Direct Deposit Authorization Form

As an employer, you can pay your employees several different ways: paper check, direct deposit, prepaid debit card, or cash. Direct deposit is often the easiest and most secure way to deliver paychecks, which is why it is by far the most popular. In fact, more than 82% of US workers are now being paid by direct deposit.

An employee who chooses to be paid by direct deposit must fill out a direct deposit authorization form, complete with bank routing numbers and account numbers. The form acts as a permission slip for you to deposit the employees net pay electronically into their bank account.

As part of the verification process, many employers will ask for a voided blank check to confirm the accuracy of the bank account information provided by the employee.

What Do Small Business Owners Need To Know About Taxes

All of the information above can apply to both business owners and employees. But as a small business owner, employees may ask you, How much federal tax is taken out of my paycheck? Now, youll have a better understanding of the process. This will also help you understand questions about your own paychecks.

Be sure to get Form W-4 from employees during onboarding if you run the payroll on your own. Additionally, have employees verify their personal information is correct at the end of the year as youre preparing Form W-2 for tax season.

From there, payroll calculators will be your friend to help you calculate payroll for salaried employees and contractors.

How Your Paycheck Works: Fica Withholding

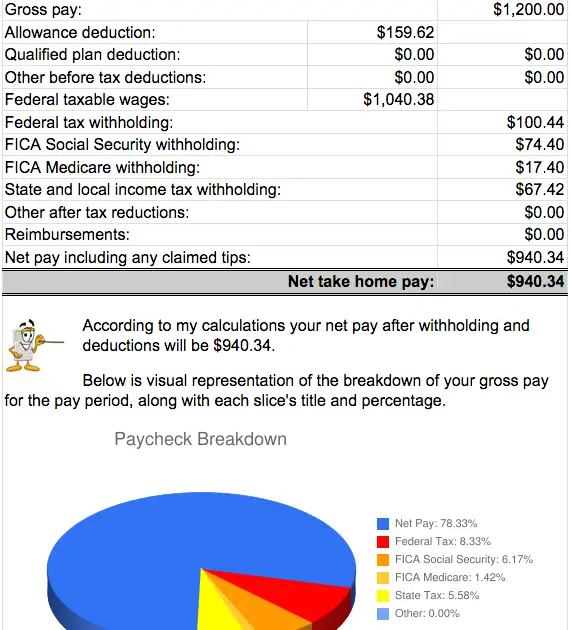

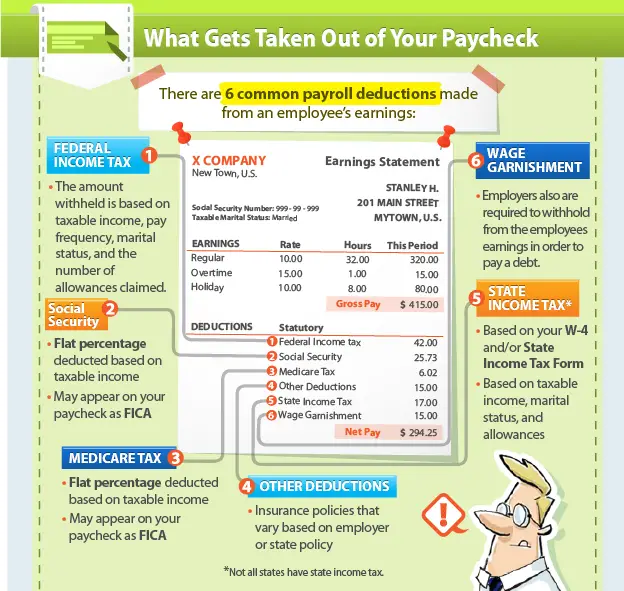

In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act. Your FICA taxes are your contribution to the Social Security and Medicare programs that youll have access to when youre a senior. Its your way of paying into the system.

FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2022 is $147,000 . So for 2022, any income you earn above $147,000 doesnt have Social Security taxes withheld from it. It will still have Medicare taxes withheld, though.

There is no income limit on Medicare taxes. 1.45% of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1.45%. If you make more than a certain amount, you’ll be on the hook for an extra 0.9% in Medicare taxes. Here’s a breakdown of these amounts:

- $200,000 for single filers, heads of household and qualifying widows with dependent children

- $250,000 for married taxpayers filing jointly

- $125,000 for married taxpayers filing separately

Also Check: What Happens If You Have Not Filed Tax Return

Tip #: Dont Miss Your Business Write

Most write-offs are missed because people donât keep track of what they buy for work. In the frenzy to pull everything together before taxes are due, eligible write-offs tend to fall through the cracks.

Do yourself a favor and start keeping up with your expenses now. More of your purchases count as business expenses than you might realize, and they could significantly lower your taxable income. Here are a few examples of business tax deductions you can take:

- ð¶ Your cell phone and internet bill

- ð Work-related parking fees and toll passes

- ð§âð» Software subscriptions

- ð³ Bank and credit card fees on accounts you use for work

- ð Computers and electronic accessories

If youâre wondering where to start with this, youâve come to the right place. The Keeper Tax app is specifically designed for gig and freelance workers.

