How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

What Are Gross Earnings On A Paycheck

A pay stub also lists gross and net income to-date. This means you know exactly how much money you are taking home. This allows you to accurately and confidently plan your monthly and yearly budgets.

Be sure to check that the information on your last pay stub of the year matches the information on your W-2 form, which details your wages and taxes paid for the year.

Understanding Payroll Taxes Is Important

Understanding payroll taxes is important because knowing how these taxes work helps you to figure out what’s being deducted from your paycheck. Paying FICA taxes also entitles you to earn work credits that will help you qualify for Social Security benefits as a senior.

The good news is, now you know what payroll taxes are, how they work, and how much they’re likely to cost you.

This article was written by Christy Bieber from The Motley Fool and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to .

Don’t Miss: When Will The First Tax Refunds Be Issued 2021

What Is A Paycheck Calculator

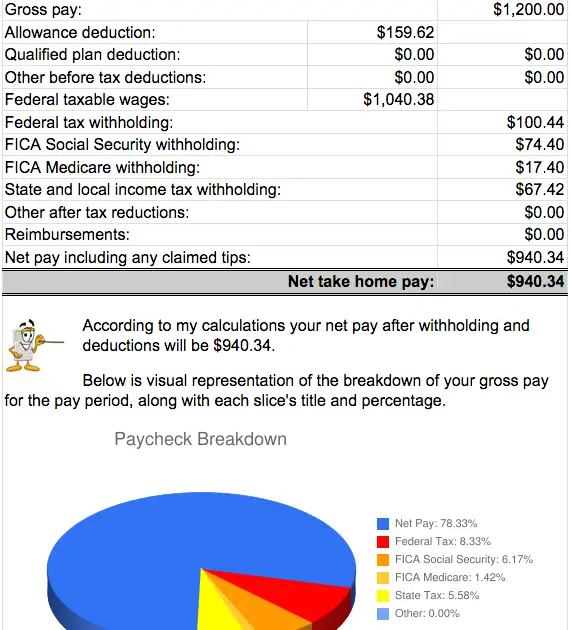

A paycheck calculator lets you know what amount of money will be reserved for taxes, and what amount you will actually receive. Generally, paycheck calculators will show the take-home salary for salaried and hourly workers they can also help calculate the amount of overtime pay will be paid out directly in your check.

To get the most accurate estimate, look at your pay stub, paying attention to withholdings for federal, state, and local taxes, FICA deductions for Social Security and Medicare, and any other deductions for health insurance, retirement, and flex spending accounts.

State And Local Payroll Deductions

Forty-one states have income taxes and while some have flat-rate deductions, others base certain taxes according to a table.

- Localities within 17 states levy taxes that are automatically withheld from wages.

- Some such local taxes are in flat dollar amounts, some are calculated as a percentage of income to withhold, and others use IRS-like tables.

- In six states and U.S. territories, employees pay disability taxes.

- Three states have unemployment insurance taxes.

- One state has a workers’ compensation tax.

Don’t Miss: How Can I Make Payments For My Taxes

You Can Increase Your Tax Refund

Although the tax withholding system is designed to produce the most accurate withholding possible , you can tweak your W-4 form to generate a refund if that’s what you really want. Simply add an additional amount on Line 4 for “extra withholding.” That will increase your income tax withholding, reduce the amount of your paycheck and either jack up your refund or reduce any amount of tax you owe when you file your tax return.

If you have a specific refund amount in mind, let the IRS’s Tax Withholding Estimator tell you how much to put down on Line 4. On the results page, you can tell the tool that you’d “like to end up the year with a refund of at least $1,000 or $5,000 or whatever you want,” says Isberg, and “it’ll actually take you through the Q& A and give you a nice analysis and instructions on how to adjust your withholding to get to the result you want.” You can even download a W-4 form with the appropriate amount preloaded on Line 4.

What Is The Percentage Of Federal Income Tax Withheld

As an employer, you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal, state, and local tax authorities.

To calculate how much of your employeeâs federal income tax to withhold, youâll need a copy of their Form W-4, as well as your employeeâs gross pay.

