Overview Of Oregon Taxes

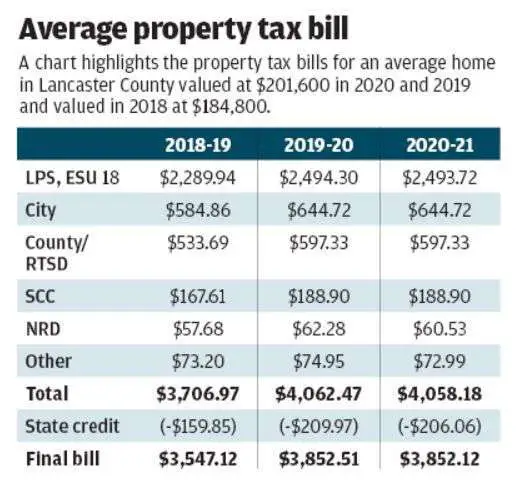

Oregon has property tax rates that are nearly in line with national averages. The effective property tax rate in Oregon is 0.90%, while the U.S. average currently stands at 1.07%. However, specific tax rates can vary drastically depending on the county in which you settle down.

| Enter Your Location |

| of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your countys effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

read more

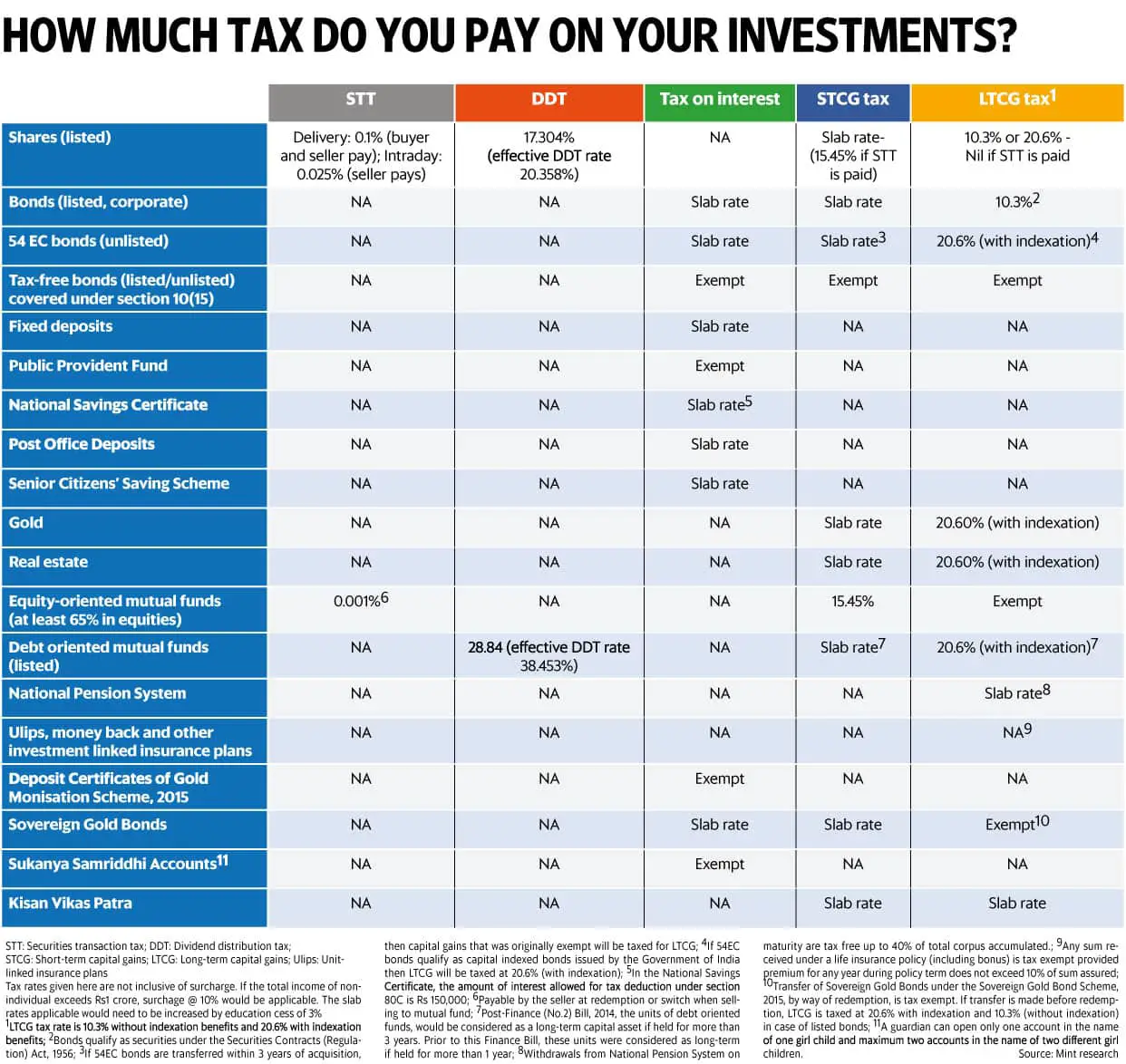

Capital Gains Tax Rates

It’s important to note that the tax rates on capital gains from the sale of stocks, bonds, cryptocurrency, real estate, and other capital assets aren’t necessarily the same as the tax rates mentioned above for wages, interest, retirement account withdrawals, and other “ordinary” income. When determining the tax on capital gains, the rates that apply generally depend on how long you held the capital asset before selling it.

If you hold a capital asset for one year or less, any gain from the sale is considered short-term capital gain and taxed using the rates for ordinary income listed above. However, if you hold the asset for more than one year, the gain is treated as long-term capital gain and taxed a lower rate either 0%, 15%, or 20%. As with the ordinary tax rates and brackets, which specific long-term capital gains tax rate applies depends on your taxable income. However, the long-term capital gain brackets are set up so that you’ll generally pay tax at a lower rate than if the ordinary tax rates and brackets were applied.

For more on the taxation of capital gains, see Capital Gains Tax 101: Basic Rules Investors and Others Need to Know.

Getting Started With The W

When you begin employment and at certain times thereafter, you fill out a federal Form W-4 withholding form, which is provided by your employer. Prior to the new tax law in 2018, you would also state the number of withholding allowances you wished to claim these were the personal exemptions you took, and they reduced your taxable income.

