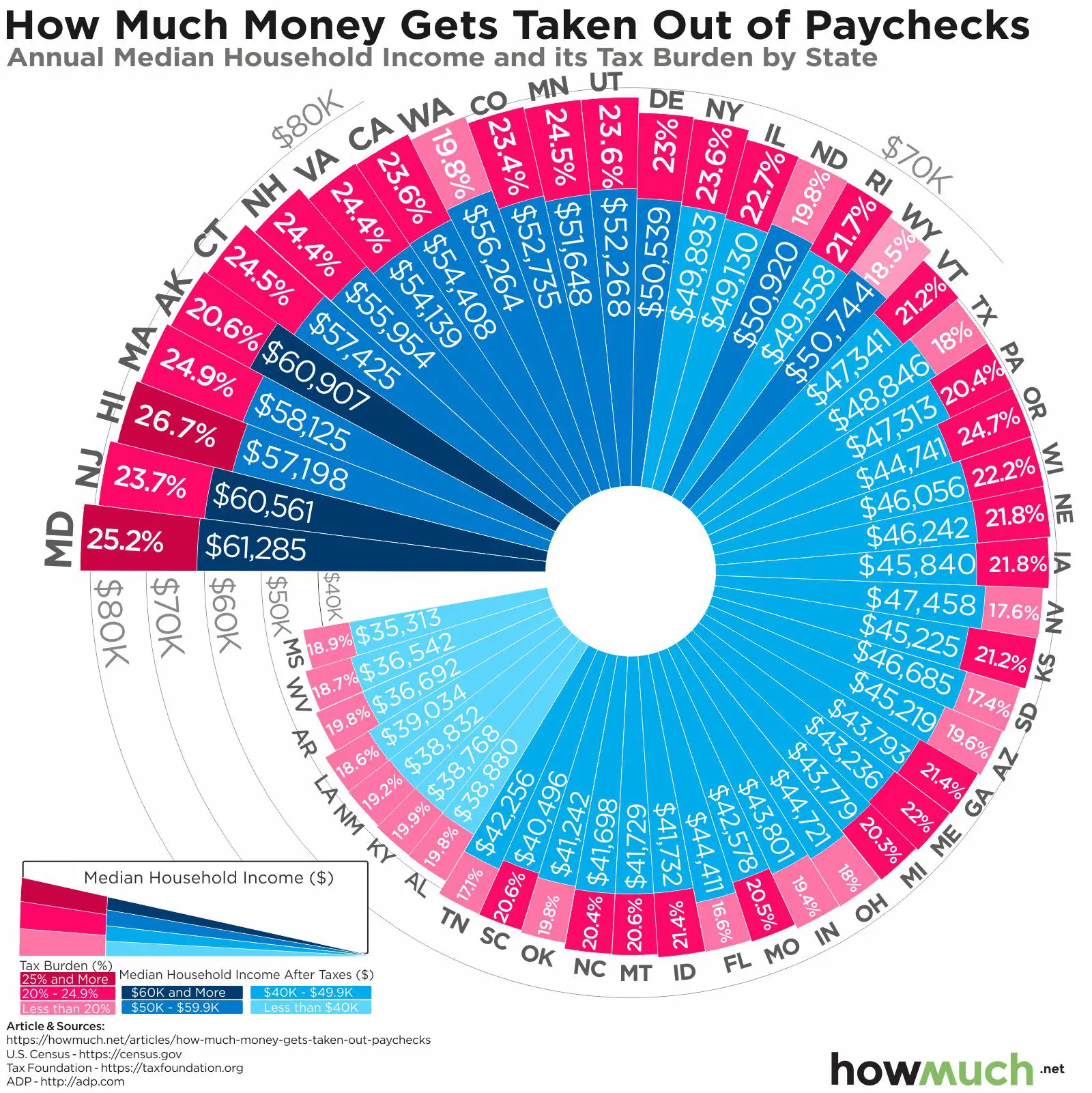

State And Local Income Taxes

The Federal Government isn’t the only one that takes a chunk out of your paycheck. Forty-one states also have income taxes, and the amount you pay varies depending on which state you live in. Some states, such as Colorado and Illinois , have flat-rate deductions, which means everyone in the state pays the same percentage in income taxes.

Other states, such as California and New York, have deductions based on a table. That means the percentage you pay in income taxes depends on your income level.

