Gather Documents For All Sources Of Income

When you know your filing status, you will need to gather documents for all sources of income for yourself, your spouse , and any dependents . The total of all these sources of income is known as your gross income. Below are the most common tax forms that you will need in order to calculate your gross income.

- Form W-2 shows the income you earned through services performed as an employee.

- If you worked a contract job or side gig, then you will need a Form 1099-NEC . It reports income earned while working for a non-employer person or entity .

- Form 1099-MISC reports amounts earned from other income sources, including rents, prizes, fishing boat proceeds, or crop insurance payments.

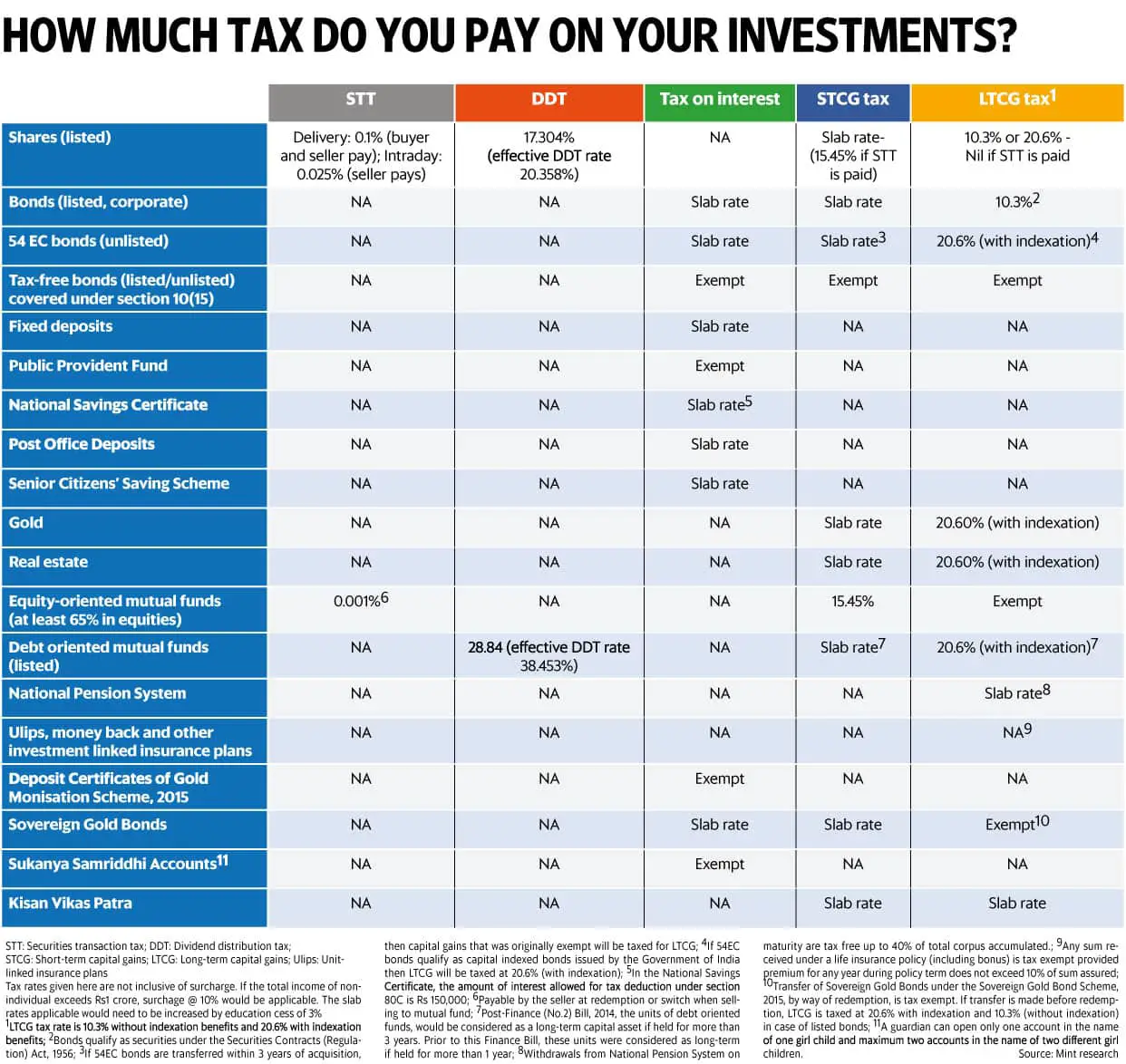

- If you earned more than $10 in interest during the tax year, then you will receive a Form 1099-INT from your financial institution.

