How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

Which Is More Important Marginal Or Effective Tax Rate

Generally, marginal rates are used for making decisions about what will happen if your income or deductions go up or down while effective rates are for knowing what percentage of your taxable income is being paid in tax. When looking at the importance of these two tax rates, your circumstance will determine which is more important. If you are trying to determine the impact of a specific change in income such as making a Roth conversion that is in addition to your other income, your marginal tax rate will typically tell you the answer. If you are trying to determine how much of your income to withhold for taxes then your effective tax rate typically will give you a better answer than your marginal tax rate. If the U.S. tax system used a flat tax, the marginal and effective tax rate would be the same.

Are Us Taxes Low

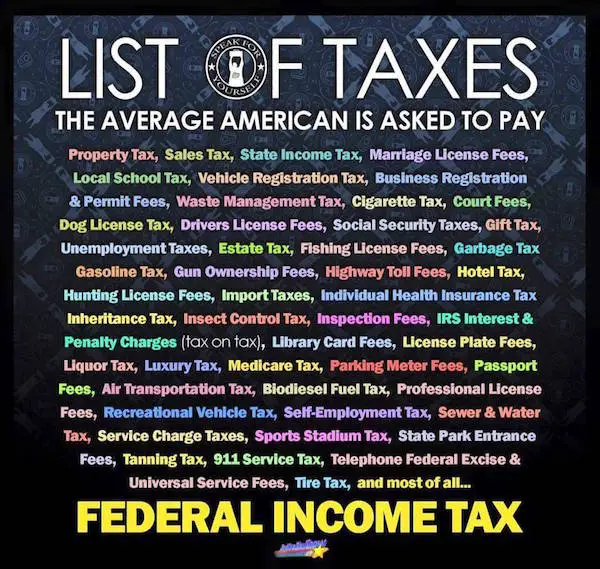

Generally speaking, U.S. taxes are lower than in other developed nations. In 2018, total U.S. tax revenue represented 24% of gross domestic product according to the Tax Policy Center, whereas the average among the other 35 member countries of the Organisation for Economic Co-operation and Development was 34%.

Also Check: How Is K1 Income Taxed

How Do Tax Brackets Work

A progressive tax system means that tax rates increase as your taxable income goes up and your income enters a higher tax bracket. This has you pay a greater rate of tax on each successive chunk of income. Each chunk of incomeincome in a tax bracketshows the percentage of tax you pay on that portion of your income. This means whichever tax bracket youre in, its rate wont apply to your entire income unless your taxable income ends in the lowest bracket.

Current Income Tax Slabs In India

Here are the current tax slabs in India:

| Net Income Range | |

|---|---|

| Rs 2,50,000 to Rs 5,00,000 | 5% |

| More than 15,00,000 | 30% |

After calculating your total taxable income, you can cross-check with the table above to understand which tax bracket you belong to and how much percentage of the taxable income you would pay as tax.

Knowing how much income tax to pay, the next step is to know how to file your income tax.

Also Check: How Much Tax Is Taken From My Paycheck

Federal Top Income Tax Rate

| Year | |

|---|---|

| 2012 | 35.00% |

When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It’s important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn’t. Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information.

One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return.

How Can I Avoid Paying Tax On My Pension

To avoid the tax hit completely on your lump sum retirement distribution, it is advisable that you contact your investment representative, banker or new employer’s retirement administrator before you agree to receive your pension distribution. Establish a rollover IRA account with your investment broker or banker.

Don’t Miss: Is Memory Care Tax Deductible

Medical Dental Or Vision Premiums

Some companies have a program where they will reimburse you for your medical, dental, or vision premiums. Every employee contributes to a pool used to reimburse employees for these types of expenses.

Although you might get reimbursed, the premiums are still considered taxable income. This is because the company doesnt actually give you any moneyit just takes the money out of your paycheck before taxes are taken out.

