How Long Will It Take My Hmrc Tax Rebate To Come

With working on your rebate claim, we’ll get it calculated, checked and on the taxman’s desk fast. to handle a typical tax refund claim, so it’s a great idea not to leave yours until the last minute. The sooner we have your information, the sooner you’ll get your tax rebate.

If you’ve missed out on claiming before, it still might not be too ate to get back what you’re owed. You can claim back overpaid tax for up to 4-years, with the tax year ticking over on the 6th April. Anything you’re still owed after 4 tax years roll by, is lost forever.

Tax Refund Calculator

Federal Income Tax Return Calculator

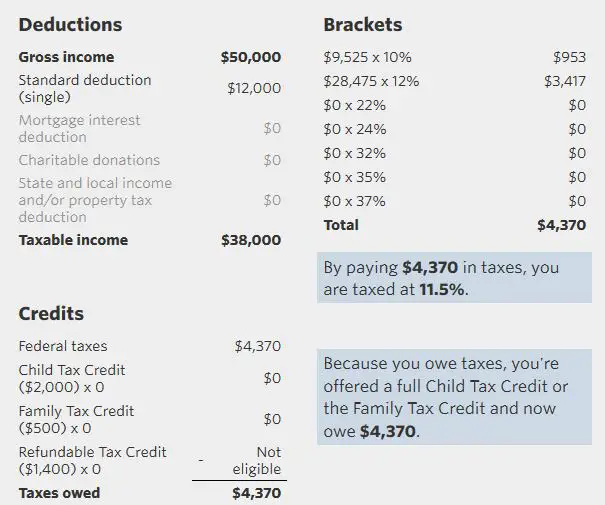

Estimate how much you’ll owe in federal taxes, using your income, deductions and credits all in just a few steps with our tax calculator.

How we got here

The United States taxes income progressively, meaning that how much you make will place you within one of seven federal tax brackets:

Single filers

|

$995 plus 12% of the amount over $9,950 |

|

|

$4,664 plus 22% of the amount over $40,525 |

|

|

$14,751 plus 24% of the amount over $86,375 |

|

|

$33,603 plus 32% of the amount over $164,925 |

|

|

$47,843 plus 35% of the amount over $209,425 |

|

|

$157,804.25 plus 37% of the amount over $523,600 |

|

$1,990 plus 12% of the amount over $19,900 |

|

|

$9,328 plus 22% of the amount over $81,050 |

|

|

$29,502 plus 24% of the amount over $172,750 |

|

|

$67,206 plus 32% of the amount over $329,850 |

|

|

$95,686 plus 35% of the amount over $418,850 |

|

|

$168,993.50 plus 37% of the amount over $628,300 |

|

$995 plus 12% of the amount over $9,950 |

|

|

$4,664 plus 22% of the amount over $40,525 |

|

|

$14,751 plus 24% of the amount over $86,375 |

|

|

$33,603 plus 32% of the amount over $164,925 |

|

|

$47,843 plus 35% of the amount over $209,425 |

|

|

$84,496.75 plus 37% of the amount over $314,150 |

Head of household

|

$1,420 plus 12% of the amount over $14,200 |

||

|

$6,220 plus 22% of the amount over $54,200 |

||

|

$13,293 plus 24% of the amount over $86,350 |

||

|

$32,145 plus 32% of the amount over $164,900 |

||

|

$46,385 plus 35% of the amount over $209,400 |

||

|

$523,601 or more |

$156,355 plus 37% of the amount over $523,600 |

Tax Refund Calculator: How Much Will Margaret Get Back In Taxes

How much does she stand to get back?

Subtract the red circle from the blue for the refund.

Uncle Sam might owe Margaret $14,465 when all is said and done. And if her situation doesnt change in 2021, her refund will actually grow to $20,584.

NOTE: Everyones tax situation is unique and any online tax refund calculator will, at best, provide you with a rough estimate of how much youll get back. The two examples above are incredibly simple and dont fully capture the nuances of someones actual financial situation.