How Do I Claim A Refund If I Have Stopped Working Part Way Through The Tax Year

If you have stopped work part way through the tax year and know that you are not going to have a continuing source of taxable income , you should be able to claim an in-year tax repayment using form P50. This means your refund will be paid within the tax year, rather than having to wait until the end of the tax year.

You should not need to send in your P45, however if the details on your form P50 do not match HMRC payroll records, then you may be asked to send it in so keep it somewhere safe.

You may also be able to use form P50 to claim a refund where you become unemployed and know that you definitely will not be working again for at least four weeks.

If you start work again after that, some adjustments may be needed over the rest of the tax year to take into account the fact that you have already had an in-year refund. If you start a new job within four weeks of finishing your old one, make sure you give your new employer form P45 . They should pay any refund you are entitled to with your pay from your new job .

Once you have sent in a P50, if you are entitled to a repayment of income tax, HMRC will send it to you this may be by cheque in the post, or direct to your bank account if you so request.

You can also nominate someone else to receive the refund and it can be paid by post or directly into their bank or building society account.

Is Social Security Taxable

Social Security income is generally taxable at the federal level, though whether or not you have to pay taxes on your Social Security benefits depends on your income level. If you have other sources of retirement income, such as a 401 or a part-time job, then you should expect to pay some income taxes on your Social Security benefits. If you rely exclusively on your Social Security checks, though, you probably wont pay taxes on your benefits. State taxes on Social Security, on the other hand, vary from state to state. Regardless, it can be helpful to work with a financial advisor who can help you understand how different sources of retirement income are taxed.

You May Like: What Percentage Do Federal Taxes Take Out

What Is A Tax Bracket

A tax bracket is a range of taxable income that is subject to a specific tax percentage. The brackets used to calculate your income tax depend on your filing status. In 2021 there are seven tax brackets with each one having a different tax rate ranging from 10% to 37%. For example, the brackets below show the first tax bracket if you are filing as single is from $0 to $9,950 with a tax rate of 10%.

TurboTax Tip: Ordinary income is taxed at seven different rates: 10, 12, 22, 24, 32, 35 and 37 percent. These are marginal rates, meaning that each rate applies only to a specific slice of income, rather than to your total income.

Tip #: Consider Deferring Your Business Income

This isnât a feasible option for everyone. But for those of you who invoice clients, consider delaying your December invoicing until the New Year.

Hereâs why: A payment you receive on December 31st has to be reported on your tax return by the following April. However, a payment you get on January 1st doesnât have to be reported until April of the following year. Thatâs 11 extra months!

Delaying your income by just a couple of days can give you lots of extra breathing room to plan for taxes.

Also Check: What Is Wotc Tax Credit

What Is My Tax Bracket

OVERVIEW

The federal income tax system is progressive, which means that tax rates go up the greater taxable income you have. The term “tax bracket” refers to the income ranges with differing tax rates applied to each range. When figuring out what tax bracket youre in, you look at the highest tax rate applied to the top portion of your taxable income for your filing status.

How Will Having A Second Job Affect My Benefits

Taking a second job can affect your tax credits or other benefits. So you need to work out how much extra youll be earning.

If youre claiming Universal Credit, and arent getting the work allowance, your payment will go down 63p for every £1 earned.

Find out more in our guide Universal Credit explained

If youre still claiming Working Tax Credit, youll need to tell the Tax Credit Office if your income changes by more than £2,500. But this might count as a change in circumstances and could mean you have to make a new claim for Universal Credit.

Find out more about how income changes affect Working Tax Credit in our guide

Don’t Miss: How To Find Tax Return Information

What Is The Marriage Tax Allowance And Who Can Get It

The marriage tax allowance allows you to transfer £1,260 of your personal allowance to your spouse or civil partner if they earn more than you.