The app will find and sort all of your business write-offs automatically. When youâre ready to file, all you have to do is upload your 1099s, and weâll handle the rest.

State And Local Payroll Tax

Employers are also responsible for paying state and local payroll tax on behalf of employees.

As with federal payroll tax, part of this tax is employer-paid, and part is employee-paid. Keep in mind that âemployee-paidâ just means that you, the employer, withhold a certain amount from your employeeâs paycheck and then remit it as part of your payroll taxes.

In addition to state payroll tax , employers are also responsible for remitting state income tax on behalf of their employees.

State and local payroll taxes are governed at the state and local levels, and payroll tax rates and rules vary by jurisdiction. To find out more about payroll tax in your state and local area, check out the Federation of Tax Administratorsâ list of each stateâs taxing authority.

Don’t Miss: How To File Taxes For Social Security Disability

How Do I Create A Paycheck For An Employee

Employers typically have two basic options for creating paychecks:

If You Withdraw The Money Early

For traditional 401s, there are three big consequences of an early withdrawal or cashing out before age 59½:

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw the $10,000 in your 401 at age 40, you may get only about $8,000.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government another $1,000 of that $10,000 withdrawal.

You will have less money for later, especially if the market is down when you start making withdrawals. That could have long-term consequences.

There are a lot of exceptions. This article has more details, but in a nutshell, you might be able to escape the IRSs 10% penalty for early withdrawals from a traditional 401 if you:

-

Receive the payout over time.

-

Qualify for a hardship distribution with the plan administrator.

-

Leave your job and are over a certain age.

-

Are getting divorced.

Also Check: How To Reduce Income Tax

How You Can Affect Your California Paycheck

Though some of the withholding from your paycheck is non-negotiable, there are certain steps you can take to affect the size of your paycheck. If you choose to save more of each paycheck for retirement, for example, your take-home pay will go down. Thats why personal finance experts often advise that employees increase the percentage theyre saving for retirement when they get a raise, so they dont experience a smaller paycheck and get discouraged from saving.

Should you choose a more expensive health insurance plan or you add family members to your plan, you may see more money withheld from each of your paychecks, depending on your companys insurance offerings.

If your paychecks seem small and you get a big tax refund every year, you might want to re-fill out a new W-4 and a new California state income tax DE-4 Form. The California DE-4 forms tells your employer how many allowances youre claiming and how much to withhold from each of your paychecks. If you take more allowances, you might get a smaller refund but you should get bigger paychecks. Conversely, if you always owe tax money come April, you may want to claim fewer allowances so that more money is withheld throughout the year.

What Percentage Of My Paycheck Is Withheld For Federal Tax 2021

The federal withholding tax has seven rates for 2021: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The federal withholding tax rate an employee owes depends on their income level and filing status. This all depends on whether you’re filing as single, married jointly or married separately, or head of household.

Recommended Reading: Can I Pay My State Taxes Online

Delaware Resident Working Out Of State

Q. Im considering taking a job in Maryland. I know the states do not have a reciprocal agreement. How does the credit work for taxes paid to another state? Will I owe County taxes in MD?

A. If you are a resident of Delaware who works in Maryland, you may take credit on line 10 of the Delaware return for taxes imposed by other states. You must attach a signed copy of your Maryland return in order to take this credit.

Even though you may not be liable for Maryland County Taxes, Maryland imposes a Special Non-resident tax on their non-resident income tax return.

What Should You Do With Your Paycheck Stub

Pay stubs are used to verify payment accuracy and may be necessary when settling wage/hour disputes. For this reason, employees may want to save their pay stubs, but arent required to do so. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.

You May Like: When Is Filing Tax Deadline

Annual Filing Option For Household Employers

Employers of household service employees may elect to file and pay the Virginia income tax withheld from their employees’ salaries on an annual basis, at the same time they submit the employees’ Forms W-2 for the year. In order to qualify for the annual filing, the employment must consist exclusively of domestic service in the private home of the employer as defined in the Federal Employment Tax Regulations. Employers may register for this filing option online, or by using Form R-1H. See Household Employer for more information.

Making Payments To The Irs

Just because youve calculated payroll and paid your employees doesnt mean your job is done. You also need to send the taxes you withheld to the respective taxing authority. For FIT and FICA, that is the IRS. For state and local income taxes, that is your states withholding tax agency.

Be sure to send both the taxes you withheld from your employees paycheck as well as the taxes that you as the employer are responsible for.

The timing of when you send the federal taxes depends on how much you pay employees, how frequently you pay them, and your lookback period . The IRS Form 941, Employers Quarterly Federal Tax Return, provides details on how, when, and where to pay FIT and FICA.

The deadline to file Form 941 is the last day of the month following the end of a calendar quarter. For example, for the quarter ending on March 31st, Form 941 is due on April 30th. There are significant penalties for not filing this form, so dont forget!

