Federal Income Tax In Florida

Floridians low tax burden is due to the absence of an income tax, making Florida one of seven states without an income tax. Even though Floridians pay federal income taxes, the Florida constitution prohibits this tax.

Depending on your filing status, you pay federal income tax at a rate of 22% on your taxable income.

You can deduct the most common personal deductions to lower your taxable income. The total value of these deductions cannot exceed $6,100 for single filers and $12,200 for married filing jointly.

Recommended Reading: When Do I Need To File My Taxes By

Overview Of Georgia Taxes

Georgia has a progressive income tax system with six tax brackets that range from 1.00% up to 5.75%. Peach State residents who make more money can expect to pay more in state and federal taxes. There are no local income taxes in Georgia.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

How You Can Affect Your Ohio Paycheck

If you want a bigger Ohio paycheck, there are several steps you can take. For starters, you can fill out a new W-4 form so that you can adjust your withholdings. This can decrease the amount your employer withholds and thus make each paycheck bigger. Just remember that you might have a bill during tax season if you dont withhold enough throughout that year. Another option to increase the size of your Ohio paycheck is to seek supplemental wages, such as commissions, overtime, bonus pay, etc. The tax withholding rate on supplemental wages is a flat 3.5%.

On the other hand, you may want to shrink the size of each paycheck for tax reasons. If youre getting a big tax bill every year, you might want to fill out a new W-4 form and request additional withholding. You can also specify a dollar amount to withhold from each paycheck in addition to what your employer is already withholding. There is a line on the W-4 where you can write in any additional withholding you want. If youre unsure how much to write in, use the paycheck calculator to get an idea of what your tax liability is. The end result of requesting an additional withholding is receiving smaller paychecks, but you may have a smaller tax bill or even a refund come tax season.

You May Like: How To Get Maximum Tax Deductions

How Your Paycheck Works: Fica Withholding

In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act. Your FICA taxes are your contribution to the Social Security and Medicare programs that youll have access to when youre a senior. Its your way of paying into the system.

FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2022 is $147,000 . So any income you earn above that cap doesnt have Social Security taxes withheld from it. It will still have Medicare taxes withheld, though.

There is no income limit on Medicare taxes. 1.45% of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1.45%. If you make more than a certain amount, you’ll be on the hook for an extra 0.9% in Medicare taxes. Here’s a breakdown of these amounts for tax years 2022 and 2023:

- $200,000 for single filers, heads of household and qualifying widows with dependent children

