Is There A Minimum Tax For Llc In Nj

Additionally, there is a minimum tax of $375 due each year for New Jersey LLCs that are taxed as an S-Corp.

How much will my business taxes be?

On average, the effective small business tax rate is 19.8%. However, businesses pay different amounts in taxes based on their entities. Generally, sole proprietorships pay a 13.3% tax rate, small partnerships pay a 23.6% tax rate, and small S-corporations face a 26.9% tax rate.

How do I pay sales tax on a small business in NJ?

File all Sales and Use Tax returns electronically, either online or by phone through the NJ Sales and Use Tax EZ File Systems.

How Do Llc Taxes Work

An LLC is typically treated as a pass-through entity for federal income tax purposes. This means that the LLC itself doesnt pay taxes on business income. The members of the LLC pay taxes on their share of the LLCs profits. State or local governments might levy additional LLC taxes. Members can choose for the LLC to be taxed as a corporation instead of a pass-through entity.

There are several types of LLC taxes. The federal government, as well as state and local governments, levy these taxes. All LLC members are responsible for paying income tax on any income they earn from the LLC as well as self-employment taxes. Depending on what you sell and whether you employ anyone, you might also be responsible for paying payroll taxes and sales taxes. To complicate things even more, an LLC can opt to be taxed as a different business entity.

In this guide, well cover the entire range of LLC taxes, what youll be responsible for, and options for reducing your tax bill. Understanding your tax burden in advance can help you make smarter financial decisions.

Llc Taxed As S Corp Or C Corp

As an alternative, an LLC can choose to be taxed as a corporation by filing Form 8832, Entity Classification Election, with the IRS.

An LLC can also file a further election to be taxed as an S corporation. Corporate taxation can be more complicated and its a good idea to consult an accountant before choosing to be taxed as a corporation. Some of the reasons an LLC might choose corporate taxation include:

- You plan to leave a substantial amount of money in the business each year to finance expansion or for other reasons.

- Your profits are far greater than the amount the owner/employees should reasonably make in salary and you want to minimize self-employment taxes.

An LLC taxed as a C corporation files a corporate income tax return each year. The shareholders also report any salary and dividends they receive on their personal tax returns.

An LLC taxed as an S corporation follows a procedure similar to a partnership, filing an informational return and providing members with a Schedule K-1 form showing their share of the profits . The members then report that income on Schedule E of their personal tax returns.

Read Also: Can You Pay Irs Taxes With Credit Card

How To Pay Yourself From A Single Member Llc

You pay yourself from your single member LLC by making an ownerâs draw.

Your single-member LLC is a âdisregarded entity.â In this case, that means your companyâs profits and your own income are one and the same. At the end of the year, you report them with Schedule C of your personal tax return . Making an ownerâs draw is like officially noting the fact that some of your LLCâs income is staying in the company as retained earnings, and some of it youâre taking for personal use.

Business Income Tax Rate For S

Pass-through entities include sole proprietorships, partnerships, S corporations and LLCs that have not elected to be taxed like a C-corp. Roughly 95% of businesses in the U.S. are pass-through entities.

The term pass-through stems from the fact that the business doesnt pay federal income taxes directly. Instead, business income and losses pass through to the owners and members, who pay taxes on business profits via their individual income tax returns.