The new tax law eliminates exemptions, though it also raises the standard deduction. Your employer uses your W-4 form to determine what percentage of federal and state income taxes to withhold from your paycheck.

Read Also: Michigan Gov Collectionseservice

Also Check: How Can I File My Ga State Taxes For Free

Is $97k A Year Enough To Live On Comfortably

In 2022, the federal poverty line was about $13,590 per year, excluding Alaska and Hawaii. With that in mind, a $97,000 salary sounds great.

However, that number merely describes the poverty line, not what it means to live comfortably. Its also difficult to say whether this is a good salary for every U.S. city, as the cost of living varies significantly depending on the state and city you reside in. Use the chart below, which lists the average household income per state, to determine whether your $97k yearly salary is reasonable for your area.

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

Uncover industry-specific deductions, get unlimited tax advice, & an expert final review with TurboTax Live Self-Employed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: How To Find Out How Much Property Tax I Paid

What Are Quarterly Estimated Tax Payments

The American tax system works on a pay-as-you-earn system. In other words, as you earn money throughout the year, you need to receive income for it. This way, the government will also receive a steady income.

For this reason, taxes are paid in two ways. W-2 employees will pay their taxes through withholding, whereas taxpayers that get their money through freelancing will pay through quarterly taxes.

If you are self-employed, theres no way to have your tax payments withheld from your paycheck. For this reason, the IRS requires that the individuals make these payments themselves, by their due date.

Quarterly tax payments are usually a better alternative to paying the taxes all in one lump sum. The IRS allows you to do that as well, but this might cause you to be overwhelmed by the larger sum. By paying quarterly, you pay in smaller increments, and the penalty will not be as big.

