Apply For A Tax Id Number For A New Business Online

If you want your tax ID as quickly and easily as possible, you should apply online. To do that, you need to gather the information noted above. Then, you should find a service that can help you process an online application.

In most cases, you fill out the information, and you get the tax ID for your business that same day or the very next business day. Then, you can start using your EIN on government forms, banking documents, or anywhere else you need it. To learn more about why do I need a tax ID number for a new business and to see an overview of how you use these numbers, check out the details in section four.

Apply For Your Tax Id Number Via Phone

You can apply for a Tax ID Number via phone if you call in with the relevant information. However, you will need to call in during business hours, and you will need to complete the process from start to finish over the phone. If you get disconnected, you will need to begin the process over again. While getting a Tax ID Number over the phone is possible, it also means you wont have any written or digital record of your Tax ID Number: it will be verbally given to you over the phone. Getting a Tax ID Number over the phone will take longer than getting a Tax ID Number online.

Filing For Tax Exempt Status

Its best to be sure your organization is formed legally before you apply for an EIN. Nearly all organizations are subject to automatic revocation of their tax-exempt status if they fail to file a required return or notice for three consecutive years. When you apply for an EIN, we presume youre legally formed and the clock starts running on this three-year period.

Also Check: How Are Lump Sum Pensions Taxed

Why Do I Need A Tax Id Number

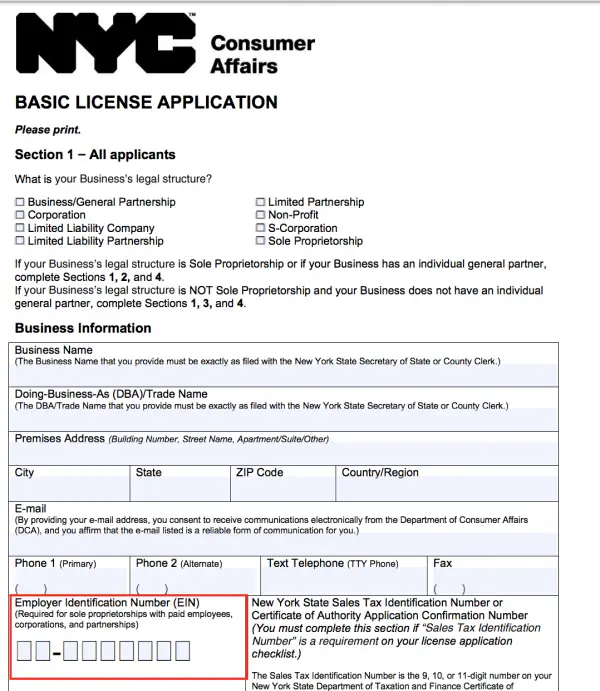

A Tax ID Number is like a social security number for an entity that either does business or hires employees. With a Tax ID Number, you can file federal taxes, open bank accounts, get business loans, and apply for permits and licenses. Without a Tax ID Number, you will be unable to perform basic business tasks, such as filing payroll taxes. A Federal Tax ID Number should not be confused with a State Tax ID Number: one is used for federal taxes and hiring, while the other is used for state-related taxes and documents.

Even a sole proprietorship will need a Tax ID Number to begin hiring and paying employees. While you can pay contractors without a Tax ID Number , you cannot pay employees without a Tax ID Number. The EIN Number is used on the initial hiring forms, to pay payroll taxes, on end-of-year payroll forms, and on things such as visa applications and worker permits. It is also used to acquire business lines of credit, credit cards, and loans, under the companys name rather than the business owners.

As a Tax ID Number is used for most business tasks, it should be one of the first things that a business acquires. You can get your EIN Number within an hour by filling out an online Tax ID application.

Apply For An Ein Online Or By Mail Or Fax

The IRS has a few options to apply for an EIN. You can apply online, by fax or by mail. Applicants who are currently overseas and seeking to immigrate to the U.S. for business purposes can also choose to apply by phone. For all U.S.-based applicants, the online application is the easiest and fastest method.

For the online application, the IRS’ online EIN assistant offers an easy step-by-step form. The online application is available Monday through Friday from 7 a.m. to 10 p.m. EST.

The assistant walks you through the application process and provides links to help resources and other information. Keep in mind that youll automatically be logged out of the system after 15 minutes for security reasons, and each responsible party is only able to apply for one EIN per business day.

If you use the IRS’ online application, you will receive your EIN instantly once you electronically submit your application. Fax applications take four business days to process. Mailed applications take four weeks.