Your next step is to determine the method you want to use to calculate withholding. Most employers have two options, the wage bracket method and the percentage method. While not exactly simple, the wage bracket method is the more straightforward way to calculate payroll tax.

Read Also: Is Nursing Home Care Tax Deductible

Overview Of Georgia Taxes

Georgia has a progressive income tax system with six tax brackets that range from 1.00% up to 5.75%. Peach State residents who make more money can expect to pay more in state and federal taxes. There are no local income taxes in Georgia.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

How To Calculate Federal Income Tax Withholding Using The Wage Bracket Method

In IRS Publication 15-A, find the tables marked âWage Bracket Percentage Method Tables.â Use the table corresponding to your employeeâs pay period.

Check form W-4 to determine whether the employee files income tax as married or single and the number of allowances they claim.

Find the employeeâs gross wage for the pay period in columns A and B. The wage should be over the amount found in column A but under the amount found in column B.

Subtract the amount found in Column C.

Multiply the result by the percentage found in Column D.

Check form W-4 to determine if the employee requests additional tax withheld from each paycheck. If they do, add that amount to the final number.

The end result is the amount you should withhold from the employeeâs paycheck for that pay period.

The Percentage Method is much more complicatedânot recommended if youâre doing this alone. If you want to learn more about the Percentage Method, you can read all about both methods in IRS Publication 15-A.

Once youâve figured out how much income tax to withhold from your employeesâ paychecks, your next step is to figure out how much FICA to withhold , and how much youâll be required to pay on their behalf.

You May Like: Do I Have To Pay Taxes On My Unemployment

How We Approach Editorial Content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

What Do I Do With My Pay Stubs

Keep your pay stubs for a year. Your employer will send you a W-2 form each year. A W-2 form says how much money you earned during the year. Your W-2 also says how much money your employer took out for taxes. When you see that your W-2 is right, you can get rid of your pay stubs for that year.

Shred your pay stubs before you throw them away. Your pay stubs might have your Social Security number on them. Someone could use that to steal your identity.

Read Also: How To Get The Most Out Of Tax Return

Adjust Your Tax Withholding

Once you know the total amount you will owe in federal taxes, the next step is figuring out how much you need to have withheld per pay period to reach that target but not exceed it by Dec. 31.

Then fill out a new W-4 form accordingly.

You don’t have to wait for your employer’s HR department to hand you a new W-4 form. You can print one yourself from the IRS website.

How State Taxes Work

States that levy an income tax may set a flat rate or rates based on the amount of income you earn, as do local governments that levy an income tax. For both local and state income taxes, you generally pay tax on your compensation income based on the state and locality where you work, rather than where you live.

To avoid double taxation, you are generally given a credit for the state and/or local government where you paid the tax so you do not have to pay extra taxes where you live in addition to those you paid in the locality and state where you work.

Don’t Miss: How To Register For Tax Id

Summary Of Payroll Taxes

There are two types of payroll taxes: ones that come out of your own pocket, and ones that you just collect from employee paychecks and remit to the government.

Payroll taxes that come out of your pocket:

-

FICA tax: covers social security and Medicare. This cost is shared by employer and employee. The employer portion is 6.2% for social security and 1.45% for Medicare, and youâll collect and remit the same amount from your employees. Review a CPAâs summary in just a 4 minute read.

-

FUTA tax: covers unemployment insurance. The total amount is 6.0%. However, most states have a 5.4% credit, meaning most employers only pay 0.6%. Get everything you need to know in a 9 minute read.

Payroll taxes that you just collect and remit:

-

Federal income taxes

-

State and local taxes

Weâll cover each of these in detail, beginning with federal income tax withholding, since itâs the most commonly asked about.

Ask The Cra To Apply Other Tax Deductions

Complete and file Form T1213 Request to Reduce Tax Deductions at Source if you know youre going to have significant deductions in a given year. Examples: RRSPRRSP See Registered Retirement Savings Plan.+ read full definition contributions, rental losses, child care expenses. Give the approval letter you receive from the CRA to your employer. They will reduce the taxTax A fee the government charges on income, property, and sales. The money goes to finance government programs and other costs.+ read full definition taken from your pay.

