The Bottom Line On Illinois Hourly Payroll Tax

Processing Illinois payroll taxes for your hourly employees in an accurate and timely manner is crucial. Doing so will ensure your business runs as smoothly as possible. The last thing you would want on your books is a hefty tax penalty.

While tax rates fluctuate every year, staying on top of your numbers and documentation will come in handy. Using Gustos payroll software or a tax professional is a smart investment to tackle questions and challenges.

What To Do If You Live In A State With Reciprocity

If you live in a state that has reciprocity with Illinois, there are a few steps you should take to make sure your records are up-to-date for tax time. The forms you need to fill out will depend on your situation, whether you’re living in a state with a reciprocal agreement, and whether you’ve already had Illinois taxes withheld from your paycheck.

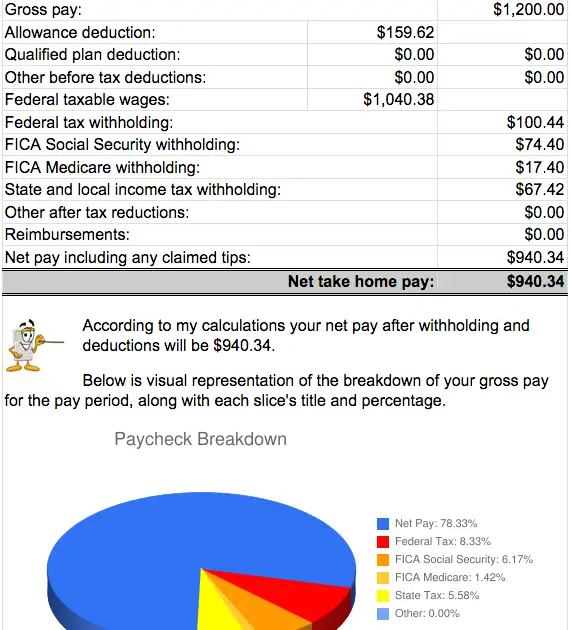

Calculate Federal Payroll Taxes

First of all, lets calculate federal payroll taxes for your employees. You can use our Illinois payroll calculator to calculate all your employees federal withholdings, plus any additional taxes your business is responsible for paying.

Heres a summary of all you need to know when youre calculating payroll taxes for your hardworking Illinoisans! For a more detailed explanation of all of the steps below, check out our step-by-step guide.

- Gross wages, which is simply the amount of money an employee has earned during the last pay period.

- For hourly employees, multiply the number of hours worked by their pay rate and make sure you dont forget to take overtime into consideration.

- For salaried employees, divide each employees annual salary by the number of pay periods you have over the course of a year.

You May Like: When Do You File Taxes 2021

How Your Illinois Paycheck Works

When you were a teenager you may have had a part-time job that paid you under the table. In that case, your paycheck, whether in the form of a check or cash, was simply your hourly wage multiplied by the number of hours you worked.

But once you start working on the books, calculating your paycheck isnt that straightforward. Your employer will withhold money from your paycheck, which means you cant simply multiply your hourly wage by the hours you worked, or divide your annual salary by the number of paychecks you get per year.

For each pay period, your employer will withhold 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. Together these are called FICA taxes, and your employer will pony up a matching contribution. Any earnings you make in excess of $200,000 will be subject to an additional 0.9% Medicare tax .

Your employer will also withhold money from each of your paychecks to put toward your federal income taxes. The percentage thats withheld will depend on things such as your income, your filing status and any tax credits you indicate on your W-4 form.

If youre paid more frequently, each of your paychecks will be smaller. Thats why pay frequency is a question on every paycheck calculator. A bigger paycheck may seem enticing but smaller, more frequent paychecks can make it easier to budget without coming up short by the end of the month.

If You Dont Have Employees

If you run a small business without any employees, youâll still have to remit payroll taxesâfor yourself. This is called self-employment tax and is effectively Medicare plus Social Security for yourself . Learn more in our guide to self-employment taxes.