What Are The 2021 Federal Income Tax Brackets

Single filing status

| If taxable income is over: | but not over: |

| 10% of the amount over $0 | |

| $9,950 | $995 plus 12% of the amount over $9,950 |

| $40,525 | $4,664 plus 22% of the amount over $40,525 |

| $86,375 | $14,751 plus 24% of the amount over $86,375 |

| $164,925 | $33,603 plus 32% of the amount over $164,925 |

| $209,425 | $47,843 plus 35% of the amount over $209,425 |

| $523,600 | $157,804 plus 37% of the amount over $523,600 |

| If taxable income is over: | but not over: |

| 10% of the amount over $0 | |

| $19,900 | $1,990 plus 12% of the amount over $19,900 |

| $81,050 | $9,328 plus 22% of the amount over $81,050 |

| $172,750 | $29,502 plus 24% of the amount over $172,750 |

| $329,850 | $67,206 plus 32% of the amount over $329,850 |

| $418,850 | $95,686 plus 35% of the amount over $418,850 |

| $628,300 | $168,994 plus 37 % of the amount over $628,300 |

| If taxable income is over: | but not over: |

| 10% of the amount over $0 | |

| $9,950 | $995 plus 12% of the amount over $9,950 |

| $40,525 | $4,664 plus 22% of the amount over $40,525 |

| $86,375 | $14,751 plus 24% of the amount over $86,375 |

| $164,925 | $33,603 plus 32% of the amount over $164,925 |

| $209,425 | $47,843 plus 35% of the amount over $209,425 |

| $314,150 | $84,497 plus 37% of the amount over $314,150 |

Head of Household filing status

Read Also: What’s The Minimum Income To File Taxes

Tax Brackets & The Tax Cuts And Jobs Act Of 2017

The Tax Cuts and Jobs Act of 2017 guides current tax policy. Among its notable achievements:

- Number of brackets remained steady at seven.

- Four of the lowest five marginal rates dropped between one and four points the top rate sank 2.6 points, to 37%.

- Modified bracket widths.

- Eliminated the personal exemption, but nearly doubled the standard deduction.

- Indexed brackets and other provisions to the Chained Consumer Price Index measure of inflation .

- Retains the charitable contribution deduction.

- Caps the mortgage interest deduction to the first $750,000 in principal value.

- Deduction for state and local income, sales, and property taxes limited to a combined $10,000.

While taxpayers still may use itemizing if their total deductions work to their advantage , boosting the standard deduction was designed to simplify calculations for the vast majority of filers and it worked. For the 2018 tax year, 90% of households opted for the standard deduction, up from 70% in recent previous years .

Federal Income Tax Return Calculator

Estimate how much you’ll owe in federal taxes, using your income, deductions and credits all in just a few steps with our tax calculator.

How we got here

The United States taxes income progressively, meaning that how much you make will place you within one of seven federal tax brackets:

