding More Accurately

One way to adjust your withholding is to prepare a projected tax return for the year. Use the same tax forms you used the previous year, but substitute the current tax rates and income brackets. Calculate your income and deductions based on what you expect for this year, and use the current tax rates to determine your projected tax.

Then, use the withholding calculator on the IRS website to see the suggested withholding for your personal situation. The number of dependents you support is an important component of your analysis, as is the number of streams of income.

Don’t Miss: 1040paytax.com Official Site

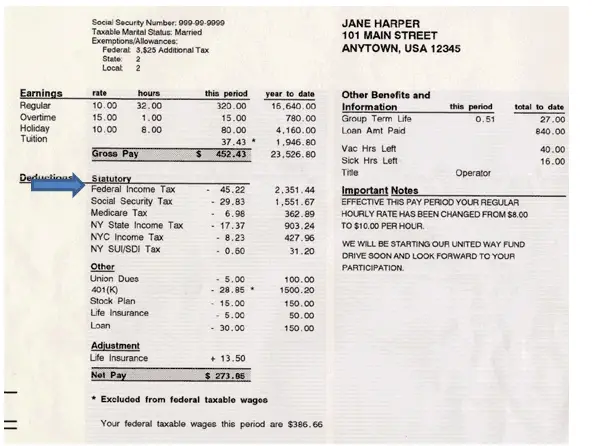

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

Australian Income Tax Calculator

Employment income: Employment income frequency

Enter an income to view the result

The estimated tax on your taxable income is0

| Your income after tax & Medicare levy: |

|---|

| Your marginal tax rate: |

This means for an annual income of you pay:

| No tax on income between $1 – $18,200 | $0 |

| 19c for every dollar between $18,201 – | 0 |

| 32.5c for every dollar between – | 0 |

| 37c for every dollar between – $180,000 | 0 |

| c for every dollar over $180,000 | 0 |

- The rates are for Australian residents.

- Your marginal tax rate does not include the Medicare levy, which is calculated separately.

- The Medicare levy is calculated as 2% of taxable income for most taxpayers. The Medicare levy in this calculator is based on individual rates and does not take into account family income or dependent children.

- The calculations do not include the Medicare Levy Surcharge , an additional levy on individuals and families with higher incomes who do not have private health insurance.

- These calculations do not take into account any tax rebates or tax offsets you may be entitled to.

- For the 2016-17 financial year, the marginal tax rate for incomes over $180,000 includes the Temporary Budget Repair Levy of 2%.

- In most cases, your employer will deduct the income tax from your wages and pay it to the ATO.

- 2020-2021 pre-budget reflects the tax rates prior to those announced in the Budget in October 2020.

You May Like: Can You File Missouri State Taxes Online

How Your Texas Paycheck Works

Your hourly wage or annual salary can’t give a perfect indication of how much you’ll see in your paychecks each year because your employer also withholds taxes from your pay. You and your employer will each contribute 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. These taxes together are called FICA taxes.

No matter which state you call home, you have to pay FICA taxes. Income you earn that’s in excess of $200,000 , $250,000 or $125,000 is also subject to a 0.9% Medicare surtax. Your employer will not match this surtax, though.

Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. The same is true if you contribute to retirement accounts, like a 401, or a medical expense account, such as a health savings account . These accounts take pre-tax money so they also reduce your taxable income.

Your marital status, pay frequency, wages and more all contribute to the size of your paycheck. If you think too much or too little money is being withheld from your paycheck, you can file a fresh W-4 with your employer at any time during the year. When you do this, be sure to indicate how much extra income you want withheld so as to avoid a tax bill come April each year.

What To Do With The Extra Money

If your employer decides to participate in the tax deferral and you end up with extra money in your paychecks, youll want to be strategic about where you put the funds.

Normally, tax withholding is taken care of by your employer and you dont have to think about it, says Rachel Elson, an associate financial planner at Perigon Wealth Management in San Francisco. But this new policy pushes the personal finance responsibility onto the employee.

Elson recommends looking at your paycheck and getting a sense of what the normal deposit is. Then, take the extra amount and transfer it to a savings account somewhere off to the side where you wont be tempted to spend it.

Levy suggests the same, recommending people set the money aside to ensure they have it readily available to repay back taxes come 2021. It could end up being a couple of thousand dollars, she says.

If you need the money urgently, you can put it towards paying off your essentials, including bills and minimum payments on any debts.

You could also use the opportunity to pay off high-interest debt. If you have a credit card where youre paying 15-20% interest, use that extra money to knock that down, and reckon with the fact that youre going to have a lean period from January to April, Elson says.

