Tax Deductions And Tax Credits

When youre looking for ways to save on your taxes, you might automatically jump to tax deductions and tax credits. But do you know the difference between the two? According to H& R Block, tax credits directly decrease the amount of taxes you owe, while tax deductions lower the overall amount of your taxable income.

Since deductions lower your taxable income, they also lower the amount of taxes you owe by decreasing your tax bracket, not by lowering your actual taxes. There are standard deductions and itemized deductions:

- Almost everyone qualifies for the standard tax deduction the deduction amount varies based on your filing status , but everyone with the same filing status receives the same standard deduction amount.

- There are many possible itemized deductions, and the deduction amounts vary by individual. These are some of the most common itemized deductions:

- Certain medical and dental expenses above 7.5% of your adjusted gross income

- State income taxes

- State sales and local tax

- Mortgage interest

- Student loan interest

There is a catch when it comes to itemized deductions, however. Each taxpayer is only permitted to take either their standard or itemized deductions, whichever is higher, but not both.

When it comes to tax credits, there are two types refundable or non-refundable:

Which is better? If you had to choose, youd probably prefer to receive a tax credit. Here is a list of possible tax credits:

- Earned income credit

- Premium tax credit

- Health coverage tax credit

Deduction For Use Of Your Car And/or Truck

Working as a self employed person may require travel to meet customers or picking up and delivering various items. If so, you have two options you can use as a deduction.

How this is calculated. First of all, keep an accurate and complete mileage log book recording each use of the vehicle. For the tax year 2021 the mileage rate to use is .56 per mile. At the end of the year, you simply multiply the total miles used for business by the IRS mileage allowance.

The second option is to use the actual expense method.

Youll need to save all of your receipts for the year for gas & oil, licenses, insurance, repairs, tires, etc. In addition, the vehicle can be depreciated. If you lease a vehicle, IRS Publication 463 has rules about how much of the lease payment you can deduct. In any event, use the method that gives you the best deduction.

Getting Started With Your Self Employment Taxes

Theres a lot of software out there for putting together your taxes so you dont need a CPA level knowledge for how to do taxes as a contractor. Catch is designed to pull money from your account only when you get paid, ensuring that you withhold the right amount and have money set aside for each quarter.

Getting your taxes started is a lot more intimidating than it has to be. For most freelancers, the entity is pretty straightforward, so taxes arent quite as complicated as you think. Even if you dont get it exactly right, the IRS makes space for you to pivot and adjust before its a huge deal.

The worst thing you can do is ignore your tax burden because youre too intimidated to get started. However, if you dive in and do your research, youll be able to get your taxes covered in no time.

to get started managing your taxes. Its simple, automatic, and ensures youre never left scrambling.

Also Check: What’s The Deadline For Filing Taxes

What Are Estimated Taxes

Some people confuse self-employment tax with estimated taxes, which are more properly called estimated tax payments. Whatever you call them, they arent a different or separate tax, but merely how you pay your self-employment and income taxes all year long. Remember, taxes are pay-as-you-go, and estimated tax payments are how you pay as you go. See Estimated Tax Payments for more details about how the payments work.

Deduction For Continuing Education

Working as a self employed person may require that you take various courses to maintain or improve your skills. If you qualify, you can deduct the cost of tuition, books, supplies, laboratory fees, and even travel to and from classes.

How this deduction works: This deduction is limited to maintaining or improving your skills if needed in your line of work. If youre simply taking courses to make a career change, it wont work. IRS Publication 970 covers this topic very well. So, if youre filing your own taxes, please be aware of this.

Don’t Miss: Can I Get An Extension On My Taxes

Deduction For A Home Office

Many self employed individuals work from an office in their home, and are eligible to use this tax break as a deduction when filing taxes if self employed. The expense includes a portion of your rent or mortgage interest, real estate taxes, homeowners insurance, utilities, and repairs. If youre filing your own taxes, make sure you read the rules for claiming this deduction.

Before the Tax Cuts and Jobs Act became effective, certain employees who were required by their employer to do some work at home were eligible, but no more. Now, only those who file a self employed tax return can take it.

