Is There A Time Limit For Amending A Return

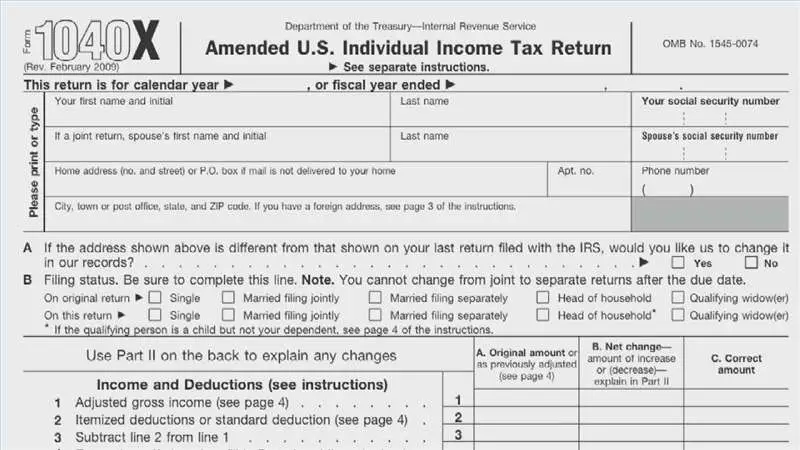

The IRS advises that you generally must file Form 1040X to amend a return within three years from the date you filed your original tax return, or within two years of the date you paid the tax, whichever is later. Be sure to enter the year of the return you are amending at the top of Form 1040X.

If you miss the deadline, the IRS may not let you amend your return and you could miss out on any deductions, credits or tax benefits the amendment would allow you to claim. However, time periods for claiming a refund are suspended for a period when the IRS determines a taxpayer to be financially disabled because of a physical ailment or mental impairment.

Claim Missed Deductions Or Credits

Now let’s get into some of the more common reasons why you might want to file an amended return. Many people file one to claim an overlooked tax deduction or credit. The tax code is chock full of tax breaks, so it’s easy to miss one that applies to you. If you discover a deduction or credit that you qualify for after filing your original return, simply file an amended return within the three-year period described above to claim it now and get a refund. It might not be worth the effort if it’s only going to reduce your taxes for that year by a few bucks, but you do have the option.

Also, if you’re amending an older return, remember that the recent tax-reform law changed many tax breaks beginning with the 2018 tax year. Several deductions and credits were eliminated or reduced, but others were added or expanded. So just because you’re entitled to a tax break now doesn’t mean you were entitled to it on your pre-2018 return.

How To Amend A Tax Return: Step

Amended tax returns are filed to rectify mistakes on previously filed taxes. Amending a tax return is not a complicated process, but you need to be careful not to miss anything when filing for an amendment. But if you go through all the required steps the first time you file for an amendment, youll have no additional responsibilities regarding the amendment process, and you wont have to refile tax returns.

Read Also: Can You Change Your Taxes After Filing

Why Some Workers Waiting On $1189 Unemployment Tax Refunds Should Amend 2020 Tax Returns

- 13:06 ET, Nov 2 2021

SOME workers who are waiting on refunds for tax paid on unemployment benefits may want to amend their 2020 tax return.

The Internal Revenue Service is still sending refunds for people who paid too much in taxes for their 2020 unemployment benefits.

This week, the agency sent out 430,000 refunds averaging $1,189.

Before and during the pandemic, unemployment benefits were considered taxable income.

The American Rescue Plan passed on March 11, 2021 set out to provide some relief.

The plan provides tax breaks by waiving federal tax on $10,200 of unemployment benefits collected in 2020. This applies to each taxpayer who earns less than $150,000.

If you are married, each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to $10,200.

If your modified adjusted gross income is $150,000 or more, you cant exclude any unemployment compensation.