Payroll taxes when you do have employees gets a little trickier.

Also Check: When Is The Last Day To File Taxes This Year

Illinois State Tax Resources

SurePayroll, Inc. and its subsidiaries assume no liability and make no warranties on or for the information contained on these state payroll pages. The information presented is intended for reference only and is neither tax nor legal advice. Consult a professional tax, legal or other advisor to verify this information and determine if and/or how it may apply to your particular situation.This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs. **Rates include surcharges.

Now Write Those Paychecks

Youre the boss of your business, and now youre the boss of payroll! Once youve calculated each employees net pay by implementing deductions and withholdings, youre good to cut those checks.

In addition to making sure your employees dont have to wait any longer for their paychecks, make sure you set aside the amount of money your company needs to pay. FICA and UI payments can add up quickly, but if you fulfill them on time, youll be golden.

Federal tax filings are done through Forms 940 and 941 , but taxes can be paid on an ongoing basis through the EFTPS payment system. Learn more about the IRS here.

Recommended Reading: How Much Is My Car Tax

Earned Income Tax Credit

The Illinois Earned Income Tax Credit/Earned Income Credit is for working people with low to moderate income to help reduce the amount of tax they owe. The credit is refundable, which means it may result in a refund. You can only claim the Illinois EITC/EIC if you qualify for it on your federal income tax return and itâs worth 18% of your federal EITC/EIC.

You may qualify for the federal EITC/EIC if your adjusted gross income is under $57,414 , you meet basic rules such as having investment income below $10,000 and a valid Social Security number, and you meet the requirements for those without a child or meet all of the qualifying child rules.

Living In Another State And Working In Illinois

You are not subject to Illinois income tax on wages, salaries, tips, or commissions received from employers in Illinois if you are a resident of Iowa, Kentucky, Michigan, or Wisconsin. However, this does not apply to any other type of income received in Illinois, such as lottery winnings.

Income outside of your normal wages, salary, tips, or commissions is taxable in Illinois, regardless of residency.

You May Like: Do I Need To File Income Tax Return

Illinois Income Tax Withholding

Illinois law requires employers to withhold state income tax from employees’ wages and remit the amounts withheld to the Department of Revenue.

Under reciprocal agreements between Illinois and the states of Iowa, Kentucky, Michigan, and Wisconsin, wages earned in Illinois by residents of those states are exempt from Illinois state income tax withholding.

How Does Illinois Unemployment Insurance Work

Unemployment Insurance supplies funding for the Illinois Department of Employment Security , which pays benefits to the unemployed. The wage base is $12,960 for 2022 and rates range from 0.725 to 7.625%. If youre a new employer, your rate is 3.53%.

Newly registered businesses must register with IDES within 30 days of starting up. You can register electronically through the MyTax Illinois website.

You May Like: How To Order Tax Forms From Irs

State And Local Payroll Tax

Employers are also responsible for paying state and local payroll tax on behalf of employees.

As with federal payroll tax, part of this tax is employer-paid, and part is employee-paid. Keep in mind that âemployee-paidâ just means that you, the employer, withhold a certain amount from your employeeâs paycheck and then remit it as part of your payroll taxes.

In addition to state payroll tax , employers are also responsible for remitting state income tax on behalf of their employees.

State and local payroll taxes are governed at the state and local levels, and payroll tax rates and rules vary by jurisdiction. To find out more about payroll tax in your state and local area, check out the Federation of Tax Administratorsâ list of each stateâs taxing authority.

Pay State Unemployment Tax :

As the employees pay state Income Tax, the state also requires the employers to pay State Unemployment Tax for each employee’s first income of $12960. The tax rate range from 0.525 â 6.925% .

However, there is a piece of good news for new employers as they only have to pay on a flat rate of 3.225% on the wages earned by each employee.

Note: Paying SUI taxes in full and on time, can get the employer, a FUTA tax credit of up to 5.4.

