What Is A Tax Lien

A tax lien is a lien that a city or town automatically receives on your real estate as soon as your property taxes or water/sewer bills are assessed. If you do not pay your property taxes or water/sewer bill by their due dates, this lien allows a city or town , after proper proceedings, to sell or become the owner of your property so that the city or town can be paid what it is owed. After getting a lien because your property taxes or water/sewer bills were not paid by their due date, the city or town may mail you a demand for payment. If you do not pay it within 14 days of receiving that demand letter, the city or town may conduct a taking of your property, or it may conduct a tax sale of your property. The city or town also may assign the right to enforce the lien to a third party.

How Is My Property Value Determined

The Nueces County Appraisal District identifies property to be taxed, determines its appraised value, whether to grant exemptions, the taxable owner and address, and which taxing jurisdictions may tax the property. For information on values, to file for an exemption, or to report changes in ownership or address, please call the Appraisal District 881-9978. The Appraisal District office is located at 201 N. Chaparral, Corpus Christi, Texas 78401. Nueces County Appraisal District information can also be accessed through their website, the address is www.ncadistrict.com.

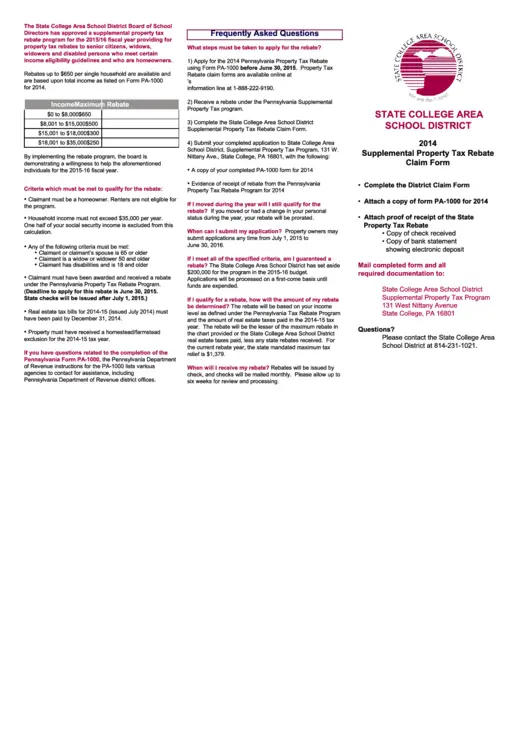

Are Other Exemptions And Assistance Programs Available That Will Help Defray The Amount Of Supplemental Taxes Due

Yes. Supplemental taxes are eligible for the same property tax exemptions and assistance programs as your annual taxes. In addition to the homeowner’s exemption, you can apply through the Assessor’s Office for a number of other assessment exemptions that result in savings. You must, however, file for all exemptions before the 30th day following the date of the notice from the Assessor of your supplemental assessment. For further information, contact the at

In addition, the State of California administers programs that provide property tax assistance and postponement of property taxes to qualified homeowners and renters who are 62 and older, blind, or disabled.

For information on the State’s Homeowner or Renter Assistance Program, call the California Franchise Tax Board at .

For information on the Property Tax Postponement Program, call the California State Controller’s Office at .

If you would like to receive additional information on understanding property taxes, delinquent property taxes, or mobilehome property taxes, please write to the Sonoma County Tax Collector, P.O. Box 3879, Santa Rosa, CA 95402, ATTN: Secured Property. You may also email your request to .

Don’t Miss: How To Calculate Sales Tax In California

Do The Elderly Disabled Or Disabled Veterans Receive Any Discounts Or Exemptions

Eligibility requirements include: age/ disability ownership/ residency and income. To apply for property tax relief you must meet these three basic criteria – these are described below. Reimbursements for the property taxes of low-income homeowners who are elderly or disabled are provided by the state of Tennessee. Reimbursements are given on all or part of the local taxes paid on property which the taxpayer owns and uses as his/her residence.

What Does It Mean To Redeem The Property And How Do I Redeem

You may reclaim full ownership of your property by paying the tax you owe, even if there has been a tax taking, tax sale, or tax receivable assignment. This is called redeeming the property or exercising your right of redemption. The amount that you owe may be more than just the original amount of the tax bill that you received: it might include additional taxes due after the original tax bill, costs, legal fees, and/or interest.