For state tax filings, you should contact your states withholding tax agency for filing requirements for state and local income tax rates. Each state is different.

Read Also: Do You Claim Unemployment On Your Taxes

The Taxes Owed Depend On Your Age The Type Of Account And More

How much you will pay in taxes when you withdraw money from an individual retirement account depends on the type of IRA, your age, and even the purpose of the withdrawal. Sometimes the answer is zeroyou owe no taxes. In other cases, you owe income tax on the money you withdraw. You can even owe an additional penalty if you withdraw funds before age 59½. On the other hand, after a certain age, you may be required to withdraw some money every year and pay taxes on it.

There are multiple IRA options and many places to open these accounts, but the Roth IRA and the traditional IRA are by far the most widely held types. The withdrawal rules for other types of IRAs are similar to the traditional IRA, with some minor unique differences. These other types include the , SIMPLE IRA, and SARSEP IRA. Each has different rules about who can open one. But before getting into the details, you should know that the Internal Revenue Service refers to a withdrawal from an IRA as a distribution.

Will I Owe Money If I Claim 1

While claiming one allowance on your W-4 means your employer will take less money out of your paycheck for federal taxes, it does not impact how much taxes you’ll actually owe. Depending on your income and any deductions or credits that apply to you, you may receive a tax refund or have to pay a difference.

Also Check: When Do You Get Your Tax Return

Overview Of Vermont Taxes

Vermont has a progressive state income tax system with four brackets. The states top income tax rate of 8.75% is one of the highest in the nation. No Vermont cities have local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

How Much More Taxes Will I Pay If I Claim 0

Asked by: Granville Wisozk

If you claim 0, you should expect a larger refund check. By increasing the amount of money withheld from each paycheck, you’ll be paying more than you’ll probably owe in taxes and get an excess amount back almost like saving money with the government every year instead of in a savings account.

Also Check: Do I Need Tax Loss Harvesting

Financial Facts About The Us

The average monthly net salary in the United States is around 2 730 USD, with a minimum income of 1 120 USD per month. This places US on the 4th place out of 72 countries in the International Labour Organisation statistics for 2012.

The United States’ economy is the largest and one of the most open economies in the world, representing approximately 22% of the gross world product. The US leads the world by having a high productivity of manufactured goods, a well-developed infrastructure, and abundant natural resources. The United States financial market is also the largest and the most influential in the world. This makes the USD the most used currency in international transactions.

Over 128 of the world’s 500 largest companies are headquartered here, including: Walmart, ExxonMobil, Chevron, Apple, JP Morgan Chase, and many others. Thanks to its strong economy, the United States has always attracted a high number of immigrants from all over the world. The net migration rate is among the highest in the world.

The US is the 4th largest country by area in the world with over 50 states, covering a vast part of North America. Washington D.C. is the capital of the United States. Other major cities include: New York a global finance and culture center, Los Angeles famed for filmmaking and known as the “Creative Capital of the World”, Chicago renowned for its museums and bold architecture.

How To Determine Your Tax Bracket

As mentioned above, determining your tax bracket hinges on two things: filing status and taxable income. Here are some useful details:

The IRS recognizes five different filing statuses:

- Single Filing Unmarried, legally separated and divorced individuals all qualify all single.

- A married couple agrees to combine income and deduct the allowable expenses.

- A married couple files separate tax returns to keep an individual income lower. This is beneficial in certain situations like repaying student loans under an income-driven repayment plan.

- Head of Household Unmarried individuals who paid more than half the cost of keeping up a home for the year and have a qualifying person living with them in their home for more than half the year.

- Qualifying Widow A widow can file jointly in the year of their spouses death. A qualifying widow has a dependent child and can use the joint tax rates and the highest deduction amount for the next two years after their spouses death.

Recommended Reading: Do I Have To Report Stimulus Check On Taxes

How Much Taxes Are Taken Out When You Claim 1

Asked by: Manuel Dietrich

When your Federal income tax withholding is calculated, you are allowed to claim allowances to reduce the amount of the Federal income tax withholding. In 2017, each allowance you claim is equal to $4,050 of income that you expect to have in deductions when you file your annual tax return.

Where Does All That Money Go

Federal income tax is the governments biggest source of revenue. It is used to pay the countrys ongoing expenses, such as national defense, infrastructure needs, social assistance programs, and paying interest on the national debt.

Many people are surprised to learn that all of the income you make is not taxed at one rate. Lets say you are the single filer in the example above, earning $41,600 per year. Your income falls into the 22% tax bracket. But, if you paid a flat 22% tax rate, you’d owe $9,152. Yikes. What gives?

Federal income taxes are paid in tiers. For a single filer, the first $9,875 you earn is taxed at 10%. The next $30,249 you earn–the amount from $9,876 to $40,125–is taxed at 15%. Only the very last $1,475 you earned would be taxed at the 22% rate. This IRS Tax Table can help you figure out how much federal income tax you owe.

Also Check: How To Lower Your Tax Bracket