Who Calculates The Amount Of Tax I Owe

If you submit your tax return on paper, HMRC normally calculate your tax for you and send you a tax calculation, known as a form SA302.

If you send a paper tax return after 31 October , HMRC may calculate your tax, but they do not guarantee to tell you how much tax you owe in time for the payment deadline of 31 January.

If you submit your tax return online, HMRCs online system will calculate your tax automatically, and you can view the calculation online or print it out.

You may already have had tax deducted from some income, for example you are registered under the Construction Industry Scheme or you are employed and self-employed. In this situation you include all the income on the tax return, whether or not it has already been taxed, and also include the tax that has been deducted at source. However, do not include any tax paid as a payment on account. The tax calculation will then automatically take account of any tax paid at source so the final position shown by the calculation will be the amount that is left to be paid through Self Assessment or to be refunded. Any payments on account already made should then be compared to the final position shown by the calculation to see whether there is any further amount to pay or to be refunded.

Example: Chloe

|

Tax calculation |

|

|

Total income tax due by 31 January 2023 |

£786 |

We illustrate this below:

- 31 January 2022: £600

- 31 July 2022: £600

Read Also: What Form To File Extension Taxes

Independent Contractor Taxes: An Example

So, how does calculating your own independent contractor taxes work?

Lets say during the year you earn $40,000 as an independent contractor from working with two companies. These are your only jobs and youre not an employee anywhere else. You should receive a 1099-MISC from each company confirming how much they paid you during the year. Youll include this income on Part 1 of your Schedule C.

You also have some expenses that you can deduct from your income. You work from a qualified home office, which is 200 square feet and using the simplified method, you can deduct $5 per square foot. Your home office deduction is $1,000.

You also drove 600 miles during the year for some required assignments, so you can take a deduction of $348 . In total, you have $1,348 in deductions so the total net profit as an independent contractor that you report on Schedule C is $38,652. That income amount will be included on Form 1040 as your taxable income.