Read Also: How To File Federal Taxes Electronically

How Do I Figure Out The Percentage Of Taxes Taken Out Of My Paycheck

How do I calculate taxes from paycheck? Calculate the sum of all assessed taxes, including Social Security, Medicare and federal and state withholding information found on a W-4. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck.

How do you calculate income after taxes?

Youll pay no tax on the first £ 12,500 that youre earning. This is your yearly personal allowance.

How to calculate your pretax income?

Revenue Cost of sales. This is calculated as beginning inventory plus extra purchases and less ending inventory. Gross profit. This is your revenue less the cost of sales. Expenses. Earnings before tax. Net income.

Withhold Illinois State Payroll Taxes:

As you are done with your federal payroll taxes, now is time to withhold Illinois state income tax. This tax is to be withheld from the employee’s paycheck. The state charges a flat rate of 4.95% for Income tax on its residents, regardless of income level and filing status.

Moreover, the supplemental wage tax rate, according to Illinois State, is also the same 4.95%.

Employers are required to withhold the amount based on the information, including the number of allowances to claim, provided by the employee in Form IL-W-4, in which an employee must update the form if any significant event takes place in their lives like child’s birth, divorce or marriage.

You May Like: How Do I Protest My Property Taxes In Harris County

Illinois Salary Paycheck And Payroll Calculator

Calculating paychecks and need some help? Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois.

Well do the math for youall you need to do is enter the applicable information on salary, federal and state W-4s, deductions, and benefits.

The information provided by the Paycheck Calculator provides general information regarding thecalculation of taxes on wages for Illinois residents only. It is not a substitute for the advice of anaccountant or other tax professional. The Paycheck Calculator may not account for every tax orfee that applies to you or your employer at any time. ZenPayroll, Inc., dba Gusto does not warrant, promise or guarantee that the information in the PaycheckCalculator is accurate or complete, and Gusto expressly disclaims all liability, loss or riskincurred by employers or employees as a direct or indirect consequence of its use. By using thePaycheck Calculator, you waive any rights or claims you may have against Gusto in connectionwith its use.

Illinois Payroll Laws Taxes And Regulations

Withholding agents are liable by law for the taxes they are required to withhold. Withholding agents are responsible for their appropriate taxes, even if they fail to withhold from their employees.

In this section we will overview the State of Illinois payroll and tax requirements, which all withholding agents must adhere to.

For more information, see Publication 130, Who is Required to Withhold Illinois Income Tax.

Also Check: What School District Am I In For Taxes

Fica And Employment Taxes

Established by the federal government under IRC section 3121, the Federal Insurance Contributions Act requires all businesses to deduct federal taxes from each paycheck. Unlike individual taxes, FICA is paid by both the employer and employer, typically at a rate of 7.65% of taxable wages over to the IRS.

Unless specifically excluded by statute, all forms of payment are considered taxable. The same rule applies for types of base pay, such as hourly, weekly, piecework, and more.

While nearly all forms of payment are included in FICAs policies, the following types of compensation are exempt from Illinois payroll:

- Wages paid after an employees death

- Wages paid to disabled employees who collect Social Security disability insurance benefits

- Expense reimbursements for driven mileage

- Retirement contributions by employer

Register With The Illinois Department Of Employment Security

After receiving your EIN and EFTPS account, your business can now register with the Illinois Department of Employment Security. To register a new business, complete the REG-1 form. Applications can be completed online, by mail, or in person.

- Registering with the IDES Online

- To register online, first visit

- On the homepage, select Register a New Business under the Register section.

- Following the instructions given, complete application.

- After review, submit the form.

- Registering with the IDES by Mail

- To register by mail, first open the REG-1 form from the MyTax website.

- Complete the form. The IDES recommends filling out the form digitally, then printing off the completed application.

- After printing off the form, send the application to:CENTRAL REGISTRATION DIVISION ILLINOIS DEPARTMENT OF REVENUE PO BOX 19030 SPRINGFIELD IL 62794-9030

Learn more about managing your companys payroll in-house or with a service.

