Why Is It Important To Have Accurate Paychecks

Having accurate paychecks isnt just important for employees. Its an essential part of operating your business legally. Fail to pay employees fairly under federal, state, or local laws, and you may find yourself facing thousands of dollars in fines. Underpaying employee overtime is one of the most common labor law violations businesses commit. If you live in California, New York, or Texas, where local laws go beyond federal requirements, youll want to be especially diligent.

Us Federal Income Tax Brackets And Other Information

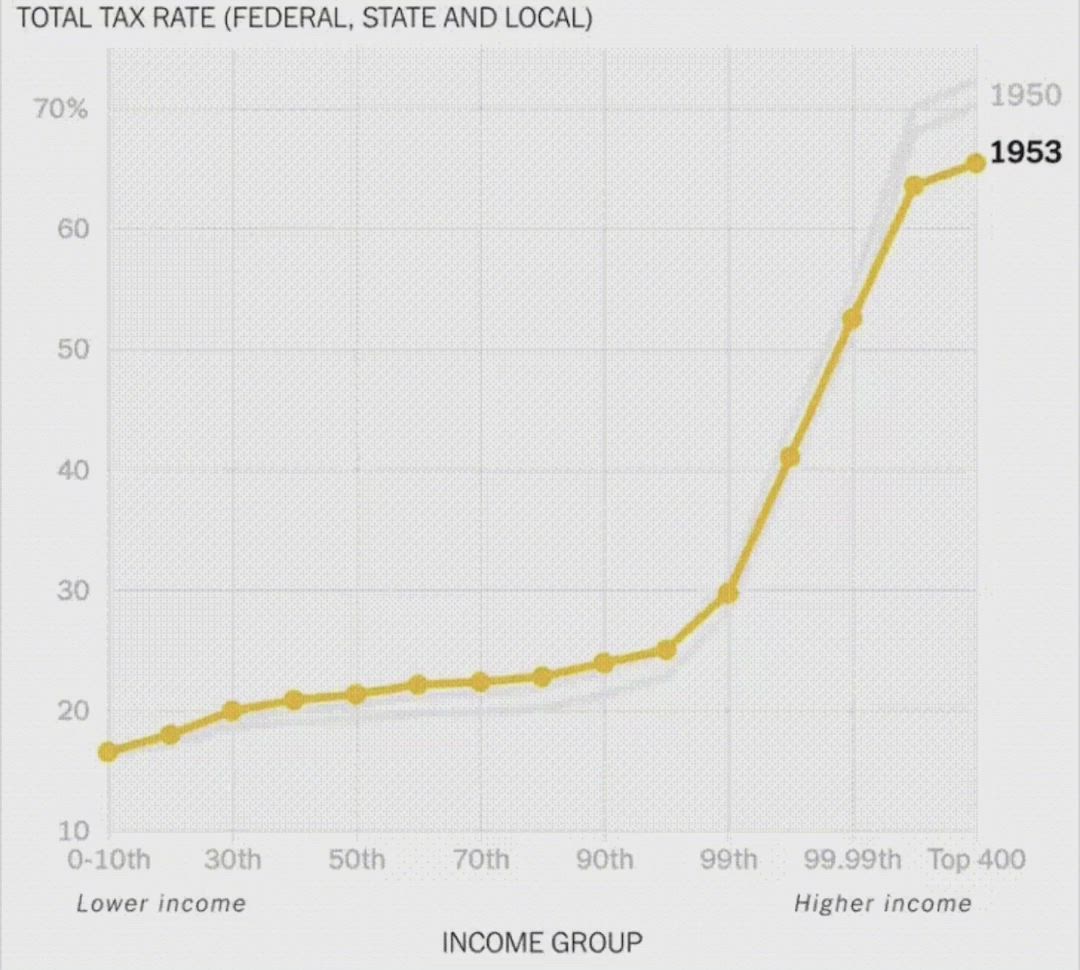

The personal income tax system in the United States is a progressive tax system. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Federal tax rates range from 10% to 37% with each bracket being shifted slightly depending an individual’s filing status.

