How To Pay Quarterly Estimated Taxes

You can easily pay your quarterly taxes online by linking your bank account to EFTPS.com, the electronic federal tax payment system. You can pay using a credit card, but you may have to pay an additional service fee if you choose to go that route. Additionally, individuals can use IRS Form 1040-ES to submit quarterly payments, while corporations can use Form 1120-W. Payments are due each quarter of the calendar year. The IRS can penalize those who dont file quarterly taxes when theyre due–so be sure to pay on time. Quarterly payment due dates are:

April 15 for income from January 1 to March 31

June 15 for income from April 1 to May 31

September 15 for income from June 1 to August 31

January 15 for income from September 1 to December 31

Its a good idea to create an estimated taxes bank account to hold funds for estimated tax payments. This way youll always have the money you need to pay quarterly estimated taxes in full and on time, avoiding expensive penalties.

How much money you should set aside depends on your personal circumstances and tax rate, but you should plan to set aside at least 30% of your revenue to account for income tax, Social Security tax, and Medicare tax.

How Do I Know If I Owe Quarterly Taxes

If you are currently a small business owner or self-employed, you likely owe quarterly taxes. Self-employed workers usually include:

- Members in a partnership that conducts business, like an LLC

- Part-time or full-time business owners

Just as there are employment-related rules for quarterly taxes, there are also financial rules. The IRS only requires you to make estimated payments if you owe $1,000 or more when you file your return. This minimum for estimated taxes drops to $500 for corporations, generally. However, the IRS does require the self-employment tax as well if your individual net earnings exceed $400.

You may not need to pay quarterly, though, if you already pay a sufficient amount during the year. For instance, people who have a W-2 job on top of their 1099 income may pay enough in taxes through their W-2 full-time job.

Add Quarterly Tax Payment Reminders To Your Calendar

Never miss a quarterly payment with lightweight calendar reminders.

Sarah is a staff writer at Keeper Tax and has her Enrolled Agent license with the IRS. Her work has been featured in Business Insider, Money Under 30, Best Life, GOBankingRates, and Shopify. She has nearly a decade of public accounting experience, and has worked with clients in a wide range of industries, including oil and gas, manufacturing, real estate, wholesale and retail, finance, and ecommerce. Sarah has extensive experience offering strategic tax planning at the state and federal level. During her time in industry, she handled tax returns for C Corps, S corps, partnerships, nonprofits, and sole proprietorships. Sarah is a member of the National Association of Enrolled Agents and maintains her continuing education requirements by completing over 30 hours of tax training every year. In her spare time, she is a devoted cat mom and enjoys hiking, baking, and overwatering her houseplants.

Being self-employed comes with a number of challenges â including estimated taxes. Luckily, our quarterly tax calculator takes the guesswork out of a complicated task.

Also Check: How To Find Out If Irs Received My Tax Return

Make Sure Payments Cover All Of The Taxes You Owe

- Besides income taxes on your business earnings and other sources of income, estimated taxes should include projected liability for the following types of federal and state taxes.

Alternative minimum tax

- Youll pay this if your tax is more than your regular income tax. The AMT, which is figured using different rules rather than consistent tax rules, is intended to make sure those able to reduce their regular burden through various exclusions and deductions pay at least some income tax. The IRS details how to determine if this applies to you.

Additional Medicare of 0.9% on your earned income

- This tax applies if your wages and net earnings from self-employment exceed $200,000 if youre single, $250,000 if youre married filing jointly, or $125,000 if youre married filing separately.

Net investment income tax of 3.8%

This tax applies to the lesser of your adjusted pre-tax income over a threshold amount, or your net investment income. For pre-tax income, the threshold is $200,000 if single, $250,000 if married filing jointly, or $125,000 if married filing separately.

- Net investment income equals investment income minus investment expenses. Investment income includes profits from dividends from stocks, interest earned from bank accounts, and capital gains from property sales. It does not include business income if you materially participate .

