Tax Deadline For Quarterly Estimated Payments

If you’re self-employed, an independent contractor or have investment earnings, you might be curious about another set of deadlines: quarterly estimated payments. The IRS requires these quarterly estimated tax payments from many people whose income isnt subject to payroll withholding tax.

For estimated taxes, the answer to “When are taxes due?” varies. The year is divided into four payment periods, and each period has its own payment due date. Check below to see the dates for 2022.

|

If you earned income during this period |

Estimated tax payment deadline |

|---|

Individual Income Tax Filing Due Dates

- Typically, most people must file their tax return by May 1.

- Fiscal year filers: Returns are due the 15th day of the 4th month after the close of your fiscal year.

If the due date falls on a Saturday, Sunday, or holiday, you have until the next business day to file with no penalty.

Filing Extensions

Can’t file by the deadline? Virginia allows an automatic 6-month extension to file your return . No application is required. You still need to pay any taxes owed on time to avoid additional penalties and interest. Make an extension payment.

What Is The Last Day To File Taxes

The last day to file taxes for individual federal income tax returns is April 15, or as late as April 18 in the event Tax Day falls on a Saturday, Sunday or official holiday. Some state-level holidays can extend the tax deadline by one day further. You can request a six-month filing extension through filing Form 4868, making your last day to file individual income taxes October 17, 2022.

If you also file taxes for your small business as a partnership, LLC or S Corp, the last day to file taxes is March 15 unless it falls on a weekend or official holiday. If your business runs on a non-calendar tax year, your federal tax return is generally due by the 15th day of the third month following the end of the tax year.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Read Also: When Does Irs Open For 2021 Tax Season

Do You Have To Pay Taxes On An Ira After 70

All of the money in your traditional IRA belongs to you. … You must begin taking minimum withdrawals from your traditional IRA in the year you turn age 70 1/2. The amount you withdraw at that time is taxed as ordinary income, but the funds that remain in your IRA continue to grow tax deferred regardless of your age.

Pay As Much As You Can By The Tax Deadline

When David D. was hit with a $14,000 tax bill, he didnt have much time to come up with the money. My wife and I were expecting our first kid so we were trying to save up for that, David explained. Failing to pay the full amount by the deadline meant David would be charged penalties and interest on top of the $14,000. Determined not to be in debt, he decided to sell one of his two carswhich was fully paid forin order to cover the amount.

Not everyone has the option to sell a vehicle, but you probably have unused items, like clothes or old toys, that could easily be sold for extra cash. If you cant afford to pay your taxes, this is one instance when we recommend waiting until the deadline to pay so that you can give yourself as much time as possible to save up and earn extra money.

Read Also: How Can I Get Old Tax Returns From Turbotax

When Do You Start Paying Property Taxes On A New Home

Of all the costs that you have to consider when buying a new home, property taxes are often one of the most difficult to comprehend. It can be tough to figure out what youll owe and when youll owe it, and if youre a first time homeowner, you might not even be sure how you pay property taxes in the first place. But regardless of whether youre in the know or not, eventually you will have to start paying property taxes on a new home, so it helps to know what youre getting into.

Below, well go over the basics of property taxes and when you have to start paying them, with some additional information thats helpful for new homeowners to know.

Where Can I Find Help With My Taxes

You can find helpful and affordable assistance by choosing a provider from CNETs roundup of the best tax software for 2021. But the IRS does offer some free tax help, too. The Volunteer Income Tax Assistance program is designed to offer guidance to people who make less than $54,000 per year, have disabilities or have limited facility with English. And the Tax Counseling for the Elderly program specializes in tax issues that affect people who are 60 or older. Due to COVID-19, however, many VITA sites, and all TCE sites, have been closed. For now the IRSInternational Taxpayer Service Call Center remains available at 267-941-1000, Monday through Friday, 6 a.m. to 11 p.m. ET.

Read Also: What Is Tax Liability Zero

Read Also: How To File Missed Tax Returns

How To Calculate Your Property Taxes

If youre curious about what you can expect when it comes to paying property taxes on a new home, then you could use a property tax calculator to come up with an estimate of what your yearly cost might be. Property tax calculators take into account the state and county you live in as well as the value of your property.

Note that your assessed value isnt just based on the purchase price of your home. County assessors do their own valuations and may come up with a number lower or higher than what you paid. If you think they missed the mark when you do get your assessment, you can appeal it. For the purposes of estimating property taxes though, just use the purchase price of your home.

Things do get a little bit trickier if youre trying to calculate what youll be paying in property taxes on a new build. Thats because its not just your lot itself that improves as land gets developedits the entire area around you, and that increases the value of your property as well. If youre moving into a new development, you may see your property taxes increase pretty regularly while your neighborhood gets more and more improved.

If You Owe Taxes You Have Options

Its best for all taxpayers to file and pay their federal taxes on time. If you cant pay the full amount due at the time of filing, consider one of the payments agreements the IRS offers. These include:

- An agreement to pay within the next ten days.