Play around with them and be as specific as you can. The more details you can provide the better of an idea youll have of what youll receive for your refund.

So now you know roughly how much youll be getting back and youre ready to collect the money Uncle Sam owes you.

Before you hoist your Dont tread on me flag and march down to the IRS building to get your money, you should know about all the ways you can get your tax refund.

Read Also: Where To File Pa State Taxes For Free

Public Service Loan Forgiveness

Under the PSLF program, borrowers who work full-time at a nonprofit organization or government agency could have their loans forgiven after making 120 qualifying payments. Not all federal loan types qualify, and you must be enrolled in an eligible income-driven repayment plan to participate.

For more guidance, use Federal Student Aidâs PSLF help tool to search for qualifying employers and confirm your eligibility.

What It Means For Your Earnings

This Which? calculator provides an estimate of how the changes to national insurance will affect you.

As a result of ditching the levy almost 28 million people will keep an extra £330 of their money on average next year, whilst 920,000 businesses are set to save almost £10,000 on average, according to the Treasury.

Mr Kwarteng confirmed that the funding for health and social care services will be maintained at the same level as if the levy was in place, to ensure the NHS is protected through the winter and the long-term investment in social care is delivered.

Scrapping the national insurance increase will give workers back some of their pay packet above the national insurance threshold of £12,570 saving £155 a year for someone paid £25,000, £343 for a worker on £40,000, and £1,093 for anyone with a salary of £100,000.

Recommended Reading: Where Do You Go To File Taxes

Bottom Line On Tax Returns

An accurate income tax return estimator can keep you from banking on a refund thats bigger in your mind than the real refund that hits your bank account. It can also give you a heads-up if youre likely to owe money. Unless youre a tax accountant or someone who follows tax law changes closely, its easy to be surprised by changes in your refund from year to year. Use the tool ahead of time so you arent already spending money you may never see. You can also run the numbers through a tax refund calculator earlier in the year to see if you want or need to make any changes to the tax withholdings from your paycheck.

How To Estimate Your Tax Refund

More than half of all tax filers in the United States received a tax refund in 2021 for the 2020 tax year, according to the IRS. Figuring out what youll get back on your tax return can help you plan for the impact your refund will have on your personal finances. You can estimate your tax refund easily with a few key pieces of information and a bit of math.

Before diving into the math, its important to understand the difference between your tax return and your tax refund. A tax return is the form you file annually that outlines your income, expenses, investments and other tax-related information. The information on your tax return will determine whether you receive a tax refund.

You get a tax refund when you pay more taxes to your state government or the federal government than your actual tax liability. A refund is a check from the government for the amount you overpaid.

The first step in estimating your tax refund is to calculate your taxable income. Taxable income can be calculated as your gross income minus all deductions. There are two types of tax deductions: standard and itemized.

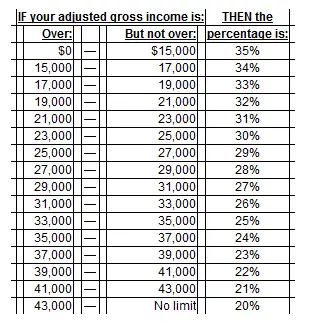

Once you find out your taxable income, the next step to estimating your refund is to apply your tax bracket. Your tax bracket determines what percent of your taxable income the government collects. So if you earn a higher income, youll pay a higher percentage of that income in taxes. That progressively increasing percentage is your marginal tax rate.

Don’t Miss: What Is The Tax In Georgia

Estimate Your Income Tax For A Previous Tax Year

Use this service to estimate how much Income Tax you should have paid for a previous tax year.

There are different ways to:

If youre self-employed, use the HMRCself-employed ready reckoner to budget for your tax bill.

You may be able to claim a refund if youve paid too much.