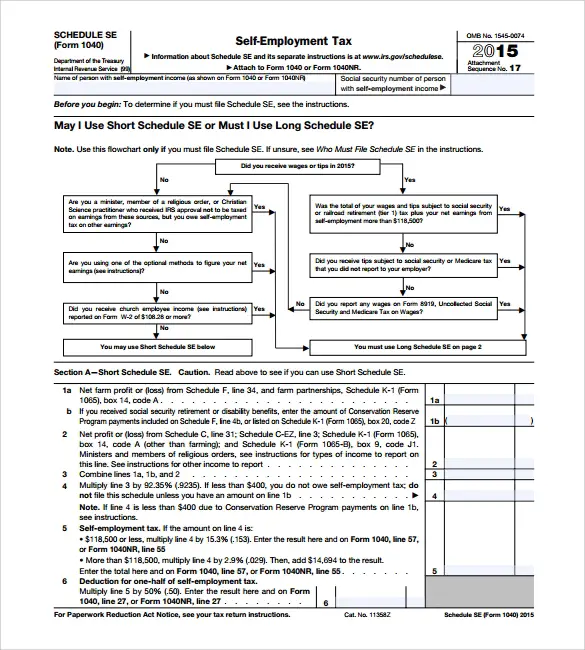

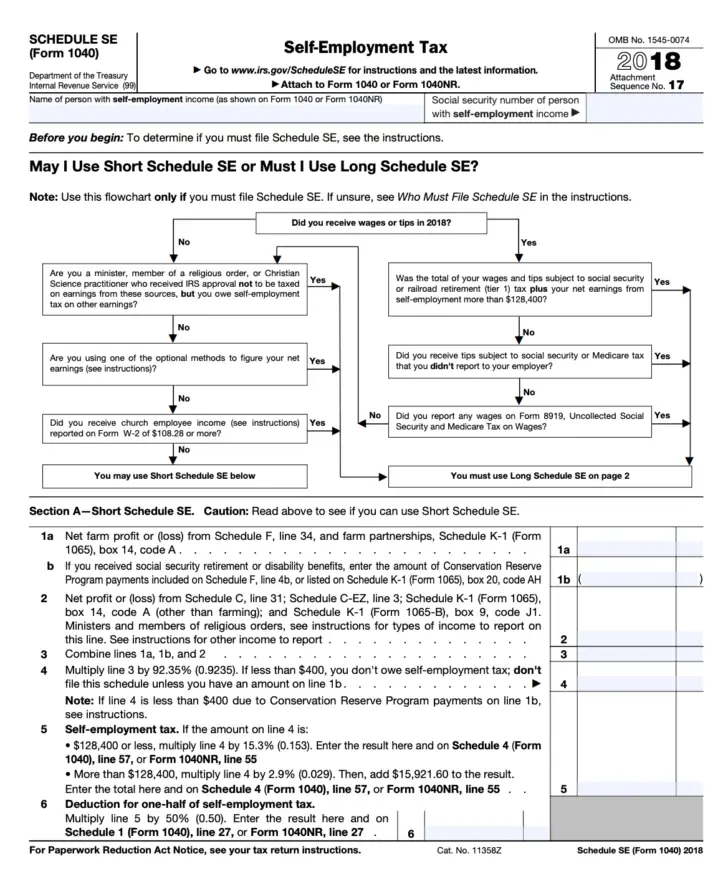

Once you know how much you earned, youll need to figure out how much you must pay in self-employment taxes. Using Schedule SE, you calculate that you owe self-employment taxes of $5,914. Half of this tax that you pay is taken as a deduction on Page 1 of your Form 1040.

Now that youve completed your Schedule C and Schedule SE, you have the income and deduction information you need to finish filing your 1040 personal tax return.

How To Calculate Your Self

The self-employment tax rate for 2019 is 15.3%, which encompasses the 12.4% Social Security tax and the 2.9% Medicare tax. Self-employment tax applies to your net earnings. For 2019, only the first $132,900 of your earnings is subject to Social Security tax , but a 0.9% additional Medicare tax may also apply to your self-employment earnings if they exceed $200,000 if youre a single filer, or $250,000 if youre filing jointly.

As mentioned earlier, to accurately calculate your self-employment tax, you need to calculate your net self-employment earnings for the year which is your self-employment gross income minus your business expenses. Typically, 92.35% of your self-employment net earnings is subject to self-employment tax. Once you have your total net earnings from self-employment that are subject to tax, apply the 15.3% tax rate to determine your total self-employment tax.

If youve had a loss or just a little bit of income from self-employment for the year, there are two optional methods to calculate net earnings in the IRS Schedule SE.

Read Also: How To Pay Ohio State Taxes

Filing Your Taxes Can Be Tricky When You’re Self

Theres no avoiding giving Uncle Sam his due, and if you want to avoid an audit, its important to do it right the first time. Unlike W-2 employees, self-employed individuals do not have taxes automatically deducted from their paychecks. Its up to them to keep track of what they owe and pay it on time.

Because taxes arent automatically deducted, take-home pay for the self-employed tends to be higher than it is for wage earners. However, unless you want the IRS to come knocking, its wise to set aside a chunk of those funds to cover your tax obligations.

Business owners, whether they are self-employed freelancers or corporation owners, are responsible for complying with tax law with respect to their business, said Shoshana Deutschkron, vice president of communications and brand at Upwork. Financial literacy is a critical skill, that literacy includes an understanding of taxation.

You need to hold on to some of your money, added Lise Greene-Lewis, CPA and tax expert for TurboTax. You should pretend you dont have that much money because your income varies so often. You have to think about paying your taxes.

Not only are government forms daunting, but learning the ropes of taxation can be truly complicated. If youre filing as self-employed with the IRS, here are the basics of filing, paying and saving for taxes.

Set Up Your Tax Forms

Heres what you need to know about filing quarterly taxes and your annual return.

How to File My Quarterly Taxes

OR you can do it yourself.

How to File My Annual Taxes as a Freelancer

Recommended Reading: What Is Minnesota Sales Tax

Deduction For Office Supplies

Just about anything that you use in your business operations office can be deducted. As long as its File self employed tax return ordinary and customary for your type of business, the IRS will let it fly. I wont list everything that qualifies as its quite lengthy. If youre on a cash basis of accounting, you can deduct it when you buy it. Even if you charge it on a on the last day of the year and dont pay it until the following month, youre good.

