The Numbers And Social Security

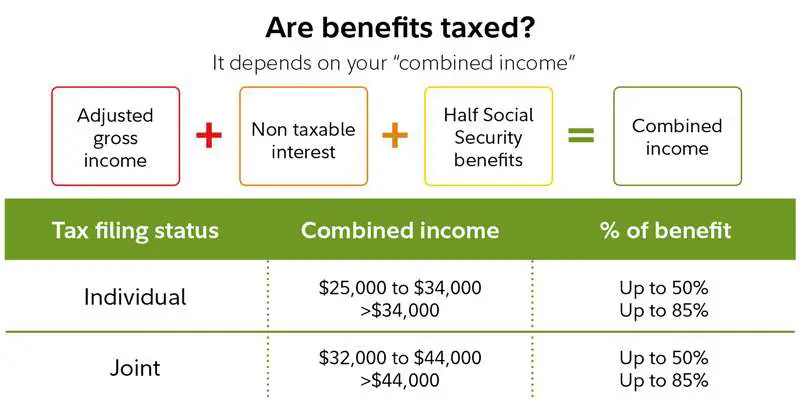

If you want to know your potential tax liability, you should start by adding about half of your Social Security benefits to other income. There are additional factors that must be accounted for at this stage. Youll need to record tax-exempt interest earned, savings bond interest, and other benefits that could be excluded for whatever reason. If you come up with a figure that larger than the base for your filing status, then youll to pay taxes on the difference.

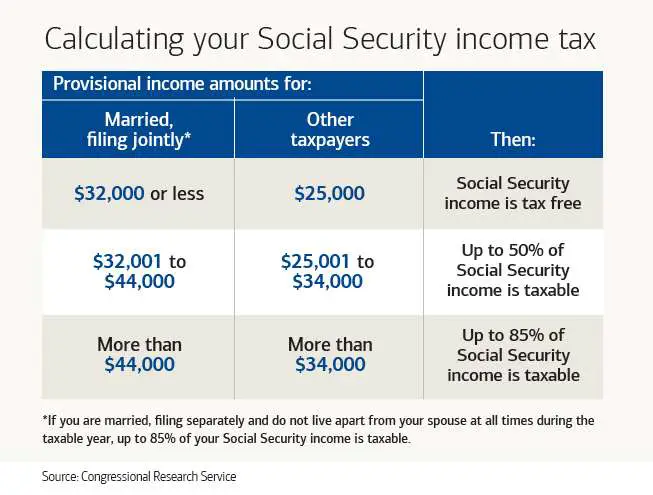

Base numbers are $25,000 for a single head of household or widow/widower with a dependent, $25,000 for married filing separately who did not live together during the tax year, and $32,000 for married couples filing jointly. Finally, there is no charge for married persons filing separate returns that who lived together during the tax year.

All of this makes up the raw data when you want to find out how much your social security will be taxed. Its possible for up to half of your Social Security benefits to be taxed if youre a single filer and your total income plus half the benefits exceeds $34,000. The number is $44,000 if youre married and have filed jointly.

Ways To Get More Benefits

While Social Security may only provide some of your retirement income, it does pay to boost your benefits as much as possible. To that end, you can grow your benefits by:

- Working at least 35 years

- Fighting for raises throughout your career

- Boosting your earnings with side work during your career

- Delaying your claim until age 70

There’s nothing wrong with planning to rely on Social Security as a notable retirement income source. Just don’t make the mistake of thinking you’ll manage to get by on those benefits alone. If you operate under that assumption, you could end up having to drastically cut back on expenses as a senior — and struggle needlessly along the way.

Social Security Tax Rates

Social Security functions much like a flat tax. Everyone pays the same rate, regardless of how much they earn, until they hit the ceiling. As of 2021, a single rate of 12.4% is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of $142,800.

Half this tax is paid by the employee through payroll withholding. The other half is paid by the employer. So employees pay 6.2% of their wage earnings up to the maximum wage base, and employers also pay 6.2% of their employee’s wage earnings up to the maximum wage base, for a total of 12.4%.

This 12.4% figure does not include the Medicare tax, which is an additional 2.9% divided between employee and employer.

Read Also: Form Acd-31015

Example Of Social Security Taxation

Let’s say a single, 68-year-old retired woman, Susan, receives a Social Security benefit totaling $18,000 for 2021.

Susan collected $30,000 from other means throughout the year, so her provisional income is $39,000 .

Then, 85% of Susan’s total Social Security benefit, $15,300, is subject to federal income tax.

If you collect Social Security and anticipate you’ll need to pay federal taxes on your benefit, you can make estimated quarterly payments or elect to have federal taxes withheld either 7%, 10%, 12%, or 22% of your monthly benefit. You can also have additional taxes withheld from your other income sources, such as a pension.

Important: The following states also tax federal Social Security benefits, according to AARP: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont, and West Virginia.

