Do I Need To Bring My Passport When I Go Shopping Or Can I Have A Copy Of It

One of the most popular questions I get asked regarding the tax refund process in Paris, is do you have to carry your passport or will a copy of it work? I completely understand why you wouldnt want to carry your passport around if its not needed.

Unfortunately, for the tax refund process in Europe, you have to have your actual passport. What I highly recommend is if you plan on going shopping, get all your shopping in one day. That way, you arent carrying around your passport for multiple days.

Who Should File A Tax Return

Most U.S. citizens and permanent residents who work in the United States need to file a tax return if they make more than a certain amount for the year.

You may want to file even if you make less than that amount, because you may get money back if you file. This could apply to you if you:

- Have had federal income tax withheld from your pay

- Made estimated tax payments

- Qualify to claim tax credits such as the Earned Income Tax Credit and Child Tax Credit

How Do Tax Credits Work

A tax credit is subtracted directly from the amount of tax you owe, so it reduces your total tax liability dollar for dollar, and the value of the credit is the same for everyone who is eligible to receive it. This is different from tax deductions, which subtract from your taxable income.

The value of a tax deduction depends on your marginal tax rate, so the more income you earn, the less a deduction is potentially worth. Here are a few examples of the most common tax credits claimed by taxpayers each year.

Most Common Tax Credits

- Earned Income Tax Credit

- The earned income tax credit helps low- to moderate- income workers and families who meet certain requirements reduce their tax liability.

- Child Tax Credit

- You could increase your tax refund by thousands of dollars by claiming the child tax credit for each child you claim as a dependent. If you received an advance payment of part of your 2021 CTC under the American Rescue Plan, you can claim the rest of the CTC when you file your tax return for the 2021 tax year.

- Savers Credit

- Putting away money for retirement may entitle you to a savers credit on your tax return. If you contributed to an IRA this year, the retirement savings contribution credit will reduce your tax liability by between 10% and 50% of the amount of your contributions, depending on your income.

- Education Credits

- The IRS offers credits for qualifying education expenses, such as the American opportunity tax credit and the lifetime learning credit.

Read Also: Where Do I Find My Tax Id Number

Tax Credits For Education Expenses

Two types of tax credits, the Lifetime Learning Credit and the American Opportunity Tax Credit, provide tax benefits for qualified educational expenses for postsecondary education. The rules for these credits differ. The IRS provides a comparison chart online. It also provides an extensive list of FAQs to help you determine which credit to claim.

Layovers Where To Get Your Vat Tax Stamp

Many times, when you are traveling you wont have a direct flight, you will experience a layover, and sometimes this layover can occur in another European country. You may be wondering, Im leaving Paris, France but I have a layover in Italy, where do I scan the VAT TAX refund paperwork? Thats a great question, you would scan the VAT TAX paperwork in Paris, France before you leave and not in Italy when you land for your layover.

Read Also: How To Start My Own Income Tax Business

Can You Buy I Bonds In An Ira

Unfortunately, you can’t purchase I Bonds in your individual retirement account or in any other tax-advantaged account. You’ll need to use any available cash or your tax refund to purchase I Bonds.

Remember that the balance of your I Bond allocation will sit in your TreasuryDirect account. You must hold the bonds for at least a year, and you will lose the last three months’ worth of interest if you redeem the bonds before five years have passed since the purchase.

Send A Paper Return By Mail

If you are mailing someone elses paper return

If you prepare other peoples returns, mail each persons return in a separate envelope. However, if you file returns for more than one year for the same person, put them all in one envelope.

Don’t Miss: How Can You Pay Your State Taxes Online

If You Owe More Than You Can Pay

If you cannot pay what you owe, you can request an additional 60-120 days to pay your account in full through the Online Payment Agreement application or by calling no user fee will be charged. If you need more time to pay, you can request an installment agreement or you may qualify for an offer in compromise.

Filing A Full Tax Return

Depending on your circumstances, you may want to consider filing a full tax return. There are a few reasons to consider this option:

To file a full tax return online go to MyFreeTaxes.com.