- $250,000 for married taxpayers filing jointly

- $125,000 for married taxpayers filing separately

What Is The Percentage Of Federal Income Tax Withheld

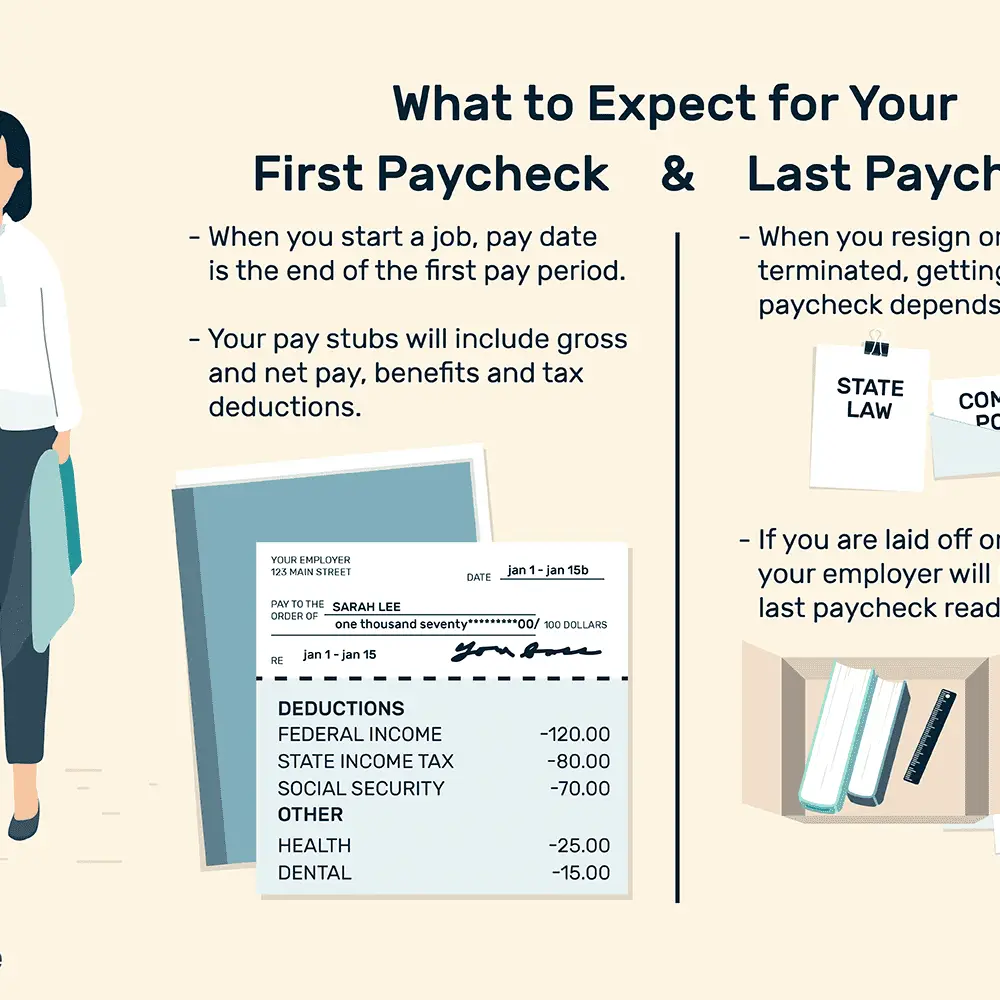

As an employer, you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal, state, and local tax authorities.

To calculate how much of your employeeâs federal income tax to withhold, youâll need a copy of their Form W-4, as well as your employeeâs gross pay.

Your next step is to determine the method you want to use to calculate withholding. Most employers have two options: the Wage Bracket Method or the Percentage Method. While not exactly simple, the wage bracket method is the more straightforward approach to calculating payroll tax.

You May Like: What Is The Corporate Tax Rate

You Can Outsource Payroll Tax

Payroll tax is complex. The calculations are nitpicky, and the penalties are steep. Even paying payroll taxes just a day late comes with a 2% penalty on the amount due, with that penalty rising as high as 15% for past due payroll taxes.

If youâd rather not deal with the stress, we highly recommend outsourcing your payroll to a company like Gusto. Theyâll take the headache out of everything from paying your employees the right amount at the right time to handling pesky withholding calculations and payroll taxes. Whenever you need to check your records, youâll have automatically generated pay stubs to review with all the essential information.

Read Also: Penalty For Missing Tax Deadline

How To Calculate Withholding Tax: A Simple Payroll Guide For Small Business

Small businesses need to calculate withholding tax to know how much money they should take from employee paychecks to send to the Internal Revenue Service to cover tax payments.

Employers calculate withholding tax by referring to an employees Form W-4 and the IRSs income tax withholding table to determine how much federal income taxes they should withhold from the employees salary or wages.

There are two main methods small businesses can use to calculate federal withholding tax: the wage bracket method and the percentage method.

To calculate withholding tax, youll need the following information:

- Your employees W-4 forms

- The IRS income tax withholding tables and tax calculator for the current year

Small business owners should learn how to calculate withholding taxes to make sure employees are being taxed at the correct rate.

