How Do I Fix My Tax Return If It Gets Rejected

If the IRS computers look at your return and something just doesnt add up, your tax return gets rejected. The issue could be as simple as a typo in a Social Security Number or an address.

The good news is that you can simply file your taxes againno amended return process needed. Just log back into 1040.com to see which part of your return needs to be fixed, make the change, and refile .

Here are a few of the most common errors:

- A name doesnt match Social Security records

- An address was entered incorrectly

- An Employer Identification Number was entered incorrectly

- A date of birth was entered incorrectly

- A child was already claimed on someone elses return

- Using the married filing separately status in a community property state AZ, CA, ID, LA, NM, NV, TX, WA, or WI which is not allowed

- An incorrect number was used to identify yourself to the IRS, such as an incorrect prior-year AGI or Employer Identification Number

Submit Your Amended Forms

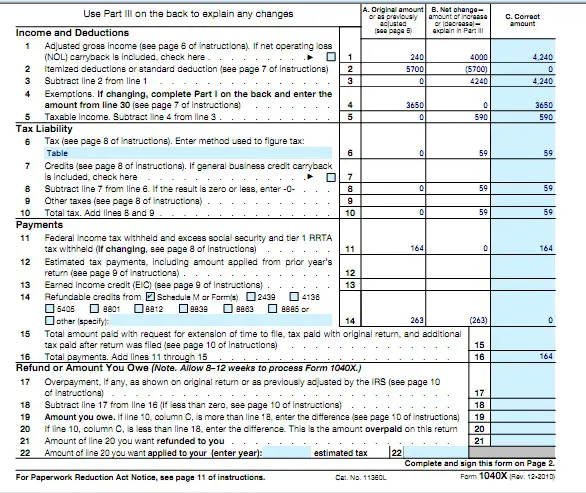

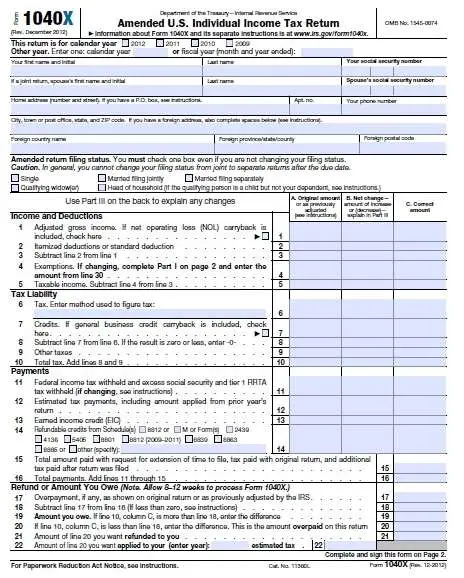

Beginning with the 2019 tax year, the IRS allows you to e-file amended tax returns if you filed the original return electronically and provided that your tax software supplier supports electronically filing amended returns. To amend a return for 2018 or earlier, you’ll need to print the completed Form 1040-X and any other forms you’re amending. Attach any necessary supporting documentation, such as:

- Any new or amended W-2s or 1099 forms

- Other forms or schedules that changed, such as Schedule A if you updated your itemized deductions

- Any notices that you received from the IRS regarding your amended return

Mail all the forms and documents to the address provided in the instructions or electronically file the return if you are able to.

If amending your tax return results in a higher tax bill, you will need to make an additional tax payment. You can mail a check with the amendment or go online and make a payment at the IRS website after logging into their system. By making a payment now instead of waiting for the IRS to send an invoice, you can minimize the interest and penalties you’ll owe.

Keep in mind that if you file an amended tax return on paper rather the e-filing, it can take the IRS eight weeks or longer to process the amendment. You can check the status of your amended return using the IRS’ Where’s My Amended Return? Wait about three weeks from the date you mailed your return for the information to show up in the IRS system.