You need details of:

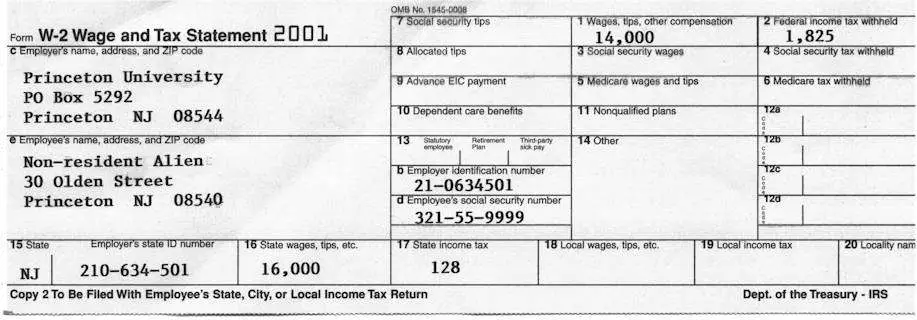

- your earnings, before and after tax – get this from your P60

- any savings – get this from your bank statements or annual statement from your bank or building society

- any Gift Aid donations youve made to charity

How To Track Your Tax Refund

Many taxpayers prefer to get their tax refund via direct deposit. When you fill out your income tax return youll be prompted to give your bank account details. That way, the IRS can put your refund money right in your account, and you wont have to wait for a check to arrive in the mail.

If you file your taxes early, you dont have to wait until after the tax deadline to get your tax refund. Depending on the complexity of your tax return, you could get your tax refund in just a couple of weeks. To get a timeline for when your refund will arrive, you can go to www.irs.gov/refunds. You can check the status of your refund within 24 hours after the IRS notifies you that it has received your e-filed tax return .

In a given tax year, you may want to know how big your refund will be so you can plan what to do with it. You may want to use it to boost your emergency fund, save for retirement or make an extra student loan or mortgage payment.

Also Check: How To Become Tax Exempt

H& r Block Tax Refund Calculator

An increasing number of people are turning to H& R Block to get their income tax prepared and filed every year. Their user-friendly tax tools take all the hard work and stress out of tax form preparation and will always get you the largest refund.

One popular tool is the H& R Block Tax Refund Calculator. This online calculator will help you see what amount you can expect back in your tax refund.

Just answer a few simple questions about your life, income, W2, and expenses, and our free tax refund estimator will give you an idea of how much youll get as a tax refund.

H& R Block has been helping Americans with their taxes since 1955. Their online tax software is rated #1.

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Also Check: How Do I Calculate My State Taxes

How Much Student Loan Debt Can Be Forgiven

If you meet the income criteria and owe money on federal student loans, youâre eligible for $10,000 in student loan forgiveness, or up to your existing loan balance, whichever is less. If you also received a Pell Grant along with your student loans, youâre eligible for up to $20,000 in loan forgiveness.

Tax Refund Calculator: How Much Will John Get Back In Taxes

John is a single 30-year-old with no dependents. Last year, he made $75,000, withheld $15,000, and collected no government benefits.

Check out how much he could get for his 2017 tax refunds .

Subtract the red circle from the blue for the refund.

$3,105. Just about the average for tax refunds! AND with the new tax laws, he stands to get even more in his refunds in 2019 .

How about someone whos married with children?

Bonus:

Don’t Miss: Are There Tax Credits For Solar Panels

Estimate Again Once Time Has Passed

Anytime something changes with your tax situation, you may want to come back to the calculator again. This will ensure that you are always on the right track financially. The more often you estimate your taxes, the better prepared you can be when it comes time to file.

Tax laws change throughout the year, but you can make sure that you are prepared using a tax calculator. By utilizing a tax refund calculator, you can have peace of mind knowing that your tax refund will be the best one possible.

Are Tax Calculations Only Based On Earnings

No. In fact, there are quite a few things that can affect the tax you owe each year. Here are just a couple of examples.

- , for married couples where one spouse was born before the 6th of April 1935. Couples born after would use Marriage Allowance instead, where one spouse transfers part of their Personal Allowance to the other. This can be useful if either of you isnt getting the full benefit of your Personal Allowance.