You May Like: How To Calculate Sales Tax For Tax Return

How Much Taxes Is Taken Out Of A Paycheck In Illinois

4.95%Everyones income in Illinois is taxes at the same rate due to the states flat income tax system of 4.95%. Also, not city or county levies a local income tax. In Illinois, the Supplemental wages and bonuses are charged at the same state income tax rate.

How much take home pay is 60k Illinois?

If you make $60,000 a year living in the region of Illinois, USA, you will be taxed $13,748. That means that your net pay will be $46,253 per year, or $3,854 per month.

How much is 80k a year after taxes in Illinois?

If you make $80,000 a year living in the region of Illinois, USA, you will be taxed $20,668. That means that your net pay will be $59,333 per year, or $4,944 per month. Your average tax rate is 25.8% and your marginal tax rate is 34.6%.

How To Calculate Take

To calculate Take Home Pay or Paycheck, you need to go through several steps that include calculation of Gross Pay, Pre-Tax Deductions, Federal Taxes, State Taxes, Post Tax Deductions, Local Tax, etc.

To make it easy for you, we have divided this guide into steps, which would give a general idea. However, there may be some differences or additional taxes that you may be subjected to, according to your situation. As it’s a comprehensive guide, we can only discuss general aspects.

Read Also: Can I Still Do My Taxes

Collect Employee Payroll Forms

Best completed during the onboarding of new employees, businesses must collect the following forms for all employees in order to be compliant with state and federal requirements:

- W-4 Employees Withholding Certificate

- I-9 Employment Eligibility Verification

- Direct Deposit Authorization

- IL-W-4 Employees and Other Payees Illinois Withholding

Note: All employees must complete their I-9 verification no later than their first day of work. I-9 forms must be stored for 3 years after the date of hire, 1 year after employment ends, or whichever is later.

State Minimum Wage Law: 2022

Entering 2022, the state of Illinoiss minimum wage is set at $12 per hour, just in the middle of a progressive yearly increase to $15 per hour.

While the law sets a minimum compensation rate, there are a few exceptions:

- New employees over the age of 18 can be paid up to 50 cents less per hour.

- Minors working under 650 hours per year can be paid ~75% of the current hourly minimum wage.

- Employees in gratuity-based industries can be paid 60% of the current hourly minimum wage.

- Full-time hourly employees that exceed 40 hours in a work week are due compensation at time and one-half the regular rate.

|

Illinois State Minimum Wage Chart |

|

Year |

Also Check: How To Get Stimulus Check On Taxes

Important Illinois Payroll Tax Laws & Items

Make sure you cross each of these off your list

1. How to Report New Hires in Illinois

All Illinois employers must report new hires within 20 days after the new employees first day working. You have three options to report new hires.

2. Illinois Minimum Wage

As of January 1, 20221, the minimum wage in Illinois is $121.00/hour. Different rates apply to tipped employees and employees under 18 years of age.

| Minimum Wage in Illinois |

| $15.00 per hour |

You may pay up to $0.50 less an hour for your new hires in their first 90 days of employment. This applies to workers over the age of 18.

3. Overtime Pay in Illinois

Illinois labor laws require you to pay hourly employees for any hours worked over a 40-hour workweek. The rate you must pay for any overtime hours is 1 ½ of your hourly-paid employees regular hourly rate.

Compensatory time in lieu of overtime if prohibited in Illinois.

4. PTO, Holiday, and Sick Leave in Illinois

All employers in the State of Illinois are required to pay their employers for any earned vacation hours upon separation from your business. Sick pay is not required to be paid at separation unless the employers written policy says so.

The Employee Sick Leave Act requires employers to allow employees to use any sick leave they earned to care for certain relatives under the employer policies.

Employers are not obligated to pay hourly employees for any hours not worked, including holidays.

5. Illinois Paystub Requirements

6. Workers Compensation in Illinois