- A short-term payment plan to pay within 11-120 days.

- An installment agreement, to pay the balance due in monthly payments.

Businesses owing $25,000 or less from the current and prior calendar year, who can pay what they owe within 24 monthly payments, can use the online application.

Read Also: What Does Tax Topic 152 Mean

How Do I Get My Irs Debt Forgiven

Apply With the New Form 656 An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can’t pay your full tax liability or doing so creates a financial hardship. We consider your unique set of facts and circumstances: Ability to pay.

Extension Of Time To Pay

The IRS offers an extension of up to 120 days to pay your taxes.

Terms:

- Good for any amount due.

- You must agree to pay the full bill within 120 days.

Time to complete:

- If you request an extension using the IRS online payment agreement tool, it takes about 15 minutes.

- Requesting an extension by phone usually takes about an hour .

When it may take more time:If you have back tax returns, the IRS will need to process them before granting you an extension.

Also Check: What Happens If You Forget To File Your Taxes

Taxes : If You Got An Extension In May Your Taxes Are Due Today

The extension deadline for 2020 income taxes is Oct. 15. Heres everything you need to know.

In 2021, the IRS once again postponed the income tax due date. Last year, the deadline was extended to July 15 due to the pandemic this year, they were due back in May. If you requested and received an extension, however, your deadline is here: Friday, Oct. 15.

And this year, your return may be more complicated than usual, wrapped up in potentially thorny issues including unemployment insurance claims, stimulus check income and pandemic-driven changes in residence. Heres everything you need to know about filing your 2020 taxes.

Read Also: How To Calculate Paycheck After Taxes

What If I Owe More Than I Can Pay

This year, many people are dealing with financial troubles due to the pandemic, job loss, and other factors. If you’re one of them, you may not have the funds available to pay your tax bill by the deadline. But don’t put off filing just because you can’t afford to pay the amount due on the day you need to file your tax return. The IRS starts charging penalties and interest on the day the return is due, no matter when you file. You can minimize failure-to-file penalties by filing as soon as possible, paying as much as you can when you file, and setting up an installment plan for the balance.

Recommended Reading: How To File Pa State Taxes

What Is Capital Gains Tax

A capital gains tax is a tax you pay on the profit made from selling an investment.

You dont have to pay capital gains tax until you sell your investment. The tax paid covers the amount of profit the capital gain you made between the purchase price and sale price of the stock, real estate or other asset. When you sell, your gain is referred to as realized. Conversely, unrealized gains and losses occur when you have yet to officially sell the investment.

How much you pay in taxes depends in part upon whether you made a short-term or long-term capital gain on your investment, and each is taxed in different ways.

Short-Term vs. Long-Term Capital Gains Taxes

- Short-Term Capital Gain

- Short-term capital gains tax rates apply to assets you sell in one year or less of owning them.

- Long-Term Capital Gain

Short-term capital gains are taxed as ordinary income, such as the income tax you pay on your salary, at your standard federal income tax rate. This tends to be a higher rate than for long-term capital gains taxes, which are based on defined tax brackets that are adjusted each year for inflation.

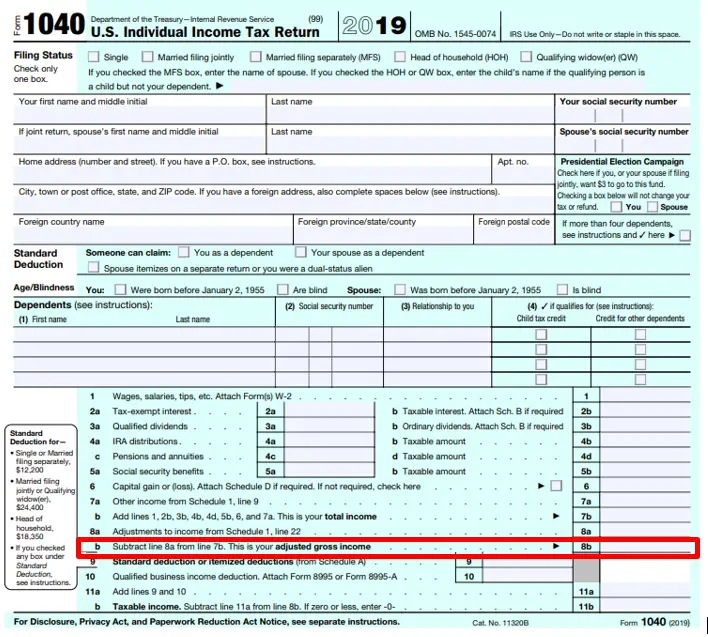

What Do I Do About Missing Tax Forms

If you havent received your income forms, you should first contact the employer and request a copy or ask that it be re-sent. If that doesnt work, you can then contact the IRS at 800-829-1040 . Youll need to provide the following information:

- Name, address, Social Security number, and phone number

- Your employers name, address, and phone number

- Dates you worked for your employer

- An estimate of your paid wages and federal income tax withheld during 2020

Read Also: What Are The Different Tax Brackets

How Your Down Payment Affects Property Tax Payment Options

Your down payment actually makes a difference in how you get to pay your property taxes. Some lenders require first-time homeowners who put down less than 20% to pay their property taxes through their mortgage. The thinking behind that is that you dont have enough equity in your home for the lender to feel comfortable letting you pay the taxes yourself.