- Registered blind people can get a boost to the tax-free portion of their income, on top of their normal Personal Allowance.

How much tax you owe can also change according to the NICs or Student Loan payments youre making, or if youre earning any money overseas. The tax rules are different, for instance, for people working abroad for foreign employers than for full-time UK workers.

The other things you need to know about are your . Your tax code is a string of numbers and letters that HMRC uses to work out your tax calculations. Tax codes cover your Personal Allowance and any special circumstances affecting your tax situation. Its really important the make sure your which is why RIFT will always check it for you and get it fixed if its wrong.

If youre making any salary sacrifices in order to get benefits from your boss, the tax you owe can be affected. The same goes for any contributions youve made to a pension plan. Its always worth double-checking on details like these, so RIFT takes special care with them.

Construction

Recommended Reading: How Do I Pay My State Taxes In Missouri

Don’t Use This Tool If:

- You have a pension but not a job. Estimate your tax withholding with the new Form W-4P.

- You have nonresident alien status. Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens.

- Your tax situation is complex. This includes alternative minimum tax, long-term capital gains or qualified dividends. See Publication 505, Tax Withholding and Estimated Tax.

Who Cannot Get An Estimate Online

You cannot get an estimate online if you:

- are entitled to claim

- were born on or before 5 April 1938 and get the higher allowances

- have other taxable income, for example from dividends and trusts

- are a higher rate taxpayer and want to estimate your Gift Aid tax relief

You can check youve paid the right tax by contacting HMRC or by getting help from an accountant.

Recommended Reading: How Much Will My Mortgage Be With Taxes And Insurance

Work Mileage And Tax Rebates

Travel to temporary worksites is one of the main reasons why people end up being owed tax rebates each year. Our quick and simple will give you an instant estimate* of how much you can claim back from HMRC for your work travel.

The basic system works like this: HMRC has decided on a set of for essential work travel. If youre footing the bill for public transport or travel in your own vehicle to a temporary workplace, the taxman says you can be reimbursed up to the appropriate AMAP rate. If youre getting nothing toward your travel from your employer, or getting less than the AMAP rate you qualify for, you can claim back the difference as a tax rebate.

Cars and vans:

- 45p per mile for the first 10,000 miles.

- 25p per mile after that.

Motorcycles:

Tax Refund Calculations

Our Other Tax Refund Calculators

Tax Rebate Services has produced multiple tax refund calculators to help support you on your tax rebate journey and they are all completely free to use. The calculators cover many of the popular subjects surrounding refunds and taxpayers who overpay income tax.

Tax refund calculators by Tax Rebate Services:

After you have used our refund calculators you will be given more information on each subject to guide you through the next steps.

You May Like: Is The Tax Assessment The Value Of The Property

Benefits Of Filing Jointly As Married Spouses

Spouses usually choose to file their taxes jointly once married. The following are examples of some benefits that come with filing jointly:

Taxbackcom Reviews & Feedback

- BaskaranGreat Support, Very kind, High quality Professional interaction. Please keep doing the great work. Dedicated self service portal area to upload documents. Would appreciate if declaration as well could maintained online or support offline PDF document with save option at initial stage to estimate refund instead of sending out hard copies to avoid corrections.

18 February 2022

- Eamonn KeoghThis is a very good service. The Taxback team made it very easy and uncomplicated for me to access my tax back.

14 February 2022

- Eoin KelleherTaxback.com and Nina Velikova are excellent in pursuing all your overpaid taxes – I can’t recommend them enough for their professionalism and expert help.

02 February 2022

- Mattia FiorentiniNot so fast service due to Xmas holiday but professionalism is one of their point and they respect it.

10 January 2022

- Excellent!They make everything easy taking care of the whole process. Really great service. Trustworthy.

01 January 2022

- Ron BritI was thankful to the one who assisted me as I process my tax refund. It was a great service. Keep it up

18 December 2021

Also Check: When Is The Last Day To Do Your Taxes