How Much Do People Pay In Taxes

Andrew Lundeen

Tax day is a day away and this time of year there are always questions about who pays how much in taxes.

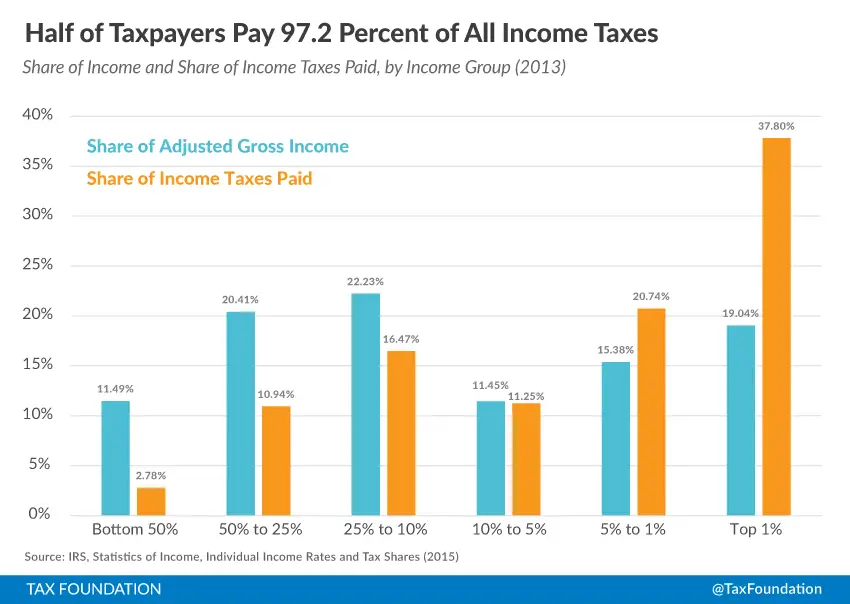

A recent poll by Pew Research Center found that the feeling that some wealthy people dont pay their fair share, bothered 79 percent of respondents some or a lot. Recent analysis by the Joint Committee on Taxation shows that these respondents can rest easy.

When it comes to individual income taxation in the United States, the average tax rate paid increases as we move up the income scale . As a group, taxpayers who make over $1,000,000 pay an average tax rate of 27.4 percent. At the bottom of the income scale, taxpayers who earn less than $10,000 pay an average tax rate of -7.1 percent, which means they receive money back from the government, in the form of refundable tax credits. The next income group up has an even lower negative tax rate at 11 percent.

These results are as expected. The U.S. income tax system is progressive, with marginal tax rates increasing as incomes increase and a large number of tax credits that limit the tax burden for lower incomes.

Many would argue, however, that people pay more federal taxes that just individual income taxes. They are correct. People also pay social insurance taxes , business taxes, and excise taxes.

Whether this level of progressivity is the correct amount requires a larger discussion, but its important to note that progressive taxes come with an economic cost.

Was this page helpful to you?

State And Local Taxes

When applicable, you may also need to pay state income taxes. Currently, there are only nine states where you will not have to worry about this, and they include the following:

- Texas

- Tennessee

- New Hampshire

If you reside anywhere else, you will pay 7% or less of your net earnings to your state. Keep in mind that, even though they technically have a state-level tax, neither Tennessee nor New Hamshire impose taxes on actively earned income, just dividends and interest.

Forms That Independent Contractors File

The main form that all of your numbers will go on is a regular 1040. Regardless of your background and type of earnings, everyone in the U.S. submits this form. Where the paperwork veers off a little, however, is the point when you start working with the supporting schedules.

The income that you report for your independent contracting must come from a Schedule C. Furthermore, to account for the self-employment tax, you need to include a Schedule SE. If you made any estimated tax payments, which will be discussed shortly, you need to ensure that those accompany your return as well.

The best starting point is Schedule C. You begin by adding all of your earnings in Part I on lines one through seven. After that, you go through lines eight through 28 to derive the total expenses. Finally, you will get your net profit or loss on line 31. That number will go directly on line 12 of your form 1040. Also, do not forget to calculate your qualified business deduction from section 199A of the new tax law from 2017, which will amount to 20% of the net income that you made. That is, of course, as long as you satisfy certain requirements that most independent contractors do. To find out more about them, review the overview provided by the IRS.

You May Like: Do You Get A 1099 From Doordash

How Is Income Tax Calculated

Canstar has an income tax calculator that can assist you to calculate your approximate income tax for the current financial year. The income tax calculator calculates the tax payable on gross wages paid in equal weekly amounts. The rates are obtained from the Australian Taxation Office. No allowance is made for tax deductions, Medicare or other levies and/or payments.