If a tax taking or tax sale has taken place, and the tax title to your property is still held by the city or town, and no tax foreclosure case has been filed in the Land Court, you may redeem by paying the city or towns treasurer the total amount you owe.

If the city or town conducted a tax taking or tax sale, and the tax title to your property was then assigned to a third party, and no tax foreclosure case has been filed yet in the Land Court, you can redeem by either paying the total amount you owe to the third party, or the total amount you owe to the city or towns treasurer.

If no tax sale or tax taking has taken place, but the tax receivable has been assigned to a third party, you can redeem by paying the total amount owed to the third party.

If a foreclosure case has been filed, but the court has not yet issued a finding stating how much you must repay to redeem, you and the other party could agree on how much you owe in order to redeem.

Also Check: Where Do I Pay My Federal Taxes

What Is The Procedure For Purchasing Abandoned Property

Property can be bought for delinquent taxes only after a lawsuit for tax lien foreclosure has been filed, and later a judgment has been granted by the court to sell the property. You will need to contact the law firm that administers delinquent tax sales on behalf of Nueces County. The law firm for Nueces County is Linebarger Goggan Blair & Sampson, L.L.P. Their telephone number is 888-6898.

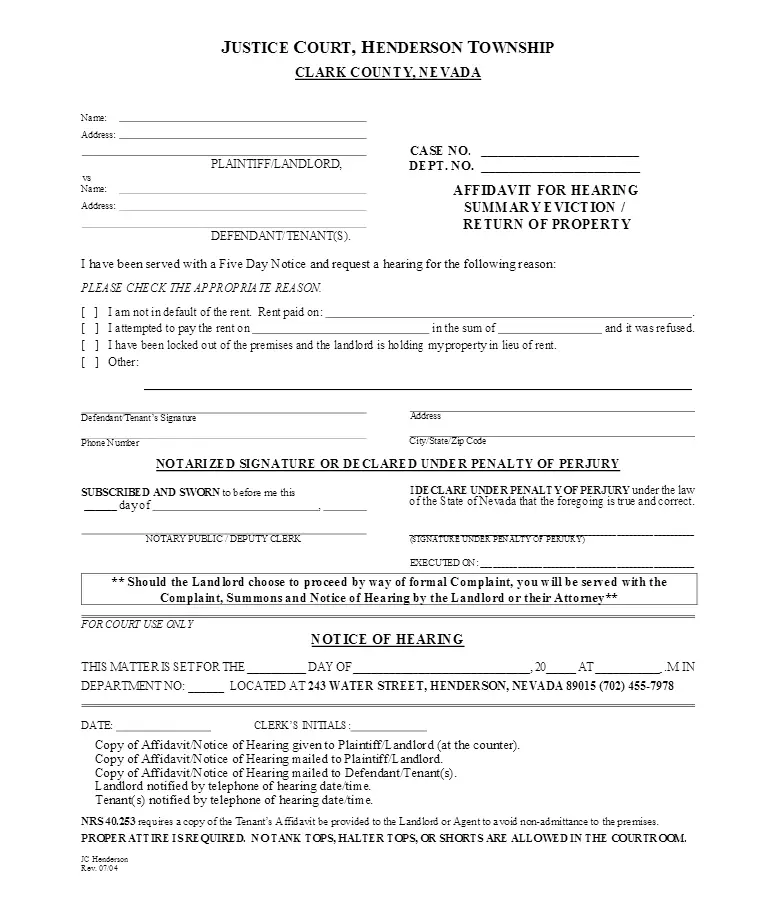

How To Manage A Tax Collector Lawsuit

Sometimes no matter how much you focus on getting your payments in on time and handling your finances, you can still be faced with a lawsuit from the tax collection agency. When this happens, you might initially fear that you will lose your home or worse. But dont worry if you are faced with a lawsuit from a tax collection agency, you have options on how to move forward.

