How To Estimate Your Federal Withholding

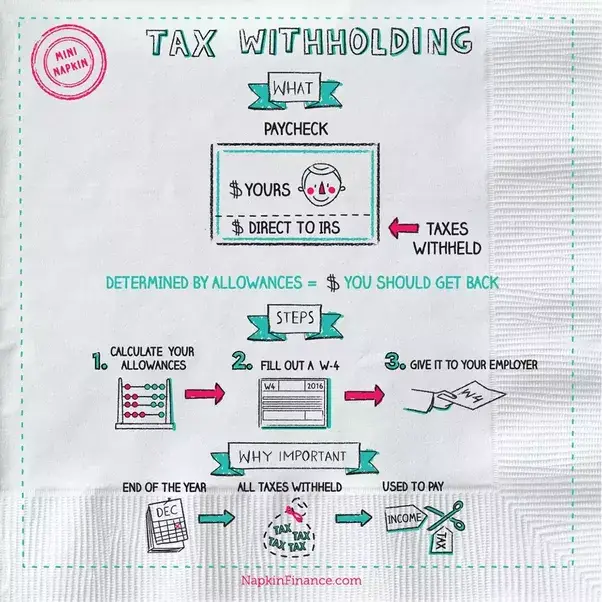

If you want to change your withholding amount in order to ensure a refund, the first thing you have to understand is how withholding is calculated. Although the calculation can be complicated, it is easier since the IRS introduced a new Form W-4 in 2020.

For instance, withholding allowances are no more, which leaves less room for unexpected results after you submit your W-4. In fact, you are only required to fill out steps 1 and 5, where you provide personal information such as your name and address, and then sign the form.

In order to calculate your withholding, take a look at your most recent pay stub. From your pay stub, youll need the following information:

- Wages or salary per pay period

- Wages or salary year-to-date

POLL: Do You Think States Should Suspend Their Gas Taxes?

Plug this information into the IRSs Tax Withholding Estimator. For an accurate calculation, you may have to provide other numbers, such as contributions to a 401, HSA, FSA, and any bonuses you may have received. The estimator also includes various adjustments and tax credits enter anything here that may apply to you. The steps after income and withholding are optional, but be sure to select the standard deduction in that step, unless you itemize.

How Do Tax Credits Affect Your Tax Bracket

Tax credits lower your tax bill dollar-for-dollar, but they dont affect your marginal tax bracket. However, they do lower your effective tax rate. You cant lower your tax bracket by claiming a credit. While you might have the goal of falling into a lower tax bracket, your primary goal should be to get your effective tax rate as low as possible. Deductions can help get you into a lower tax bracket and have a lower effective tax rate, but tax credits will help you lower your effective tax rate more given their ability to reduce your tax bill dollar-for-dollar.

Federal Income Tax Withholding

Employers withhold federal income tax from their workers pay based on current tax rates and Form W-4, Employee Withholding Certificates. When completing this form, employees typically need to provide their filing status and note if they are claiming any dependents, work multiple jobs or have a spouse who also works , or have any other necessary adjustments.

Recommended Reading: When Are Taxes Accepted 2021

Taxes On Pension Income

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs, 401s, 403s and similar retirement plans, and tax-deferred annuitiesin the year you take the money. The taxes that are due reduce the amount you have left to spend.

You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money. In either case, your employer will withhold taxes as the payments are made, so at least some of whats due will have been prepaid. If you transfer a lump sum directly to an IRA, taxes will be deferred until you start withdrawing funds.

Smart Tip: Taxes on Pension Income Vary by StateIts a good idea to check the different state tax rules on pension income. Some states do not tax pension payments while others doand that can influence people to consider moving when they retire. States cant tax pension money you earned within their borders if youve moved your legal residence to another state. For instance, if you worked in Minnesota, but now live in Florida, which has no state income tax, you dont owe any Minnesota income tax on the pension you receive from your former employer.

Also Check: Government Grants Anyone Can Get

What To Know About How Covid 19 Pandemic Changed Tax Laws

Each week, Zachs email newsletter will cover topics such as retirement, savings, loans, mortgages, taxes and investment strategies. Answer a few questions about your life, income and expenses with our tax calculator and it will answer the questions we want. Answer: Will I receive funds or owe money to the IRS? how many

Most Americans are required to pay federal income tax, but the amount you must pay depends on many factors. We use your information to evaluate your filing status and taxable income and then answer the question How much is your refund?

Next, lets take a closer look at how much tax youve already paid this year. For most people, this is the amount your employer withholds from your paycheck.

We use your income information to find tax credits that will affect your refund or balance and deductions to reduce your taxable income.

Recommended Reading: What Is The Income Tax Rate In Arizona

How You Can Affect Your North Carolina Paycheck

North Carolina taxpayers who find themselves facing a large IRS bill each tax season should review their W-4 forms, as theres a simple way to use the form to address this issue. Specifically, you can elect to have an extra dollar amount withheld from each of your paychecks to go toward your taxes. While your paychecks will be slightly smaller, youll lower the chances of owing money to Uncle Sam during tax season.