Do I Need To Do A Tax Return

Generally, if youve met any of these criteria, you need to determine if you may need to lodge an Australian tax return: you have obtained a tax file number , you have worked in or for the benefit of Australia, you have received Australian-sourced investment income that is not subject to withholding. Once youve met one of these criteria, you must either lodge a tax return or advise the ATO one is not required through a non-lodgment advice form every financial year. You should seek professional tax advice if you are unsure whether you should lodge a return.

- Read the full story by Ursula Lepporoli, KPMG

Read Also: Do Doordash Drivers Pay Taxes

Tax Rates And Tax Brackets

Depending on the amount of income you earn, you will fall within one of five federal tax brackets, and one of the five Ontario tax brackets. Each tax bracket is taxed at a different rate. The system is based on what is called graduated tax rates. This means that if your income increases so that you enter a new tax bracket, only the amount of your income that falls in the higher tax bracket gets taxed at the higher rate. Tax brackets are set by both the federal government and by each province.

State Local And Territorial Income Taxes

Income tax is also levied by most U.S. states and many localities on individuals, corporations, estates, and trusts. These taxes are in addition to federal income tax and are deductible for federal tax purposes. State and local income tax rates vary from 1% to 16% of taxable income. Some state and local income tax rates are flat and some are graduated. State and local definitions of what income is taxable vary highly. Some states incorporate the federal definitions by reference. Taxable income is defined separately and differently for individuals and corporations in some jurisdictions. Some states impose alternative or additional taxes based on a second measure of income or capital.

States and localities tend to tax all income of residents. States and localities only tax nonresidents on income allocated or apportioned to the jurisdiction. Generally, nonresident individuals are taxed on wages earned in the state based on the portion of days worked in the state. Many states require partnerships to pay tax for nonresident partners.

Tax returns are filed separately for states and localities imposing income tax, and may be due on dates that differ from federal due dates. Some states permit related corporations to file combined or consolidated returns. Most states and localities imposing income tax require estimated payments where tax exceeds certain thresholds, and require withholding tax on payment of wages.

Recommended Reading: How Much Does Doordash Take In Taxes

Us Tax Bracket Questions

Want to understand how the changes to the tax brackets affect you? Or learn how you may be able to lower your taxable income? The knowledgeable tax pros at H& R Block can help.

This year, most people will get a Form 1095 to report details about their health insurance. Learn more about Forms 1095-A, B and C at H& R Block.

If You Work More Than One Job

Keep the wage base in mind if you work for more than one employer. If you’ve earned $69,000 from one job and $69,000 from the other, you’ve crossed over the wage base threshold. Neither employer should withhold any further Social Security tax from your payor pay half the 12.4% on your behalfuntil year’s end.

It doesn’t matter that individually, neither job has reached the wage base threshold. The wage base threshold applies to all your earned income. But separate employers might not be aware you’ve collectively reached this limit, so you’ll have to notify both employers they should stop withholding for the time being. However, you can always receive reimbursement of any overpayment when you file your taxes.

These are annual figures, so the Social Security tax starts right back up again on Jan. 1 until you hit the next year’s Social Security wage base.

Also Check: Efstatus.taxact.com.

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Income Tax Rates And Bands

The table shows the tax rates you pay in each band if you have a standard Personal Allowance of £12,570.

Income tax bands are different if you live in Scotland.

| Band | |

|---|---|

| over £150,000 | 45% |

You can also see the rates and bands without the Personal Allowance. You do not get a Personal Allowance on taxable income over £125,140.

Recommended Reading: Can You File Taxes With Doordash

A Taxing Decision: Rrsp Or Tfsa

RRSPs and TFSAs are both tax-free savings options. However, they differ in the features they offer. An RRSP is more of a retirement savings account. Early withdrawals can lead to financial consequences. TFSAs are also long-term investment options. However, they offer a much more flexible withdrawal policy. Unlike RRSPs, TFSAs do not give you a tax deduction.

There are pros and cons to both savings options. Many choose that have both investment accounts gives them the best of both worlds. An RRSP compounds your money over a long period of time and gets you a tax deduction. However, income tax applies when making a withdrawal. There are also consequences to withdrawing early.

A TFSA may have a lower interest rate and does not offer tax savings. However, you can withdraw your money anytime without having to worry about any penalties or taxes.

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The 2021 credit can be up to $6,728 for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $4,000 or $8,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

Read Also: Highest Paying Plasma Donation Center Near Me

How To Calculate Your Tax Liability Using Brackets

So let’s say you’re an individual filer with adjusted gross income of $65,000 in 2021 and take the standard deduction of $12,550. That leaves taxable income of $52,450, putting you in the 22% bracket. But it doesn’t mean you pay 22% tax on all of your earnings. Instead, your income would be taxed taxed as follows:

- $9,950 taxed at 10%, resulting in $995 of income taxes

- The amount between $9,950 and $40,525 taxed at 12%, for a total tax of $3,669

- The amount between $40,525 and $52,450 taxed at 22%, for a total tax of $2,624

So putting it all together, your total income tax for the year would be $7,288.