Take Your 2019 Standard Deduction

North Carolinas flat tax rate for 2018 is 5.49 percent, and standard deductions were $8,750 if you filed as single, and $17,500 if you were married and filing jointly. However, 2019 brought an increase of standard deductions to $10,000 for single taxpayers, and $20,000 for married couples filing jointly.

Recommended Reading: How Do I File My Missouri State Taxes For Free

Add The Employees Pay Information

You should see fields that say pay type, pay rate, hours worked, pay date,and pay period. Start with pay type and select hourly or salary from the dropdown menu.

If the employee is hourly, input their hourly wage under pay rate, and fill in the number of hours they worked that pay period. If the employee worked more than 40 hours, and thus accrued overtime, record 40 here and save the rest for additional pay.

If the employee is salaried, both the pay rate and hours worked fields will disappear. Instead, youll need to know how much the employee makes each pay period. Youll put that into the field labeled amount.

Then select the pay date and the employees pay frequencyor, rather, if you pay them weekly or every two weeks.

How Your South Carolina Paycheck Works

The reason your paychecks never quite add up to your quoted salary or hourly rate is that your employer withholds some money to pay for taxes. No matter which state you work in, you will need to pay FICA taxes and federal income taxes.

FICA taxes include Social Security and Medicare taxes. Each pay period, 6.2% of your income goes toward Social Security taxes and 1.45% toward Medicare. Your employer matches those amounts so that the total contributions to FICA taxes are double what you pay. If you have income in excess of $200,000 you will also need to pay a Medicare surtax of 0.9%. Your employer does not match this surtax.

While employers usually cover half of workers FICA taxes, you might find yourself responsible for paying the entire sum if you are self-employed or a contract worker. Luckily, if you do have to pay the full FICA taxes, you may be eligible to receive the employer portion in return via a tax deduction. If you’re seeking further guidance with minimizing your tax burden while maximizing your earnings, its always helpful to talk with a financial advisor.

Read Also: How To Calculate Fuel Tax

Hws Will Help You Do The Right Thing

HWS knows that most families want to pay their household employees legally and ensure that the employee receives workers compensation and unemployment insurance protections. You also want to establish a principled relationship with your employee who is caring for and interacting with precious family members. Getting the relationship started on the right footing, including complying with legal and tax formalities, helps set the tone for the relationship.

Calculate And Subtract Federal Taxes:

Once you have determined the taxable wages, it’s time to deduct Federal Income taxes for the Taxable wages.

IRS requires the employers to withhold federal income tax from the employee’s paycheck, according to the details provided by the employee on Form W-4. The employee fills this form at the start of the job. The form includes all the necessary information, including income, number of allowances to claim, number of dependents, amount of additional taxes to deduct, and much more.

The employees are required to keep their Form W-4 up to date with all their current information, especially marriage, divorce, or child’s birth.

The federal income tax is charged according to the tax brackets in which the taxpayer’s income falls. The latest income tax brackets and rates are as follow:

| 37% |

Read Also: What Will My Tax Return Be

North Carolina Median Household Income

| 2011 | $43,916 |

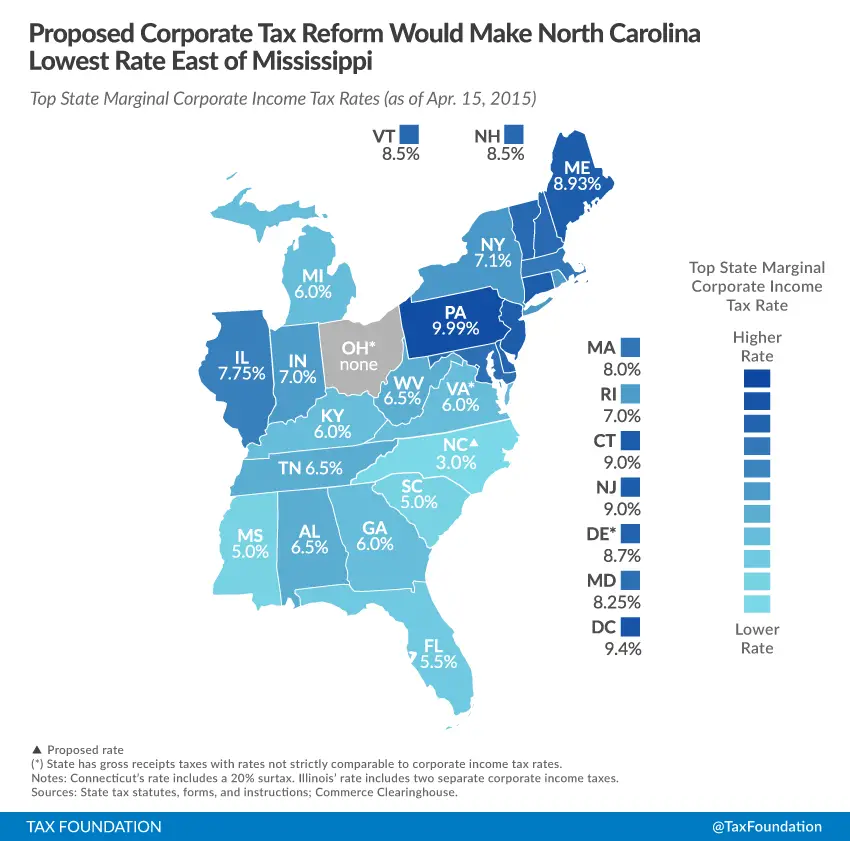

Every taxpayer in North Carolina will pay 5.25% of their taxable income for state taxes. North Carolina has not always had a flat income tax rate, though. In 2013, the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. The act went into full effect in 2014, but before then, North Carolina had a three-bracket progressive income tax system, with rates ranging from 6% to 7.75%. The new law introduced a single flat rate of 5.8% and more than doubled the standard deduction for North Carolina taxpayers.

No cities in North Carolina levy local income taxes.

A financial advisor in North Carolina can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial planning including retirement, homeownership, insurance and more to make sure you are preparing for the future.

Read Also: When Is An Estate Tax Return Required

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Also Check: What Is Tax Deadline 2021

The State Of South Carolina

South Carolina is the southern part of the original land grant created by King Charles I of England in 1629 and was named in his honor along with North Carolina. South Carolina was settled by the English in 1670 and was based on a plantation culture with a wealthy society that depended on manual labor. Eventually, the two carolina colonies split up into north and south sections in 1729. South Carolina went on to become one of the original 13 colonies. One interesting historical aspect is that the Civil War began after Fort Sumter was attacked in the harbor of Charleston.

There are still some features of the South of the pre-Civil War days present in the state. Some come in the form of eloquent buildings that were built before the war that are still standing in Charleston, Beaufort, and other cities while some come in the form of large plantations in parts of South Carolina that were once the center of the economy. However, South Carolina has transformed into a growing research center and banking state. The state also has mountains, seashores and many other historic sites that make it an ideal destination.

Accrued Paid Time Off

If there are no company policies in place, the employer is required to pay employees for accrued time off upon termination of employment .

Earned time off cannot be forfeited unless the employer has a written forfeiture clause in its company policies under N.C.G.S. 95-25.13. This means that if your company handbook or policies manual does not specifically state what happens with accrued paid time off, you are liable to pay it upon termination.

Recommended Reading: How To File Taxes With Retirement Income

Federal Insurance Contributions Act

Also known as paycheck tax or payroll tax, these taxes are taken from your paycheck directly and are used to fund social security and medicare.