Finally, nine states, including Florida and Alaska, do not have state income taxes.

Its Easy To Account For Tax Credits And Deductions

The W-4 form makes it easy to adjust your withholding to account for certain tax credits and deductions. There are clear lines on the W-4 form to add these amounts you cant miss them. Including credits and deductions on the form will decrease the amount of tax withheld, which in turn increases the amount of your paycheck and reduces any refund you may get when you file your tax return.

Workers can factor in the child tax credit and the credit for other dependents in Step 3 of the form. You can also include estimates for other tax credits in Step 3, such as education tax credits or the foreign tax credit.

For deductions, its important to note that you should only enter deductions other than the basic standard deduction on Line 4. So, you can include itemized deductions on this line. If you take the standard deduction, you can also include other deductions, such as those for student loan interest and IRAs. However, do not include the standard deduction amount itself. It could be a source of error if folks just put in their full amount, warns Isberg.

If you have multiple jobs or a working spouse, complete Step 3 and Line 4 on only one W-4 form. To get the most accurate withholding, it should be the form for the highest paying job.

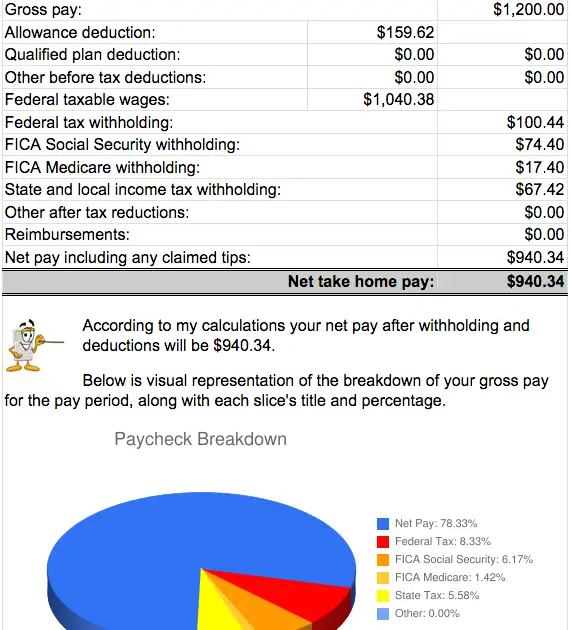

Payroll Hourly Paycheck Calculator

This calculator uses the withholding schedules, rules and rates from IRS Publication 15.

APL Federal Credit Union

© 2018 APL Federal Credit Union. .All rights reserved. 800.367.5796 · 11050 Johns Hopkins Rd. · Laurel, MD 20723

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Also Check: How Much Will I Make After Taxes In Texas

What Small Business Owners Need To Know For Payroll

All of the information above can apply to both business owners and employees. For example, as a small business owner, if youre asked how much federal tax is taken out of my paycheck by employees, youll have a better understanding to explain the process. Additionally, if youre asking this question for your personal paychecks youll also know. If youre one of the small business owners following a DIY approach to payroll, you really need to know the above information.

To handle payroll on your own, make sure that youre getting Form W-4 from employees during onboarding. Additionally, youll want employees to verify their personal information is correct at the end of the year as youre preparing Form W-2 for tax season. From there, payroll calculators will be your friend. Payroll calculators can help you calculate what payroll will be for salaried employees and contractors.

You May Like: Do You Have To Pay Taxes On Plasma Donations

Using A Paycheck Calculator

The IRS offers a withholding calculator so taxpayers can ensure they have the correct amount of tax taken out of their paychecks. If you have too much tax taken out of your paycheck, you will receive a refund, but in the meantime, youre giving the government an interest-free loan. If you have too little tax withheld, youll end up having to send the IRS a check when you file your taxes and for many people, thats a true hardship.

Don’t Miss: Will The Stimulus Checks Be Taxed

What Is Gross Income

Before we can understand why your taxes are so high on your paycheck, we need first to define one key term: gross income. Gross income is simply the total amount of money you earn in a period before any deductions are taken out.

It includes wages, salaries, bonuses, commissions, and other taxable income. You subtract any deductions or exemptions you qualify for when calculating your taxable income, which is taxed at various rates depending on your filing status.

Most taxpayers gross income and taxable incomes are one and the same. However, there are a few instances where thats not the case. For example, if you have income from investments or rental property, that would be considered gross income but not taxable income.

