How Are Pensions Taxed

Pensions are fully taxable at your ordinary tax rate if you didn’t contribute anything to the pension. If you contributed after-tax dollars to your pension, then your pension payments are partially taxable. If the payments start before age 59 1/2, you may also be subject to a 10% early distribution penalty.

Estimate Your Tax Bracket

Having a rough idea of your tax bracket can help you estimate the tax impact of major financial decisions.

Have you ever been asked for your approximate tax bracket by an advisor, attorney, financial provider, or even a Fidelity representative? Knowing your tax bracket can be useful in many scenarios, including when you open new accounts.

While your tax bracket won’t tell you exactly how much you’ll pay in taxes, it can help you assess the tax impact of financial decisions. For instance, if you’re in the 35% tax bracket, you could save 35 cents in federal tax for every dollar spent on a tax-deductible expense, such as mortgage interest or charity.

Is It Better To Claim 1 Or 0 On Your Taxes

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. … If your income exceeds $1000 you could end up paying taxes at the end of the tax year.

Recommended Reading: When Is Irs Accepting Tax Returns 2021

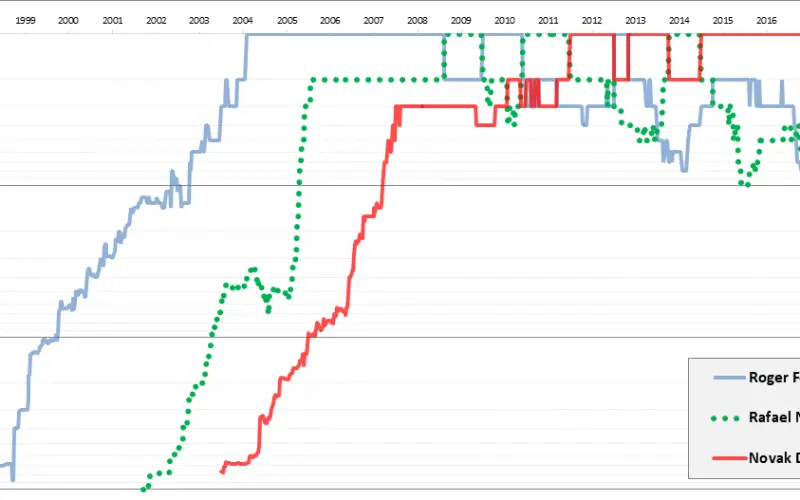

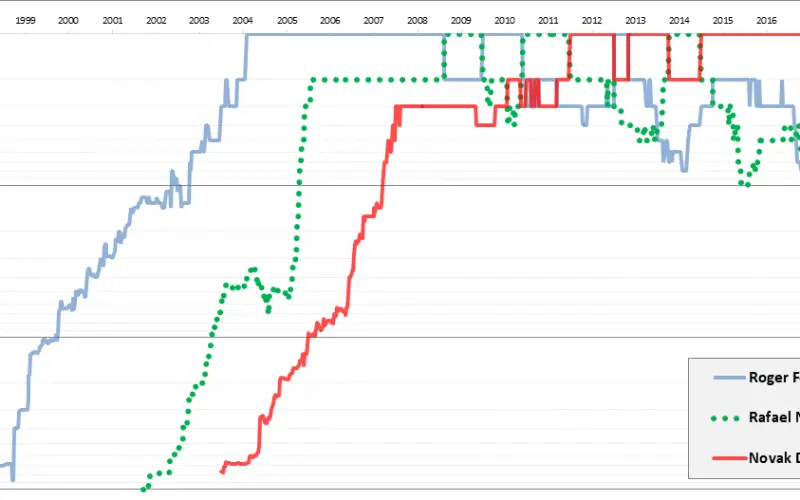

Tax Brackets: Do You Really Know How Youre Taxed

One question we often get asked is how tax brackets work. A lot of people arent sure how income is taxed and how to determine which tax bracket they actually fall into. Taxpayers are often confused by how their income tax is calculated and then they dont understand why they owe more money than they expected.

Tax brackets, unfortunately, tend to be confusing to those who dont deal with taxes every day. Heres what a lot of people need to know when it comes to income taxes and tax brackets.

What Do Small Business Owners Need To Know About Taxes

All of the information above can apply to both business owners and employees. But as a small business owner, employees may ask you, How much federal tax is taken out of my paycheck? Now, youll have a better understanding of the process. This will also help you understand questions about your own paychecks.

Be sure to get Form W-4 from employees during onboarding if you run the payroll on your own. Additionally, have employees verify their personal information is correct at the end of the year as youre preparing Form W-2 for tax season.

From there, payroll calculators will be your friend to help you calculate payroll for salaried employees and contractors.

Recommended Reading: How Do I File My Taxes With Turbotax

What Is My Tax Bracket

OVERVIEW

The federal income tax system is progressive, which means that tax rates go up the greater taxable income you have. The term “tax bracket” refers to the income ranges with differing tax rates applied to each range. When figuring out what tax bracket youre in, you look at the highest tax rate applied to the top portion of your taxable income for your filing status.