Also Check: What Age Do You Have To File Taxes

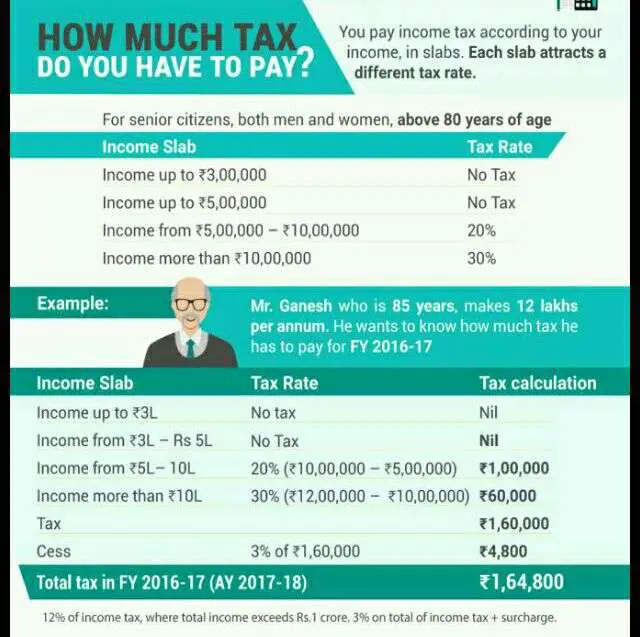

What Are Tax Brackets

Tax brackets were created by the IRS to determine how much money you need to pay the tax agency each year.

The amount you pay in taxes depends on your income. If your taxable income increases, the taxes you pay will increase.

But figuring out your tax obligation isnt as easy as comparing your salary to the brackets shown above.

Read Also: How To Mail State Tax Return

What Is Chapter 62f

Stay informed about local news and weather. Get the NBC10 Boston app foriOSorAndroid and pick your alerts.

Chapter 62F is a Massachusetts General Law that requires the state Department of Revenue to issue a credit to taxpayers if total tax revenues in a given fiscal year exceed an annual cap tied to wage and salary growth in the Commonwealth.

The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

A financial advisor can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

Don’t Miss: How To Reduce Tax Liabilities

Us Tax Calculator: $50k Salary Example

Before reviewing the exact calculations in the $50,000.00 after tax salary example, it is important to first understand the setting we used in the US Tax calculator to produce this salary example. It is important to also understand that this salary example is generic and based on a single filer status, if you are looking for a precise calculation we suggest you use the US Tax Calculator and alter the settings to match your tax return in 2023.

This $50k after tax salary example includes Federal and State Tax table information based on the 2023 Tax Tables and uses Idaho State Tax tables for 2023. The $50k after tax calculation includes certain defaults to provide a standard tax calculation, for example the State of Idaho is used for calculating state taxes due. You can produce a bespoke Tax calculation or compare salaries in different states and/or at different salary package rates if you need a more detailed salary overview or tax calculation for a specific state.

Estimate Your Tax Bracket

Having a rough idea of your tax bracket can help you estimate the tax impact of major financial decisions.

Have you ever been asked for your approximate tax bracket by an advisor, attorney, financial provider, or even a Fidelity representative? Knowing your tax bracket can be useful in many scenarios, including when you open new accounts.

While your tax bracket won’t tell you exactly how much you’ll pay in taxes, it can help you assess the tax impact of financial decisions. For instance, if you’re in the 35% tax bracket, you could save 35 cents in federal tax for every dollar spent on a tax-deductible expense, such as mortgage interest or charity.

Also Check: Where Do I Find Real Estate Taxes Paid On 1098

Will The Refunds Be Treated As Taxable Income

The refunds are not taxable as income at the state level.

All tax refunds, including the 62F refunds, are taxable at the federal level only to the extent that an individual claimed itemized deductions on their fedreal return for tax year 2021. Refund recipients who itemized on their federal returns for 2021 will receive a Form 1099-G from the Department of Revenue by Jan. 31, 2023 to use when completing their 2022 federal return.

The administration plans to distribute the refunds on a rolling basis through Dec. 15. The administration had previously estimated refunds of about 13% of income tax liabilities.

Taxpayers who owed state personal income tax last year and already filed their 2021 return are eligible and do not need to take any additional steps to receive their refunds.

Information from State House News Service and Mass.gov was included in this report.

What About The 2023 Tax Brackets

The IRS typically provides the tax brackets for the upcoming year in late October or early November. At this point, there’s no reason to believe that the timetable will be modified this year, so that’s when we expect the 2023 tax brackets to be released.

Again, the 2023 rates won’t change, but the brackets will be adjusted for inflation. And, since inflation is much higher now than it has been in the recent past, the extent to which the brackets will get “wider” is expected to be greater for 2023 than it has been for the past several years.

For example, the 22% bracket for a single person in 2021, which ran from $40,526 to $86,375 of taxable income, covered $45,849 of taxable income . For the 2022 tax year, that same bracket covers $47,299 of taxable income . So, for 2022, the 22% bracket for single filers is $1,450 wider than it was for 2021. However, for 2023, the width of the same bracket is expected to increase by more than twice the rate of growth seen in 2022.

