You’re Responsible For Self

Self-employment tax has the potential to be confusing because at first glance, it seems like it would be the tax you pay for being self-employed. However, according to the United States tax code, self-employment tax encompasses your FICA payments, which are cash contributions to the nations Medicare and social security coffers.

As a W-2 worker, your employer pays half of your FICA and you pay the other half. Just like your income tax, both your and your employers FICA payments are made automatically.

When you become self-employed, youre on the hook for the full 15.3 percent since, in this instance, you are both the employee and the employer, Mastio said. Failure to understand this can lead to not setting aside enough cash at the end of the year to cover your self-employment tax obligations.

The Deductible Part Of Self

Good news: Half of your self-employment tax is a deduction in and of itself.

If you recall, employers are permitted to write-off their portion of FICA since itâs essentially an added cost of having employees. In the same vein, the additional 7.65% freelancers pay to be their own boss is an eligible write-off against their income taxes. Youâd forgotten about income taxes for a second, huh? Your business income is subject to bothincome and SE tax.

In general, this isn’t great. Say you’re in the bottom income tax bracket, the 10% bracket. To find out your total tax liability from both income and SE tax, you’d add that 10% to the 15.3% you’re paying in SE tax â resulting in 25.3%. That’s just over a fourth of your total income!

Luckily, the employer portion of your SE tax can be used to reduce your income taxes. Youâll deduct half when you fill out Schedule SE.