You can also save on taxes by putting your money into pre-tax accounts like a 401, 403 or health savings account , provided your employer offers these options. Retirement accounts like a 401 and 403 not only help you save money for your future, but can also help lower how much you owe in taxes. The money that goes into these accounts comes out of your paycheck before taxes are deducted, so you are effectively lowering your taxable income while saving for the future. HSAs work in a similar manner and you can use the money you put in there toward medical-related expenses like copays or certain prescriptions.

Not yet a North Carolina taxpayer, but planning a move to the state soon? Take a look at our North Carolina mortgage guide for important information about rates and getting a mortgage in the state.

State And Local Payroll Deductions

Forty-one states have income taxes and while some have flat-rate deductions, others base certain taxes according to a table.

- Localities within 17 states levy taxes that are automatically withheld from wages.

- Some such local taxes are in flat dollar amounts, some are calculated as a percentage of income to withhold, and others use IRS-like tables.

- In six states and U.S. territories, employees pay disability taxes.

- Three states have unemployment insurance taxes.

- One state has a workers’ compensation tax.

Also Check: How To Set Up Sales Tax In Quickbooks

Eight : Take Other Deductions

You’re not quite done yet with deductions. Here are some other possible deductions from employee pay you might need to calculate:

- Deductions for employee contributions to health plan coverage

- Deductions for 401 or other retirement plan contributions

- Deductions for contributions to internal company funds or charitable donations

Remember, all deductions start with and are based on gross pay.

What Was Updated In The Federal W4 In 2020

In 2020, the IRS updated the Federal W4 form that eliminated withholding allowances. The redesigned Form W4 makes it easier for your withholding to match your tax liability. Hereâs how to answer the new questions:

- Step 2: check the box if you have more than one job or you and your spouse both have jobs. This will increase withholding.

- Step 3: enter an amount for dependents.The old W4 used to ask for the number of dependents. The new W4 asks for a dollar amount. Hereâs how to calculate it: If your total income will be $200k or less multiply the number of children under 17 by $2,000 and other dependents by $500. Add up the total.

- Step 4a: extra income from outside of your job, such as dividends or interest, that usually don’t have withholding taken out of them. By entering it here you will withhold for this extra income so you don’t owe tax later when filing your tax return.

- Step 4b: any additional withholding you want taken out. Any other estimated tax to withhold can be entered here. The more is withheld, the bigger your refund may be and youâll avoid owing penalties.

If your W4 on file is in the old format , toggle “Use new Form W-4” to change the questions back to the previous form. Employees are currently not required to update it. However if you do need to update it for any reason, you must now use the new Form W-4.

You May Like: Can I File Taxes With My Last Pay Stub

Check State Numbers Twice

Always double-check your employee’s state withholding certificates as allowances and deductions can compute differently using state tax information. In Louisiana, workers claim exemptions and deductions versus allowances. A person claiming one personal exemption and one deduction and earning $800 every two weeks has $18.27 withheld. The tax tables for many states specify a dollar amount of taxation versus a percentage or dollar and percentage combination.

How Much In Taxes Is Taken Out Of Your Paycheck

Where does the money go, and what is it used for?

If you’re making money, chances are you’ll have to pay taxes on it. In fact, Uncle Sam takes a decent-sized chunk of your paycheck before it even hits your bank account. Before you sign a lease or nail down your budget, youll need to figure out your “take-home pay,” or the amount of your hard-earned money that will actually end up in your pocket.

In this article, well answer two questions: How much can you expect to pay in taxes, and just what is that tax money used for?

Don’t Miss: What Is Ca Use Tax

The Federal Withholding Rate: Getting A Bigger Paycheck

Needless to say, if your employer withholds taxes for your additional side-income, they will send you a smaller paycheck. You may offset this by the fact that you dont need to set part of your freelance earnings aside for taxes.

However, what if someone only has one source of income? The W-4 could allow them to bring home a larger paycheck.

Under the new tax laws, consumers have a bigger standard deduction and more childcare credits that they may claim.

Since the previous, 2019 W-4 applied to the old tax code, it made it difficult to take advantage of these credits and deductions. Nonetheless, the 2020 W-4 changes accommodate these expenses.

Taxpayers will pay a lower federal withholding rate and, at the same time, claim more allowances. Consequently, a company is required to withhold payroll taxes for employees based on the updated deductions and credits.

In other words, employers will send the worker a bigger paycheck.

How To Calculate Withholding And Deductions From Employee Paychecks

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R& D, programmer analyst, and senior copy editor.

Are you considering doing your own payroll processing? Calculating withholding and deductions for employee paychecks isn’t difficult if you follow the steps detailed here.

Your goal in this process is to get from the gross pay amount to net pay . After you have calculated gross pay for the pay period, you must then deduct or withhold amounts for federal income tax withholding, FICA tax, state and local income tax, and other deductions.

Recommended Reading: How Can You Find Out If Someone Filed Their Taxes

Underpayment Can Lead To A Bill Penalty Or Both

The IRS requires you to pay your taxes as you go, and if you were hit with a bill, its because you didnt pay enough as you went in 2021. That means that your employer withheld too little from your paycheck on your behalf for the IRS.

