What Is The Tax Rate On 401k Withdrawals After Retirement

There is a mandatory withholding of 20% of a 401 withdrawal to cover federal income tax, whether you will ultimately owe 20% of your income or not. Rolling over the portion of your 401 that you would like to withdraw into an IRA is a way to access the funds without being subject to that 20% mandatory withdrawal.

Withdrawal Timing To Save Taxes

Using a tax-deferred 401 does not mean you never pay taxes, however. Participants pay taxes when they withdraw their earnings and contributions.

Taxable income often drops in retirement, potentially putting you into a lower tax bracket than you had as an employee. Money you take from a tax-deferred 401 during retirement years therefore, can get taxed at a rate lower than what you pay while fully employed.

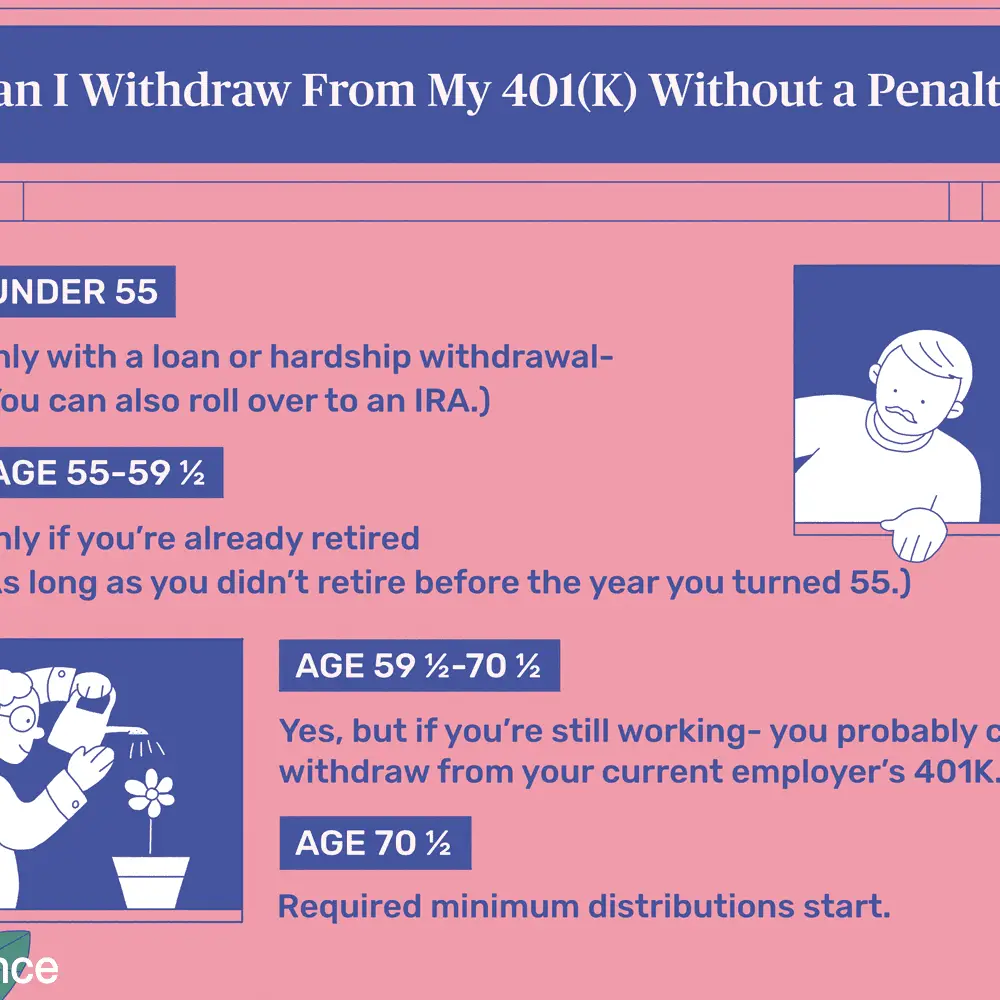

- Withdraw money early, though, and you will usually pay taxes plus a 10% penalty.

- The IRS lets you begin to withdraw without a penalty at age 59 1/2, and requires you to begin withdrawing by April 1 the year after you turn 72 or after age 70 1/2 if you attained this age prior to January 1, 2020.

What To Know About Early Withdrawals

Your 401 funds are meant to be your safety net in retirement, so taking money out before retirement isnât a great idea. But if youâre in a financial pinch, you may not have another choice. Just know you will be responsible for paying taxes on your withdrawals, even if youâre not retired yet. This will raise your tax bill for the year, though how much depends on the size of your withdrawal and how much other income you earn during the year.