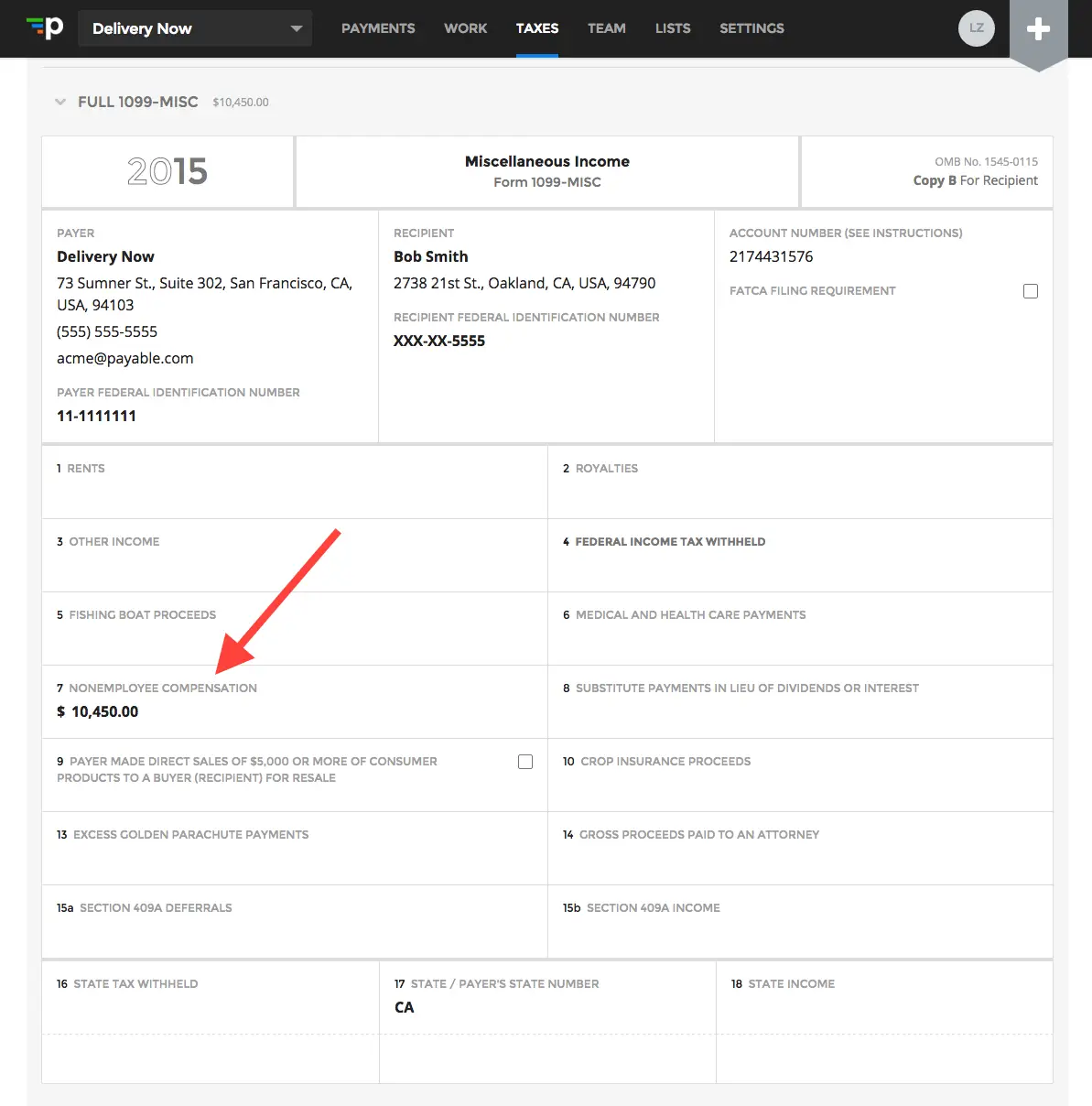

How To Fill Out A 1099

The company you worked for throughout the year will total your earnings on each 1099 MISC form. Throughout the year, you should collect and track your earnings, either in the form of paystubs or invoices from employers.To lower the amount of tax you pay, track your business expenses and hold onto receipts where you can. It’s vital that you enter your business expenditures onto your 1099 MISC form to calculate your exact taxable income.

Recommended Reading: Are Moving Costs Tax Deductible

When Is A Verbal Agreement Legally Binding

For any contract to be binding, there are four major elements which need to be in place. The crucial elements of a contract are as follows:

Therefore, an oral agreement has legal validity if all of these elements are present. However, verbal contracts can be difficult to enforce in a court of law. In the next section, we take a look at how oral agreements hold up in court.

Record All Business Deductions

The more you track tax deductions and the more organized you are, the better youâll be during tax season. Remember, you are responsible for paying both sides of the self-employment tax. When you know your expenses and accurately track them, you will understand what tax deductions you can get and can maximize them. Simply follow the Schedule C instructions to claim your tax deductions.

Note: Itâs critical to separate business expenses from personal ones, as you donât want to merge the two accidentally. If you want to do all of that automatically, try Bonsais freelancer 1099 expense tracking software. Our tax software can help you organize all of your expenses and save you money on your tax bill at the push of a button.

You May Like: How To Figure Out Tax Deductions From Paycheck

Do I Qualify For A 1099

In the US, the state your taxpayer information is associated with will determine your qualification for a Form 1099-K. In most states, accounts meeting both of the following criteria qualify for a Form 1099-K and must be reported to the IRS by Square:

More than $20,000 in gross sales from goods or services in the calendar year

AND more than 200 transactions in the calendar year

Square may report, solely within its discretion, on amounts below these thresholds to meet state and other reporting requirements:

What Happens If I Dont Amend My Tax Return

The IRS gets a Form 1099-G from the state unemployment office showing what they paid you. If you dont include that income on your tax return, the IRS computers will automatically flag your return.

The IRS will calculate the additional amount you owe and send you a bill. It will usually take several weeks or months to do so. In addition to the extra taxes, you will owe interest and penalties from when your tax return was due until you pay in full.

Also Check: Are Taxes Due By Midnight May 17

Forms That Independent Contractors File

The main form that all of your numbers will go on is a regular 1040. Regardless of your background and type of earnings, everyone in the U.S. submits this form. Where the paperwork veers off a little, however, is the point when you start working with the supporting schedules.

The income that you report for your independent contracting must come from a Schedule C. Furthermore, to account for the self-employment tax, you need to include a Schedule SE. If you made any estimated tax payments, which will be discussed shortly, you need to ensure that those accompany your return as well.

