Resident Individual Income Tax

Resident taxpayers who are required to file a federal individual income tax return are required to file a Louisiana income tax return,IT-540, reporting all of their income. If a Louisiana resident earns income in another state, that income is also taxable by Louisiana. A temporary absence from Louisiana does not automatically change your domicile for individual income tax purposes. As a resident taxpayer, you are allowed a credit on Schedule G for the net tax liability paid to another state if that income is included on the Louisiana return.

Residents may be allowed a deduction from taxable income of certain income items considered exempt by Louisiana law. For example, Louisiana residents who are members of the armed services and who were stationed outside the state on active duty for 120 or more consecutive days are entitled to a deduction of up to $30,000. In each case, the amount of income subject to a deduction must be included on the Louisiana resident return before the deduction can be allowed.

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

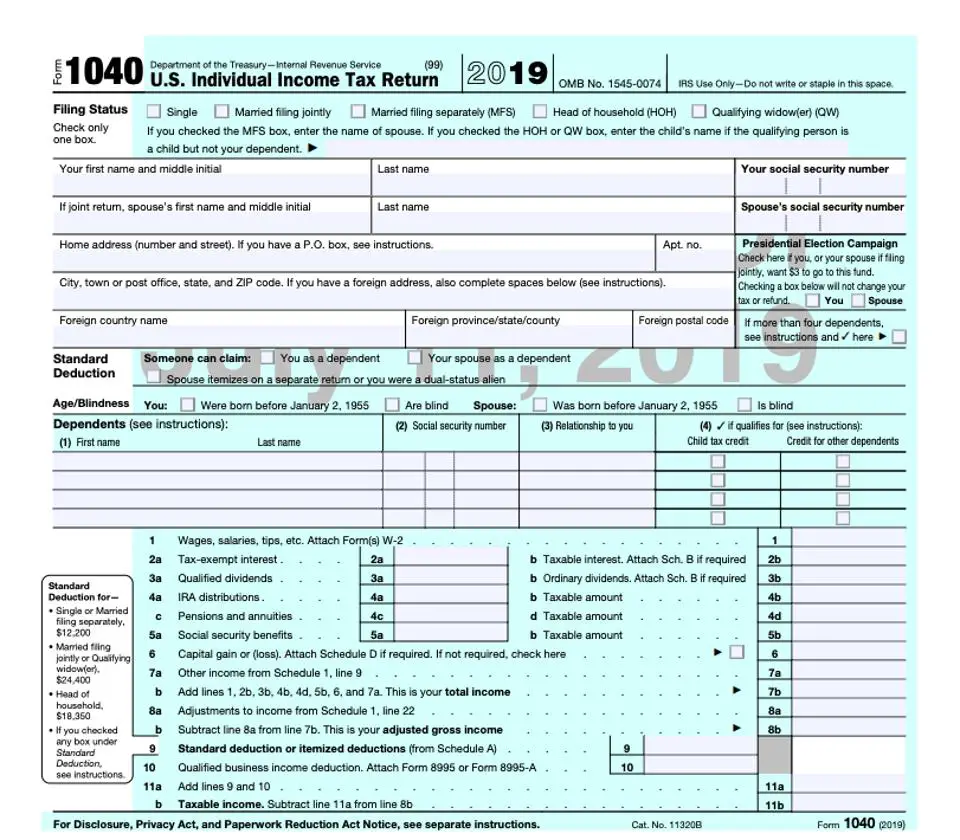

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

Recommended Reading: Get My Stimulus Payment Phone Number

How Much Can I Get With The Ctc

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 . Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you dont owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

Read Also: How To Pay Back Taxes Online

What To Do If You Missed The Deadline To Claim Your Money

If you missed any of the deadlines above to claim your missing child tax credit payments or stimulus money, donât worry. You can still claim that money when you file your taxes in 2023 â you just wonât receive it this year.

The final cutoff day for claiming the money will be on Tax Day in 2025, but we recommend filing as soon as possible.

You May Like: How To Check If You Received 3rd Stimulus Check

Which Tax Return Will The Irs Base My Third Stimulus Payment On

Q. I used the Recovery Rebate Credit on my 2020 tax return because my 2020 income was lower than 2019. Will the 2020 figures be used for the new $1,400 stimulus payment?

Need the money

A. Yes.

But timing is everything.