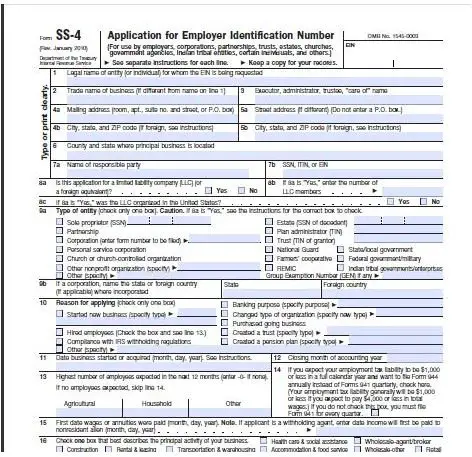

Should you choose to get an EIN via fax or mail, you’ll have to send in the completed Form SS-4.

Don’t Miss: What’s The Last Day To File Taxes 2021

What Documents Do I Require When Applying For A Tin

Those trying to figure out how to get TIN number online in Nigeria often want to know what documents they will be required to present.

For individuals

- A duly completed TIN application form

- A verifiable form of identification. Common options include a national driverâs license, international passport, national identity card, or a certified copy of your full birth certificate.

For a registered but not incorporated business

These are businesses that have been registered with the Corporate Affairs Commission but are not yet incorporated.

- A duly filled TIN application form

- Application letter

- Particulars of the companyâs directors

- Statement of share capital

One must present the original and two copies of each document. The originals are only required for sighting and verification. One copy is left with the FIRS, while another will be signed and stamped by an FIRS official as proof of your application.

If you have been trying to figure out how to get TIN Number in Nigeria, this guide has you covered. For individuals, the process just got easier with the automatic TIN allocation. For non-individuals, the online application process is also quite straightforward.

Also Check: How To Qualify For Roth Ira

How To Get A Federal Tax Id: Apply Online In 5 Simple Steps

Are you ready to start or grow your business? If your answer is yes, use this guide to learn how to get a federal tax ID, when to use it, and how.

When forming a business entity such as an LLC, you’ll need to apply for a federal tax ID numberor employer identification number to file taxes and complete other business tasks. This nine-digit number is similar to a Social Security number and is issued by the Internal Revenue Service . It’s easy to apply, and all you need to do is fill out a one-page form online and submit it.