If youâre under 59 1/2 when you make your 401 withdrawal, youâll also pay a 10% early withdrawal penalty unless you qualify for an exception. Exceptions include medical expenses that exceed 7.5% of your adjusted gross income , a first-home purchase, or becoming permanently disabled, among other life events. Note that these exceptions donât get you out of paying taxes on your withdrawals they only eliminate the 10% penalty.

The federal government waived the 10% early withdrawal penalty in 2020 due to the COVID-19 pandemic. It has also given people who take withdrawals in 2020 up to three years to pay that money back, rather than making them pay taxes on the full sum when they file their 2020 return. These allowances have not been extended into 2021.

Read Also: Are You Taxed On Cryptocurrency Gains

Do You Need To Deduct 401 Contributions On Your Tax Return

You do not need to deduct 401 contributions on your tax return. In fact, there is no way for you to deduct that money.

When employers report your earnings at the end of the year, they account for the fact that you made 401 contributions. To give you an example, lets say you have a salary of $50,000 and you contribute $5,000 into a 401 account. Only $45,000 of your salary is taxable income. Your employer will report that $45,000 on your W-2. So if you try to deduct the $5,000 when you file your taxes, you will be double-counting your contributions, which is incorrect.

Do You Pay Tax On 401 Contributions

A 401 is a tax-deferred account. That means you do not pay income taxes when you contribute money. Instead, your employer withholds your contribution from your paycheck before the money can be subjected to income tax. As you choose investments within your 401 and as those investments grow, you also do not need to pay income taxes on the growth. Instead, you defer paying those taxes until you withdraw the money.

Keep in mind that while you do not have to pay income taxes on money you contribute to a 401, you still pay FICA taxes, which go toward Social Security and Medicare. That means that the FICA taxes are still calculated based on the full paycheck amount, including your 401 contribution.

Don’t Miss: How Does Getting Married Affect Taxes

How To Avoid An Early Withdrawal Penalty

You can avoid the 401 early withdrawal penalty by waiting until you are 59 ½ to take distributions from your plan. The IRS also lists various situations which could exempt you from the 10% tax, such as taking an early distribution due to a qualifying disability or reducing excess contributions. Make sure to review the exemptions list to see if your situation qualifies.

Another way to avoid the 10% early withdrawal tax is to opt for a loan against your 401 account. Your loan amount won’t be taxed as a distribution as long as:

- You borrow 50% or less of your vested balance up to $50,000.

- The loan is repaid within five years .

- Your payments are substantially level.

- Payments are made at least quarterly over the life of the loan.

While 401 loans can be a good alternative, not all plan providers offer them so you’ll have to check to see if it’s an option for you.

How 401 Hardship Withdrawals Work

The IRS allows anyone to take penalty-free withdrawals if they have an “immediate and heavy financial need.” You can use the money to cover your needs or those of someone else.

You may qualify for a hardship distribution if the funds go to:

- Pay for certain medical expenses

- Buy a primary residence

- Cover college tuition, fees, room, and board

- Prevent eviction or foreclosure

- Pay for burial and funeral expenses

- Make necessary home repairs after a disaster

The amount you’re able to withdraw will be limited to the amount necessary to cover the expense.

Recommended Reading: How To Pay My Federal Income Taxes Online

What Is Required 401 Distributions Or Required Minimum Distributions

If you dont take any distributions and reach the age of 70 ½, the IRS will step in and force you to take a distribution. They are called Required Minimum Distributions . The IRSs rationale is hey time to pay up you arent getting any younger. The IRS has a schedule and they will tell you how much your minimum distribution will be. This distribution of course will be considered income and will add to your other income for the affected year.

Assuming your 401 k is traditional and not ROTH, a distribution will be taxed as income. This distribution will be added to your other income for the year and may or may not push you into a higher tax bracket. It would be prudent to seek a tax professional and do some tax planning.

Need Help with understanding Minimum Distributions ?

Taxes If You Withdraw Money In Retirement

When you withdraw money from a 401 in retirement, you will owe taxes in the year when you take the distribution. The withdrawals will be taxed as your other sources of income at your tax bracket rate. At the minimum, you will pay federal income taxes on the distribution. If you are a resident of a state that imposes state income taxes on retirement distributions, you will pay extra taxes. However, certain states don’t tax 401 distributions, and you wonât pay additional taxes.

For Roth 401 withdrawals, you wonât pay income taxes when you withdraw money in retirement, since you had already paid income taxes at the onset. You must have reached 59 ½ and have held the account for five years or more to qualify for tax-free withdrawals from your Roth 401.

If you are already 72, you must start taking the required minimum distributions from a traditional 401 and Roth 401. If you do not take the mandatory distributions, you will incur a 10% penalty on the distribution not taken.

Read Also: What Day Are The Taxes Due

How Taxes And Rmds Affect Retirement Withdrawals

Generally, your first stop for withdrawals should be RMDs from tax-deferred accounts or any account that requires a lifetime RMD. Thatâs because any RMD that hasnât been withdrawn for the year could be subject to a 50% tax penalty.3 This is where donating to charity, in other words a qualified charitable distribution , can both satisfy the RMD and avoid a taxable event.