Employment taxes on a household employee

How To File Quarterly Taxes: A Small Business Guide To Quarterly Estimated Tax Payments

Myranda Mondry,

When you think about tax time, you probably think about the whirlwind of tax forms that occurs between January 1 and April 15. But, in actuality, tax time comes four times a year.

The United States tax system is pay as you go, meaning you pay income taxes as you recieve income rather than all at once at the end of the year. These tax payments are broken up into four installments that occur once every three months called quarterly estimated tax payments. And if you expect to owe more than $1,000 in taxes at the end of the year, you need to make these payments.

But dont worry. More than likely, youve been making these quarterly payments all along and just didnt realize it. If you work for an employer and submit a W-4 form, your employer calculates your quarterly tax payments for you and automatically withholds them from your paycheck. However, for small business owners, the responsibility of calculating and paying quarterly estimated payments falls on you. And it all starts with determining how much youll owe in taxes by the end of the year.

Read Also: Where To File Va State Taxes

Why Do Some People Have To Pay Quarterly Taxes

Income received from just about any source is generally subject to income tax. That can include not only federal income tax, but also state income tax, and Social Security and Medicare tax.

The IRS requires that at least most of your tax liability be paid before the tax due date. While this is automatically accomplished through regular withholding, it must be done through quarterly estimated tax payments where withholding isnt available.

What Happens If I Dont Make Estimated Tax Payments

If you are required to make estimated tax payments and you dont make them or dont pay in enough the IRS will assess underpayment interest at the published quarterly rate. The underpayment interest rate for 2020 Q1 and Q2 was 5% and it is now holding at 3% for Q3.

Its important to note that the interest rates are annual rates and you will only pay on the underpayment amount. This interest is also non-deductible and more expensive than deductible business interest at the same rate.

Also Check: How Much Is The Penalty For Filing Taxes Late

When Is The Due Date For Estimated Payments

Due dates for quarterly estimated tax payments are spread throughout the year, having you input four forms and payments. The dates for California are the same as with the rest of the United States. The only difference is the percentage needed for each payment.

This is how much you will have to pay for each due date:

- First Quarter – April 15, 2021 – 30%

- Second Quarter – June 15, 2021 – 40%

- Third Quarter – September 15, 2021 – 0%

- Fourth Quarter- January 18, 2022 – 30%

It is important that you respect all of these due dates. Otherwise, you will be subjected to tax liability, for not reporting your taxable income.

What Is The Penalty For Not Paying Quarterly Taxes

If you miss a deadline, make the payment as soon as possible. Dont wait until the next deadline to pay them simultaneously. You could face fines and tax penalties when you file your tax return at the end of the year.

If you dont make sufficient payments throughout the year or on time, then an extra penalty may be added to what you owe on your tax return. That amount will depend on how much you underpaid and exactly how late you were with your payments.

The IRS isnt satisfied with receiving what you owe all at once at the end of the year instead of at the end of each quarter. Even missing a deadline by a few days can mean an extra fine. Understanding your tax obligations throughout the year can be difficult and stressful, but its necessary to avoid extra fines and unnecessary complications.

Recommended Reading: How To File Taxes If Self Employed And Employed

Should I Pay In Equal Amounts

Usually, you pay your estimated tax payments in four equal installments. But you might end up with unequal payments in some circumstances:

- If you had your previous year’s overpayment credited to your current year’s estimated tax payments

- If you don’t figure your estimated payments until after April 15 when the first one is typically due

- If you unexpectedly make a lot of money in one quarter

Example:

You calculate that you need to pay $10,000 in estimated taxes throughout the year, and you don’t make your first payment until June 15 , so your first payment will be $5,000. Your September payment and your January payment will be $2,500 each. However, you may still owe an underpayment penalty for the first quarter because the first payment wasn’t made by the April 15 deadline.

Do I Have To Make Estimated Tax Payments

If you intend to file as a sole proprietor, a partnership, S corporation shareholder, and/or a self-employed individual, youâll generally need to make estimated quarterly tax payments if you will owe taxes of $1,000 or more.