Keep An Eye On The Calendar

Generally, the IRS audits only returns from the previous three tax years though there are major exceptions. So although it might be tempting to wait and see if the IRS will catch you in an error, it might be cheaper to fess up sooner rather than later.

The IRS charges interest and penalties on outstanding tax liabilities going all the way back to the original due date of the tax payment. So the longer you wait to fix a mistake, the more expensive that mistake can get.

Recommended Reading: How To Buy Tax Forfeited Land

Requesting Changes To Your Tax Return

- Request changes OnlineThe fastest, easiest and most secure way to change a return is to use the Change my return option found in the CRAs My Account or to use ReFILE. If you cannot request changes online because your return is still being processed, you can wait a few days until it has been assessed and then use one of the options in How to change a return.

- Send an adjustment request formIf you prefer, you can complete Form T1-ADJ, T1 Adjustment Request, and mail it to your tax centre, together with all your supporting documents for the change you want to make.

Can You File A Form 1040x Online

Form 1040-X can now be e-filed, and is available through some companies. 1040.com does not currently offer 1040-X e-file however, while you cant send the amended return online through 1040.com, you can use 1040.com again to fix the tax return and fill out the Form 1040X

Before you start filling out Form 1040X, make sure you print your original return so that youll have it to refer to. Then, print Form 1040X and the corrected version of your tax return and mail the whole package to the IRS address provided below.

Also Check: Where Is My State Refund Ga

When To File An Amended Tax Return

There are times when you should amend your return and times when you shouldn’t. Here are some common situations that call for an amendment:

- You realized you missed out on claiming a tax deduction or credit.

- You accidentally claimed the wrong tax filing status.

- You need to add or remove a dependent.

- You forgot to claim taxable income on your tax return.

- You realize you claimed an expense, deduction or credit that you weren’t eligible to claim.

You usually don’t need to file an amended return if you discover math or clerical errors on a recently filed tax return. The IRS will often correct those types of mistakes on its own and, if necessary, send you a bill for the additional tax due or a refund if the error was in your favor.

Before filing an amended return, make sure the IRS has already processed the tax return you need to amend. That way, you can ensure the IRS won’t get your original return and amended return mixed up. If you’ve already received your tax refund, then you know the IRS has already processed your return.

Just keep in mind that the IRS limits the amount of time you have to file an amended return to claim a refund to:

- Within three years from the original filing deadline, or

- Within two years of paying the tax due for that year, if that date is later.

If you’re outside of that window, you can’t claim a refund by amending your return.

How Long Will It Take For The Changes To Be Made

- If you submitted your request online, your change request will take about two weeks to be processed.

- If you submitted your request by mail, your change request will take longer. Due to COVID-19, the CRA may take 10 to 12 weeks to process paper adjustments.

Keep in mind that some adjustment requests are considered complex and may take longer to process. Complex requests include situations where additional information or review is required.

For more information on processing times, go to Service Standards in the CRA.

Online or by mail, you can request an adjustment for any of the 10 previous calendar years. For example, a request made in 2021 must relate to 2011 or a later tax year. Adjustment requests for different years should be on different forms but they can be mailed in together or submitted to the CRA at the same time.