Another reason lenders may require this payment method is that first-time homeowners may forget when property taxes are due. That could result in the municipality putting a lien on their home, which would take priority over the mortgage debt. So, lenders are invested in ensuring that they get the money that theyve lent back without any issues.

If you put down more than 20%, you may have the choice to pay property taxes as part of your mortgage or separately. Once your home is paid off, youll have to take on the task of paying property taxes yourself.

What Happens If You Miss The Tax Filing Deadline And Are Owed A Refund

If you overpaid for the 2021 tax year, there’s typically no penalty for filing your tax return late. However, you should file as soon as possible.

Generally, you have three years from the tax return due date to claim a tax refund. That means for 2021 tax returns, the window closes in 2025. After three years, unclaimed tax refunds typically become the property of the U.S. Treasury.

Read Also: How Much Is Sales Tax In Ohio

Set Up A Payment Plan

The IRS offers payment plans if you can’t pay all or even anything you owe right away. The important thing is that you don’t ignore your plight, hoping that it will go away, because it won’t.

You can set up a monthly installment agreement with the IRS, allowing you to pay what you owe over time. You can even decide how much you want to pay per month, at least to some extent. The entire balance has to be paid off within 72 months, so your minimum payment would be what you owe divided by 72. Leave some room for interest and penalties when you’re making your calculations.

You’re not prohibited from paying more than the amount you’ve committed to in any month. You can retire the debt sooner and minimize interest charges by doing so.

The IRS will still charge the late-payment penalty as well as interest, but it’s reduced to 0.25% a month. There’s a one-time setup fee of $130 as of 2022, increasing to $225 if you don’t apply online. But if you do apply online and if you agree to have the monthly payments taken from your bank account by direct debit, this one-time processing fee drops to $31. And the IRS offers a low-income setup fee option of $43 if you qualify. Direct debit is required if you owe more than $25,000.

You don’t have to qualify for the installment agreement by submitting a collection information statement to prove your assets and income, at least not if you owe less than $50,000. You can apply online using the Online Payment Agreement Application on the IRS website.

Dont Miss The Tax Day Deadline Stiff Penalties Await Those Who Dont File Their Return By Midnight Tonight

Happy Tax Day 2021! We normally celebrate Tax Day on April 15, but the IRS pushed the due date back to May 17 this year because of the COVID-19 pandemic. So, if you havent already filed your 2020 federal income tax return and paid any tax due, you have until midnight tonight to get it done.

But, of course, some people will miss the Tax Day deadline. And, as you might guess, the IRS doesnt take that lightly and will make you pay a price. If youre curious about what punishment the IRS is going to bring down on you, heres a glimpse of the interest and penalties you may face if you dont act before the tax deadline.

You May Like: Are Tax Returns Delayed This Year

Read Also: How To File 2 Different State Taxes

Penalty & Interest Charges

- You will receive penalty on your individual income tax return/payment if not paid within the specified time due per The Revenue Act of 1941.

- Penalty is charged at 5% for the first two months and then 5% for each additional month thereafter up to a maximum of 25%.

- Interest is calculated by multiplying the current interest rate by the amount of tax you owe.

- You may request a waiver of penalty in writing. You are required to explain your reason for late payment of tax. You must submit supporting documentation and meet the reasonable cause criteria outlined in the Revenue Administrative Bulletin 1995-4 before a waiver of penalty will be considered.

How Long Do I Have To Pay My Taxes

The IRS will provide up to 120 days to taxpayers to pay their full tax balance. Fees or cost: There’s no fee to request the extension. There is a penalty of 0.5% per month on the unpaid balance. Action required: Complete an online payment agreement, call the IRS at 829-1040 or get an expert to handle it for you.

Don’t Miss: When Will My Federal Tax Return Come

When To Pay Estimated Taxes

For estimated tax purposes, the year is divided into four payment periods. You may send estimated tax payments with Form 1040-ES by mail, or you can pay online, by phone or from your mobile device using the IRS2Go app. Visit IRS.gov/payments to view all the options. For additional information, refer to Publication 505, Tax Withholding and Estimated Tax.

Using the Electronic Federal Tax Payment System is the easiest way for individuals as well as businesses to pay federal taxes. Make ALL of your federal tax payments including federal tax deposits , installment agreement and estimated tax payments using EFTPS. If its easier to pay your estimated taxes weekly, bi-weekly, monthly, etc. you can, as long as youve paid enough in by the end of the quarter. Using EFTPS, you can access a history of your payments, so you know how much and when you made your estimated tax payments.

Corporations must deposit the payment using the Electronic Federal Tax Payment System. For additional information, refer to Publication 542, Corporations.