Recommended Reading: When Do We Get Our Taxes

Earned Income Tax Credit

The earned-income tax credit is a refundable tax credit available to low-income workers. For 2021, the EITC can be claimed by any low-income worker with a dependent child. It is also available to childless, low-income workers who have a principal residence in the U.S. for more than half the year and who are 19 or older, specified students age 24 or older, or former foster youth and homeless youth age 18 or older. An individual who is claimed as a dependent on another taxpayer’s return is not eligible to claim the EITC.

The credit percentage, earnings cap, and credit amount vary depending on a taxpayer’s filing status, the number of dependent children, and their level of earned income. To be eligible, a taxpayer must have earnings but cannot have investment income in excess of $10,000 for 2021. The credit reduces the amount of tax owed on a dollar-for-dollar basis. If the amount of this credit is greater than the amount of tax that a taxpayer owes, the taxpayer may be eligible for a refund.

The maximum credits for 2021 are $1,502 for workers with no qualifying children $3,618 for one qualifying child $5,980 for two qualifying children and $6,728 for three or more qualifying children. AGI ceilings apply to the EITC. For single returns, heads of household, and widowed and married persons filing separately, the maximum AGI levels per child/dependent for the EITC are $21,430 for none $42,158 for one $47,915 for two and $51,464 for three or more.

Tax Return Filing Status

Youll also have to determine your filing status. This is important because it helps determine how much in income tax you’ll pay. You can file as:

- Single: You’ll file as a single taxpayer if you are not married and aren’t being claimed as a dependent on someone else’s tax returns. Single taxpayers are eligible for a standard deduction of $12,550 for the 2021 tax year.

- Most people who are married file in this category. This allows them to file one joint tax return. If you file under this category, your standard deduction for the 2021 tax year is $25,100.

- Married couples can also each file their own tax returns, reporting only their personal income, deductions and credits. The standard deduction for taxpayers who file this way is $12,550 for the 2021 tax year.

Also Check: What Does Payroll Tax Pay For

Benefits Of Filing A Tax Return

Get money back. In some cases, you may get money back when you file your tax return. For example, if your employer withheld taxes from your paycheck, you may be owed a refund when you file your taxes.

Avoid interest and penalties. You may avoid interest and penalties by filing an accurate tax return on time and paying any tax you owe in the right way before the deadline. Even if you can’t pay, you should file on time or request an extension to avoid owing more money.

Protect your credit. You may avoid having a lien placed against you when you file an accurate tax return on time and pay any tax you owe in the right way before the deadline. Liens can damage your credit score and make it harder for you to get a loan.

Apply for financial aid. An accurate tax return can make it easier to apply for help with education expenses.

Build your Social Security benefit. Claiming your self-employment income on your return ensures that it will be included in your benefit calculation.

Get an accurate picture of your income. When you apply for a loan, lenders will look at your tax return to figure your interest rate and decide if you can repay. If you file accurate tax returns, you may get a loan with a lower interest rate and better repayment terms.

Get peace of mind. When you file an accurate tax return and pay your taxes on time, you’ll know that you’re doing the right thing to follow the law.

Tax Deductions And Tax Credits Explained

Remember that a tax deduction reduces your taxable income, cutting your tax bill indirectly by reducing the income that’s subject to a marginal tax rate. A tax credit is a dollar-for-dollar discount on your tax bill. So, if you owe $1,000 but qualify for a $500 tax credit, your tax bill goes down to $500.

What if youre eligible for tax credits that are greater than what you owe say, $1,000 in tax credits with a $500 liability? Whether you get that $500 difference refunded to you will depend on whether the tax credits you qualify are refundable or not. Refundable tax credits go into your tax refund if they exceed what you owe. By contrast, some tax credits are nonrefundable, which means they have the power to reduce your tax liability down to zero but cant be refunded to you if they exceed your liability. Our tax return calculator will take all of this into account when figuring out what you can expect at tax time.