Also Check: Www.1040paytax

Paycheck And Salary Calculators

A paycheck calculator lets you know how much money will be in every check that you receive from your employer, and they are available online for free.

Salary calculators can help you determine how much you could be earning, and how much a job offer is worth and how far your paycheck will go in a specific location, based on the cost of living in that area.

How Do I Compare Fees To Cash My Paycheck

You can cash your paycheck at a business to get money in your hands. You might cash your paycheck at:

- a bank or credit union

- some convenience stores, grocery stores, or other stores

- check-cashing stores

Cashing a paycheck at your bank or credit union is usually free. Sometimes, the bank named on the check might cash a paycheck if you do not have an account.

Businesses charge different fees for cashing a check. Call, visit, or go online to find out what a business charges. Check-cashing stores sometimes charge high fees.

Don’t Miss: Michigan Gov Collectionseservice

Everything Deducted From Your Paycheck Explained

Congratulations, youve earned your first paycheck! Youre probably excited, as you should beyou put in work, and have some cash in the bank to show for it. But if youre like many newly employed people out there, you might also be a little bit confused after running the numbers and noticing that your take-home pay isnt exactly as much as you thought it would be.

Whats up with that? Upon further examining your paystub at your first job, youll notice a few line items categorized as deductions.Deductions are all of the things that were taken out of your gross pay, leaving you with your net pay, or take-home pay. While there are some deductions you cant really control, others are part of your employee benefits package, so you can adjust them according to what works for you and your budget.

Its OK to be a bit baffled on your first payday. Weve all been there before. To help clear up the confusion, we broke down typical paycheck deductions, where your earnings are going, and how much control you have over it.

Paycheck Calculators To Estimate Your Pay

Here are some calculators that will help you analyze your paycheck and determine your take-home salary.

ADP Salary Payroll Calculator

Free salary reports covering virtually every occupation, as well as information on salary, benefits, negotiation, and human resources issues for U.S. and Canadian markets. Salary negotiation tips, small business solutions, and cost of living comparisons are also available.

Also Check: How Much Does H & R Block Charge To Do Taxes

Where Does All Your Money Go Your Paycheck Explained

Payday! Getting your paycheck is exciting, but it can also be a bit disappointing once you realize how much money youre actually taking home. Why arent you making as much as you expected? Your paycheck stub has all the answers.

Though not all paychecks are alike, there are elements that all employers must include. Lets break it down:

Gross Pay vs. Net Pay

Lets say you are making $35,000 a year and you are paid every two weeks that means you should be taking home $1,346.15 each pay period. But unfortunately, this isnt the case. $1,346.15 is your gross pay, or the total amount youve earned before everything is taken out of your check. Then you are left with your net pay, which is the total amount of money you get to take home.

What accounts for the difference between your gross pay and net pay? A ton of deductions and withholdings.

Federal Income Taxes

When you were first hired, you filled out a W-4 form and claimed the number of tax exemptions you have. This amount tells the federal government how much money to take out of each paycheck to cover your taxes. The more allowances you take the less federal income tax the government will take out of your paycheck.

When it comes time to filing your taxes at the end of each year, the amount already taken out will go towards the total you owe. If too much money is withheld from your paycheck, you receive a refund after you file your tax return. If you havent paid enough, you could end up owing at the end of the year.

Federal Income Tax Withholding

Employers withhold federal income tax from their workers pay based on current tax rates and Form W-4, Employee Withholding Certificates. When completing this form, employees typically need to provide their filing status and note if they are claiming any dependents, work multiple jobs or have a spouse who also works , or have any other necessary adjustments.

Don’t Miss: Where Is My State Refund Ga

How You Can Affect Your Washington Paycheck

While you dont have to worry about paying state or local income taxes in Washington, theres no escaping federal income tax. However, there are certain steps you may be able to take to reduce the taxes coming out of your paychecks.

The simplest way to change the size of your paycheck is to adjust your withholding. Your paychecks will be smaller but youll pay your taxes more accurately throughout the year. You can also specify a dollar amount for your employer to withhold. There is a line on the W-4 that allows you to specify how much you want withheld. Use the paycheck calculator to figure out how much to put.

Another thing you can do is put more of your salary in accounts like a 401, HSA or FSA. If you contribute more money to accounts like these, your take-home pay will be less but you may still save on taxes. These accounts take pre-tax money, which means the money comes out of your paycheck before income taxes are removed. This reduces your taxable income. Payments you make for most employer-sponsored health and life insurance plans also pre-tax.

With no state or local income taxes, you might have an easier time saving up for a down payment for a home in Washington. If youre looking to make the move, take a look at our guide to Washington mortgage rates and getting a mortgage in Washington.