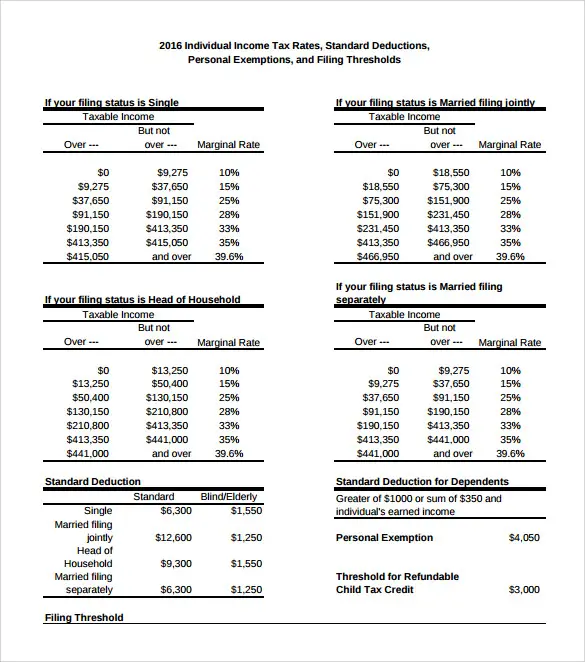

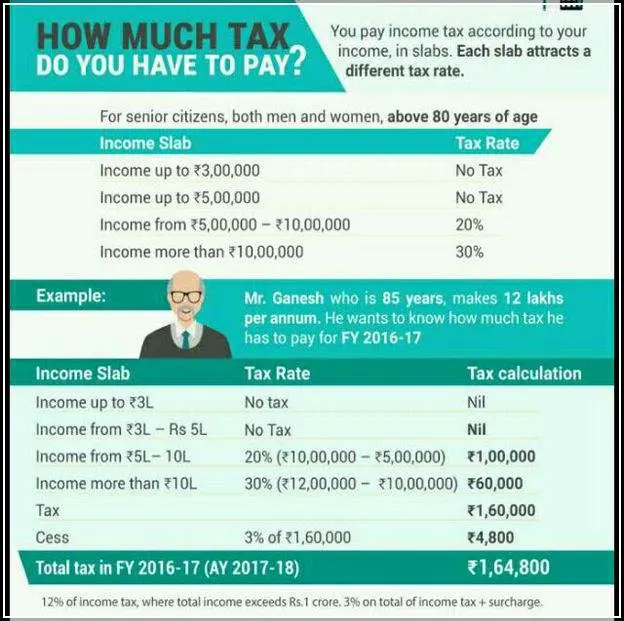

On individual tax returns, business income is taxed at the same rates as other ordinary income, such as wages from a job or interest earned from a savings account. For the 2022 tax year , the federal income tax brackets are:

Read Also: Which States Have The Lowest Property Taxes

Special Tips Of Llc Taxes For Business Owners

LLCs are the only type of business that can choose how to be taxed. The default tax structure is to treat the LLC as a pass-through entity, allowing all income to be taxed as self-employment income for the LLC owners. However, members can elect to have the LLC taxed as a corporation, giving owners the ability to choose the best tax structure for them.

Since LLC income is normally taxed as self-employment income, business owners can also claim their share of business expenses to reduce their tax burden. Look into the tax deductions available in your state and how much of your business expense can be deducted.

Filing Taxes As A C Corporation

If an LLC thinks it can lower its tax bill by being taxed as a corporation, it can file Form 8832 with the IRS and opt to be taxed as a C corporation.

Getting taxed as a C corporation means that instead of letting the LLCâs income and expenses flow through to their personal tax returns, the LLC owners will now get taxed separately from the company, and the LLC will have to file its own separate corporate tax return.

Also known as Form 1120, LLC owners use the corporate tax return to report the corporationâs income, gains, losses, deductions, credits, and to calculate its tax liability. Like Schedule C, youâll need all of your companyâs important financial information and statements on hand before filling it out.

You May Like: What Is Property Tax Used For

Llc Tax Rate Introduction

Creating a business entity has several advantages. The formation of a business entity provides protection for your assets, increasing your financial visibility, and making your taxes easier to handle. Selecting the right corporate entity will decrease your annual tax bill significantly. Being taxed as an S corporation is the simplest way for business owners to lower the amount of tax bills.

This is accomplished by:

- The formation of an S corporation

- The formation of a Limited Liability Company or LLC and electing to be taxed as an S corporation

In order to calculate your business’s corporate tax, you need to know what the taxable income is first.