Wider tax brackets are generally a good thing, since it helps prevent “bracket creep.” In other words, if a bracket gets wider, you’re less likely to end up in a higher tax bracket if your income stays flat or doesn’t increase at the rate of inflation from one year to the next.

You May Like: Will Capital Gains Tax Increase In 2021

How To Calculate Taxes Taken Out Of A Paycheck

Calculations, however, are just one piece of the larger paycheck picture.

What Is The Total Income Tax On $200000

Its a question we probably ask ourselves the most, Mow much tax will I pay? Whether you are comparing salaries when taking a new job, producing a payslip example or understanding what your payslip will look like after a pay raise, its important to understand how much tax you will pay, particularly when a pay rise or change in financial situations mean that your tax calculation will change significantly.

Read Also:

You May Like: What If I File My Taxes 1 Day Late

How To Pay Your 1099 Taxes

If you think you might owe more than $1,000 in federal income taxes, you should be making payments throughout the year â not just when you file your return. These additional payments are referred to as âquarterlyâ or âestimatedâ tax payments. You pay your quarterly taxes on the 15th day following the end of the quarter. For example, letâs say you expect to owe $2,000 in taxes. You would divide that amount by four and make your quarterly tax payments on the following schedule:

| Quarter |

|---|

| $500 |

We havenât gotten into all the nitty-gritty here â like the forms that are involved in the filing process. If youâre interested in more details, check out our blog post on how to pay self-employment taxes step by step.

What Is Included In My Trial

During your trial you will have complete digital access to FT.com with everything in both of our Standard Digital and Premium Digital packages.

Standard Digital includes access to a wealth of global news, analysis and expert opinion. Premium Digital includes access to our premier business column, Lex, as well as 15 curated newsletters covering key business themes with original, in-depth reporting. For a full comparison of Standard and Premium Digital, .

Change the plan you will roll onto at any time during your trial by visiting the Settings & Account section.

Read Also: How Do I Figure Out My Taxes

Coronavirus Tax Relief For Self

Coronavirus Aid, Relief, and Economic Security Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020. This means that 50% of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27, 2020, and ending December 31, 2020, is not used to calculate the installments of estimated tax due. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

Recommended Reading: What Time Do Taxes Need To Be Filed

Filing Taxes As A C Corporation

If an LLC thinks it can lower its tax bill by being taxed as a corporation, it can file Form 8832 with the IRS and opt to be taxed as a C corporation.

Getting taxed as a C corporation means that instead of letting the LLCâs income and expenses flow through to their personal tax returns, the LLC owners will now get taxed separately from the company, and the LLC will have to file its own separate corporate tax return.

Also known as Form 1120, LLC owners use the corporate tax return to report the corporationâs income, gains, losses, deductions, credits, and to calculate its tax liability. Like Schedule C, youâll need all of your companyâs important financial information and statements on hand before filling it out.

You May Like: What Is Property Tax Used For

Read Also: What Is The Income Tax Rate In North Carolina

How Your Paycheck Works: Fica Withholding

In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act. Your FICA taxes are your contribution to the Social Security and Medicare programs that youll have access to when youre a senior. Its your way of paying into the system.

FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2022 is $147,000 . So for 2022, any income you earn above $147,000 doesnt have Social Security taxes withheld from it. It will still have Medicare taxes withheld, though.

There is no income limit on Medicare taxes. 1.45% of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1.45%. If you make more than a certain amount, you’ll be on the hook for an extra 0.9% in Medicare taxes. Here’s a breakdown of these amounts:

- $200,000 for single filers, heads of household and qualifying widows with dependent children

- $250,000 for married taxpayers filing jointly

- $125,000 for married taxpayers filing separately

How Do State And Federal Taxes Affect Your Refund

In addition to federal income tax, you may also pay state income taxes depending on where you live. You wont pay state income tax if you live in one of these eight states: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming.

New Hampshire doesnt tax wages, but does tax dividends and interest, though recent legislation has been passed to phase out this tax beginning in 2024.

If you live in one of the other 41 states, youll need to file a state tax return in addition to your federal tax return. The IRS website contains a directory to help you find information on your states tax requirements.

Key Differences Between State and Federal Taxes

- State tax rates are typically lower than federal tax rates.

- States can have different types of tax credits and deductions.

- The amount of tax withholdings will vary for state and federal taxes.

Recommended Reading: How To Fill Out Tax Form 8962