How Much Taxes Are Taken Out When You Claim 1

Asked by: Manuel Dietrich

When your Federal income tax withholding is calculated, you are allowed to claim allowances to reduce the amount of the Federal income tax withholding. In 2017, each allowance you claim is equal to $4,050 of income that you expect to have in deductions when you file your annual tax return.

Don’t Miss: How To Read My Tax Return

Overview Of New York Taxes

New York state has a progressive income tax system with rates ranging from 4% to 10.9% depending on taxpayers income level and filing status. Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. New York Citys income tax system is also progressive and rates range from 3.078% to 3.876%.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

How To Get Into A Lower Tax Bracket And Pay A Lower Federal Income Tax Rate

Two common ways of reducing your tax bill are credits and deductions.

-

Tax credits directly reduce the amount of tax you owe they dont affect what bracket youre in.

-

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

In other words: Take all the tax deductions you can claim they can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate.

Don’t Miss: What Property Tax Exemptions Are Available In Texas

How The Tax System Works With Multiple Income Streams

If you have multiple streams of income, you need to realize, it is taxed altogether, not separately. The IRS looks at how much total income you have received in the tax year and that is how they determine your tax bracket.

So if you earn $75,000 from your salary job, but earn $25,000 a year in pension or other income, then you will move up a tax bracket. You will then earn a total of $100,000 for the year. You can use the same process to figure out how much taxes you will owe total for all your income.

The income tax brackets work as a tiered system, not a flat tax percentage on all your income. So when you hear youve moved up a tax bracket, dont be scared. Moving up a tax bracket doesnt necessarily mean youre going to lose more money it just means the portion of money youve earned over your previous tax bracket will be taxed at a higher rate.

If you are unsure how your multiple streams of income may affect your taxes, reach out to a tax attorney at Polston Tax who can advise you on what you can expect at tax time.

Do I Have To File Taxes If I Made Less Than $10000

If your gross income was less than $10,000, you may not have to file a federal income tax return. But you may still want to file if you worked during 2020 and your employer withheld tax from your paycheck. Filing a tax return even if youre not required to do so is the only way to get any tax youre owed refunded to you.

Recommended Reading: How To File Taxes Online Step By Step

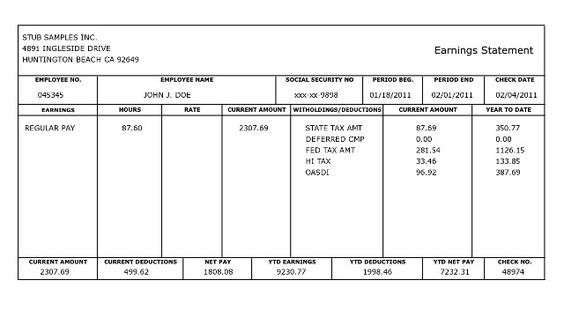

What Is The Percentage Of Federal Income Tax Withheld

As an employer, you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal, state, and local tax authorities.

To calculate how much of your employeeâs federal income tax to withhold, youâll need a copy of their Form W-4, as well as your employeeâs gross pay.

Your next step is to determine the method you want to use to calculate withholding. Most employers have two options: the Wage Bracket Method or the Percentage Method. While not exactly simple, the wage bracket method is the more straightforward approach to calculating payroll tax.

How Much Of My Paycheck Can I Keep If I File Taxes

You can keep a certain amount of your salary. The IRS determines the amount of your benefits based on your enrollment status, timing of payment, and number of dependents. For example, if you are single with no dependents and earn $1,000 every two weeks, the IRS can collect up to $538 per check per billing period.

Also Check: Ccao Certified Final 2020 Assessed Value

Also Check: How To File Income Tax Return Online

You Can Outsource Payroll Tax

Payroll tax is complex. The calculations are nitpicky, and the penalties are steep. Even paying payroll taxes just a day late comes with a 2% penalty on the amount due, with that penalty rising as high as 15% for past due payroll taxes.

If youâd rather not deal with the stress, we highly recommend outsourcing your payroll to a company like Gusto. Theyâll take the headache out of everything from paying your employees the right amount at the right time to handling pesky withholding calculations and payroll taxes. Whenever you need to check your records, youâll have automatically generated pay stubs to review with all the essential information.

How Income Brackets Are Taxed

One thing you need to understand is that not all your income is taxed in the same bracket. For example, if you are a single filer and make $100,000 a year, you fall into the 24% tax bracket. However, that doesnt mean your entire $100,000 income is all taxed at 24%.

Instead, tax brackets work almost like a ladder. Part of your income is taxed at each step, and with each step, the tax on your income increases. If you have questions or concerns about which tax bracket applies to your income, speak with our team at Polston Tax today.

Read Also: Are Estate Planning Fees Tax Deductible

What Percent Of Taxes Is Deducted From My Paycheck

Social Security Tax and Medicare Tax are two federal taxes that are deducted from your paycheck. The Social Security tax is a percentage of your gross pay until you reach your annual income limit.