Other deductions from your pay cheque

You May Like: How To Correct State Tax Return

Penalties For Not Withholding Enough

The IRS expects to be paid taxes as soon as wages are earned. If the information in an employees W-4 results in too little being withheld for taxes, the employee could be subject to a penalty for underpayment of taxes, even if the taxes are subsequently paid when the employee files a tax return.

The only employees who are exempt from withholding taxes are those who had no tax liability in the previous year and expect to owe no taxes in the current tax year. All other employees need to be sure to have enough withheld to cover their tax liability. Those who have significant additional income from investments or interest are encouraged by the IRS to make additional estimated tax payments to cover nonwage income.

You Can Outsource Payroll Tax

Payroll tax is complex. The calculations are nitpicky and penalties are steep. Even paying payroll taxes just a day late comes with a 2% penalty on the amount due, with that penalty rising as high as 15% for past due payroll taxes.

We highly recommend outsourcing your payroll to a company like Gusto. Theyâll take the headache out of everything from paying your employees the right amount at the right time, to handling pesky withholding calculations and payroll taxes.

When it comes time to record payroll costs on your books, Bench can take care of that for you. Learn more about how we are saving small business owners hours of admin every month.

Read Also: How Do Tax Liens Work

How Much Is Typically Taken Out Of A Paycheck For Taxes

Every first-time jobholder is probably a bit surprised to find the amount on their first paycheck is less than their total earnings. The difference between the amount of money earned, or gross pay, and the amount a worker takes home is due to taxes. All wage earners are required to pay certain federal taxes that are automatically withheld from their wages. Some states also withhold for state income tax. Understanding exactly how much in taxes is taken out of your paycheck can help lessen the shock.

Everything Deducted From Your Paycheck Explained

Congratulations, youve earned your first paycheck! Youre probably excited, as you should beyou put in work, and have some cash in the bank to show for it. But if youre like many newly employed people out there, you might also be a little bit confused after running the numbers and noticing that your take-home pay isnt exactly as much as you thought it would be.

Whats up with that? Upon further examining your paystub at your first job, youll notice a few line items categorized as deductions.Deductions are all of the things that were taken out of your gross pay, leaving you with your net pay, or take-home pay. While there are some deductions you cant really control, others are part of your employee benefits package, so you can adjust them according to what works for you and your budget.

Its OK to be a bit baffled on your first payday. Weve all been there before. To help clear up the confusion, we broke down typical paycheck deductions, where your earnings are going, and how much control you have over it.

Recommended Reading: When Does The Irs Start Accepting Tax Returns For 2021

Most Tax Filers Get Refunds

If you received a tax refund last year, you aren’t alone. In fact, you’re in the majority. According to the IRS, almost 112 million tax filers received refunds in 2019. Or, in other words, about seven out of every 10 returns resulted in a refund. And filers that chose the direct deposit option received an average refund of $2,975.

- This windfall at tax time can be handy. However, it may provide even more value spread out throughout the year, rather than receiving it all at once.

- The average tax filer would have received roughly an additional $248 per month if they adjusted their withholding to neither get a refund nor owe taxes.

It’s Easy To Account For Tax Credits And Deductions

The W-4 form makes it easy to adjust your withholding to account for certain tax credits and deductions. There are clear lines on the W-4 form to add these amounts you can’t miss them. Including credits and deductions on the form will decrease the amount of tax withheld, which in turn increases the amount of your paycheck and reduces any refund you may get when you file your tax return.

Workers can factor in the child tax credit and the credit for other dependents in Step 3 of the form. You can also include estimates for other tax credits in Step 3, such as education tax credits or the foreign tax credit.

For deductions, it’s important to note that you should only enter deductions other than the basic standard deduction on Line 4. So, you can include itemized deductions on this line. If you take the standard deduction, you can also include other deductions, such as those for student loan interest and IRAs. However, do not include the standard deduction amount itself. It could be “a source of error if folks just put in their full amount,” warns Isberg.

If you have multiple jobs or a working spouse, complete Step 3 and Line 4 on only one W-4 form. To get the most accurate withholding, it should be the form for the highest paying job.

You May Like: How To Get Social Security Tax Statement