These topics take you through how to calculate withholding tax:

In this article, well cover:

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

Recommended Reading: Is Social Security Taxed Federally

Reasons Why You Might Not Have Paid Federal Income Tax

Now we know that federal taxable income is quite important and that youll have to pay it if you wish to help with the flourishing of the country. This makes it even more confusing when you are not asked to pay for it. Here are the most common causes why that might happen:

- You Didnt Earn Enough

- You Are Exempt from Federal Taxes

- You Live and Work in Different States

- Theres No Income Tax in Your State

- There Has Been a Payroll Error

Each of these reasons is explored in more detail below.

Using A Paycheck Calculator

The IRS offers a withholding calculator so taxpayers can ensure they have the correct amount of tax taken out of their paychecks. If you have too much tax taken out of your paycheck, you will receive a refund, but in the meantime, youre giving the government an interest-free loan. If you have too little tax withheld, youll end up having to send the IRS a check when you file your taxes and for many people, thats a true hardship.

Dont Miss: Will The Stimulus Checks Be Taxed

You May Like: How Much Is Tax In Washington State

Why Was No Federal Income Tax Withheld From My Paycheck

If you don’t see federal income tax being taken out of your paycheck, it is either because your employer considers you an independent contractor, meaning you will receive a 1099 and likely be required to pay quarterly estimated taxes or you claimed exemption from federal income taxes e.g. you do not expect to have a tax liability for the current year.

How To Determine Gross Pay

For salaried employees, start with the person’s annual salary divided by the number of pay periods. For hourly employees, it’s the number of hours worked times the rate .

If you are not sure how to pay employees, read this article on the difference between salaried and hourly employees.

Here are examples of how gross pay for one payroll period is calculated for both salaried and hourly employees if no overtime is included for that pay period:

Let’s say your employee makes an annual salary of $30,000. This salary is divided by the number of pay periods in the year to get the gross pay for one pay period. If you pay salaried employees twice a month, there are 24 pay periods in the year, and the gross pay for one pay period is $1,250 .

An hourly employeeis paid at an hourly rate for the pay period. If an employee’s hourly rate is $12 and they worked 38 hours in the pay period, the employee’s gross pay for that paycheck is $456.00 .

Don’t Miss: How Much Medicare Tax Is Withheld

What Are Federal Taxes

Federal taxes are the taxes withheld from employee paychecks. These taxes fall into two groups: Federal Income Tax and . Federal Unemployment Tax Act is another type of tax withheld however, FUTA is paid solely by employers.

For employees, there isnt a one-size-fits-all answer to, How much federal tax is taken out of my paycheck? However, free online tax and learning how payroll taxes work helps understand what take-home pay may look like.

Yukon Indexing For 2022

For 2022, the Yukon income thresholds, the personal amount, and the Canada employment amount have been changed based on changes in the consumer price index.

The indexing factor for January 1, 2022, is 2.4%. The tax credits corresponding to the claim codes in the tables have been indexed accordingly. Employees will automatically receive the indexing change, whether or not they file Form TD1YT, 2022 Yukon Personal Tax Credits Return.

Don’t Miss: How To Restart Taxes On Turbotax

The Irs Is Changing Paycheck Withholding Rules: Whats Next

Most taxpayers will appreciate the 2020 W-4 changes. The new form allows you to include additional sources of income. Equally as important, a company is required to withhold payroll taxes for your side earnings.

Additionally, working individuals may receive a larger paycheck when they add childcare allowances and an expanded standard deduction to their W-4s.

However, all of this means that you should keep a close eye on your annual refunds, which will most likely change.

Firstly, to enjoy these advantages, employees must file the new W-4 this year. Otherwise, a company is required to withhold payroll taxes for workers based on past W-4 submissions. These are outdated in comparison to the recently-overhauled tax code.

Sure, filling out a new form may seem like a time consuming process. In the short term, it is certainly easier to use the previous document.

Yet by taking a few hours to redo your W-4 for the entire year, you could bring home several hours worth work each week. Equally as important, you dont need to update the same form in the future if your expenses stay the same.