The best starting point is Schedule C. You begin by adding all of your earnings in Part I on lines one through seven. After that, you go through lines eight through 28 to derive the total expenses. Finally, you will get your net profit or loss on line 31. That number will go directly on line 12 of your form 1040. Also, do not forget to calculate your qualified business deduction from section 199A of the new tax law from 2017, which will amount to 20% of the net income that you made. That is, of course, as long as you satisfy certain requirements that most independent contractors do. To find out more about them, review the overview provided by the IRS.

Calculating Taxable Income Using Exemptions And Deductions

Of course, calculating how much you owe in taxes is not quite that simple. For starters, federal tax rates apply only to taxable income. This is different than your total income, otherwise known as gross income. Taxable income is always lower than gross income since the U.S. allows taxpayers to deduct certain income from their gross income to determine taxable income.

To calculate taxable income, you begin by making certain adjustments from gross income to arrive at adjusted gross income . Once you have calculated adjusted gross income, you can subtract any deductions for which you qualify to arrive at taxable income.

Note that there are no longer personal exemptions at the federal level. Prior to 2018, taxpayers could claim a personal exemption, which lowered taxable income. The tax plan signed in late 2017 eliminated the personal exemption, though.

Deductions are somewhat more complicated. Many taxpayers claim the standard deduction, which varies depending on filing status, as shown in the table below.

You May Like: Do You Have To Declare Unemployment On Taxes

When To Ask For Help

Although taxpayers are responsible for recording their income and filing their taxes, there are times when you don’t know what to do about a situation. In these situations, ask for help from the IRS or a tax advisor.

For example, if a taxpayer does not receive a 1099-R and contacting the payer has not resolved the issue, the IRS suggests you contact them. The IRS will, in turn, contact the payer or employer on your behalf.

Claim Your Other Income Tax Savings On Form 1040

On your Form 1040, youâll claim tax savings on your:

- â Health insurance

- â Retirement contributions

Thereâs no âone weird trickâ to dealing with the IRS. But there are definitely plenty of legal methods for avoiding extra taxes on your 1099 income.

Melissa Pedigo, CPA

Melissa Pedigo has been a CPA for over 20 years and she is one of the only CPA copywriters in the world. With a vast knowledge of U.S. tax and accounting, sheâs able to write about tax and finance topics from a unique perspective…as an industry expert. When sheâs not writing or being an accounting nerd, youâll find her watching and playing tennis, reading, tending to her half-grown garden, and studying foreign languages

Find write-offs.

Read Also: What Do I Need To Bring To Tax Preparer

Calculator And Estimator For 2023 Returns W

This Tax Return and Refund Estimator is currently based on 2022 tax tables. It will be updated with 2023 tax year data as soon the data is available from the IRS. Prepare and e-File your 2021 IRS and State Income Taxes via eFile.com. Let’s DoIT: IT is Income Taxes

This calculator is integrated with a W-4 Form Tax withholding feature. In case you got any Tax Questions: Contact an eFile.com Taxpert® before, during or after you prepare and e-File your Returns. It’s free to AskIT: IT is Income Taxes!

Of course, if you are ready to prepare and e-File your Return then let’s go and eFileIT now: IT is Income Taxes! Don’t get TurboCharged or TurboTaxed in 2022 when you can eFileIT up to 60% less. Dare To CompareIT

Restart This Tax Return Calculator will calculate and estimate your 2022 Tax Return. Answer each question by either clicking on the options shown or by entering dollar amounts or other values. For more help, click on the question mark symbol at the end of each question.

Restart Enter your and your spouse’s estimated or reported annual 2022 income from all jobs and income sources. One income type is required in order to proceed to the next section.

Bottom Line: Stop Hoarding Receipts

At Keeper Tax, weâre on a mission to expose regressive misconceptions like the paper receipts myth.

At the end of the day, we hate seeing freelancers and contractors held back from getting the tax savings they deserve.

You can bet that corporations claim every tax write-off possible. So you should too. And antiquated recordkeeping practices should not be holding you back.

Justin W. Jones, EA, JD

Justin is an IRS Enrolled Agent, allowing him to represent taxpayers before the IRS. He loves helping freelancers and small business owners save on taxes. He is also an attorney and works part-time with the Keeper Tax team.