Social Security benefits for retirees, beneficiaries, and disabled people are considered a form of income by the IRS. But only a portion is subject to taxation 15% of your total benefit for the year is always tax free.

If your income for the year is more than $34,000, or more than $44,000 if you’re married, then you can expect to pay income taxes on most of the benefits you collected.

If you’d prefer to pay taxes as you go to avoid a large bill during tax season, opt in to withholding by filling out the form and returning it to your local Social Security office by mail or in person.

The Future Of Social Security Taxation

There have been a few proposals to eliminate the taxation of Social Security benefits, but with a looming shortfall in 2034, dont hold your breath for any proposal succeeding that would reduce revenues for the SSA. Taxes on Social Security benefits are probably here to stay.

Instead of waiting on the unlikely elimination of these taxes, start building a plan to potentially reduce or eliminate these taxes.

A Roth IRA is a good place to start. It is probably the most valuable tool for minimizing Social Security taxes. Why? Roth distributions are not included in your combined income!

If you think you may eventually be subject to taxes on your Social Security benefit, consider building a pool of money in your Roth account. You may be able to contribute to a Roth IRA up to $6,000 .

Check with your retirement plan at work, as well, to see if they offer a Roth option. Using a Roth in 2022 will allow you to put in up to $20,500 per year .

Finally, you may want to consider converting traditional IRAs to Roth IRAs. Theres certainly a lot to consider when doing so, but since the tax benefits could extend beyond the tax free nature of the Roth, this could be a winning move.

As a next step in your learning about this topic, you should consider joining the nearly 400,000 subscribers on my YouTube channel! This is where I break down the complex rules and help you figure out how to use them to your advantage.

Read Also: How To File Taxes From Doordash

Three Ways To Reduce The Taxes That You Pay On Benefits

Is Social Security taxable? For most Americans, it is. That is, a majority of those who receive Social Security benefits pay income tax on up to half or even 85% of that money, because their combined income from Social Security and other sources pushes them above the very low thresholds for taxes to kick in.

But you can use some strategies, before and after you retire, to limit the amount of tax that you pay on Social Security benefits. Keep reading to find out what you can do, starting today, to minimize the amount of income tax that you pay after retiring.

Dont Forget Social Security Benefits May Be Taxable

Tax Tip 2020-76, June 25, 2020

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits.

Social Security benefits include monthly retirement, survivor and disability benefits. They don’t include supplemental security income payments, which aren’t taxable.

The portion of benefits that are taxable depends on the taxpayer’s income and filing status.

You May Like: Cook County Appeal Property Tax

Your Monthly Benefit Is Less Than The Average Seniors

Social Security gives out a uniform COLA to all seniors, so no matter what your benefit looks like, youre entitled to that 5.9% boost in the coming year. But if your benefit is lower than the average, then you wont see your paycheck from Social Security go up by $92.

Imagine you collect $1,250 a month in benefits now. In that case, after applying a 5.9% COLA, youd be looking at a raise of about $74 a month, not $92.

Of course, the opposite holds true if your monthly benefit is higher than the average seniors. In that case, you might see a more sizable raise.

Read Also: Csl Plasma Taxes

How To Minimize Taxes On Your Social Security

If your Social Security benefit is relatively fixed, albeit with small annual increases, you really have only two avenues left to get into that tax-free zone: reducing tax-exempt interest or adjusted gross income. And since most people dont have tax-exempt interest, youre left with one option.

Therefore, the secret is to reduce your adjusted gross income in order to prevent provisional income from triggering a tax on Social Security, says Kelly Crane, president and chief investment officer at Napa Valley Wealth Management in St. Helena, California.

Here are a few ways to reduce your adjusted gross income to get into the tax-free zone:

You May Like: How To Protest Property Tax Harris County

How Is Social Security Taxed

A retirees provisional income is used to determine the tax owed on their Social Security benefit.

Provisional income is equal to adjusted gross incomeplus non-taxable interest plus half of annual Social Security benefits.

That total is then applied to the following income limits to determine how much of the Social Security benefit will be taxed at the filers marginal tax rate:

| Provisional income for a single, head of household, or qualifying widow filer | Provisional income for a married, joint filer | Amount of Social Security benefit taxed |

| Under $25,000 |

Also Check: Do I Have To Claim Plasma Donation On Taxes

Are Social Security Benefits Taxable

If you have a lot of income from other sources, up to 85% of your Social Security benefits will be considered taxable income. If the combination of your Social Security benefits and other income is below $25,000, your benefits wonât be taxed at all. The amount of your benefits that is subject to taxes is calculated on a sliding scale based on your income. Money that Social Security recipients pay in income taxes on their benefits goes back into funding Social Security and Medicare.

If your retirement income is high enough that your benefits are taxable, how do you pay those benefits? You can ask Social Security for an IRS Voluntary Withholding Request Form if youâd like the government to withhold taxes from your Social Security benefits. Otherwise, youâre expected to file quarterly tax returns to pay these taxes over the course of the year.