Single filers

|

$995 plus 12% of the amount over $9,950 |

|

|

$4,664 plus 22% of the amount over $40,525 |

|

|

$14,751 plus 24% of the amount over $86,375 |

|

|

$33,603 plus 32% of the amount over $164,925 |

|

|

$47,843 plus 35% of the amount over $209,425 |

|

|

$157,804.25 plus 37% of the amount over $523,600 |

|

$1,990 plus 12% of the amount over $19,900 |

|

|

$9,328 plus 22% of the amount over $81,050 |

|

|

$29,502 plus 24% of the amount over $172,750 |

|

|

$67,206 plus 32% of the amount over $329,850 |

|

|

$95,686 plus 35% of the amount over $418,850 |

|

|

$168,993.50 plus 37% of the amount over $628,300 |

|

$995 plus 12% of the amount over $9,950 |

|

|

$4,664 plus 22% of the amount over $40,525 |

|

|

$14,751 plus 24% of the amount over $86,375 |

|

|

$33,603 plus 32% of the amount over $164,925 |

|

|

$47,843 plus 35% of the amount over $209,425 |

|

|

$84,496.75 plus 37% of the amount over $314,150 |

Head of household

|

$1,420 plus 12% of the amount over $14,200 |

||

|

$6,220 plus 22% of the amount over $54,200 |

||

|

$13,293 plus 24% of the amount over $86,350 |

||

|

$32,145 plus 32% of the amount over $164,900 |

||

|

$46,385 plus 35% of the amount over $209,400 |

||

|

$523,601 or more |

$156,355 plus 37% of the amount over $523,600 |

Don’t Miss: Who Does Not Have To File Income Tax

How Can I Best Prepare For My Tax Bill

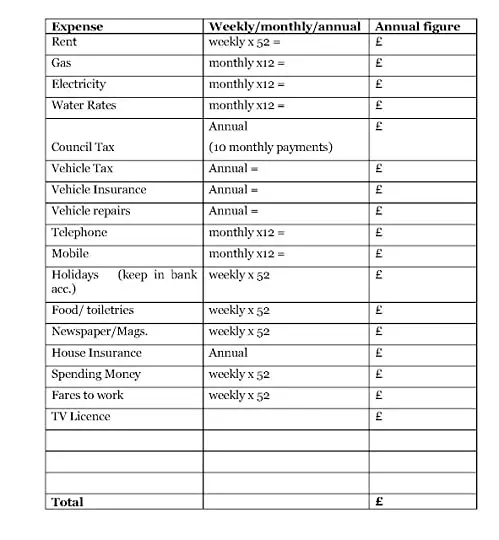

For most people, setting aside a rough percentage of their net income each time they are paid , will help make sure that their tax bill, along with the payments on account, can be met. Our table may help you work out your rough % using 2022/23 rates assuming you are using the cash basis or if using the accruals basis you get paid promptly. Please note this does not include Class 2 NIC and that these are based on UK income tax rates see our webpages for information on Scottish rates of income tax and the Welsh rates of income tax:

|

Net income |

Example: Hugh

Hugh began trading as an electrician in April 2022. He estimates that in the 2022/23 tax year he will invoice approximately £22,000 and expects his expenses to be around £2,500, resulting in profits of £19,500. Hugh looks at the table above and decides to put aside 19% of his net income each time his invoices were paid, meaning at the end of the tax year, he had saved £3,705 towards his tax bill.

On completion of his accounts and tax return Hugh calculates his actual profits to be £19,000 instead of £19,500 and his 2022/23 tax bill looks like this:

Total due by 31 January 2024 £3,127.88.

|

Net profit from self-employment |

How Do I Figure Out What My Marginal Tax Rate/tax Bracket Is

The easiest way to figure out your marginal tax rate is to look at the federal tax brackets and see in which bracket your taxable income ends. This represents your marginal tax rate. If you need help determining your tax bracket, visit TurboTaxs Tax Bracket Calculator. Simply provide your filing status and taxable income to estimate your tax bracket.

Also Check: How To Get S Tax Id Number

Casino Taxes By State

In the United States, gambling and gaming tax revenue is derived from three main sources: casinos, state lotteries, and racinos. Each state has its own individual tax rate for these gaming activities, and the total amount of tax revenue generated varies widely from state to state. Casino tax revenue accounted for the largest share of gaming tax revenue in 2015, at $9.2 billion. Nevada, the state with the most casinos in the country, collected the most casino tax revenue, at $1.1 billion. This was followed by Pennsylvania , Illinois , and Maryland . State lotteries are another major source of gaming tax revenue, generating $6.6 billion in 2015. Six states California, Florida, New York, Texas, Pennsylvania, and New Jersey each generated over $1 billion in lottery tax revenue in 2015.

States With No Income Tax Might Put More Pressure On Lower

Income taxes are usually progressive in nature, meaning that they tax higher earners at a greater rate than lower earners. Other taxes typically dont have that Robin Hood-like characteristic.