Next, consider withdrawing from accounts that are taxable to youregardless of whether you spend or reinvest those distributions. Examples include capital gains, dividends, and interest.

For most retirees, withdrawing more than the RMD from tax-deferred accounts generally should be the last choice. This is due to the way these accounts are taxedevery dollar withdrawn from tax-deferred accounts is taxed as ordinary income.

However, if youâre in a year in which your overall income is lower than normal, or if you feel your future tax rate will go up, you may want to think differently. Consider drawing from tax-deferred money up until the point that it would push you into the next marginal tax bracket.

Update for 2020: Because of the CARES Act, which was passed in late March 2020, you can choose not to take your RMD this year, leaving your funds invested longer instead of taking a withdrawal in a volatile market.

Read Also: Who Do I Call About My 401k

Early Withdrawal Calculator Terms & Definitions:

- 401k â A tax-qualified, defined-contribution pension account as defined in subsection 401 of the Internal Revenue Taxation Code.

- Federal Income Tax Bracket â The division at which tax rates change in the federal income tax system .

- State Income Tax Rate â The percentage of taxes an individual has to pay on their income according to the laws of their state.

- Lump-sum Distribution â The withdrawal of funds from a 401k.

- Rollover â Moving the 401k contribution to another retirement fund option, often an IRA.

- Penalties â The payment demanded for not adhering to set rules.

- Future Value Before Taxes â The value of oneâs asset at the end of the term before taxes are paid.

- Future Taxes to be Paid â The taxes that are required to be paid at the end of the term.

- Future Net Available â The amount left after taxes and penalties are deducted.

- Annual Rate of Return â The percentage earned every year by having funds in an account.

You May Like: How To Transfer Roth 401k To Roth Ira

You May Like: When To File Tax Return

How Much Tax Do I Pay On 401k Withdrawal

When you withdraw funds from your 401 account, you will owe income taxes and a potential penalty. Find out how much you will owe.

One of the attractive features of a 401 plan is that it is tax-deferred, meaning that there is no tax charged on contributions, or on interest and gains earned on the retirement savings until you withdraw it. This allows individuals to contribute a bigger portion of their paycheck to their retirement savings up to the 401 contribution limit. However, you will still have to pay taxes when you withdraw money from a 401 plan.

When you make a withdrawal from a 401 account, the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made. For example, if you fall in the 12% tax bracket rate, you can expect to pay up to 22% in taxes, including a 10% early withdrawal penalty if you are below 59 ½. However, if you are above 59 ½, you will only pay income taxes on the amount withdrawn. You must file your annual tax return, reporting all the income earned during the year, including the 401 distributions, and taxes you have already paid.

Taxes Withheld From Distributions For Active Employees

When you take a distribution from your deferred compensation accounts, you will pay taxes on the distribution. The amount of tax you pay depends on several factors:

- The amount you withdraw in a calendar year, and your income in that year

- The type of Plan you have 401 or 457

- Your age and employment status

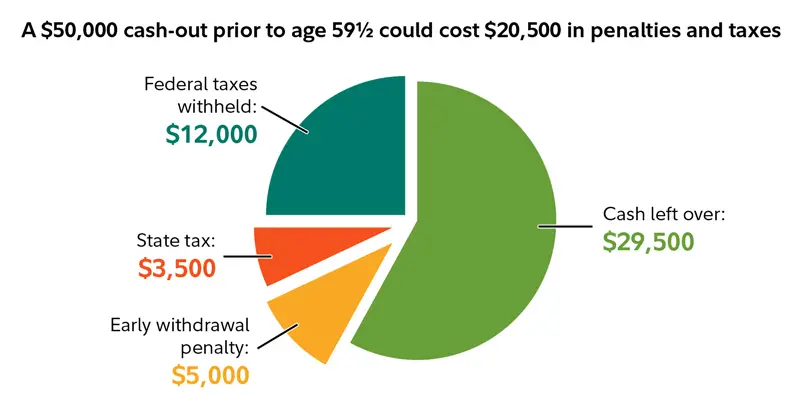

Basically, any amount you withdraw from your 401 account has taxes withheld at 20%, and if youâre under age 59½, youâll be taxed an additional 10% when you file your return.

Any amount you withdraw from your 457 account has taxes withheld at 20%. However, if you select a periodic distribution over 10 years, then only 10% is withheld for taxes.