Dont ignore it. Failing to respond to the summons or complaints you receive is one of the biggest mistakes you can make. When you cant pay a debt you owe, your first thought might be that there is nothing you can do to remedy the situation. However, this is not true and failing to respond allows them to get a default judgment against you, giving them access to new ways to collect their dues.

The best course of action is to respond by denying liability in a court of law. This allows you to negotiate a settlement that can save you money. If you force them to take action, then the collection agency is likely to either back down or work with you to come up with a settlement plan. Either way, this is never a problem you can ignore.

Delinquent property taxes are subject to lawsuits that can lead to loss of your home. However, delinquent property taxes can cause more than just a foreclosure on your home. They can lead to additional costs for you that make it even harder to get back on your feet.

Also Check: What If I File My Taxes 1 Day Late

If My Home Is In A Designated Taxable Region Will I Have To Pay The Speculation And Vacancy Tax

For 2018, most British Columbians will be exempt if they either live in their home as their principal residence or rent out their property for at least three months of the year. Short-term rentals for periods of less than one month do not count towards the three-month total.

For 2019 and onwards, over 99% of British Columbians will continue to be exempt. A home that is not a principal residence must be rented for at least six months per year to be exempt from the speculation and vacancy tax. Short-term rentals for periods of less than one month do not count towards the six-month total.

What other exemptions could I be eligible for?

You may be eligible for other exemptions, even if your residential property isnt your principal residence and you dont rent it out for the minimum number of months per year.

If youre not exempt, youll receive a tax notice with the amount you owe.

Review the full list of exemptions and exclusions.

What Are The Stages In A Tax Foreclosure Case Before The Land Court

The stages of a tax foreclosure case in the Land Court can be summarized as follows: thecomplaint, which begins the case notice, which includes the Land Courts preparation of a title examiners report that identifies all interested parties the answer in which you respond in writing to the complaint the hearing, where you appear before the court and orally make arguments and the courts finding, where the court determines if and how you can redeem the property and the courts judgment of foreclosure, which, if you have not redeemed before judgment, gives full ownership of the property to the plaintiff.

Also Check: Where Do I Get My Unemployment Tax Form

What Are Some Exemptions How Do I Apply

Exemptions reduce the taxable value of your property however, the amount of exemption varies for each taxing jurisdiction. This lowers your tax amount. Some of these exemptions are:

Can I Remove Charges For School Districts On My Tax Bill

Qualified School District Special Taxes are a particular type of special tax that is voter-approved and pursuant to Government Code 50079, authorizes only K-12 school districts to place this type of direct charge on the tax roll. In some instances, Qualified School District Special Taxes may qualify for one of the following exemptions:

Please note: School bonds that are calculated based on value of the property do not qualify for any exemptions.

These exemptions are granted by the taxing agency, which will need to be contacted directly for information on qualifying factors. Please visit our section on School Parcel Tax Exemptions for School District contact information. The phone numbers are also made availble on your tax bill.

You May Like: What Is The Agi On Taxes

Do I Need To Pay The Full Amount Needed To Redeem At Once

You can pay the total amount that you owe all at once, or you can make multiple payments. A city or town also may have bylaws or ordinances allowing it to enter into payment agreements. A payment agreement might allow you to pay the amount you owe over a period of time and/or waive certain charges that you owe. However, any payment agreement will still require a minimum payment of at least 25% of the amount needed to fully redeem the property, and there are limits on both the amount of interest that can be waived through a payment agreement and the number of years over which payments can be spread. After a tax lien foreclosure case has been filed in the Land Court, the court also may be able to create a payment plan when it issues its finding .

How Much Do I Have To Pay To Redeem The Property

The overall amount that you owe and must pay to redeem your property will depend on the circumstances of your case. In addition to the amount of the original taxes or bills owed, it might include taxes or bills that become due after the original taxes or bills, as well as costs, legal fees, and interest. The total amount will depend on factors such as whether the city or town made a tax taking, tax sale, or assignment, how much time has passed, and if the new holder of the tax title has had to pay costs and fees. Once a foreclosure case is filed in the Land Court, the amount you need to pay in order to redeem will be determined by the court .