In order to estimate corporate taxable income:

- Complete Form 1120

- As a starting point, use last year’s taxable income

Calculating Self Employment Taxes

The first $106,800 of your taxes are made up of Social Security and Medicare taxes, which is estimated at 15% .

Most individuals concentrate on income taxes since they have a higher rate, but they overlook the bigger picture.

Because Self-Employment taxes are the first round of payments, they frequently account for more money paid out of pocket.

There are two types of Self-Employment taxes: the Social Security tax and the Medicare tax.

The Social Security tax is 12.4% on income up to $128,400 in 2019. The Employee and the Employer both pay self-employment taxes.

The Medicare tax is 2.9% on all income. This tax is paid by the employee only.

Read Also: Where To File Georgia State Taxes

Requesting An Extension Of Time For Filing A Return

Revised Statute 47:287.614allows an extension of time for filing the combined corporation income and franchise tax return not to exceed seven months from the date the return is due. All extension requests must be made electronically on or before the returns due date. The returns due date is May 15th for calendar year filers, and the 15th day of the fifth month following the close of the taxable year for fiscal year filers. Extension requests received after the returns due date or on paper will not be honored. An extension may be requested in the following manner:

Requesting the extensions electronically through the Bulk Extension Filing application or the Online Extension Filing application on LDR’s web site

Filing an extension request electronically by calling 225-922-3270 or 888-829-3071. For an extension request, select option #3, then select option #2. Taxpayers will need the Corporations LA account number to request the extension or

Requesting the extensions electronically through tax preparation software that supports the electronic filing of the Louisiana Application for Extension to File Corporation Income and Franchise Tax.

How Does A Sole Proprietor Pay Taxes

As a sole proprietor you must report all business income or losses on your personal income tax return the business itself is not taxed separately.

What do you have to do every year for your LLC?

The LLC Annual Report will keep your LLC in good standing. Fees and due dates vary by state. Once your LLC is formed, paperwork with the state is not over. As a part of the ongoing requirements for your LLC, your state requires that you file an Annual Report and pay a filing fee every year.

Don’t Miss: How To Calculate 1099 Taxes

Llc Filing As A Corporation Or Partnership

A Limited Liability Company is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owners tax return . A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation. For income tax purposes, an LLC with only one member is treated as an entity disregarded as separate from its owner, unless it files Form 8832 and elects to be treated as a corporation. However, for purposes of employment tax and certain excise taxes, an LLC with only one member is still considered a separate entity.

How Much To Pay Yourself From Your Llc

When you earn a share of your LLCâs profits as salary, you need to make sure youâre paying yourself adequately. If youâre earning a $1,000 salary from your LLC that files a corporation, and an additional $90,000 as dividends, youâll pique the IRSâ interest. Thatâs because you arenât paying payroll tax on the $90,000.

But when the IRS says you should pay yourself a âreasonableâ salary, what do they mean by âreasonableâ? They never explain.

Hereâs the best method:

The less you earn as a salary, and the more as dividends, the fewer taxes youâll have to pay. The trick is striking the right balance. An accountant can help with this.

You May Like: How Do I File My Taxes With Turbotax

How To Distribute Your Paychecks As An Llc Owner

Once youve set up a separate business entity, you can set up a business bank account, as well. This isnt required, but its a big help to keep your accounting in order and protect your personal finances in case of liabilities against the business.

The money you earn for sales or services should go into the business account first. Use that to cover business expenses, and make payments into a personal account you use for personal and household expenses.

You can take money out of your business account in any form you wante.g., cash, paper or electronic checks, ACH payments, PayPal or Venmo. However you do it, youre responsible for applicable income and self-employment taxes on your business income.

A payroll service can significantly simplify this process. For example, you can sign up for a service such as Gusto or Wave, set yourself up as an employee or contractor, and automatically receive payments to your personal bank account via ACH. Gusto even files W-4s, W-2s, W-9s and 1099s for you and pays payroll taxes automatically. Wave does this in some states.

