How To Avoid Paying Taxes When You Sell Stock

One way to avoid paying taxes on stock sales is to sell your shares at a loss. While losing money certainly isn’t ideal, at least losses you incur from selling stocks can be used to offset any profits you made from selling other stocks during the year. And, if your total capital losses exceed your total capital gains for the year, you can deduct up to $3,000 of those losses against your total income for the year.

I know what you’re thinking: No, you can’t sell a bunch of shares at a loss to lower your tax bill and then turn around and buy them right back again. The IRS doesn’t allow this kind of “wash sale” — called by this term because the net effect on your assets is “a wash” — to reduce your tax liability. If you repurchase the same or “substantially similar” stocks within 30 days of the initial sale, it counts as a “wash sale” and can’t be deducted.

Of course, if you end the year in the 0% long-term capital gains bracket, you’ll owe the government nothing on your stock sales. The only other way to avoid tax liability when you sell stock is to buy stocks in a tax-advantaged account.

A Sidebar For The 83 Election Of Restricted Stock Awards

The tax rules above cover both restricted stock units and restricted stock awards when they vest. However, if you have restricted stock awards , you may want to consider an 83 election when the grant is awarded.

If you choose an 83 election, you choose to be taxed on the value of your unvested restricted stock when it is granted, not when it vests.

The hope for those who elect 83 is that the total value of the award is lower at grant than it is when it vests. If this plays out to be true, then you will have needed to pay less in income tax than had you not elected 83.

The risk is twofold. One, you are paying tax on something you dont yet own. If you forfeit the shares prior to the vesting, you will have paid tax on something that you never owned.

A second risk is that the award decreases in value from the time the award is granted to the time it vests In this situation, you will have likely paid more tax than you would have had you waited.

The rules for an 83 election can be complicated. The same goes for properly evaluating the risk/reward tradeoff of this decision. If you are considering this as part of your strategy, you may want to speak with a professional.

What To Do When Your Restricted Stock Units Vest

Restricted stock units might seem relatively easy to manage once they vest, especially when compared to the potential complexity of vested non-qualified and incentive stock options.

RSUs look straightforward because your options can seem limited, meaning you have fewer decisions to make. But the truth is, you may have several choices around the actions to take next, including how to pay the requisite tax due or if you should retain shares after vesting.

Your choices may have a significant impact on the rest of your financial life, so you need to understand how to appropriately evaluate potential outcomes and choose a course of action based on what best fits into your overall financial plan.

To make the best possible decisions around how to handle restricted stock units once they vest, there are certain factors and issues to consider.

Don’t Miss: Do You Report Roth Ira Contributions Your Tax Return

Ways To Mitigate A Tax Bill

If you realize that you have capital gains and could be hit with a tax bill at the end of the year, there are a few things you could do now to offset what you’d owe.

One is tax-loss harvesting, which is basically selling assets at a loss which can then offset your gains, according to Anjali Jariwala, CFP, CPA and founder of FIT Advisors in Torrance, California. These losses never expire and can be carried forward into future years, she said.

Another thing you can do to avoid a bill is to donate stock, according to Gorman.

“If you are a charitable person and your portfolio has increased in value, you can cherry-pick a few stocks to donate directly to charity,” she said. “Then you don’t have to recognize the capital gain and you potentially get a tax deduction, depending on what tax bracket you’re in and if you itemize.”

When you get to the point where you’re investing in the market, you can’t put your head in the sand about taxesMegan GormanManaging partner at Chequers Financial Management

People looking to begin investing who don’t want to have to worry about capital gains taxes and have longer-term time horizons, such as those who are saving up for retirement, can utilize a tax-deferred individual retirement account, such as a traditional or Roth IRA. These types of accounts won’t incur a capital gains tax, but there are other restrictions for taking out any earnings before retirement age.

Will My Broker Give Me A Form

In a word: yes.

If you sold any investments, your broker will be providing you with a 1099-B. This is the form you’ll use to fill in Schedule D on your tax return. The beauty of this is that it’s generally plug-and-play. Everything you need can be ripped right off of the 1099-B and inputted into the tax return.

Furthermore, if you received dividends from stocks or interest from bonds, you should also receive a 1099-DIV or a 1099-INT. Often, you’ll all of these forms in a single package from your broker, which is supposed to be sent to you no later than Jan. 31.

Don’t Miss: 1040paytax.com Official Site

Whats Considered A Capital Gain

If you sell an asset for more than you paid for it, thats a capital gain. But much of what you own will experience depreciation over time, so the sale of most possessions will never be considered capital gains. However, youre still liable for capital gains taxes on anything you purchase and resell for a gain.

For example, if you sell artwork, a vintage car, a boat, or jewelry for more than you paid for it, thats considered a capital gain.