That covers federal income taxes. What about state income taxes? That depends. In 13 states, your Social Security benefits will be taxed as income, either in whole or in part the remaining states do not tax Social Security income.

Recommended Reading: Do I Have To Pay Taxes On Doordash

Know The Earnings Limits

Those hoping to work in retirement need to be especially careful if they’re planning to claim Social Security benefits early. Even if youâre just working part-time, itâs important to consider how that continuing income will affect your benefits.

The SSA caps how much you are allowed to earn if you start taking your benefits before full retirement age, which is 66 for most baby boomers. In 2021, the annual earned income cap is $18,960, and for every $2 you earn over that limit, the SSA withholds $1 off the top of your benefits. So if you earn $20,960 this year and you haven’t yet reached the year you will turn full retirement age, your benefits will be reduced by $1,000âon top of any income taxes you may have to pay on the remaining benefits. Once you reach the year that you’ll turn full retirement age, the earned income cap goes up to $50,520 and for every $3 you go over, it’s a $1 withholding.

There is some good news, however: Because the penalty is determined by your individual earned income, if you retire early but your spouse doesn’t, your spouse’s earned income will not be factored into the earnings limit. Additionally, when you reach your full retirement age, the earnings limit disappears and Social Security will recalculate your benefit amount if you were negatively impacted by the earnings limit.

How To Calculate Your Social Security Benefit Taxes

Just because you could owe taxes on up to 50% or 85% of your Social Security benefits doesn’t mean you’ll actually owe taxes on that amount. If you fall into the 50% taxation range, the government says you should owe taxes on the lesser of half of your Social Security benefits or half of the difference between your combined income and the taxation threshold set by the IRS for your tax filing status.

Examples make this easier to understand, so let’s consider an individual who receives $12,000 in Social Security benefits annually and has a combined income of $30,000. You’d calculate the amount they’d owe taxes on this way:

Things get even more complicated if you fall into the 85% taxation range. If our individual had a combined income of $40,000 instead and still received $12,000 in annual Social Security benefits, you would calculate how much they would owe in taxes this way:

You May Like: Can You File Taxes With Doordash

State Taxation Of Social Security Benefits

In addition to federal taxes, some states tax Social Security benefits, too. The methods and extent to which states tax benefits vary. For example, New Mexico treats Social Security benefits the same way as the federal government. On the other hand, some states tax Social Security benefits only if income exceeds a specified threshold amount. Missouri, for instance, taxes Social Security benefits only if your income is at least $85,000, or $100,000 if you’re married filing a joint return. Utah includes Social Security benefits in taxable income but allows a tax credit for a portion of the benefits subject to tax.

Although you can’t have state taxes withheld from your Social Security benefits, you generally can make estimated state tax payments. Check with the state tax agency where you live for information about the your state’s estimated tax payment rules.

How Do I Calculate My Taxable Social Security Benefits

To calculate whether you will be called to pay taxes on your social security benefits you will need to follow a simple step and fill out a simple equation. Adding up your income from all sources with 50% of your Social Security Benefits will give you the amount that is known as your combined income. If that combined income is above the limit that the IRS sets, then you will be made to pay taxes on a part of your social security benefits. What part of them that will be will depend on your specific situation.

- $25,000 for single filers

- $32,000 for joint filers

To try and determine the taxable social security benefits that you will be receiving you can use an online calculator. By adding all of your information there you will be able to see how much of the amount that you are getting is going to be taxed.

Don’t Miss: Doordash 1099 Nec

Who Could Be Affected

People in the 10%, 12%, and 22% federal tax brackets could be affected by the high marginal rate, especially those with above-average Social Security benefits. If youre part of this group, consider working with a tax professional to fine-tune your retirement expenses, income, and tax projections. Doing so could help you determine whether additional planning or adjustments may be necessary.

Suppose you and your spouse collect $70,000 a year in combined annual Social Security benefits and your only other income is $65,000 of distributions from individual retirement accounts . This makes your provisional income $100,000. At that level, you havent quite reached the 85% cap on taxability of Social Security.* Now suppose you take an additional $1,000 from your IRA. You might expect to pay $220 more in taxes since youll be in the 22% bracket. However, since that $1,000 results in $850 more of your Social Security benefits being subject to tax, your tax bill increases by $407 . Your marginal tax rate is really 40.7% at this point, but at higher income levels, it eventually goes back down to 22%. If there are steps you can take to minimize the income taxed at this level, they are worth considering.

Calculating Your Social Security Income Tax

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income. If you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2021, according to the Social Security Administration.

For the 2021 tax year, single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either a) half of your annual Social Security benefits or b) half of the difference between your combined income and the IRS base amount.

The example above is for someone who is paying taxes on 50% of his or her Social Security benefits. Things get more complicated if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

Read Also: Doordash How Much Should I Set Aside For Taxes