When the IRS processes your tax return is what will make the difference in determining what year the agency will use to calculate your stimulus payments, said Steven Gallo, a certified public accountant and personal financial specialist with U.S. Financial Services in Fairfield.

He said the worst case scenario is that you will have to wait until it processes your 2020 tax return to see your third stimulus payment.

It is our understanding that the current checks would be cut based on the most current tax return information the IRS has in their system, therefore if your 2020 tax return had not been processed prior to the first round of checks being issued they would still be using 2019 information, Gallo said. Once your 2020 return is processed and if it determines that you are eligible for stimulus relief, the IRS has until the end of 2021 to issue your check.

The IRS has not yet given guidance on how taxpayers will be able to make adjustments in the future.

The agency is still backed up with some 2019 returns that havent yet been processed, so its possible that 2020 returns may also take longer to process.

Email your questions to .

If you purchase a product or register for an account through one of the links on our site, we may receive compensation.

You May Like: Do You Have To Pay Taxes On Personal Injury Settlements

What Can Slow Down Your Refund

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund. Learn more about our refund review process and what we’re doing to protect taxpayers.

- Missing information or documents. If we send you a letter requesting more information, please respond quickly so we can continue processing your return.

- Errors on your return. We found a math error in your return or have to make another adjustment. If the adjustment causes a different refund amount than you were expecting, we will send you a letter to explain the adjustment.

- Problems with direct deposit. If you requested direct deposit, but the account number was entered incorrectly, your bank won’t be able to process the deposit. When this happens, your bank notifies us, and we will manually re-issue your refund as a check. This process could take up to 2 weeks between the time we receive notification from the bank and when you receive the check.

Do I Qualify For The Middle Class Tax Refund

You will need to have filed your 2020 tax return by October 10, 2021. You also cannot have been declared as a dependent. You must have been a California resident for at least 6 months in 2020 and be a California resident on the date the MCTR payment was issued. Eligibility and amount received is dependent on income.

You May Like: How Does The Child Tax Credit Work 2021

Nonresident Athlete Individual Income Tax

A nonresident individual who is a member of the following associations is considered a professional athlete and is required to electronically file a Louisiana income tax return, IT-540B reporting all income earned from Louisiana sources:

- Professional Golfers Association of America or the PGA Tour, Inc.

- National Football League

- East Coast Hockey League

- Pacific Coast League

Income from Louisiana sources include compensation for the services rendered as a professional athlete and all income from other Louisiana sources, such as endorsements, royalties, and promotional advertising. The calculation of income from compensation is based on a ratio obtained from the number of Louisiana Duty Days over the total number of Duty Days. Duty Days is defined as the number of days that the individual participated as an athlete from the official preseason training through the last game in which the individual competes or is scheduled to compete.

Earned Income Tax Credit

Another tax credit that is less generous this year is the Earned Income Tax Credit, or EITC, which is aimed at low- and moderate-income workers.

During the pandemic, the EITC was increased for a group of workers who typically don’t benefit much from it: Adults without kids. In 2021, low-income workers without children were eligible to receive a credit worth up to $1,500.

This year, the tax credit is reverting to a lower amount for this group $560 in 2022.

Low-income parents who qualify for the EITC will actually receive slightly higher amounts in 2022, as that figure is adjusted annually for inflation. For instance, this year eligible parents with two children can receive an EITC of $6,164, compared with $5,980 in 2021.

Don’t Miss: How Much Is Ny State Tax

If Your Refund Isnt What You Expected

If your refund amount isnt what you expected, it may be due to changes we made to your tax return. These may include:

- Corrections to any Recovery Rebate Credit or Child Tax Credit amounts

- Payments on past-due tax or debts, offset from all or part of the refund amount

For more details, see Tax Season Refunds Frequently Asked Questions.

Tax Stimulus Check: This Is How You Can Get One Last Stimulus Check

A third stimulus check is still available if you havent received it yet

While the deadlines for the first two Economic Impact Payments have passed, the third stimulus check, worth up to $1,400 per person, is still available if you havent already gotten it.

According to CNBC.com, the majority of qualified beneficiaries of the payments permitted by the American Rescue Plan in March 2021 had already received stimulus payments via direct deposit or mailed checks as of January 2022. If you havent gotten a payment, your only option is to file a 2021 tax return, which is due on April 18.