How Do I Know If Im Exempt From Federal Taxes

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For 2022, you need to make less than $12,950 for single filers, $25,900 for joint filers, or $19,400 for heads of household. For 2023 the standard deductions increased to $13,850 for single filers, $27,700 for joint filers, and $20,800 for heads of household.

If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication 505 for current laws.

Claiming exempt from federal tax withholding on your W4 when you arenât eligible isnât illegal but it can have major consequences. You might receive a large tax bill and possible penalties after you file your tax return.

Recommended Reading: When Are Va State Taxes Due

How You File Affects When You Get Your Refund

The Canada Revenue Agencys goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

We may take longer to process your return if we select it for a more detailed review. See Review of your tax return by CRA for more information.

If you use direct deposit, you could get your refund faster.

You May Like: Doordash Driver Tax Information

How To Increase A Take Home Paycheck

Salary Increase

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the company’s performance has noticeably improved, due in part to the employee’s input. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator.

Reevaluate Payroll Deductions

Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse’s company may have health insurance coverage for the entire family it would be wise to compare the offerings of each health insurance plan and choose the preferred plan.

Open a Flexible Spending Account

Work Overtime

Cash Out PTO

Temporarily Pause 401 Contributions

Also Check: What States Do Not Have State Income Tax

How To Calculate Federal Income Tax Withholding Using The Wage Bracket Method

In IRS Publication 15-A, find the tables marked âWage Bracket Percentage Method Tables.â Use the table corresponding to your employeeâs pay period.

Check form W-4 to determine whether the employee files income tax as married or single and the number of allowances they claim.

Find the employeeâs gross wage for the pay period in columns A and B. The wage should be over the amount found in column A but under the amount found in column B.

Subtract the amount found in Column C.

Multiply the result by the percentage found in Column D.

Check form W-4 to determine if the employee requests additional tax withheld from each paycheck. If they do, add that amount to the final number.

The end result is the amount you should withhold from the employeeâs paycheck for that pay period.

The Percentage Method is much more complicatedânot recommended if youâre doing this alone. If you want to learn more about the Percentage Method, you can read all about both methods in IRS Publication 15-A.

Once youâve figured out how much income tax to withhold from your employeesâ paychecks, your next step is to figure out how much FICA to withhold , and how much youâll be required to pay on their behalf.

Calculating Employee Payroll Taxes In 5 Steps

Once your employees are set up , youre ready to figure out the wages the employee has earned and the amount of taxes that need to be withheld. And, if necessary, making deductions for things like health insurance, retirement benefits, or garnishments, as well as adding back expense reimbursements.

In technical terms, this is called going from gross pay to net pay.

If youre trying to figure out a specific step, feel free to skip to the one youre looking for:

- Step 1: Figure out gross pay

- Step 2: Calculate employee tax withholdings

Also Check: How Do I Estimate Taxes For Self Employment

Your Paycheck Next Year Will Be Affected By Inflation Heres How

If you get a raise, you may not end up in a higher tax bracket. But more of your income may be subject to Social Security taxes. And youll probably pay more for health care.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this articleGive this articleGive this article

By Ann Carrns

You already know that inflation is taking a bigger and bigger bite out of your wallet. Now, its going to affect the size of your paycheck in 2023.

Even if you get a sizable raise next year, you wont necessarily take home more money. Many ingredients are baked into the recipe that produces your take-home pay, like deductions for taxes and health care benefits, and your contributions to retirement accounts.

Whether youll see more money in your paycheck, less or about the same will depend on your circumstances. Heres a preview of what is changing next year.

Moving Toward More Equitable State Tax Systems

The standard deduction is an amount set by the IRS each year and is an easy choiceits like an automatic tax exemption. If you choose to take the standard deduction, your taxable income is automatically reduced by a certain amount based on how you file . This reduces the tax you have to pay. No need to dig through receipts or bank statements to find your deductions.

It takes more work to verify your deductionsyou have to list all the deductions you want to claim one by one. And you must complete a Schedule A form with your tax return and keep your records to support your claims.1

Yes, itemizing is a big hassle, but its worth the hassle if you can claim enough deductions to reduce your taxable income more than the standard deduction.

How do you know which option is best for you? There are a few things you should know before you make your decision this year.