For larger items like computers, desks and furniture, and other office equipment, you need to treat them differently. Their useful life is usually longer than one year, and are normally classified as assets. Instead of deducting the full amount all at once, youre required to depreciate them over 5 to 7 years. The life years depends on the type of asset.

However, there is a Section 179 option in the tax code, whereby you can elect this option to expense it all in the first year. For the year 2021, the annual limit is $1,050,000 of qualifying equipment. These annual limits were increased substantially to promote business buying. If youre filing taxes as self employed, this can be a nice deduction.

+ Common Self Assessment Tax Return Mistakes

January is the dreaded month when the HMRCs deadline for submitting a self-assessment tax return looms. If you havent already completed the online tax return, then youd be wise to familarise yourself with the most common Self Assessment tax return mistakes and how to avoid them.

While there are stiff penalties for filing a tax return late, you can also get into trouble with HMRC for not taking care with your answers. The taxman wont take into account any lame excuses for mistakes made or a late return!

So, here are the most common errors people make with links to more essential reading under each section.

You May Like: Did The Irs Extend The Tax Deadline For 2021

Deduction For Business Travel And Meals

When you file taxes if self employed, these can be legitimate expenses and deducted at 50% on your Schedule C. These include hotels, air fare, taxis and food as long as they are actual business expenses as defined in the tax code. Be advised that if your spouse or other family members accompany you, their expenses are not deductible unless they are employees of your business.

Prior to 2021, you were able to deduct meal costs that werent lavish or extravagant, and werent for entertainment. The cost of the meal had to be separately listed as such. In 2021, the percentage was increased to 100% as long as the meal was in a bona fide restaurant.

You have an option to use a standard daily meal allowance established by the US General Services Administration if you so desire. If I were to use that method, Id still keep my receipts for all meals just in case of an audit.

Personal Income Tax Deadline

Your personal income tax deadline as an independent contractor is the same as it is for employees. All personal income tax, filed with Form 1040, is due April 15 of each year. If April 15 falls on a weekend or a holiday, they are due the next business day.

With your Form 1040, youll file your Schedule C, Profit and Loss from Business and your Schedule SE, Self Employment Tax.

If you cant file your taxes by the April 15 deadline, you should use Form 4868 to file for an automatic six-month extension. But thats only an extension to file your paperwork if you owe any taxes, youll need to pay them by the April 15 deadline to avoid being charged a penalty.

Don’t Miss: How To Calculate Tax On Calculator

Deduction For The Qualified Business Income

Filing taxes as self employed. When the Tax Cuts and Jobs Act was enacted in 2017, Section 199A of the act provided an important deduction for self employed individuals and others who received pass through income. It basically provided a deduction on the front of the Form 1040, for 20% of your net self employment income and also 20% for pass through activities net income.

There are income limits and phase-outs that are based on filing status. The law can be quite complicated a well. Certain businesses, classified as a specified service trade or business, created additional income thresholds to consider. heres a link to read more about this deduction.

Health Insurance Premiums Deduction

If you are self-employed, pay for your health insurance premiums, and are not eligible to participate in a plan through your spouses employer, you can deduct all your health, dental, and qualified long-term care insurance premiums.

You can also deduct premiums you paid to provide coverage for your spouse, your dependents, and your children younger than 27 at years end, even if they arent dependents on your taxes. Calculate the deduction using the Self-Employed Health Insurance Deduction Worksheet in IRS Publication 535.

Also Check: Who Has To File Income Tax Return

What If I Have Problems In Completing My Tax Return

If you get a tax return, please do not worry if you are not sure how to fill it in. You can contact HMRC for help. If you are concerned about completing the form contact the phone number on any of your Self Assessment correspondence or HMRCs Self Assessment helpline number. Alternatively, you may wish to contact the charity TaxAid who offer help to those on low incomes with tax problems. They can be contacted via their helpline 0345 120 3779 .