Businesses that file as a corporation generally need to make estimated tax payments if they expect to owe $500 or more in tax for the current year. If you meet these IRS minimums, then youâll likely have to file estimated quarterly taxes.

If you need some help with your estimated taxes, check out Bench. Weâll get your books in order and take care of federal tax forms .

Also Check: What Will My Property Taxes Be

Can I Avoid Paying Estimated Taxes

Probably not without incurring those penalties. Some classes of workers — particularly those whose income is exceptionally modest, inconsistent or seasonal — are exempt from having to make quarterly payments to Uncle Sam, however:

- If your net earnings were $400 or less for the quarter, you don’t have to pay estimated taxes — but you still have to file a tax return even if no taxes are due.

- If you were a US citizen or resident alien for all of last year, your total tax was zero and you didn’t have to file an income tax return.

- If your income fluctuates drastically throughout the year , you may be able to lower or eliminate your estimated tax payments with an annualized income installment method. Refer to the IRS’s 2-7 worksheet to see if you qualify.

Quarterly Estimated Tax Payments For Business Owners: How Much Should You Pay

by Jasmine DiLucci | Jan 19, 2022 | Business Taxes

Most business owners are familiar with the idea that the IRS has quarterly tax requirements, but were often asked about how much should be paid. Our answer is it depends. Business owners are usually in different situations, and we have explained the three options that we see individuals choose:

Don’t Miss: How Do I Claim My Stimulus Check On My Taxes

When Are Quarterly Taxes Due For 2021 And 2022

To avoid an Underpayment of Estimated Tax penalty, be sure to make your payments on time for tax year 2021:

| 1st Quarterly Estimated Tax Payment |

| 2nd Quarterly Estimated Tax Payment |

| 3rd Quarterly Estimated Tax Payment |

| 4th Quarterly Estimated Tax Payment |

For tax year 2022, the following payment dates apply for avoiding penalties:

| 1st Quarterly Estimated Tax Payment |

| 2nd Quarterly Estimated Tax Payment |

| 3rd Quarterly Estimated Tax Payment |

| 4th Quarterly Estimated Tax Payment |

Figuring When And How To Pay

If you’re an employee, your employer typically withholds taxes from every paycheck and sends the money to the IRS, and probably to your state government as well. This way you pay your income taxes as you go. And, if you’re like most wage earners, you get a nice refund at tax time.

But if you are self-employed, or if you have income other than your employment wages, you may need to pay estimated taxes each quarter. You may owe estimated taxes if you receive income that isn’t subject to withholding, such as:

- Gains from sales of stock or other assets

- Earnings from a business

- Alimony that is taxable

Read Also: When Do We Get Our Taxes

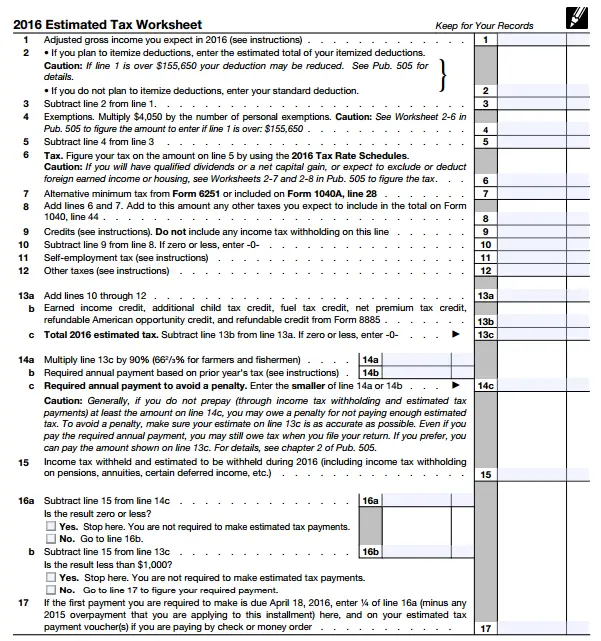

How Do I Calculate My Quarterly Tax Payment

It can be confusing to estimate your yearly expected adjusted gross income, taxable income, deductions and tax credits. This is particularly hard if youre a freelancer and your income varies during the year.