Cancelling Slips On Paper

If you choose to cancel your return on paper, clearly identify the slips as cancelled slips by writing CANCELLED at the top of each slip. Make sure you fill out all the necessary boxes, including the information that was correct on the original slip. Send two copies of the cancelled slips to the employee. Send one copy of the cancelled slips to any national verification and collection centre with a letter explaining the reason for the cancellation.

Do not file an amended T4 Summary.

Also Check: How To Pay Taxes On Contract Work

How Long Will It Take For The Changes To Be Made

- If you submitted your request online, your change request will take about two weeks to be processed.

- If you submitted your request by mail, your change request will take longer. Due to COVID-19, the CRA may take 10 to 12 weeks to process paper adjustments.

Keep in mind that some adjustment requests are considered complex and may take longer to process. Complex requests include situations where additional information or review is required.

For more information on processing times, go to Service Standards in the CRA.

Online or by mail, you can request an adjustment for any of the 10 previous calendar years. For example, a request made in 2021 must relate to 2011 or a later tax year. Adjustment requests for different years should be on different forms but they can be mailed in together or submitted to the CRA at the same time.

Dont Miss: How To File Missouri State Taxes For Free

How Do I Fix A Mistake On My Taxes After The Irs Accepts My Return

If youve found a mistake after the IRS officially accepts your return, you may wonder if theres anything actually wrong with it. After all, if the IRS approved it, doesnt that mean your tax return was fine?

That depends on the error on the return. You normally dont need to correct math errorsthe IRS will catch and make those changes for you.

On the other hand, mistakes having to do with personally identifiable information , filing status, dependents, total income, or tax breaks should be fixed, which is done by using Form 1040X.

Don’t Miss: What Forms Are Needed To File Taxes

When I Called Ldr About A Bill I Was Told That I Needed To Amend My Tax Return To Resolve The Bill How Do I File An Amended Tax Return

Amended returns can be filed by re-filing a corrected tax period return with an X marked in the Amended Return box and attaching an explanation of the changes. The amended return should be mailed to the address on the tax return.

Amended individual income tax returns can be file electronically using the Louisiana File Online application. If you filed your original tax return electronically, you may log in to your account and amend your original return. If you filed your original tax return on paper or via another electronic filing option, you can still file your amended return electronically using the Louisiana File Online application. You must register and create a User ID and password and then select the amended tax return option.

Amended business tax returns can be filed electronically using the Louisiana Taxpayer Access Point system. Once registered for the LaTAP system, you can file and pay your taxes electronically and review your tax filing and payment history for all taxes.

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

Taxpayers who received unemployment compensation in 2020 may want to amend their tax returns.

getty

Many taxpayers learned that unemployment benefits are taxable the hard way earlier this year when they filed their 2020 income tax returns. It came as such a blow to so many people, after what was a horrible year in so many other ways, that Congress included a tax exemption for the first $10,200 of unemployment insurance in the American Rescue Plan passed in March 2021. Unfortunately, that law was passed after many taxpayers had already filed their tax returns. As panic set in, the IRS asked taxpayers not to file amended returns, but to wait for an automatic adjustment that would come in the summer. The adjustments were made and the final few batches of refunds are currently being delivered to affected taxpayers. This is great news, but it is not the end of the story.

Don’t Miss: How To File Previous Years Tax Returns

Tips For Taxpayers Who Need To File An Amended Tax Return

IRS Tax Tip 2020-114, September 3, 2020

The IRS will correct common errors during processing. However, there are certain situations in which a taxpayer may need to file an amended return to make a correction. Taxpayers can now file amended returns electronically. Here are some tips for anyone who discovered they made a mistake or forgot to include something on their tax return.

Use the Interactive Tax Assistant. Taxpayers can use the Should I file an amended return? to help determine if they should file an amended tax return.

Don’t amend for math errors or missing forms. Taxpayers generally don’t need to file an amended return to correct math errors on their original return. The IRS may correct math or clerical errors on a return and may accept it even if the taxpayer forgot to attach certain tax forms or schedules. The IRS will mail a letter to the taxpayer, if necessary, requesting additional information.