For example, in the tax year 2020 Social Security tax is 6.2% for employee and 1.45% for Medicare tax.If your monthly paycheck is $6000, $372 goes to Social Security and $87 goes to Medicare, leaving you with $6000 $372 $87 = $5541

Social Security

Garnishment Limits For Unpaid Taxes

The federal government can garnish your wages if you owe back taxes, even without a court judgment. The weekly exempt amount is based on the total of the taxpayer’s standard deduction and the aggregate amount of the deductions for personal exemptions allowed the taxpayer in the taxable year in which such levy occurs. Then, this total is divided by 52. If you don’t verify the standard deduction and how many dependents you would be entitled to claim on your tax return, the IRS bases the amount exempt from levy on the standard deduction for a married person filing separately, with only one personal exemption. ).

States and local governments might also be able to garnish your wages to collect unpaid state and local taxes. Contact your state labor department to find out more.

Don’t Miss: How To File Your Taxes For The First Time

Withhold State Payroll Taxes:

As you are done with Federal Payroll Taxes, now it’s time to discuss State Payroll Taxes. The South Carolina State charges State Income Tax on the employees. Moreover, employers are required to pay State Unemployment Insurance Tax.

State Income Tax:

South Carolina follows a progressive income tax system, having six tax brackets dependent on income level and regardless of filing status and a rate ranging from 0.00% to 7.00%. Moreover, Supplemental Wages and Bonuses can be charged at a flat rate of 7.00%.

The employer withholds this tax from the employee’s paycheck according to the details provided by the employee in the Form W-4. This form is filled by the employee while joining the job. Employees are required to keep the form updated with any significant life events like marriage, child’s birth, and divorce.

| All Filers |

| 7.00% |

State Unemployment Insurance Tax

The State Unemployment Insurance Tax is an employer-funded program that provides temporary income to unemployed workers who have lost their job without fault of their own.

The state doesn’t charge in South Carolina State Disability Insurance tax on employers. However, it does require the employers to pay South Carolina State Unemployment Insurance tax, at the rate ranging from 0.06% to 5.46% on a first $14,000 earned in wages by each employee in a year. However, new employers are given relief as they only have to pay a flat rate of 0.55%.

Note:

Use An Income Tax Calculator

If you dont itemize your deductions, figuring out how much state income tax North Carolina will withhold from your paychecks is pretty straightforward. For the 2018 tax year meaning taxes filed in 2019 multiply your gross pay by 0.05499. However, if you itemize deductions you can avail yourself of one of the numerous tax calculators available online, just be sure you are using a North Carolina income tax calculator and that its for the year that you want to calculate.

The more boxes you have to fill in on the pay calculator, the more accurate the result will be. A North Carolina income tax calculator that includes boxes for your federal, state and local allowances and the ZIP code where you work is going to be more accurate than one that just requires the amount of your pay and your filing status.

References

Writer Bio

You May Like: How Much Money To Do Taxes

The Basics Of Wage Garnishment In South Carolina

As a South Carolina resident, you may have heard of the concept of having your wages garnished. Wage garnishment is a process some creditors use to force you to pay them back when you fall in arrears on your debts. During this process, a court orders your employer to withhold a certain portion of your paycheck. The portion of your paycheck withheld is sent to your creditors to be applied towards your debt. Since this is a common debt collection process, it is important to understand the basic rules of it, should you find yourself in this situation.

Garnishment generally prohibited

South Carolina is unique in that it has tight restrictions on wage garnishment. In general, South Carolina law prohibits most private parties from garnishing your wages for consumer debt. As a result, most creditors cannot seek garnishment of your wages for , purchases of goods on store credit, cash advances and other forms of consumer debt.

However, this restriction on wage garnishment does not mean that creditors cannot collect debts against South Carolina residents. Instead of wage garnishment, creditors can employ other tactics including garnishment of non-wage income, writs of execution and liens.

However, there are exceptions

Although there are tight rules regarding wage garnishment in South Carolina, the law does not protect against all forms of wage garnishment. There are three commonly encountered instances where your wages can be garnished without a court judgment:

Running Payroll In North Carolina: Step

Step 1: Register your business on the federal level. To register your business for withholding and unemployment taxes in North Carolina, you must have a Federal Employee Identification Number . Although its not required, we also encourage you to enroll in the Electronic Federal Tax Payment System , making it easy to pay your federal taxes online or over the phone.