Recommended Reading: How To Calculate Payroll Tax Expense

Can I Claim The Eitc Child Tax Credit And Child And Dependent Care Tax Credit

Provided you meet the qualifications for these tax credits, you can claim all three to the extent that you meet the requirements. Even if you don’t owe taxes for 2021, you should nevertheless file a tax return if you qualify for any of these tax credits because all three are refundableany credit amount that exceeds your tax liability is paid to you if claimed on your tax return.

How To Get The Most Money Back On Your Tax Return

Michelle P. Scott is a New York attorney with extensive experience in tax, corporate, financial, and nonprofit law, and public policy. As General Counsel, private practitioner, and Congressional counsel, she has advised financial institutions, businesses, charities, individuals, and public officials, and written and lectured extensively.

Most taxpayers either hope to pay as little income tax as is legally possible or try to receive the most money back as a refund after filing their income tax return however, come tax season, taxpayers who have not researched how to minimize their income taxes may end up paying more in taxes than the Internal Revenue Service requires of them.

To reduce your taxable income or receive a larger refund, it’s important to consider if you’re eligible for tax deductions and tax credits and whether you should itemize when you file your income tax return. We look at each of these ways to reduce your tax bill in detail below.

Read Also: How To Determine Income Tax

Access Your Tax Refund Quickly And Safely

If you think you may receive a refund, here are some things to think about before you file your return:

- If you already have an account with a bank or credit union, make sure you have your information ready — including the account number and routing number — when you file your tax return. You can provide that information on the tax form and the IRS will automatically deposit the funds into your account.

- If you have a prepaid card that accepts direct deposit, you can also receive your refund on the card. Check with your prepaid card provider to get the routing and account number assigned to the card before you file your return.

How To Claim Tax Deductible Donations On Your Tax Return

-

In general, itemize at tax time. When you file your tax return every year, you’ll need to itemize your deductions in order to claim tax deductible donations to charity. That means filling out Schedule A along with the rest of your tax return.

-

Weigh the costs and benefits ahead of time. Itemizing can take more time than if you just take the standard deduction, and it may require more expensive tax software or create a higher bill from your tax preparer. Plus, if your standard deduction is more than the sum of your itemized deductions, it might be worth it to abandon itemizing and take the standard deduction instead. If you abandon itemizing, however, you abandon taking the deduction for what you donated.

Here are the standard deduction amounts by filing status. Again, if your standard deduction is more than the sum of your itemized deductions, it might be worth it to skip itemizing and take the standard deduction instead.

|

Filing status |

|---|

Recommended Reading: How Much Tax Should I Have Paid

Does My Child Qualify For The Eitc

If you claim children as part of your EITC, they must pass three tests to be a qualifying child:

Filing A Simple Return

To claim any recovery rebate or child tax credits that you are eligible for, you can file a simple return online by going to GetCTC.org. This online resource is both mobile friendly and available in Spanish.

Read Also: Have My Taxes Been Accepted

What Is The Vat Tax Refund Process

The VAT refund tax process in Paris, France is more simple than people initially think. The first step is to spend over 100.01 Euros in a single store or department store. The second step is to ask for the cashier for the VAT refund paperwork. Sometimes, the cashiers dont offer you the tax refund because its extra paperwork for them, so make sure to ask!

You must take your tax refund paperwork with you when you leave the EU. At the airport, you will need to go over to the detaxe section at the airport and scan your paperwork. Its important to note that the Detaxe Section at the airport is before you check in. Then finally you must drop it in the box to have it mailed off. Within 3 months, you will receive your tax refund on your credit card statement.