Property such as real estate and collectibles, including art and antiques, fall under special capital gains rules. These gains specify different and sometimes higher tax rates .

And dont forget that if youve sold cryptocurrency such as bitcoin for a gain, then youll also be liable for capital gains taxes.

Handle Trading Taxes Like A Pro

Filing taxes can be confusing, especially if you have multiple income streams to account for. So, dont be afraid to consult a tax professional who can ensure you make decisions that are best for you and your trading activity.

Stay on track with your taxes using the Maxit Tax Manager in our Self-Directed Trading Account.

You May Like: Do I Need W2 To File Taxes

How To Calculate Your Profits From Selling Stocks

When you sell stock, you’re responsible for paying taxes only on the profits — not on the entire sale.

In order to determine your profits, you need to subtract your cost basis , which consists of the amount you paid to buy the stock in the first place, plus any commissions or fees you paid to buy and sell the shares.

Carry Over Losses To The Next Year

Remember capital losses offset capital gains. If you have both capital gains and capital losses in the same tax year, you must use them to offset the capital gain. However, if you only have a capital loss, or you don’t have capital gains from the prior 3 years that you could amend and offset, you can carry those capital losses forward to offset future capital gains. You might need to consult a tax professional to follow the proper steps to do this.

Article Contents11 min read

This article is provided for informational purposes only. It does not cover every aspect of the topic it addresses. The content is not intended to be investment advice, tax, legal or any other kind of professional advice. Before taking any action based on this information you should consult a professional. This will ensure that your individual circumstances have been considered properly and that action is taken on the latest available information. We do not endorse any third parties referenced within the article. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.

We provide investment services and other financial products through several affiliates.

Read Also: What Does H& r Block Charge

Seeking An Accountant’s Help

If you are concerned about your tax situation and how much you will owe this tax season, you may want to consider hiring an accountant. An accountant can not only help you determine the best way to lower your tax bill they can also help you figure out what your expected tax bill might be, so you can better plan financially.

Keep Your Restricted Stock Shares Or Sell Them

When the dust settles from vesting, paying tax, and obtaining your share ownership, you need to decide whether to keep the shares or sell them.

If you keep your shares, you will be subject to the risk-reward trade-off of owning a single stock position. A single stock position is often considered more volatile than a portfolio of stocks, meaning you may be more likely to see a greater level of volatility.

If you choose to keep the shares, you may want to consider how much of your net worth is already allocated to this single stock position. One simple rule of thumb suggests that an appropriate allocation to one stock is 10-15% of your net worth.

If you find yourself with a greater percentage than mentioned, it may warrant a longer conversation about your financial planning goals, objectives, and risk tolerance.

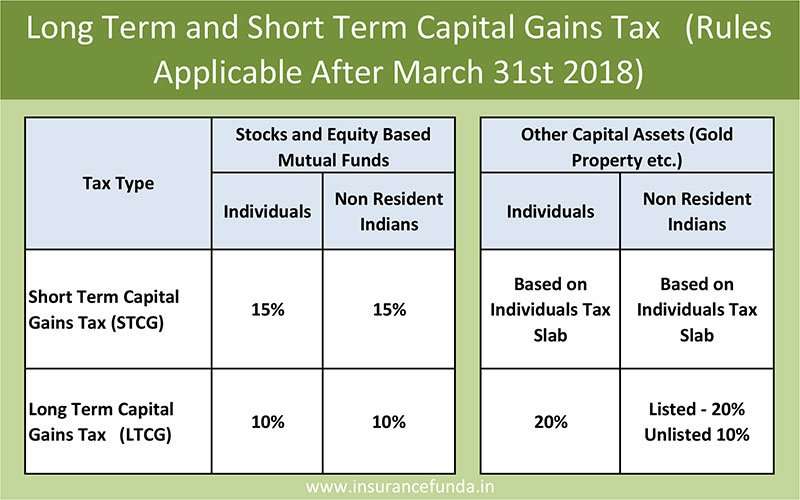

If you decide to sell your shares, you will be subject to tax rules for selling an investment which means you need to be aware of short-term and long-term holding periods and how each could affect you.

A holding period is a time between when the shares were purchased and when the shares were sold. A short-term capital gain is anything that is sold prior to being held for 1 year, and a long-term capital gain applies to anything that has been held for one year or more.

Your holding period for the restricted stock shares typically begins on the date the shares vested, and the holding period helps determine what tax may be due.

| $8,000 |

Read Also: How To Buy Tax Lien Properties In California

Adjusted Cost Base For Financial Instruments

For financial instruments such as stocks, the adjusted cost base is calculated as the number of shares multiplied by the share price at the time the shares were bought. For instance, if 100 shares of XYZ Company were purchased at a price of $30 each, then the ACB would be $3,000. If more shares of the same corporation are purchased in the future, the adjusted cost base would be the total cost of all the shares purchased at their respective prices. The adjusted cost base per share would be the average purchase price for all the shares. For instance, if you purchased 50 more shares of XYZ Company at a price of $35, the ACB per share would be $31.67. The adjusted cost base also includes any costs incurred to acquire the stock, such as trading commissions.