If your claim is successful, it will lower the higher earner’s tax bill for the tax year, but you can also backdate your claim if eligible. Only people with specific circumstances will be able to apply:

- You need to be married or in a civil partnership. Just living together doesn’t count.

- One of you needs to be a non-taxpayer. This usually means you’ll earn less than the £12,570 personal allowance between 6 April 2022 and 5 April 2023.

- The other partner needs to be a basic 20% rate taxpayer. This means you’d normally need to earn less than £50,270, or if you live in Scotland, £43,662. Higher or additional-rate taxpayers aren’t eligible for this allowance.

- You both must have been born on or after 6 April 1935. If not, there’s .

In a nutshell, one of you must be a non-taxpayer and one must be a basic-rate taxpayer.

Who Is Eligible For A Tax Rebate

To be eligible for a refund, the administration said individuals must have filed a 2021 state tax return on or before Oct. 17, 2022. An individual’s credit may be reduced due to refund intercepts, including for unpaid taxes, unpaid child support and certain other debts.

Please note that:

- Both resident and non-resident filers are eligible

- Non-residents on whose behalf a partnership files on a composite basis are eligible

- Fiduciary filers are eligible

Read Also: How Much Is My Salary After Tax

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay federal income tax, then you will also need to withhold taxes from your monthly income.

To withhold taxes from your Social Security benefits, you will need to fill out Form W-4V . The form only has only seven lines. You will need to enter your personal information and then choose how much to withhold from your benefits. The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit. After you fill out the form, mail it to your closest Social Security Administration office or drop it off in person.

If you prefer to pay more exact withholding payments, you can choose to file estimated tax payments instead of having the SSA withhold taxes. Estimated payments are tax payments that you make each quarter on income that an employer is not required to withhold tax from. So if you ever earned income from self-employment, you may already be familiar with estimated payments.

In general, its easier for retirees to have the SSA withhold taxes. Estimated taxes are a bit more complicated and will simply require you to do more work throughout the year. However, you should make the decision based on your personal situation. At any time you can also switch strategies by asking the the SSA to stop withholding taxes.

How Do Tax Credits Work

A tax credit is subtracted directly from the amount of tax you owe, so it reduces your total tax liability dollar for dollar, and the value of the credit is the same for everyone who is eligible to receive it. This is different from tax deductions, which subtract from your taxable income.

The value of a tax deduction depends on your marginal tax rate, so the more income you earn, the less a deduction is potentially worth. Here are a few examples of the most common tax credits claimed by taxpayers each year.

Most Common Tax Credits

- Earned Income Tax Credit

- The earned income tax credit helps low- to moderate- income workers and families who meet certain requirements reduce their tax liability.

- Child Tax Credit

- You could increase your tax refund by thousands of dollars by claiming the child tax credit for each child you claim as a dependent. If you received an advance payment of part of your 2021 CTC under the American Rescue Plan, you can claim the rest of the CTC when you file your tax return for the 2021 tax year.

- Savers Credit

- Putting away money for retirement may entitle you to a savers credit on your tax return. If you contributed to an IRA this year, the retirement savings contribution credit will reduce your tax liability by between 10% and 50% of the amount of your contributions, depending on your income.

- Education Credits

- The IRS offers credits for qualifying education expenses, such as the American opportunity tax credit and the lifetime learning credit.

You May Like: What Tax Form Should I Use

Calculate Your Adjusted Gross Income

The next step is to calculate your AGI. Your AGI is the result of taking certain above-the-line adjustments to your gross income, such as contributions to a qualifying individual retirement account , student loan interest, and certain education expenses.

These items are referred to as above the line because they reduce your income before taking any allowable itemized deductions or standard deductions.

Can I Work While Drawing My Pension

You can work and earn money while drawing any kind of pension, whether its a workplace, personal or state pension. The only exception to this would be a defined benefit pension you would not be able to work for the employer who provides this pension once you start to draw it .

Bear in mind that earning while drawing your pension will increase your tax bill.