You May Like: Do You Need 1099 To File Taxes

What Happens If No Federal Income Tax Is Withheld

A withholding tax takes a set amount of money out of an employees paycheck and pays it to the government. The money taken is a credit against the employees annual income tax. If too much money is withheld, an employee will receive a tax refund if not enough is withheld, an employee will have an additional tax bill.

Dont Overpay The Irs By Having Too Much Tax Withheld From Your Paycheck

The United States has a pay as you go federal income tax. This means you must pay your income taxes to the IRS throughout the year, instead of paying the whole amount due on April 15. If youre an employee, this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to the IRS.

The average taxpayer gets a tax refund of about $2,800 every year. This is because they have too much tax withheld from their paychecks.

In effect, taxpayers who get refunds are giving the IRS an interest-free loan of their money. Nevertheless, many taxpayers like getting refunds. Indeed, there were widespread complaints when many taxpayers received smaller refunds for 2018 than in past years because the IRS recalculated their withholding to take into account the changes brought about by the Tax Cuts and Jobs Act.

If you like getting a refund, go ahead and overpay your withholding. Some people view this as a form of forced savings. However, youll be better off if you dont have too much tax withheld. Ideally, your withholding should match the actual amount of tax you owe for the year. This way youll have more money in your pocket each month.

The amount of income tax your employer withholds from your regular pay depends on two things:

- the amount you earn, and

- the information you give your employer on Form W4.

Tax preparation software can also calculate your withholding.

Dont Miss: Will Property Taxes Go Up In 2022

Don’t Miss: Where To File Georgia State Taxes

What Is My Filing Status

The filing status you use largely depends on the answer to one question: Were you considered married on the last day of the year? If yes, you are considered married for tax filing that year. If not, you are considered not married.

Some particular circumstances under which married persons may be viewed as not married. For example, someone may qualify for Head of Household status even if they are not legally separated or divorced.

Types of filing statuses include:

How Much Is Typically Taken Out Of A Paycheck For Taxes

Every first-time jobholder is probably a bit surprised to find the amount on their first paycheck is less than their total earnings. The difference between the amount of money earned, or gross pay, and the amount a worker takes home is due to taxes. All wage earners are required to pay certain federal taxes that are automatically withheld from their wages. Some states also withhold for state income tax. Understanding exactly how much in taxes is taken out of your paycheck can help lessen the shock.

Read Also: How Much Does The Us Collect In Taxes

Making Payments To The Irs

Just because youve calculated payroll and paid your employees doesnt mean your job is done. You also need to send the taxes you withheld to the respective taxing authority. For FIT and FICA, that is the IRS. For state and local income taxes, that is your states withholding tax agency.

Be sure to send both the taxes you withheld from your employees paycheck as well as the taxes that you as the employer are responsible for.

The timing of when you send the federal taxes depends on how much you pay employees, how frequently you pay them, and your lookback period . The IRS Form 941, Employers Quarterly Federal Tax Return, provides details on how, when, and where to pay FIT and FICA.

The deadline to file Form 941 is the last day of the month following the end of a calendar quarter. For example, for the quarter ending on March 31st, Form 941 is due on April 30th. There are significant penalties for not filing this form, so dont forget!

For state tax filings, you should contact your states withholding tax agency for filing requirements for state and local income tax rates. Each state is different.

How Do I Calculate Payroll Taxes

Using this payroll tax calculator allows you to estimate your payroll taxes. Remember, itâs one tool for planning. Our payroll solution offers small businesses the powerful support they need, with mobile, reliable and flexible options for running payroll.

Payroll by Fingercheck calculates everything for you. Our app provides you with accurate and reliable information at the click of a button. Our automated payroll process uses internal timesheet data to calculate pay and to eliminate the risk of error with no additional input.

Our free payroll tax calculator can help you answer questions about federal and state withholding. Fingercheckâs payroll solution offers more in-depth information about such topics as federal income tax withholding or wage garnishment. Our solution can help with:

- Compliance with federal, state and municipal taxes.

- Year-end reporting and filing.

Also Check: How To Know If You Owe Federal Taxes

Check State Numbers Twice

Always double-check your employeeâs state withholding certificates as allowances and deductions can compute differently using state tax information. In Louisiana, workers claim exemptions and deductions versus allowances. A person claiming one personal exemption and one deduction and earning $800 every two weeks has $18.27 withheld. The tax tables for many states specify a dollar amount of taxation versus a percentage or dollar and percentage combination.