Do I Have To Pay Taxes On An Llc That Made No Money

When Your Company Made Little or No Money Usually, LLCs that have elected to be taxed as a general partnership or sole proprietorship are not required to file a federal tax return with the IRS. A few states require partnerships or sole proprietorships to file tax returns, even though they’re “pass-through” entities.

Don’t Miss: What Happens When You Forget To File Taxes

How Is Owners Draw Taxed

The Owners Draws are not taxable on the business income. Rather, these are taxable as the income on the owners income tax returns.

Thus, if you are a sole proprietor, your draws are considered personal income and are taxed on your income tax return.

Likewise, the IRS recognizes partnerships similar to sole proprietorships. This means that the earnings generated via partnerships are treated as personal income.

However, in the case of partnerships, a single person does not have a claim on the revenue or profits of the business.

Instead, each partner has a share in the earnings generated based on the percentage of share stated in the partnership agreement.

Therefore, each partner includes his share of income in his income tax return. Furthermore, he is required to pay income tax and self-employment taxes quarterly.

Finally, the rules about the owners draw in the case of an LLC vary depending upon the state laws. Hence, you need to go through the state laws before considering the owners draw and taxes on the same in the case of an LLC.

Also, as a business owner, you pay taxes from the owners draw as in the case of a sole proprietor or partner. This applies to both single and multiple-member LLCs.

You May Like: How To Find Out If You Owe Back Taxes

What If My Llc Made No Money

Even if your LLC didn’t do any business last year, you may still have to file a federal tax return. … But even though an inactive LLC has no income or expenses for a year, it might still be required to file a federal income tax return. LLC tax filing requirements depend on the way the LLC is taxed.

Recommended Reading: When Do People Get Tax Returns

Student Loan Interest Deduction

When you make monthly payments to your student loans, that includes your principal payment as well as any accrued interest payments. Whether you have private or federal student loans, the student loan interest deduction lets you reduce your taxable income, depending on how much interest you paid. For 2021, this reduction went up to $2,500 a year.

You’re eligible for the deduction if you paid student loan interest in the given tax year and if you meet modified adjusted gross income requirements , For 2021, you qualified if your MAGI was less than $70,000 . Partial deductions were offered for those with MAGI between $70,000 and $85,000 .

With federal student loan repayments on pause and interest at 0%, you might not have paid any interest over the past year. That said, you should log into your student loan portal and check form 1098-E for any eligible interest payments.

If eligible, this deduction will lower your taxable income, which could reduce how much you owe the IRS or increase your tax refund. You might even get placed in a lower tax bracket, which could qualify you for other deductions and credits.

Can An Llc Get A Tax Refund

Once youve filed correctly, you may wonder if the IRS will send your LLC a check for any over-payment. Aside from the C corporation, all other tax statuses are pass-through entities, meaning the individual pays taxes and receives taxes. Only C corporations can get a refund. For any other LLC filing types, the business owner will receive the refund.

So yes, you will get your excess tax payments back, but it will be you receiving the money personally, rather than your LLC getting a refund check.

Donât Miss: How Much Should You Set Aside For Taxes

Recommended Reading: How Much Do I Need To Make To Pay Taxes

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

Uncover industry-specific deductions, get unlimited tax advice, & an expert final review with TurboTax Live Self-Employed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

What Is The Tax Bracket For A Small Business

Most small businesses are not taxed like corporations.

The Internal Revenue Service agency does not recognize the legality of a sole proprietorship, partnerships, limited liability companies and limited liability partnerships as taxable corporation they are instead considered pass through entities. This means that taxable income goes directly to the owners and members who report the income on their own personal income and pay taxes at the qualifying rate.

Since most small businesses are charged at an individual income tax level, here is the Federal tax brackets for 2019 for single taxpayers tax brackets:

Recommended Reading: How Much Tax Is Taken Off Paycheck