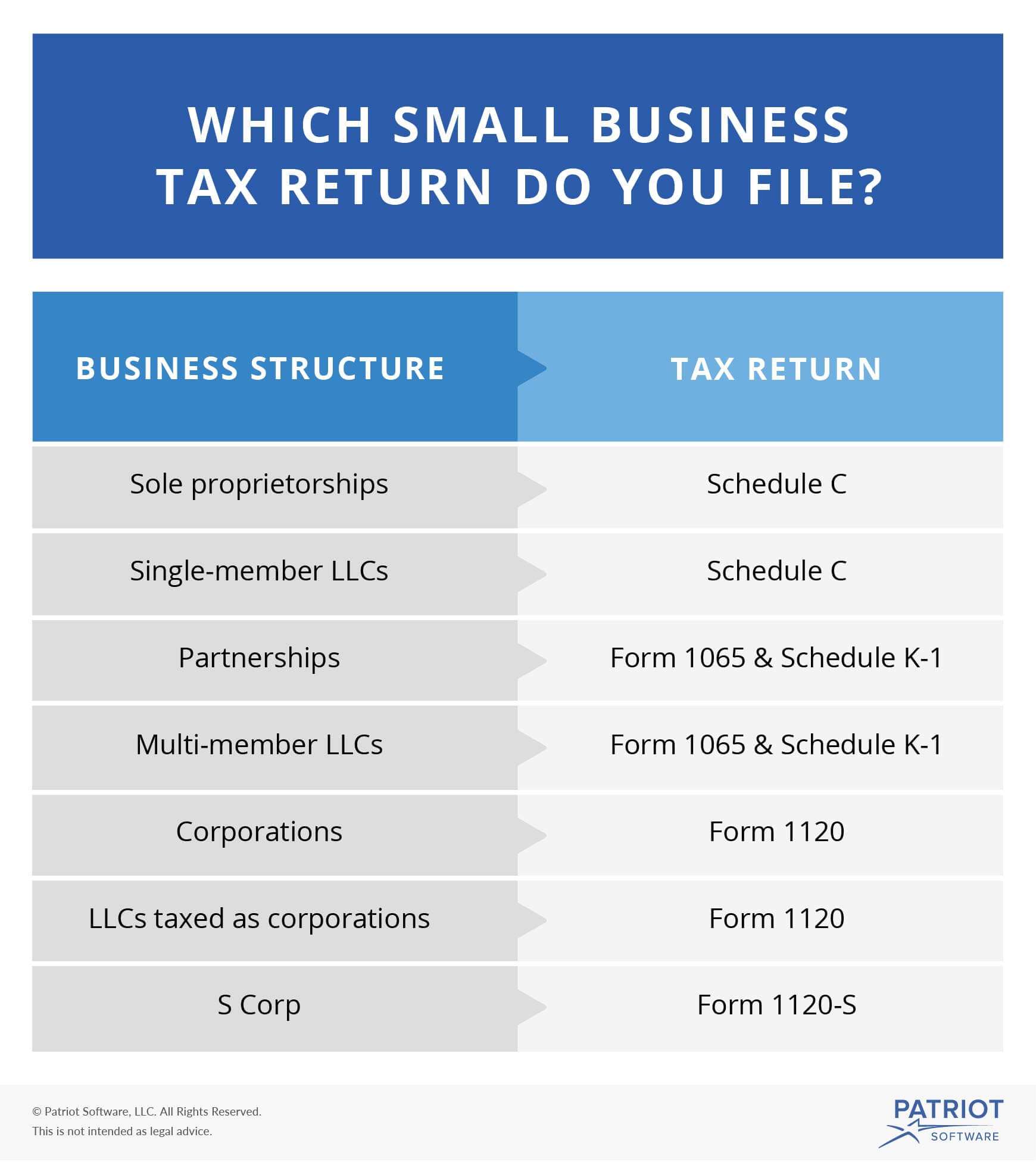

Recommended Reading: Can I File My Llc And Personal Taxes Together

There’ll Be A Slight Gain If One Of You Is A Non

If you’re the non-taxpayer and you earn slightly below £12,570, then by transferring £1,260 of your personal allowance to your partner, you will likely start having to pay income tax .