There are three methods that might help you determine your estimated tax payments. The IRS has named these “safe harbor” methods because generally you will not incur a penalty if you end up still owing taxes when you file your return. These methods are:

- 90%. Estimate what you will owe in taxes this year, multiply it by 90% and divide it into four equal payments, one for each quarterly tax due date.

- 100%. Use last year’s tax obligation before estimated payments, withholding, or refundable credits, then divide that into four equal payments. If your adjusted gross income exceeds $150,000, use 110% of last year’s tax obligation.

- Annualized. If you make the bulk of your money during only one quarter of the year, it may be easier for you to annualize your income and deductions and pay four equal payments throughout the year. However, this will require additional forms to be filed with your tax return.

You should consult your own tax advisor to determine which is the best method to figure out your estimated tax payments.

When Are Verbal Agreements Not Enforceable

There are some types of contracts which must be in writing.

The Statute of Frauds is a legal statute which states that certain kinds of contracts must be executed in writing and signed by the parties involved. The Statute of Frauds has been adopted in almost all U.S states, and requires a written contract for the following purposes:

- The sale of real estate or vehicles

- Real estate leases lasting longer than one year.

- Property transfer following the death of the owner.

- The case of a party agreeing to pay debt for someone else.

- Any contract that requires more than a year to fulfil.

- A contract involving and exceeding a specified amount of money .

Typically, a court of law won’t enforce an oral agreement in any of these circumstances under the statute. Instead, a written document is required to make the contract enforceable.

Contract law is generally doesn’t favor contracts agreed upon verbally. A verbal agreement is difficult to prove, and can be used by those intent on committing fraud. For that reason, it’s always best to put any agreements in writing and ensure all parties have fully understood and consented to signing.