Step 2: Obtain a Withholding Identification Number from the North Carolina Department of Revenue. Each new employer paying wages in North Carolina must register for a Withholding Identification Number by filling out a Form NC-BR and submitting it to the North Carolina Department of Revenue.

Step 3: Register for Unemployment Tax with the North Carolina Division of Employment Security . Your small business must register with the NC DES. Once registered, youll be issued a North Carolina unemployment insurance number automatically.

Step 4: Set up your payroll process. Established businesses may already have a payroll process in place, but a new company will need to begin with considerations such as how often employees will be paid, when they will be paid, and how hourly employees work time will be calculated. You can elect to do payroll yourself, set up an Excel payroll template, or use a payroll service.

Step 5:Collect employee paperwork. To run payroll you will need to collect specific information from each employee:

You May Like: How Much Does H& r Block Charge To Do Your Taxes

South Carolina Gas Tax

The state collects a gas excise tax of just 26 cents. This rate is middle-of-the-pack on a national scale, but be advised that its on its way up. The state will raise the tax two cents every year until it reaches 28 cents in July 2022. That higher rate will put South Carolinas gas slightly above the national average.

- Before being known as the Palmetto State, South Carolinas nickname was the Iodine State. The current nickname refers to the state tree, while the former refers to the large amount of iodine found in the states vegetation.

- Fort Sumter, in Charleston Harbor, is the site of the first shots fired during the American Civil War. They began the Battle of Fort Sumter on April 12, 1861.

Things You Must Know Before Moving To South Carolina

Before you grab and pack your stuff for moving to South Carolina, there are several factors that you should consider about the Palmetto State:

Cost of Living

Living in South Carolina is affordable overall. The housing cost is significantly lower than the national average, while health and utilities are relatively expensive. The cost of living index for SC is 88.5 points, whereas the national index is 100 points.

Cost of Housing

Owning and renting a house in South Carolina is quite affordable. The median home value in South Carolina is $170,100 compared to a national average of around $231,200. Moreover, the median rent price in the state for a single bedroom is $780, and for a double bedroom is $936. However, cost varies depending on the city and location. The cheapest places to live in South Carolina include Dillon, Fountain Inn, Bennettsville, and Mauldin.

Education

Unfortunately, statistics for quality education in South Carolina aren’t satisfying. The state has the 4th worst eighth-grade reading scores in the nation and ranks at 42nd position among 50 states for overall education.

Some of the highly respected public school districts and colleges in South Carolina include The Citadel , Coker College , University of South Carolina Aiken , Fort Mill School District , Lexington-Richland School District No. 5 and Spartanburg County School District No. 6 .

Weather

Job and Business Opportunities

Outdoor Activities

Pros and Cons

Pros:

- Low-Quality Education

Don’t Miss: How To Calculate Quarterly Taxes

Restrictions On Job Termination Due To Wage Garnishments

Complying with wage garnishment orders can be a hassle for your employer some might prefer to terminate your employment rather than comply. Federal law provides some protection for you in this situation. Under federal law, your employer can’t discharge you if you have one wage garnishment. . But federal law won’t protect you if you have more than one wage garnishment order.

Some states offer more protection for debtors. In South Carolina, your employer can’t fire you for an attempted garnishment that results from “consumer debt.” .

Who Should Use This Guide

This guide is intended for the employer and the payer. It contains tables for federal and provincial tax deductions, CPP contributions and EI premiums. It will help you determine the payroll deductions for your employees or pensioners.

For more information on deducting, remitting, and reporting payroll deductions, see the following employers guides:

- T4001, Employers Guide Payroll Deductions and Remittances

- T4130, Employers Guide Taxable Benefits and Allowances

- RC4110, Employee or Self-employed?

- RC4120, Employers Guide Filing the T4 Slip and Summary

- RC4157, Deducting Income Tax on Pension and Other Income, and Filing the T4A Slip and Summary

These guides are available on our website at canada.ca/taxes.

Don’t Miss: How To Get My Tax Return Faster