The 2021 Recovery Rebate Credit, the third stimulus check, was issued based on your income and the number of dependents stated on your 2020 or 2019 tax return. As a result, if you have qualified dependents in 2021, you may owe money. You may also be entitled for a stimulus credit if you did not file a return in 2019 or 2020.

You May Like: How Can Tax Identity Theft Occur

The Federal Income Tax: How Are You Taxed

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

What Is The Tax Refund Calculator

The tax refund calculator for 2022, and 2023 is a simple way to estimate your tax refund. You can calculate how much money you will get back from the government from your tax return.

The taxcaster calculator will ask for your filing status, income, deductions, and credits. Once you have entered all of the required information, the calculator will give you an estimate of your refund.

Read Also: How To Fill Out Small Business Tax Forms

But You Wont Have To Give Money Back Just Because You Received Too Much

The third stimulus check was issued to most people last year as an advancement of a 2021 tax credit. According to NerdWallet, this means that because the IRS did not have access to your 2021 tax information yet when sending this payment, they likely relied on your 2020 or 2019 tax return to determine if you were eligible. As a result, taxpayers might realize that they donât actually qualify for all the money they received for the third economic impact payment when filing their 2021 return.

But fortunately, the IRS has a no harm, no foul outlook on recipients in this case. According to the tax agency, you donât have to pay back money from your third stimulus check, even if you received too much. âIf you qualified for a third payment based on your 2019 or 2020 tax return, the law doesnât require you to pay back all or part of the payment you received based on the information reported on your 2021 tax return,â the IRS explains.

Estimate Your Income Tax For A Previous Tax Year

Use this service to estimate how much Income Tax you should have paid for a previous tax year.

There are different ways to:

If youre self-employed, use the HMRCself-employed ready reckoner to budget for your tax bill.

You may be able to claim a refund if youve paid too much.

You need details of:

- your earnings, before and after tax – get this from your P60

- any savings – get this from your bank statements or annual statement from your bank or building society

- any Gift Aid donations youve made to charity

You May Like: What Is Bidens Tax Plan

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Can I Estimate How Much My Tax Refund Will Be

The tax refund calculator takes into account your income, deductions, and credits to give you an estimate of your refund. The process is pretty simple.

If you are getting a refund, its best to file your taxes early in the year. If youre like most Americans, you wait until the last minute to prepare your federal income taxes. Filing your taxes early has its benefits.

The IRS issues refunds on a first-come, first-served basis, so the sooner you file, the sooner youll get your money. And if youre expecting one, why not get it as soon as possible?

You May Like: When Will My Tax Return Come

If You Did Not Qualify For The Atr

Under Indiana law, the $200 ATR eligibility requirements differ from the $125 ATR.

If you were not eligible for the $125 ATR, you would be eligible for the $200 ATR if you:

- receive Social Security benefits in 2022 and

- are not claimed as a dependent on someone elses tax return.

The General Assembly did not pass legislation proposing an affidavit to apply for the $200 ATR. No form is needed to receive this refund.

If you qualify for only the $200 ATR, you will not receive an additional taxpayer refund in 2022. Instead, you must file a 2022 Indiana resident tax return before Jan. 1, 2024, and claim the $200 ATR as a tax credit.

You must file a 2022 state tax return to claim the credit, even if you do not normally file a tax return due to your income.

Tax credits are not the same as tax deductions. Tax credits are applied dollar-for-dollar as an additional amount to your tax refund or used to reduce the amount of any tax you may owe. Eligible recipients will receive the $200 ATR in the form of a tax credit on their state income tax return.

Tax returns for 2022 will not be accepted until mid- to late-January 2023. You can find information on how to claim the $200 ATR as a credit on this page, in tax instruction booklets and on Form SC-40 by early 2023. In addition, many major tax software vendors are expected to include this information in their products.

How To Claim The Ctc

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes or submitted your info to the IRS through the 2021 Non-filer portal or GetCTC.org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return .

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return , you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit or the first and second stimulus checks.

Recommended Reading: How To Pay Car Taxes Online Sc

If You Qualified For The $125 Atr

If you were eligible for the $125 ATR, you were automatically eligible for the $200 ATR.

You should have received either:

- two direct deposits

- a direct deposit and a check or

- one combined check totaling $325 for both ATRs .

Whenever possible, DOR issued combined payments for taxpayers who filed joint tax returns in 2020.

DOR is unable to update banking information for taxpayers who changed bank accounts between refund periods.