The actual percentage you pay on the entirety of your taxable income is called the effective tax rate. You calculate your effective tax rate by dividing your total tax liability, $7,288, by your annual taxable income, $52,450. That’s an effective tax rate of 13.9%.

Note: Your effective tax rate is the actual percentage of taxes you pay overall. Your marginal tax rate is the highest tax rate your taxable income falls into.

How Do Small Business Owners Pay Taxes

Most small businesses are owned by individuals.

Partnerships, LLCs, and sole proprietorships pay no business tax, but the income is passed through to the owners, who report it on their personal tax returns. Because of this, it can be difficult to separate the tax paid on business income from the tax owed by the individual for all forms of income.

To figure your income tax rate, you must calculate your taxes for Form 1040 or 1040-SR, by adding up all your sources of income, including your business’s net income. You’ll also have to include tax credits and deductions to compute a net taxable income.

When you have your total taxable income, you can use these IRS tax tables to figure out your tax.

An easier way to figure how much income tax you owe is to use a tax preparation software program. Look for the small business version with Schedule C included. These companies also have programs for figuring partnership/LLC and corporation/S corporation taxes.

Also Check: How Can I Get My 1099 From Doordash

Income That Is Assessed For Tax

Under the PAYE system, income tax is charged on all wages, fees, perks,profits or pensions and most types of interest. Tax is payable on earnings ofall kinds that result from your employment .

Money you get which is not liable to income tax may be liable to othertaxes. If you get gifts or inheritances, you may have to pay CapitalAcquisitions Tax. If you sell assets such as property or shares you mayhave to pay Capital GainsTax.

Can I Withdraw From My 401k In 2021 Without Penalty

Although the initial payout provision of 401,000 that it will be

When do I have to pay taxes on coronavirus-related distributions?

Usually, your wages are counted pro rata over a three-year period, starting with the year in which you receive your paycheck. For example, if in 2020 you received a coronavirus-related distribution worth $ 9,000, you would report income of $ 3,000 in your federal tax return for 2020, 2021, and 2022. However, you can include the entire distribution in your payday income.

How do qualified individuals report coronavirus-related distributions regarding retirement plans?

If you are a qualified individual, you may designate any qualifying distribution as a Coronavirus-related distribution as long as the total amount indicated as Coronavirus-related distribution does not exceed $ 100,000. As mentioned earlier, a qualified individual may treat a distribution that meets the requirements to be a coronavirus-related distribution as such, whether or not a qualifying retirement plan treats the distribution as a coronavirus-related distribution. You must report a coronavirus-related distribution in your individual federal tax return for 2020. You must include the taxable portion of the distribution in your income proportionally over the 3-year period 2020, 2021 and 2022 unless you choose to include the entire amount in your income in 2020.

What is a coronavirus-related distribution?

Prev Post

Read Also: Is Doordash A 1099

Why Is It Important To Know My Tax Bracket

If your marginal tax rate doesn’t tell you how much tax you’ll actually pay, why do you even need to know what it is? For one thing, it’s because you can only determine your effective tax rate by going through the machinations of figuring out your marginal tax rate and the resulting total tax liability.

Likewise, understanding which bracket you’re in helps you understand any implications of how changes in your earnings will affect your overall tax burden, says Sri Reddy, senior vice president of retirement & income solutions at Principal Financial Group. “Even a minimal pay increase could kick you up into a higher percentage of tax payment, as well as impact whether you qualify for things such as the child tax credit,” Reddy says.

Knowing your marginal tax bracket can also influence how you approach the available deductions, such as if you choose to use the standard deduction or itemize, and perhaps give a large lump sum to charity to reduce your taxable income, Reddy says.

Your marginal tax rate can also inform your other financial decisions. “We often find clients will calculate the amount to convert to Roth, how to contribute to a retirement plan, when to sell or hold long-term capital gains, and potentially how much to give to charity based on their tax bracket,” says David S. Elder, wealth manager and partner at Merit Financial Advisors.

What Other Taxes Does A Business Pay

In addition to income taxes, the largest tax bill that small businesses pay is for payroll taxes. These taxes are for FICA taxes .

Your portion as an employer is 7.65% on employee gross payroll. Other payroll taxes, like unemployment taxes and workers’ compensation taxes, increase the amount of tax you must pay as an employer.

Other taxes your business will be responsible to pay include:

- Capital gains taxes on business investments and on the sale of business assets. The capital gains tax rate is based on how long you owned the asset.

- Property taxon real property owned by the business

- Tax on dividends from business investments

You May Like: How Much Tax Do You Pay On Doordash