Sales taxes, for example, are considered regressive. They dont change depending on the income level of the consumer. They treat everyone the same. So do levies on food, gasoline and other key consumable items.

These taxes place a bigger burden on the poor, according to ITEP research. The reason is the lowest earners in the state devote the lions share of their take-home pay to buying things that are subject to sales taxes. The wealthy, who can save a chunk of their income in their 401s and other investments, have a much smaller proportional exposure to the sales tax.

You May Like: When Should We Expect Tax Refund 2021

Notification Of Local Rate Change To Comptroller

Pursuant to Annotated Code of Maryland, Tax-General Article § 10-106, a county must provide notice of a county income tax rate change to the Comptroller on or before July 1 prior to the effective date of the rate change.

To give notice of a county income tax rate change, you must submit a certified copy of the County Council passed ordinance or bill on or before the deadline required by law.

You should mail your notice to:

You should also cc Andrew Schaufele and Wayne Green at:

Annapolis, MD 21404-1829

Resources for Local Governments Regarding Local Income Tax Requirements

- Local Income Tax Distribution Archive County by county and city by town distributions of local income tax. Also included in the distribution of local income tax revenue are comparisons of delinquent distributions and fiduciary distributions by county, and by municipality.

- Local Income Tax Rate Changes Instructions on how to notify the State of Maryland Comptrollers Office of changes to local income tax rates by counties

- Local Tax Rates: A chart depicting each county and the City of Baltimores local income tax rates.

- Income Tax Summary Report Archive This summary report is an analysis of Maryland resident and nonresident personal income tax returns filed for a given calendar year.

See the Legislative Summaries below and then choose the year of legislation.

Also Check: What To Send When Filing Taxes By Mail

It Depends On What You Mean By ‘average’

kate_sept2004 / Getty Images

The U.S. progressive tax system makes it difficult to pin down an average taxpayer. There are seven tax brackets, ranging from 10% to 37%, so the average tax rate might be expected to be 24.57%. Conveniently, there is a 24% tax bracket. So is this what the average American pays in taxes? Not really.

Different spans of income are taxed at different rates. For example, a single taxpayer who earns $89,076 would pay the 24% rate on only one dollar of income in 2022the dollar over the $89,075 ceiling for the 22% bracket. Heres how it breaks down.

You May Like: How To File Income Tax Online

What Happens If Us Citizens Dont File Their Taxes While Living Abroad

US citizens who dont file US taxes while living abroad may face penalties, interest costs, or even criminal charges. The IRS charges penalties for both late filing and late payments. If your lack of filing is willfulmeaning you knowingly avoided your US tax requirements while living abroadthen more serious legal consequences may apply.

- Failure to File Penalty: 5% of the unpaid taxes for each month the tax return is late, up to 25%

- Failure to Pay Penalty: 0.5% of the unpaid taxes for each month the tax payment is late, up to 25%

- Over 60 Days Late: The maximum for this penalty is 25% of your unpaid taxes

Fortunately, the IRS does offer a way for Americans abroad to get caught up penalty-free if they didnt know they needed to file US taxes while living overseas. Regardless of how many years youve missed, the Streamlined Filing Compliance Procedures only require you to file the past three years of federal tax returns and the past six years of FBARs, making it an easier, less expensive way to become compliant.

How Much Tax Will I Pay

If you’re a basic-rate taxpayer, what you pay in tax accounts for around a third of the money you earn.

Types of tax deducted from your income, such as PAYE and National Insurance, account for 20%. The rest goes on indirect taxes including VAT, duty on alcohol and petrol, and council tax.

This guide explains each type of tax, how much youre charged for it, and how its collected from you.

- Get a head start on your 2021-22 tax return with the Which? tax calculator. Tot up your tax bill, get tips on where to save and submit your return direct to HMRC with Which?.

Also Check: When Do I File My Taxes