Simple Steps for Receiving VAT Tax Refund Traditional Method

Tax Refund Calculator: How Much Will John Get Back In Taxes

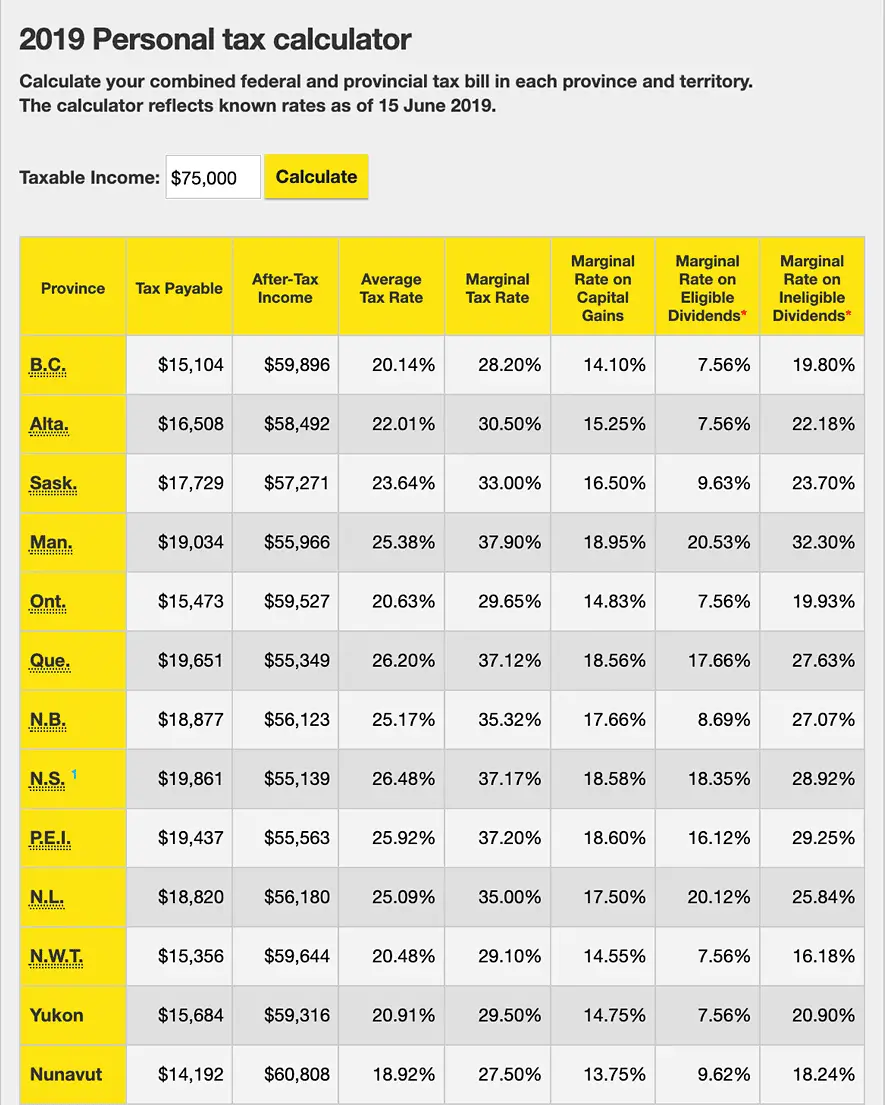

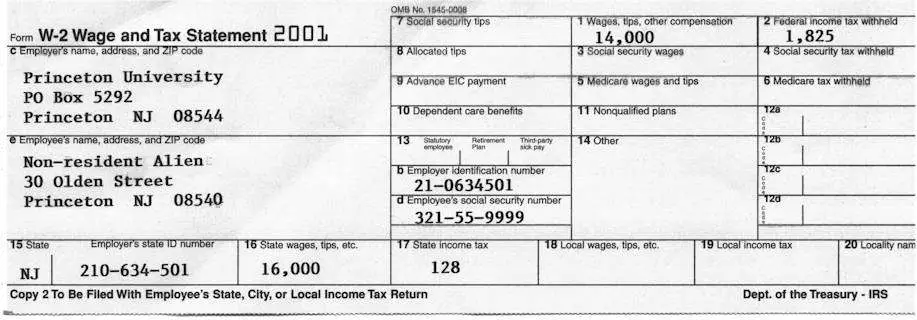

John is a single 30-year-old with no dependents. Last year, he made $75,000, withheld $15,000, and collected no government benefits.

Check out how much he could get for his 2017 tax refunds .

Subtract the red circle from the blue for the refund.

$3,105. Just about the average for tax refunds! AND with the new tax laws, he stands to get even more in his refunds in 2019 .

How about someone whos married with children?

Bonus:

Recommended Reading: How Do I Look Up My Car Taxes