You May Like: How To Efile Tax Return

Why Is A Private Company Rather Than The City Or Town The Other Party In A Foreclosure Proceeding

There are a number of reasons why a private company, rather than the city or town, is sending you notices about your unpaid taxes or water/sewer bill, or has filed a case to foreclose in the Land Court. However, even if a private company is involved, instead of the city or town, you can still redeem and reclaim ownership of your property.

If the city or town decides to conduct a tax sale, a third party, such as a private company, may purchase the tax title to your property and will have the ability to bring a foreclosure action.

Instead of conducting a tax sale itself, the city or town can conduct a tax taking, and may later choose to assign the tax title to your property to a third party. That third party would then be able to bring a foreclosure action.

The city or town may decide to assign the tax receivable for your unpaid taxes to a third party before conducting a tax sale or tax taking. The third party would then be able to conduct a tax taking as if it were the city or town. If the third party decides to conduct a tax taking after having been assigned your propertys tax receivable, that third party would then be able to bring a tax foreclosure action.

If I Buy A Used Mobilehome Subject To Local Property Taxes How Do I Get The Title Transferred To My Name

Mobilehome title insurance is administered by the State’s Department of Housing and Community Development. That department cannot transfer title of a used mobilehome subject to local property taxes without a tax clearance from the county tax collector of the county in which the mobilehome is situated.

In Sonoma County you can obtain a Mobilehome Tax Clearance Certificate by calling the at . If there are any taxes owing, they must be paid before a Tax Clearance Certificate can be issued. A security deposit may be required.

Please Note: Remember that this type of title transfer applies only to mobilehomes not on permanent foundations. If your mobilehome is attached to a permanent foundation, title transfers are handled by the County Recorder in the same manner as for conventional homes.

For more inforamtion, visit the Assessor’s Mobile Home Assessment website.

Read Also: How Do I Pay My State Taxes Online

Why Do Supplemental Tax Bills Exist

On July 1, 1983, California State law was changed to require the reassessment of property as of the first day of the month following an ownership change or the completion of new construction. In most cases, this reassessment results in one or more supplemental tax bills being sent to the property owner in addition to the annual property tax bill.

Do I Have Any Recourse If I Disagree With The Valuation Placed On My Property By The Assessor

Yes. If you disagree with the valuation placed on your property, you may take the matter up with the Assessor to see if that office will change the valuation. Additionally, the Board of Supervisors has established several Assessment Appeals Boards for the purpose of resolving valuation problems. Appeals on regular assessments must be filed each year between July 2 and November 30 . Appeals on corrected assessments, escaped assessments , or supplemental assessments must be filed no later than 60 days from the date of notice or the postmark of that notice, whichever is later.

If you choose to appeal your assessment, you should still pay your tax installments in full by the appropriate deadlines otherwise, you may incur penalties while the case is in appeals. If your appeal is granted, a refund will be issued to you.

Appeals applications and further information about the appeals process can be obtained by calling or writing to: Assessment Appeals Board, 575 Administration Dr., Room 100A, Santa Rosa, CA 95403, or you may visit the Assessment Appeals website.

See our section on Taxpayer Rights for more information.

Recommended Reading: How To Lie And Get More Money On Taxes

The Court Has Already Issued A Judgment Of Foreclosure Can I Still Redeem The Property What Can I Do To Reclaim Ownership Of My Property

Once the court issues a judgment of foreclosure, you cannot redeem the property at that point, the plaintiff will have full ownership of the property. However, there are limited circumstances in which the court will vacate, or undo, a judgment of foreclosure after the court has issued the judgment, and then give you the opportunity to redeem the property. There is a one-year window after the court enters a judgment of foreclosure during which you can ask the court, by filing a motion, to vacate the judgment. The court in its discretion will decide if it is appropriate to vacate the judgment. After one year has passed a judgment of foreclosure typically can only be vacated when there has been a violation of due process. For example, if you were not sent any notice of the foreclosure case as required by law, it may be possible to vacate the judgment.

Even after a judgment of foreclosure, you also may be able to come to an agreement with the plaintiff so that the plaintiff either itself files a motion to vacate the judgment, or consents to your motion to vacate the judgment.