Find write-offs.

Don’t Miss: How To Contribute To Ira Pre Tax

What Defines A Verbal Contract

A verbal contract refers to an agreement between two parties that’s made ââ¬âyou guessed itââ¬â verbally.

Formal contracts, like those between an employee and an employer, are typically written down. However, some professional transactions take place based on verbally agreed terms.

Freelancers are a good example of this. Often, freelancers will take on projects having agreed on the terms and payment via the phone, or an email. Unfortunately, sometimes clients don’t pull through on their agreements, and hardworking freelancers can find themselves out of pocket and wondering whether a legal battle is worth all the hassle. Ã

The main differences between written and oral contracts are that the former is signed and documented, whereas the latter is solely attributed to verbal communication.

Verbal contracts are a bit of a gray area for most people unfamiliar with contract law ââ¬âwhich is most of us, right?ââ¬â due to the fact that there’s no physical evidence to support the claims made by the implemented parties.

If You Have Income But No 1099

All income must be reported to the IRS and taxes must be paid on all income. The payee may have forgotten to prepare and submit a 1099-MISC form for the income paid to you. Most likely, the payee may not have paid you $600 or more in a calendar year, in which case, no 1099-MISC must be filed with the IRS and provided to the worker.

You May Like: How To Make Tax Return

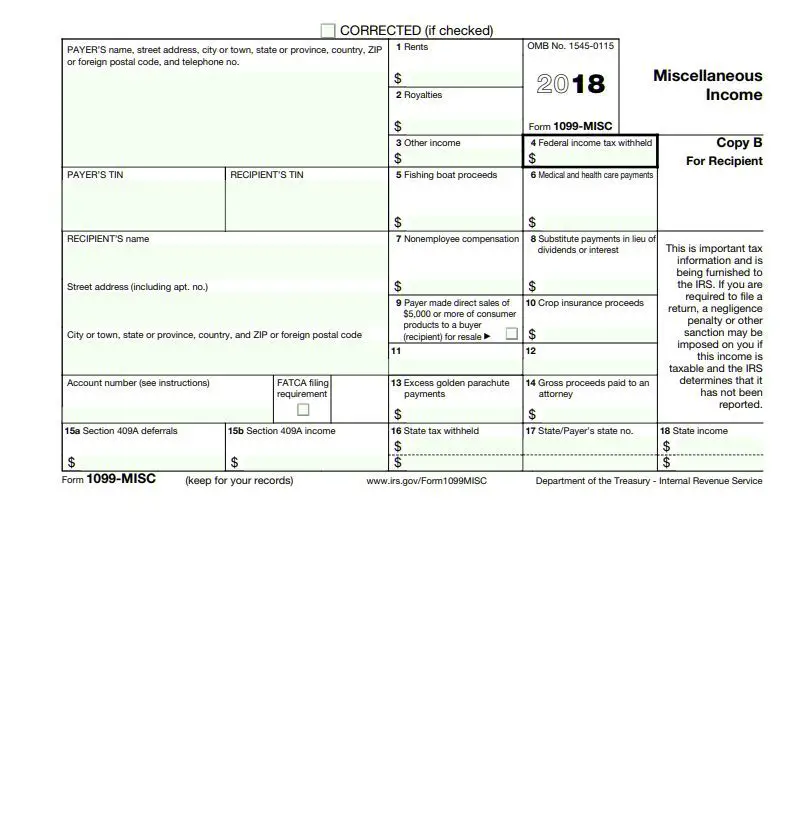

What Is An Irs 1099 Form

OVERVIEW

The 1099 form is a series of documents the Internal Revenue Service refers to as “information returns.” There are a number of different 1099 forms that report various types of payments you may receive throughout the year other than what a business might pay you.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Didnt Receive Or Disagree With Your 1099

If you didnt receive your 1099-G tax form or disagree with any of the information provided on your 1099-G tax form, please complete the EWF Customer Feedback Form.

Select the option I have an issue with my 1099-G tax form and provide further details including your EWF Claim ID number. NYSDOL will review your inquiry and send you an amended 1099-G tax form or a letter of explanation.