Employees Retirement System of Texas

Also Check: What Is K 1 Tax Form

Risks Of A 401 Early Withdrawal

While the 10% early withdrawal penalty is the clearest pitfall of accessing your account early, there are other issues you may face because of your pre-retirement disbursement. According to Stiger, the greatest of these issues is the hit to your compounding returns:

You lose the opportunity to benefit from tax-deferred or tax-exempt compounding, says Stiger. When you withdraw funds early, you miss out on the power of compounding, which is when your earnings accumulate to generate even more earnings over time.

Of course, the loss of compounding is a long-term effect that you may not feel until you get closer to retirement. A more immediate risk may be your current tax burden since your distribution will likely be considered part of your taxable income.

If your distribution bumps you into a higher tax bracket, that means you will not only be paying more for the distribution itself, but taxes on your regular income will also be affected. Consulting with your certified public accountant or tax preparer can help you figure out how much to take without pushing you into a higher tax bracket.

The easiest way to avoid these risks is to resist the temptation to take an early 401 withdrawal in the first place. If you absolutely must take an early distribution, make sure you withdraw no more than you absolutely need, and make a plan to replenish your account over time. This can help you minimize the loss of your compound returns over time.

Tax Benefits For Saving

Based on your income and filing status, your contributions to a qualified 401 may lower your tax bill even more through the Saver’s Credit, formally called the Retirement Savings Contributions Credit.

- The saver’s credit directly reduces your tax by a portion of the amount you put into your 401.

- Since its introduction in 2002, this credit for retirement savings has ranged from $1,000 to $2,000.

- Eligible taxpayers calculate their credit using form 8880 and enter the amount on their 1040 tax return.

Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premier has you covered. Filers can easily import up to 10,000 stock transactions from hundreds of Financial Institutions and up to 4,000 crypto transactions from the top crypto exchanges. Increase your tax knowledge and understanding all while doing your taxes.

Don’t Miss: Where Do I Go To Pay My Property Taxes

All 401 Distributions Are Subject To Income Tax

You can avoid this additional tax penalty if you meet certain criteria, but you cannot avoid including your retirement withdrawal from your taxable income. Some distributions can be made without penalty, but these usually require a financial hardship. I will provide more information about 401 hardship-based distributions in a moment.

Quick Tip #1

Concerned about what is appearing on your credit report now? Check your credit report today and get a free credit score instantly.

Here is more information about hardship-based distributions.

How Do I Avoid Taxes On Social Security And Retirement Income

Here’s how to reduce or avoid taxes on your Social Security benefit:

Recommended Reading: Will The Irs Extend The Tax Deadline For 2021

How To Minimize Taxes On 401 Withdrawals

Now that youre finally taking withdrawals from that 401 youve been contributing to for decades, how are 401 withdrawals taxed? Withdrawalsdistributions, in retirement-plan speakrequire you to pay taxes on what you take out, in most cases, effectively reducing your nest egg. What do you do? Here are several ways to minimize taxes on withdrawals.

You May Like: What Should I Do With My Old Company 401k

Important Tax Considerations For Lump

If you choose to withdraw your STRS Ohio account, there are important tax implications.

If you choose to have your withdrawal paid directly to you:

- Your payment will be taxed in the year it is issued.

- STRS Ohio will withhold federal tax at a rate of 20%.

- If you receive the payment before age 59-1/2, you may have to pay a 10% tax penalty for an early withdrawal.

You may roll over your withdrawal amount to an eligible retirement account that will accept your rollover and:

- Your payment will not be taxed in the current year and no taxes will be withheld.

- The funds rolled over will be taxed when removed from the account to which they were deposited.

Beginning in the year you reach age 72 or terminate employment, whichever is later, a certain portion of your payment cannot be rolled over because it is a required minimum payment that must be paid to you. STRS Ohio can tell you if your payment includes amounts that cannot be rolled over.

There are other tax implications if you withdraw your STRS Ohio account. Review our brochure titled

Don’t Miss: When Should I Get My Federal Tax Return

Withdrawal Taxes And Early Distributions

You might find yourself in a situation where you need the money in your 401 before you reach 59 1/2 years of age. The account is designed to be part of your retirement plan, but circumstances come up where you cant avoid dipping into the money for other reasons. Down payments, emergency medical bills and education costs are a few examples of expenses some people pay with 401 funds.

If this is the case for you, expect to pay a 10% penalty fee. This is on top of the income tax youll pay for withdrawing the funds. Remember, even if its paying for an emergency, its still counted for tax purposes as income. Youll want to run the numbers, adding the tax and penalty tax, to see if it makes sense to pull money out early. Its also important to factor in the opportunity cost of pulling your investments out of the market.

In some cases, there is an exception to the 10% additional tax. The IRS lists the circumstances where the tax doesnt apply. Losing your job at 55, or starting a SOSEPP plan are two examples. Youll still be on the hook for income taxes, of course.

Given the tax hit and opportunity cost of early withdrawals, its not ideal solution. Before you commit to a penalized withdrawal, consider if borrowing the money from your 401 might be a better solution.