Among vs amongstDoes among and between mean the same thing? Between is generally used to mean, for example, two things. B. between stone and anvil, while between is used for a greater number. However, these rules should be revised if the judgment seems inconvenient or overly arrogant.What is the difference amongst?Low and low are the most common prepositions in English. There is no difference in meaning between these two words, and very often

Economic And Policy Aspects

| This section needs expansion. You can help by adding to it. |

Multiple conflicting theories have been proposed regarding the economic impact of income taxes. Income taxes are widely viewed as a progressive tax .

Some studies have suggested that an income tax doesnt have much effect on the numbers of hours worked.

You May Like: Roth Ira Reduce Taxable Income

Recommended Reading: How You Do Your Own Taxes

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

How Your Paycheck Works: Fica Withholding

In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act. Your FICA taxes are your contribution to the Social Security and Medicare programs that youll have access to when youre a senior. Its your way of paying into the system.

FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2022 is $147,000 . So for 2022, any income you earn above $147,000 doesnt have Social Security taxes withheld from it. It will still have Medicare taxes withheld, though.

There is no income limit on Medicare taxes. 1.45% of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1.45%. If you make more than a certain amount, you’ll be on the hook for an extra 0.9% in Medicare taxes. Here’s a breakdown of these amounts:

- $200,000 for single filers, heads of household and qualifying widows with dependent children

- $250,000 for married taxpayers filing jointly

- $125,000 for married taxpayers filing separately

Read Also: Can You Get The Child Tax Credit With No Income

Income That Is Assessed For Tax

Under the PAYE system, income tax is charged on all wages, fees, perks,profits or pensions and most types of interest. Tax is payable on earnings ofall kinds that result from your employment .

Money you get which is not liable to income tax may be liable to othertaxes. If you get gifts or inheritances, you may have to pay CapitalAcquisitions Tax. If you sell assets such as property or shares you mayhave to pay Capital GainsTax.

Example Of Tax Brackets

Below is an example of marginal tax rates for a single filer based on 2021 tax rates.

- Single filers with less than $9,950 in taxable income are subject to a 10% income tax rate .

- Single filers who earn more than $9,950 will have the first $9,950 taxed at 10%, but earnings beyond the first bracket and up to $40,525 will be taxed at a 12% rate .

- Earnings from $40,526 to $86,375 are taxed at 22%, the third bracket.

Consider the following tax responsibility for a single filer with a taxable income of $50,000 in 2021:

- The first $9,950 is taxed at 10%: $9,950 × 0.10 = $995

- Then $9,951 to $40,525, or $30,574, is taxed at 12%: $30,574 × 0.12 = $3,669

- Finally, the top $9,476 is taxed at 22%: $9,476 × 0.22 = $2,085

Add the taxes owed in each of the brackets:

- Total taxes: $995 + $3,668 + $2,085 = $6,748

The individuals effective tax rate is approximately 13.5% of income:

- Divide total taxes by annual earnings: $6,748 ÷ $50,000 = 0.135

- Multiply 0.135 by 100 to convert to a percentage, which yields 13.5%.

Taxes that you pay on 401 withdrawals are also based on tax brackets.

Recommended Reading: Do Expats Pay Us Taxes

How Your Vermont Paycheck Works

It can be a challenge to predict the size of your paycheck because money is deducted for FICA, federal and state income taxes, as well as other withholdings. But when you start a new job, you’ll have to fill out a W-4 form. Your Vermont employer uses the information you provide on this form – with regard to your marital status and any additional dollar withholdings you take – to determine how much to deduct from your paychecks for federal and state taxes. You’ll need to submit a new form during the year if you want to make changes regarding your status or dependents.

The IRS made notable changes to the Form W-4 in recent years. The new version completely removes allowances, using a five-step process asking filers to fill out personal information, list dependents and indicate any additional income instead.

A portion of your income will also go toward paying Social Security and Medicare taxes. Collectively these are known as FICA taxes, and may be referred to as such on your pay stub. For each of these taxes, a percentage of your income is withheld for the sake of sustaining these programs. Your employer will match these percentages, meaning that in the end you will have only been responsible for half of your FICA taxes.

How Do I Determine Which Percentage To Elect

Every employee must consider the facts of their own situation and adjust their election accordingly.

If you want to keep your withholding approximately the same as last year, use last year’s federal Form W-2, or your last pay stub, to calculate which withholding percentage to elect. For example, if box 1 of federal Form W-2 shows $40,000 in wages and box 17 shows $1,000 in state income tax withheld, divide box 17 by box 1 to determine your percentage . To keep your withholding the same as last year, choose a withholding percentage of 1.8% and withhold an additional $10.77 per biweekly pay period . Be sure to take into account any amount already withheld for this year.

If you want to withhold more, choose one of the higher percentages or choose to have an additional amount withheld.

Note: Underwithholding can result in you owing tax and/or underpayment penalties when you le your Arizona return at the end of the year.

Don’t Miss: How To Get My Unemployment Tax Form

Do You Pay Taxes On Social Security

You have to pay federal income taxes if you meet certain combined income thresholds based on your filing status. Combined income includes your adjusted gross income, nontaxable interest, and half of your Social Security benefits. For example, if you file as an individual and your combined income is between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If your income is more than $34,000, you may have to pay taxes on up to 85% of your benefits. Taxes are limited to 85% of your Social Security benefits.