Read Also: Which Pages Of Tax Return To Print

Overview Of California Taxes

California has the highest top marginal income tax rate in the country. Its a high-tax state in general, which affects the paychecks Californians earn. The Golden States income tax system is progressive, which means wealthy filers pay a higher marginal tax rate on their income. Cities in California levy their own sales taxes, but do not charge their own local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Don’t Miss: Are Estate Planning Fees Tax Deductible

Illinois Median Household Income

| 2011 | $53,234 |

On the state level, you can claim allowances for Illinois state income taxes on Form IL-W-4. Your employer will withhold money from each of your paychecks to go toward your Illinois state income taxes. Illinois doesnt have any local income taxes.

If you have more than one job, youll need to split your allowances between your jobs. Let’s say you have two jobs. You cant claim the same allowances with more than one employer in a single tax year. An alternative is to divide your allowances between the two jobs on the Form IL-W-4 you give to each employer, or you could claim all your allowances with one job and none with the other. If you double-claim allowances while holding more than one job, youll owe more money at tax time.

A financial advisor in Illinois can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

If you are thinking of taking a new job and moving to Illinois, check out our Illinois mortgage guide for the ins and outs of getting a mortgage in the Prairie State.

Which Provincial Or Territorial Tax Table Should You Use

Before you decide which tax table to use, you have to determine your employee’s province or territory of employment. This depends on whether or not you require the employee to report for work at your place of business.

If the employee reports for work at your place of business, the province or territory of employment is considered to be the province or territory where your business is located.

To withhold payroll deductions, use the tax table for that province or territory of employment.

If you do not require the employee to report for work at your place of business, the province or territory of employment is the province or territory in which your business is located and from which you pay your employee’s salary.

For more information and examples, go to Chapter 1, “General Information” in Guide T4001, Employers’ Guide Payroll Deductions and Remittances.

Also Check: When Do I Pay Taxes As An Independent Contractor

Don’t Overpay The Irs By Having Too Much Tax Withheld From Your Paycheck

The United States has a “pay as you go” federal income tax. This means you must pay your income taxes to the IRS throughout the year, instead of paying the whole amount due on April 15. If you’re an employee, this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to the IRS.

The average taxpayer gets a tax refund of about $2,800 every year. This is because they have too much tax withheld from their paychecks.

In effect, taxpayers who get refunds are giving the IRS an interest-free loan of their money. Nevertheless, many taxpayers like getting refunds. Indeed, there were widespread complaints when many taxpayers received smaller refunds for 2018 than in past years because the IRS recalculated their withholding to take into account the changes brought about by the Tax Cuts and Jobs Act.

If you like getting a refund, go ahead and overpay your withholding. Some people view this as a form of forced savings. However, you’ll be better off if you don’t have too much tax withheld. Ideally, your withholding should match the actual amount of tax you owe for the year. This way you’ll have more money in your pocket each month.

The amount of income tax your employer withholds from your regular pay depends on two things:

- the amount you earn, and

- the information you give your employer on Form W4.

Tax preparation software can also calculate your withholding.

Where Does All That Money Go

Federal income tax is the governments biggest source of revenue. It is used to pay the countrys ongoing expenses, such as national defense, infrastructure needs, social assistance programs, and paying interest on the national debt.

Many people are surprised to learn that all of the income you make is not taxed at one rate. Lets say you are the single filer in the example above, earning $41,600 per year. Your income falls into the 22% tax bracket. But, if you paid a flat 22% tax rate, you’d owe $9,152. Yikes. What gives?

Federal income taxes are paid in tiers. For a single filer, the first $9,875 you earn is taxed at 10%. The next $30,249 you earn–the amount from $9,876 to $40,125–is taxed at 15%. Only the very last $1,475 you earned would be taxed at the 22% rate. This IRS Tax Table can help you figure out how much federal income tax you owe.

Read Also: How To Make Tax Return