Wait until receiving refund for tax year 2019 before filing. Taxpayers who are due refunds from their original tax year 2019 tax return should wait for the IRS to process the return and they receive the refund before filing Form 1040-X to claim an additional refund.

Pay additional tax. Taxpayers who will owe more tax should file Form 1040-X and pay the tax as soon as possible to avoid penalties and interest. They should consider using IRS Direct Pay to pay any tax directly from a checking or savings account for free.

Understand Your Taxable Income

This is perhaps the greatest piece contributing to filing errors. A lot of taxpayers are simply not aware of what counts as taxable income.

For example, did you know that you have to pay taxes on gambling winnings?

E-filing can help in this respect. Programs like TurboTax, for example, walk taxpayers through all possible income scenarios according to their tax bracket.

Visiting the IRSs website can also help. Learn more about U.S. taxable income here and income tax returns.

Along the same lines, its vital to understand all of the deductions and credits you are eligible for. Doing so can ensure you are earning the highest refund every year.

Recommended Reading: How Much Is Georgia State Tax

Can I File My Amended Return Electronically

If you need to amend your 2019, 2020 and 2021 Forms 1040 or 1040-SR you can now file the Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products.

Additionally, Tax Year 2021 Form 1040-NR Amended and Tax Year 2021 Form 1040-SS/PR Corrected returns can now be filed electronically.

When To File An Amended Tax Return

There are times when you should amend your return and times when you shouldn’t. Here are some common situations that call for an amendment:

- You realized you missed out on claiming a tax deduction or credit.

- You accidentally claimed the wrong tax filing status.

- You need to add or remove a dependent.

- You forgot to claim taxable income on your tax return.

- You realize you claimed an expense, deduction or credit that you weren’t eligible to claim.

You usually don’t need to file an amended return if you discover math or clerical errors on a recently filed tax return. The IRS will often correct those types of mistakes on its own and, if necessary, send you a bill for the additional tax due or a refund if the error was in your favor.

Before filing an amended return, make sure the IRS has already processed the tax return you need to amend. That way, it will be less likely that the IRS will get your original return and amended return mixed up. If you’ve already received your tax refund, then you know the IRS has already processed your return.

Just keep in mind that the IRS limits the amount of time you have to file an amended return to claim a refund to:

- Within three years from the original filing deadline, or

- Within two years of paying the tax due for that year, if that date is later.

If you’re outside of that window, you typically can’t claim a refund by amending your return.

Recommended Reading: How To Check If Tax Return Was Filed

Amending Your Income Tax Return

OVERVIEW

What if you’ve sent in your income tax return and then discover you made a mistake? You can make things right by filing an amended tax return using Form 1040-X. You can make changes to a tax return to capture a tax break you missed the first time around or to correct an error that might increase your tax.

How Do I Generate The Amended Return

For the current year program, log into the account and click the “Continue”, then select “2021 Amended Return” from the left side of the screen on the navigation bar. For Prior year Amended returns, select the Prior Years tab and select the tax year you wish to amend. Continue until you are in the correct return and click on the Amended Return on the left side navigation bar.

Don’t Miss: How Much Do Jobs Take Out For Taxes

How Far Back Can You Amend Taxes After Discovering Mistakes

- See More in: Back Taxes

The average American pays at least $10,000 each year in taxes.

However, sometimes this number isnt always accurate. Its entirely possible to overpay or underpay taxes if you make mistakes when filing your tax returns.

If this has happened to you, you may be able to amend your tax returns. Doing so can ensure youre paying the right amount in taxesand getting your maximum refund in your amended tax return.

The good news is you can file an amended return after they have been accepted and processed.

But how far back can you amend taxes after their due date, and what tax mistakes qualify?

Keep reading for answers to these questions and more!