Don’t Miss: What Is The Tax Rate On 401k After 65

I Did Not Receive A Refund Why Am I Receiving A Form 1099

Although you did not receive a refund, you had an overpayment of taxes that was applied to one or more of the following:

-

Consumer use tax

-

Contribution to the NC Nongame and Endangered Wildlife Fund, the NC Education Endowment Fund, or the NC Breast and Cervical Cancer Control Program

-

A portion of your overpayment was applied to the following year’s estimated tax

-

Liability for another tax year or an external agency that has a claim against your refund

How To File 1099 Taxes

In order to file your 1099 taxes, you need to submit the following information:

- Your personal information

- The payers information

- The income you received during the year

- Any tax that was withheld from the income

Regardless of any 1099 form you receive, a copy of the same form will be mailed to the IRS.

Also Check: Will I Get My Tax Refund And Stimulus Check Together

How To Claim Tax Savings On Your 1099 Income

If you want to save money with these tax tricks, youâll need to fill out some forms.

Donât want to deal with all that paperwork on your own? File through Keeper Tax. Weâll help you claim all your savings and take care of every form for you, so you can get on with your life.

If youâd rather file your own business taxes, though, read on to make sure you donât miss out on any savings.

Who Sends 1099 Forms

Several types of 1099 forms exist to document payments made between an individual or business and another party. Because 1099 forms record payments, many people can receive various 1099 forms for different reasons.

One of the most popular 1099 forms is the 1099-NEC for Non-Employee Compensation payments. For example, if youre an independent contractor or freelancer, you may receive a Form 1099-NEC documenting payments made to you throughout the year from a particular payer.

TurboTax Tip: The 1099-NEC form should include payments made to you if they are $600 or more from a single source. The is the threshold requiring a payer to file a Form 1099-NEC.

Non-Employee Compensation payments below $600 dont require filing the 1099-NEC, though the payer may still choose to do so.

Recommended Reading: Can Home Improvement Be Tax Deductible

Develop A Bulletproof Savings Plan

Tax experts across the board emphasized the importance of responsible saving so that youve got enough cash stored up to meet your tax obligations each quarter and at the end of the year.

Krause says many freelancers and private contractors entrap themselves in a pay with the next check type of mentality.

As a 1099 contractor, it can be easy to see your whole check as usable money and to convince yourself you’ll put more into your tax savings next check, Krause said. Doing this is incredibly difficult to recover from and is a very slippery slope.

She and Mastio suggest opening a separate savings account into which you can deposit money youll use for your tax payments.

Make it a priority and build it into your monthly budgeting. If it has been a problem in the past, simply open up a separate bank account and transfer 25-30 percent of each months earnings to this account and use that account to make your quarterly tax payments, Mastio said. You may end up over-estimating your payments, but at least you avoid the headache and panic of setting aside too little.

How To Calculate Estimated Tax Payments

The easiest way to calculate estimated taxes is to use the safe harbor rule. The safe harbor rule can protect you from IRS penalties for underpaying your taxes. Typically, underpaying your taxes can result in fines and interest. However, you can avoid penalties if you satisfy the requirements for the safe harbor rule.

The IRS wont penalize you if your payments meet the safe harbor guidelines. Basically, the safe harbor rule protects you as long as your current year estimated payments equal 100% or more of the previous years tax bill. Therefore, you can use the safe harbor rule to determine your estimated tax payments and avoid costly penalties.

To calculate estimated taxes under the safe harbor rule, start by taking 100% of the taxes paid on last years return. Then, divide last years total taxes by four. The resultant total is your quarterly obligation under the safe harbor rule. As long as your payments cover this total, youre protected from penalties. You might owe additional taxes if you made more than you did last year, but the IRS wont knock you for underpayment.

To avoid owing year-end taxes, you can also annualize your estimated 1099 income and deductions. However, accurately forecasting your income for 12 months is difficult. Alternatively, you can also use your businesss quarterly earnings to calculate your estimated tax payments. If you happen to overpay, the IRS will return the excess through a tax refund.

Recommended Reading: How To Do Llc Taxes Yourself