Also Check: What Is Medicare Tax Used For

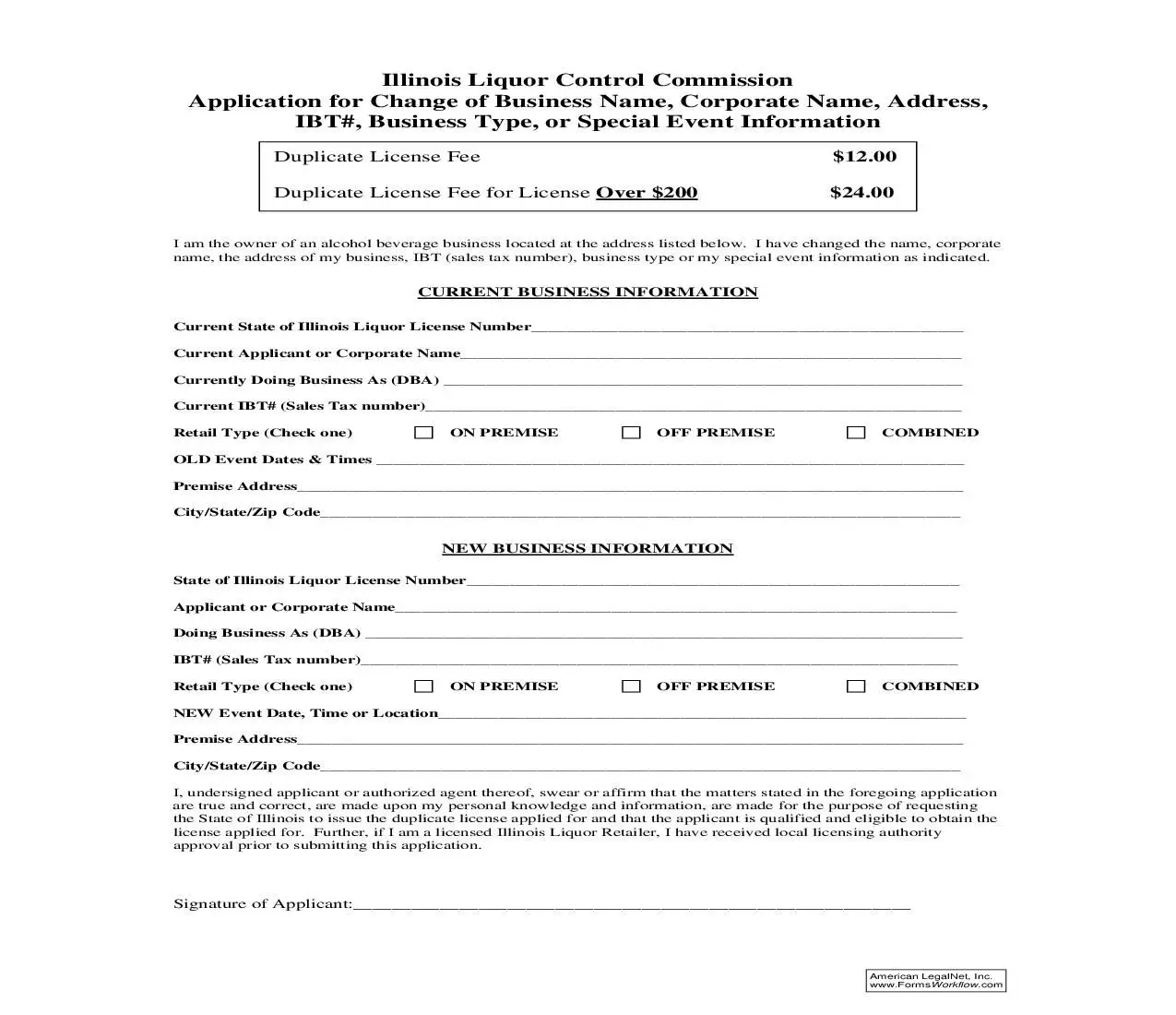

Register For A Permit If The Sale Of Goods Or Services Are Taxable

This is a combined registration form, which means you can register for one or more of the following:

- Sales and Use Tax

If you will be selling household hazardous material , you will need to obtain a separate HHM permit.

Keep a copy of the form. You may begin to collect tax immediately your proof of registration is your copy until we send you your permit number in about 4-6 weeks. The sales tax permit itself is free of charge.

A sales tax permit is not a license to buy tax-free. It is a license to collect tax. For your exempt purchases, you must use exemption certificates see below.

How To Get A Business Tax Id

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

If you run a small business, you need a federal tax ID number. Much like a social security number, this nine-digit ID is assigned only once and will never be redistributed to anyone else. A tax ID ensures your ability to legally pay your employees , file for your annual tax return, apply for business licenses, and participate in business banking. Lets go over how to get a business tax ID, who is required to have one, and a few reasons you might want to apply for oneeven if you dont have to.

You May Like: How To Call Irs About Tax Return

How To Apply For A Federal Tax Id Number:

Applying is a simple process, usually done online. If you prefer to apply via fax, mail, or telephone, you can do this too.

Its also worth remembering that applying for a tax ID number is free. If youve been asked to pay to apply, youre on the wrong site!

You can apply for your federal tax ID number here.

During the application process, you will be asked to provide basic information including details regarding your business structure or the type of organization you operate, personal information, addresses, and other details relating to your business.

If you are not applying yourself, you will need to select a person designated as the responsible party for this application. If you are the small business owner, it will most likely be yourself, but it could also be a business partner if you have one. Whoever the responsible party is, they will need to have a valid taxpayer identification number to apply.

Apply By Telephone International Applicants

International applicants may call 6 a.m. to 11 p.m. Monday through Friday to obtain their EIN. The person making the call must be authorized to receive the EIN and answer questions concerning the Form SS-4, Application for Employer Identification NumberPDF. Complete the Third Party Designee section only if you want to authorize the named individual to receive the entitys EIN and answer questions about the completion of Form SS-4. The designees authority terminates at the time the EIN is assigned and released to the designee. You must complete the signature area for the authorization to be valid.

Also Check: How To File Estate Taxes

Taxes Done Right For Freelancers And Gig Workers

TurboTax Self-Employed searches 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Resources To Help Get A Tax Id

If all of this still feels a bit overwhelming, or you have questions about your specific application, there are some resources to help you apply for a tax ID as well.

If youre already working with an accountant for your small business, ask them to help you apply for an EIN number.

- Financial institution

You can also ask for help from a financial institution like your personal bank or credit union.

- The tax helpline

As mentioned above, the IRS Business & Specialty Tax Line is an available resource for tax ID questions. This office is typically open Monday through Friday from 7:00 a.m. to 7:00 p.m. ET.

Also Check: How Can I Find An Old Tax Return

Apply For Your Tax Id Number Online

Do you need your Tax ID Number fast? Applying for your Tax ID Number online is the best option. When you apply online through a third-party tax ID service, you can get your Tax ID Number in an hour. The tax ID service will collect and verify your information and give you a Tax ID Number that can then be used immediately on official forms and documents.

Types Of Ids Your Business Can Use For Taxes

If you don’t need a federal tax ID to identify your business, you can also use a:

- SSN: The Social Security Administration issues Social Security numbers to help identify U.S. citizens for numerous purposesincluding filing taxes throughout their lives.