However, in most cases like this it’ll STILL be worth you applying for marriage tax allowance provided your partner comfortably earns above £12,570. Even if you’ve now got an income tax bill, the tax saving your partner makes should outweigh the loss you’re incurring. Here’s an example:

Peter earns £11,970 and is a non-taxpayer . His wife Fiona earns £16,070 and is a basic-rate taxpayer . If Peter decides to transfer some of his personal allowance to Fiona, he’ll have no choice but to transfer the full £1,260. That effectively leaves him with a personal allowance of £11,310 and ‘increases’ Fiona’s personal allowance to £13,830 .

Peter now earns £660 more than his personal allowance , meaning he’ll pay basic-rate tax for the year of £132 . Meanwhile, the £1,260 personal allowance ‘increase’ Fiona gets means she’ll get to keep an extra £252 . The net gain for Peter and Fiona is therefore £120.

And here’s another example of this in practice from one of our MoneySavers…

Many thanks for recommending that we consider applying for marriage tax allowance. The transfer of some of my wife’s tax allowance to myself has resulted in a cheque from HM Revenue & Customs for £968, plus each year going forward there will be further tax savings.

– Gary

How Much Of My Pension Is Tax Free

The good news is that some of your pension is tax free. If you have a defined contribution pension , you can take 25 per cent of your pension free of income tax. Usually this is done by taking a quarter of the pot in a single lump sum, but it is also possible to take a series of smaller lump sums with 25 per cent of each one being tax-free. The rest of your pension income will be taxed in the normal way.

Most defined benefit pensions also offer the option of taking a tax-free lump sum as well as a guaranteed income. Ask your scheme for details of this.

You May Like: How Does Business Tax Work

Taxable Income Vs Nontaxable Income

The IRS considers almost every type of income to be taxable, but a small number of income streams are nontaxable. For example, if you are a member of a religious organization who has taken a vow of poverty, work for an organization run by that order, and turn your earnings over to the order, then your income is nontaxable.

Similarly, if you receive an employee achievement award, then its value is not taxable as long as certain conditions are met. If someone dies and you receive a life insurance payment, then that is nontaxable income as well.

Different tax agencies define taxable and nontaxable income differently. For example, while the IRS considers lottery winnings to be taxable income in the United States, the Canada Revenue Agency considers most lottery winnings and other unexpected one-time windfalls to be nontaxable.

Income Taxes And Your Social Security Benefit

Some of you have to pay federal income taxes on your Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits .

You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service rules. If you:

- file a federal tax return as an “individual” and your combined income* is

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

Don’t Miss: How Much Tax Is Paid On 401k Withdrawal

Keep A Record Of Your Expenses

To claim a deduction, you must have a record to prove you incurred the expense and how you calculated your claim.

Keep receipts using the myDeductions tool in the ATO app to make it easier to do your tax return. You can record:

- expenses and deductions

It’s a convenient way to keep your records in one place. Then at tax time, you can upload the data directly into your tax return or email a copy to your tax agent.

Tax Rates And The Standard Rate Cut

Tax is charged as a percentage of your income. The percentage that you paydepends on the amount of your income. The first part of your income, up to acertain amount, is taxed at 20%. This is known as the standard rate oftax and the amount that it applies to is known as the standard ratetax band.

The remainder of your income is taxed at the higher rate of tax,40%.

The amount that you can earn before you start to pay the higher rate of taxis known as your standard rate cut-off point. You can see examplesof how to calculate income tax using these tax rates and the standard ratecut-off point.

Standard rate cut-off points

| 38,550 | Balance |

Example of standard rate cut-off point for a married couple or civilpartners with two incomes

In 2022, the standard rate cut-off point for a married couple or civilpartners is 45,800. If both are working, this amount is increased by thelower of the following:

- The amount of the income of the spouse or civil partner with the smaller income

If one person is earning 48,000 and their spouse or civil partner isearning 29,000:

Read Also: Can You Use Pay Stubs To File Taxes

Can My Employer Stop Me From Having A Second Job

One of the first questions you need to ask yourself is if your existing contract of employment lets you take on a second job.

You should have been given a copy of your contract when you started working for your employer. If you dont have one, your employer or HR department should be able to provide you with one.

Your employer might rule out you taking on extra jobs in situations where:

- there might be a conflict of interest, for example working for a rival company

- your second job might bring your employer into disrepute.

If youre not sure, check your contract. If theres nothing about second jobs stated in it, your employer cant prevent you from taking another job.