Don’t Miss: How To File Missouri State Taxes For Free

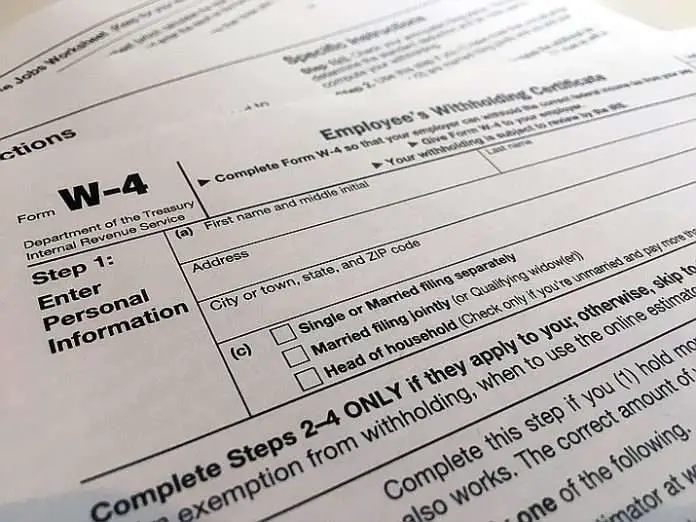

Qualify For Head Of Household

If you are unmarried, see if you qualify as head of household. Filing as head of household rather than single allows you to claim a much larger standard deduction. However, this tax filing status requires that you pay more than half the costs to maintain your home and to have a dependent who lives with you for more than half the tax year.

Married taxpayers are generally ineligible to claim this filing status. If you are married, you must determine whether to file jointly or separately. Unless you have extenuating circumstances, you should file a joint return with your spouse to take advantage of the larger standard deduction and lower tax rates.

Ask If Your Preparer Charges For An Amended Tax Return

If you used a human tax preparer, dont assume he or she will amend your tax return for free or pay the extra taxes, interest or penalties from a mistake. If you forgot to give the preparer information or gave incorrect information, for example, youll likely have to pay for the extra work.

If the error is the preparers fault, who pays for an amended tax return may depend on the wording in your client agreement.

» MORE: How to get rid of your back taxes

Don’t Miss: Michigan.gov/collectionseservice

How Can I File An Amended Return

To amend a tax return, you must file Form 1040X. The IRS began accepting electronically filed 1040X forms in summer 2020. Previously, you had to mail a paper 1040X to amend your return.

Some online tax filing services can help you complete a 1040X that you can then print and mail. For example, if you filed your original return using the free filing service, you can use it to fill out the amended return. Then youll can print and mail the form.

If youre used to e-filing your tax return, here are some tips for filing a paper 1040X:

- Be sure to sign and date the form.

- Attach any required forms that support your amendment to the 1040X. Check out the 1040X instructions for details on how to assemble your return because forms must go in a specific order when you attach them.

- Make sure you explain the reason for amending the return on Form 1040X, Part III.

- If you use software or an online service to prepare your 1040X, youll have to print a copy to mail. Its probably a good idea to print a second copy to keep for your records.

If you find you need to amend multiple years of returns, youll need to file a separate 1040X for each year. You can check the status of your amended return online through the IRS Wheres My Amended Return tool.

Your Parents Want To Claim You As A Dependent On Their Taxes But You Already Claimed A Personal Exemption

Claiming a personal exemption, you went ahead and filed your taxes before your parents had a chance to file. But your parents want to claim you as a dependent on their taxes. When you did your taxes, you failed to check the box on the 1040 that says you could be claimed as a dependent on someones elses taxes.

Now your parents cannot claim you as a dependent on their taxes. If your parents can claim you on their taxes and you agree they should youll need to file an amendment.

Also Check: Www Aztaxes Net

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

Taxpayers who received unemployment compensation in 2020 may want to amend their tax returns.

getty

Many taxpayers learned that unemployment benefits are taxable the hard way earlier this year when they filed their 2020 income tax returns. It came as such a blow to so many people, after what was a horrible year in so many other ways, that Congress included a tax exemption for the first $10,200 of unemployment insurance in the American Rescue Plan passed in March 2021. Unfortunately, that law was passed after many taxpayers had already filed their tax returns. As panic set in, the IRS asked taxpayers not to file amended returns, but to wait for an automatic adjustment that would come in the summer. The adjustments were made and the final few batches of refunds are currently being delivered to affected taxpayers. This is great news, but it is not the end of the story.

Submit Your Amended Forms

Beginning with the 2019 tax year, you can e-file amended tax returns. If you used TurboTax to prepare Form 1040-X, follow the software’s instructions to e-file the amendment.