- ITIN: The individual taxpayer identification number is a tax ID the IRS issues to all non-U.S. citizens who work in the country but aren’t eligible to receive a SSN so they can still pay their taxes.

People who have a company outside of the U.S. generally rely on an ITIN to file taxes because they don’t have a Social Security number to meet the IRS’ identification requirements.

Meanwhile, those who run a sole proprietorship and don’t employ staff typically use their personal Social Security number since they have easy access to it and there are no laws that require them to obtain a FEIN, unlike larger businesses.

Recommended Reading: When Is The Tax Filing Deadline For 2021

How To Apply For An Employer Identification Number In 3 Steps

Ideally, you should apply for an EIN when you first launch your business, but you might also be applying in time for tax season or to submit a business loan application. The application process is free through the IRS, so be wary of companies that charge you to apply for an EIN on your behalf.

Follow these simple instructions to apply for an employer identification number.

How Do I Get A Tax Id Number For A New Business

To review, here are the options if youre wondering how do I get a tax ID number for a new business. You can apply online, over fax, or through the mail. If your business is based in a country outside the United States, you can apply over the phone, and in fact, only businesses based in other countries can use the phone for their application.

You May Like: How Much Taxes To Take Out For 1099

Individual Taxpayer Identification Number

For individuals who are not eligible for Social Security, the IRS will issue a taxpayer identification number. This number is often assigned to immigrants who are not permanent US residents. Permanent residents who are not eligible for a Social Security number also can receive an ITIN. The number is nine digits long and always begins with the number nine.

Determine Your Eligibility For An Ein

There are two basic requirements that must be met to apply for an employer identification number:

-

Your principal business must be located in the U.S. or U.S. territories.

-

The person applying must have a valid taxpayer identification number, such as a Social Security number.

Your principal business is determined by identifying the main income-generating activity that you do and your main physical location. Just because you provide services outside of the U.S. doesnt necessarily mean that you dont meet the eligibility requirements. As long as your primary business activities are in the U.S., you are eligible to apply for an EIN.

The person who submits the application doesn’t need to be the business owner. The applicant can be a partner or officer of the company. The IRS allows any “responsible party” to apply, which they define as anyone who manages the company’s finances. Another individual, such as a secretary or assistant, can also apply provided that a responsible party signs Form SS-4 and fills out the third-party designee section.

Also Check: How To Pay Tax By Phone

Finding The Federal Tax Id Number Of A Third Party

If the number you are looking for is that of a business you regularly interact with, you may find it on an invoice, a receipt, or another business record. For example, day care centers often put their Employer Identification Number on forms and invoices because parents need this information for tax purposes to be able to deduct those expenses.

Nonprofit organizations often list their tax ID number on donation receipts so that the donor can take the deduction for their business or personal tax return. Some companies, especially publicly traded ones, list the EIN on their website, often on an âAbout Usâ or âLegal Disclosuresâ page or something similar.

If you have to call a business to ask for the EIN, try the Accounting Department or Human Resources as they are the ones most likely to have that on file. This is more difficult if the company is out of business, but the information does still exist. Someone is still in charge of the records. You may be able to get that information from the Secretary of Stateâs office in the state where the business operated.

If all these options still donât find the number you need, try the IRS directly to find the number. Use the contact information on IRS.gov to reach an agent. Explain why you need the number and all the things youâve already attempted. The agent can help or at least make some suggestions about the next step.

Online Ein: Frequently Asked Questions

If you are unfamiliar with the Online EIN application, you may find this section helpful in answering your questions.

Q. When can I use my Internet EIN to make tax payments or file returns?A. This EIN is your permanent number and can be used immediately for most of your business needs, including:

- Opening a bank account

- Applying for business licenses

- Filing a tax return by mail

However, it will take up to two weeks before your EIN becomes part of the IRS’s permanent records. You must wait until this occurs before you can:

- File an electronic return

- Make an electronic payment

- Pass an IRS Taxpayer Identification Number matching program

Q. Sometimes I don’t know all the information required on the application. Why do I have to complete the application online when I can send in paper or fax with missing information?A. When paper or faxed Forms SS-4 are received by the IRS with information missing, additional time is needed to process that application, delaying the issuance of your Employer Identification Number. Applicants can get their EIN much quicker if all the required information is completed.

| If your legal name contains: | Then: |

|---|---|

| A symbol or character, such as a plus symbol , at symbol , or a period | 1) Spell out the symbol or 2) drop the symbol and leave a space. Example: If the legal name of your business is Jones.Com, then input it as Jones Dot Com or Jones Com |

| Backward or forward slash | |

| Apostrophe | Drop the apostrophe and do not leave a space. |

Read Also: What Are The Us Tax Brackets