Here Are Some Common Reasons People May Need To File An Amended Return:

- Entering income incorrectly

- Not claiming credits for which they’re eligible

- Claiming deductions incorrectly

The IRS may correct math or clerical errors on a return and may accept returns without certain required forms or schedules. In these instances, there’s no need for taxpayers to amend the return.

Read Also: When Are Income Taxes Due In 2021

How To Change Or Stop A Deduction

You can change or stop the amount of tax you want us to deduct at any time.

You can do this using the same options to set up the deduction for when you get a payment above.

Use our online guide to help you manage tax deductions with your Centrelink online account.

If you cant access a self-service option, fill in the Tax Deduction Authority form for your main payment.

What Does It Mean To Amend My Taxes

Amending taxes means modifying a tax return the government has already accepted.

You can amend your taxes for very specific reasons. If you need to change your filing status, you should amend. The same goes for if you need to correct income reporting, deductions, and credits.

If youve made errors related to basic math, you dont have to amend your tax return. The IRS will actually make the changes for you!

A lot of taxpayers assume they need to file an amended return if they forgot to submit a specific form. Missing forms dont require an amended tax return, however. In this case, the IRS will reach out to you and request the missing item.

If you receive a corrected tax form after you have filed an amended tax return, however, you should amend your return.

To amend taxes, taxpayers have to fill out a specific tax form and mail it to the IRS. This only applies if you have already submitted your tax return and it has been accepted by the government.

You cant amend a return that has been rejected or is pending acceptance. Nor are you making amends when you make changes to a return you havent yet submitted.

Recommended Reading: What Info Do I Need To File Taxes

How Long Does It Take For The Irs To Amend My Return

Due to COVID-19, the IRS is taking longer to process mailed documents, such as paper tax returns. The IRS is processing mailed documents in the order that it is received.

Your amended return can take up to:

- 3 weeks from the date you mailed it to show up in the IRS system.

- 16 weeks to process.

Amended returns may take longer than 16 weeks to process if the return is incomplete, has errors, is unsigned, is associated with identity theft or fraud, or includes Form 8379, Injured Spouse Allocation. In some cases, the IRS may contact you if more information is needed to process your return.

You can track the status of your amended return starting three weeks after you have filed. Visit Wheres My Amended Return? or call 866-464-2050. Both these tools are available in English and Spanish.

What Usually Triggers An Irs Audit

Here are some common red flags that can trigger a tax audit and what you can do to avoid problems with the IRS. Next:You didn’t report all of your income. You didn’t report all of your income. You’re not the only one to receive the W-2 forms and 1099s reporting your income the IRS gets copies, too.

You May Like: How To Get The Most Money Back On Taxes

Taxpayers Who Do Need To Amend Their Tax Return Might Have Questions About How To Do So Here Are Some Things They Should Know:

- Taxpayers may now use tax software to file an electronic Form 1040-X. At this time, only tax year 2019 Forms 1040 and 1040-SR returns can be amended electronically if the original 2019 tax return was also filed electronically.

- Taxpayers who cannot or chose not to file their 1040-X electronically should complete a paper Form 1040-X.

- If filing a paper 1040-X, mail it to the IRS address listed in the form’s instructionsPDF under Where to File. Taxpayers filing Form 1040-X in response to an IRS notice should mail it to the IRS address indicated on the notice.

Is There A Time Limit For Amending A Return

The IRS advises that you generally must file Form 1040X to amend a return within three years from the date you filed your original tax return, or within two years of the date you paid the tax, whichever is later. Be sure to enter the year of the return you are amending at the top of Form 1040X.

If you miss the deadline, the IRS may not let you amend your return and you could miss out on any deductions, credits or tax benefits the amendment would allow you to claim. However, time periods for claiming a refund are suspended for a period when the IRS determines a taxpayer to be financially disabled because of a physical ailment or mental impairment.

Read Also: What Does Agi Mean For Taxes