To amend a return for 2018 or earlier, you’ll need to print Form 1040-X and any other forms you’re amending. Attach any necessary supporting documentation, such as:

- Any new or amended W-2s or 1099 forms

- Other forms or schedules that changed, such as Schedule A if you updated your itemized deductions

- Your CP2000 notice if youre amending your tax return because of a notice you received from the IRS

Mail all the forms and documents to the address provided in the instructions.

If amending your tax return results in a higher tax bill, you will need to make an additional tax payment. For an e-filed amended return, you can make a payment electronically through TurboTax. Otherwise, you can mail a check with the amendment. By making a payment now instead of waiting for the IRS to send an invoice, you can minimize the interest and penalties you’ll owe.

Keep in mind that if you file an amended tax return on paper rather the e-filing, it can take the IRS eight to 12 weeks to process the amendment. You can check the status of your amended return using the IRS’ Where’s My Amended Return? Wait about three weeks from the date you mailed your return for the information to show up in the IRS system.

Read Also: How Much Does H& r Block Charge To Do Taxes

Cancelling Slips On Paper

If you choose to cancel your return on paper, clearly identify the slips as cancelled slips by writing CANCELLED at the top of each slip. Make sure you fill out all the necessary boxes, including the information that was correct on the original slip. Send two copies of the cancelled slips to the employee. Send one copy of the cancelled slips to any national verification and collection centre with a letter explaining the reason for the cancellation.

Do not file an amended T4 Summary.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits anddeductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: How Do I Get My Pin For My Taxes

How Can I Amend My Tax Return

Fortunately, if youve made an error on your tax return and need to amend it, dont worry, there are a few ways to do so that youll find quite simple.

First and foremost, if you need to amend your tax return, do not file another return for that year.

You must wait to receive your Notice of Assessment before making any changes to your tax return. Amendments can be made for 10 previous years, so if you are filing this years , you can only amend back to 2010.

There are three ways to make amendments to your tax return: through CRA My Account, ReFile using your tax solution, or . There are rules and limitations for each one, and well take you through them so you have a better understanding of which one to choose.

For Quebec residents If you need to amend your provincial return, please click here for instructions directly from Revenu Quebec.

Requesting an Amendment Online through CRA My Account

Requesting an amendment to your tax return online simply requires you to log in to your CRA My Account and click Change my return. You select the line that needs to be corrected and input the corrected value.

Do keep in mind that you cannot request an amendment to change any of the following:

Requesting an Amendment using ReFILE and your tax software

- Making or amending an election

- Applying for certain benefits

- Applying for the disability tax credit

- Have a current reassessment in progress

- Have not yet received the original return assessment

- If you have to change personal information

Everyone Needs A Second Chance Every Now And Then And Sometimes You Even Need Another Shot At Filing Your Tax Return

Imagine you just realized that you made a mistake on your federal income tax return, or failed to claim an important deduction. Knowing that you messed up your taxes can be stressful. Your error could mean receiving a lower refund than you should or even getting hit with interest and penalties if you owe more tax than you thought.

But dont stress. To claim a refund, you typically have up to three years from the time you filed your original return, or within two years from the date you paid the tax whichever is later to go back and amend it.

Lets check out some scenarios when you might need to file an amended tax return.

You May Like: Do You Have To Report Roth Ira On Taxes

Amending Your Tax Returns

The IRS allows you to change your filing status for a tax return youve already filed if no more than three years have passed since the original tax filing deadline. For example, if you filed as a single taxpayer last year, but now realize you qualified for head of household, you need to make the change on an IRS Form 1040X.

When you change this status, you not only obtain a larger standard deduction, but your income for that year is subject to lower tax rates. Making this change will likely result in a tax refund, but you cannot receive it until you file the amended return.

You can amend a return to change from married filing separate to married filing joint but not from married filing joint to married filing separate unless you do so prior to the original filing deadline without extensions. So, once you file a joint return you can not change it to a separate return if the filing deadline has already passed.