Every pay period, most employers pull a specified amount from their employees checks to cover their tax obligations throughout the year. If your boss withholds too little, its your fault, not your employers, and youre likely to be hit with a penalty for underpaying.

Penalties vary, but the IRS says that they can cost you hundreds of dollars and if you dont pay on time, penalties incur interest and keep on growing right along with your unpaid tax bill.

POLL: Do You Think States Should Suspend Their Gas Taxes?

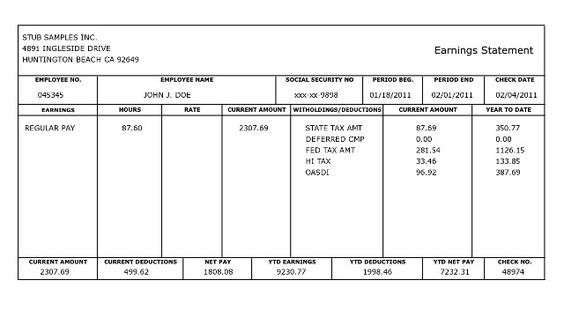

An Example Of An Employee Pay Stub

In the case of the employee above, the weekly pay stub would look like this:

| Employee Pay Stub |

|---|

You must make deposits with the IRS of the taxes withheld from employees’ pay for federal income taxes, FICA taxes, and the amounts you owe as an employer. Specifically, after each payroll, you must:

- Pay the federal income tax withholding from all employees

- Pay the FICA tax withholding from all employees, and

- Pay your half of the FICA tax for all employees.

Depending on the size of your payroll, you must make deposits monthly or semi-weekly.

You must also file a quarterly report on Form 941 showing the amounts you owe and how much you have paid.

Recommended Reading: How To File Taxes From Last Year

Moving Toward More Equitable State Tax Systems

The standard deduction is an amount set by the IRS each year and is an easy choiceits like an automatic tax exemption. If you choose to take the standard deduction, your taxable income is automatically reduced by a certain amount based on how you file . This reduces the tax you have to pay. No need to dig through receipts or bank statements to find your deductions.

It takes more work to verify your deductionsyou have to list all the deductions you want to claim one by one. And you must complete a Schedule A form with your tax return and keep your records to support your claims.1

Yes, itemizing is a big hassle, but its worth the hassle if you can claim enough deductions to reduce your taxable income more than the standard deduction.

How do you know which option is best for you? There are a few things you should know before you make your decision this year.

Are You Having Enough Withheld From Your Paycheck

With every paycheck, your employer withholds some of your earnings for taxes. If too much is withheld, its true that you will receive a refund, but when you really think about it, by waiting until tax season to claim that money back, youve essentially provided the IRS with an interest-free loan during the year. On the other hand, if you owe taxes when you file your return, you may have to scramble to pay whats due, and you could also owe interest and penalties to the IRS if you dont have enough withheld throughout the year.

The IRS has a pay as you earn policy, meaning that as you earn money throughout the year, the IRS expects that youll send them what you believe to be your best estimate of what the taxes are on that income. Your employer helps with this calculation and sends it on your behalf, but they use information you provide them to best estimate for you.

The ideal way to handle your tax withholding is to have just enough taxes withheld to prevent you from incurring penalties when your tax return is due, but still owe just a little bit rather than receive a refund. Yes, youll have to make sure you have a little set aside to make that payment in April each year, but in the meantime, you get to enjoy all of the money you earn throughout the year rather than waiting for the IRS to return it to you upon filing your return.

Don’t Miss: Where Is My 2020 Tax Return

How Do I Know If Im Exempt From Federal Taxes

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For 2022, you need to make less than $12,950 for single filers, $25,900 for joint filers, or $19,400 for heads of household. For 2023 the standard deductions increased to $13,850 for single filers, $27,700 for joint filers, and $20,800 for heads of household.

If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication 505 for current laws.

Claiming exempt from federal tax withholding on your W4 when you arenât eligible isnât illegal but it can have major consequences. You might receive a large tax bill and possible penalties after you file your tax return.

Lets Review Our Example Using The 2020 W

- Our employee earns $50,000 a year, or $2,083.33 of gross pay per semi-monthly pay period.

- Our employees federal income tax withholding is $12.29 using the new W-4.

- Social Security tax is $129.17, and Medicare tax is $30.21. The total combined FICA tax is $159.38.

- Since our employee lives in Florida, there is no state income tax withholding.

- There were no deductions or expense reimbursements.

- Thus, our employees net pay is $1,911.66.

From time to time, there may be other things youll need to add or deduct from your employees paychecks. When these items are added and subtracted, the rest of the basic math outlined above stays the same.

You May Like: How Do You File Taxes On Social Security Disability

Why Do I Owe So Much In Taxes 2020

Well the more allowances you claimed on that form the less tax they will withhold from your paychecks. The less tax that is withheld during the year, the more likely you are to end up paying at tax time. In a nutshell, over-withholding means youll get a refund at tax time. Under-withholding means youll owe.

Recommended Reading: States With No Tax On Retirement Income