Take Advantage Of Tax

When you invest your money through a retirement plan, such as a 401, 403, or IRA, it will grow without being subject to immediate taxes. You can also buy and sell investments within your retirement account without triggering capital gains tax.

In the case of traditional retirement accounts, your gains will be taxed as ordinary income when you withdraw money, but by then you may be in a lower tax bracket than when you were working. With Roth IRA accounts, however, the money you withdraw will be tax-free, as long as you follow the relevant rules.

For investments outside of these accounts, it might behoove investors who are near retirement to wait until they actually stop working to sell. If their retirement income is low enough, their capital gains tax bill might be reduced or they may be able to avoid paying any capital gains tax. But if they’re already in one of the “no-pay” brackets, there’s a key factor to keep in mind: If the capital gain is large enough, it could increase their taxable income to a level where they’d incur a tax bill on their gains.

You can use capital losses to offset your capital gains as well as a portion of your regular income. Any amount that’s left over after that can be carried over to future years.

Read Also: How Much Does H & R Block Charge To Do Taxes

Canada Revenue Agency: How To Pay Zero Taxes On Stock Market Gains

Andrew Button| December 16, 2019|More on: SHOPSHOPXIU

Did you know that the easiest way to maximize stock market gains doesnt involve picking stocks at all?

Studies show that the vast majority of mutual fund managers fail to outperform the market, and if that holds for professionals, it probably holds for the average Joe. In light of this, trying to maximize gains by beating the market may be a difficult feat to pull off.

However, theres one way to maximize your stock market returns thats so easy anybody could do it:

Minimizing your tax burden.

By holding your stocks in registered accounts, you dramatically reduce the taxes you ultimately pay on them. As a result, you ultimately realize a higher return. While it may sound hard to believe, theres one way to actually pay zero capital gains taxes on your entire portfolio.

This strategy does leave you with dividend taxes , but it can completely eliminate the need to realize capital gains.

Max Out Your Tfsa Portfolio And Buy And Hold The Rest

Tax-free savings accounts are the only totally tax-free accounts available to Canadian investors.

Offering both tax-free growth and withdrawal, they give you a double whammy of tax savings. Granted, the TFSA contribution limit is fairly low.

If you have a fair amount of disposable income you wont be able to put all of your investments in a TFSA. However, you can minimize your non-TFSA tax burden too by buying and holding dividend stocks for your non-TFSA portfolio, so you never cash out a capital gain. That way, the only tax you have to pay is the dividend tax, which has a generous credit applied to it.

Also Check: Where Is My State Refund Ga

What Happens When You Sell A Stock

Selling a stock is similar to buying it. You can put in a market order, which is a request to buy the stock as soon as possible at the best available price. You can also put in a limit order, which is a request to sell a stock if it hits a certain price point or higher a stop order, which is executed if a stock falls to a certain price or a stop-limit order, which combines stop and limit orders.

What Taxes Do I Pay On Stock Gains

When you earn money in the stock market, you have to pay income tax on it, just like any other income. But paying taxes on stock gains is a little tricky. The amount you owe depends on the type of investment income youve earned, when you earned it, how long youve owned the asset, and how much you earnedas well as your total income for the year.

Read Also: 1040paytax.com Safe

Selling A Winning Stock

When you sell a stock at a price that’s higher than what you paid for it, you’ll be subject to capital gains taxes on that sale. But the amount of tax you’ll pay will hinge on how long you held that stock before selling it.

Stocks that are held for a year or less are subject to short-term capital gains taxes, which mimic the that apply to ordinary income. Meanwhile, stocks that are held for at least a year and a day before being sold are subject to long-term capital gains taxes, which come in at a much more favorable rate. Long-term capital gains taxes amount to 0% for lower earners, 15% for moderate to high earners, and 20% for the ultra-wealthy. By contract, marginal tax rates top out at 37% for extremely high earners.

To highlight the difference, let’s say you’re single and report $100,000 a year in income. Your marginal tax rate will be 24%, which means if you sell a stock you’ve held for a year or less that results in $1,000 in gains, you’ll pay $240 in taxes.

Now, let’s say you held that same stock for at least a year and a day before selling it. In that case, you’ll only pay 15%, or $150, in taxes, because that’s the capital gains tax rate you’ll be subject to.

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

Also Check: Do You Have To Report Roth Ira On Taxes