Don’t Miss: What Happens If I Forgot To File Taxes

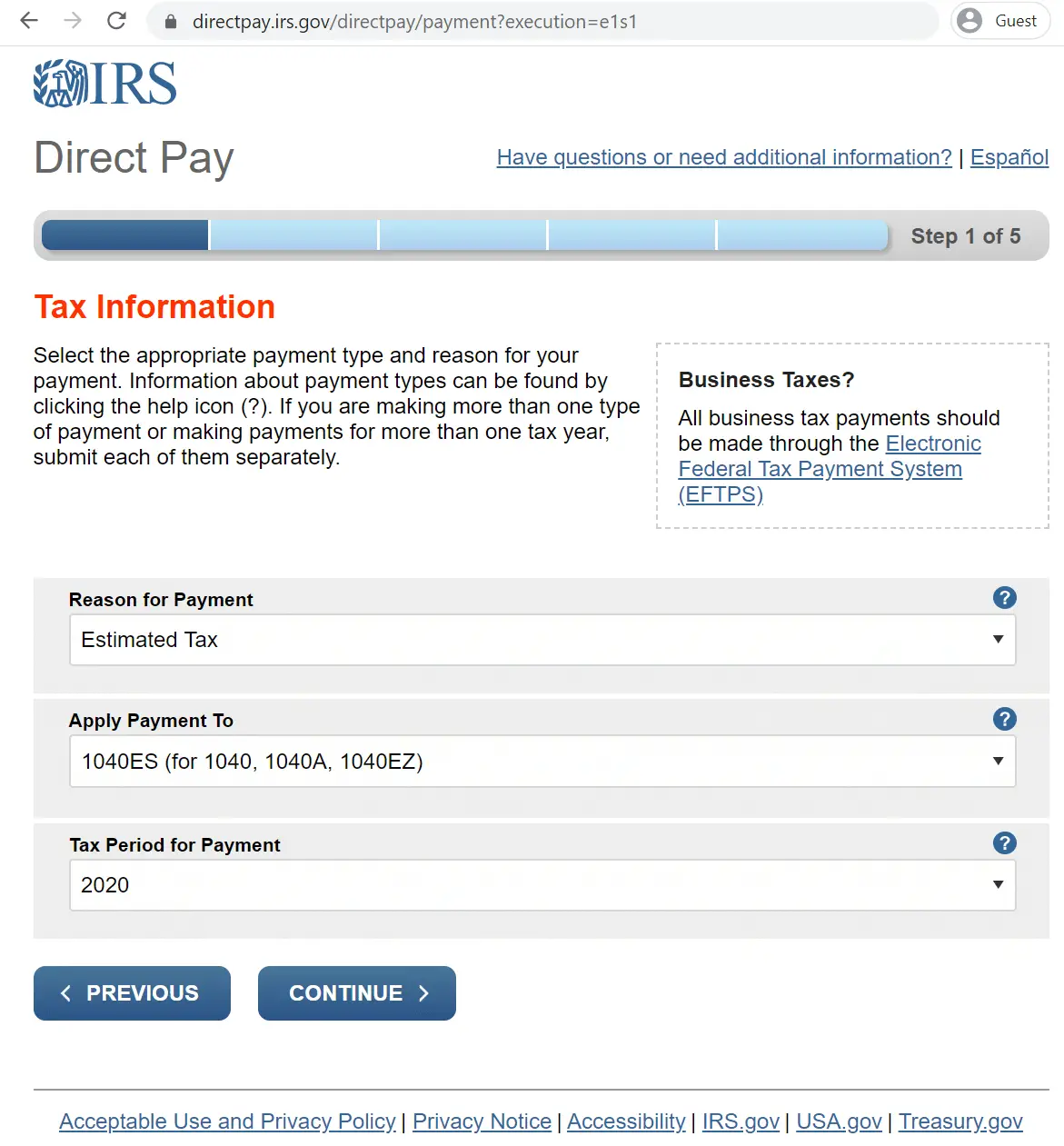

Make Payments Using Irs Direct Pay

There are many ways to make estimated tax payments but our preferred method is IRS direct pay available on the front page of www.irs.gov click the link to Make a Payment. We recommend direct pay because it is easy to make a payment online with a direct debit from your checking account. You will need some information from a prior year tax return to verify your identity prior to making the payment.

Other payment options include the governments EFTPS and mailing a check with a payment voucher.

If you are interested in more information about estimated tax for individuals you may want to visit the IRS website for form 1040-ES.

Who Pays Quarterly Taxes

Freelancers, independent contractors and small-business ownerswho expect to owe at least $1,000 in taxes from their self-employed income are required by the IRS to make estimated tax payments.

If you owe less than $1,000, you can just pay your taxes on that income when you file your tax return at the end of the year.

It doesnt take long to rack up a $1,000 tax bill, so even a side hustle could complicate your tax situation. If you have a regular job and dont want to mess with quarterly payments, you can increase your withholding at your job to offset taxes earned from your side hustle.

If youre not sure if youll need to pay quarterly taxes, you should reach out to a tax professionalwho can help you figure out which camp you fall into. If you wind up owing a significant amount of taxes and didnt pay quarterly, you may have to pay an underpayment penalty on top of the taxes you owe. So, dont overlook this!

Also Check: How To Pay Zero Taxes

How To Pay Quarterly Taxes

So, if you discover youre required to pay quarterly taxes, you must first use Schedule C of Form 1040 to determine how much you owe. However, if your net earnings equate to less than $5,000, you may be able to file a Schedule C-EZ instead. Both forms will help you determine your net earnings or loss.

Then, you will use this number on your Form 1040 to calculate the total amount of self-employment tax you must pay during the year. If you file a joint return, you and the other self-employed person must calculate income separately. Therefore, its wise to consult with a tax professional who can help you ensure youre calculating the right amounts and abiding by IRS guidelines.

Filing quarterly taxes requires that you use Form 1040-ES, Estimated Tax for Individuals. Your annual tax return from the previous year is necessary to complete this form. Once filled out, the forms worksheet will indicate whether you must file quarterly estimated tax.

To make quarterly payments you can:

- Submit the payment electronically with the Electronic Federal Tax Payment System

- Mail-in vouchers that are on the Form 1040 SE