Do I Pay Taxes On Stocks I Don’t Sell

If you dont sell shares of stock that you own, there are no capital gains taxes due, even if the shares increase in value. If you hold the stocks until you die, they would pass to your heirs, who may or may not owe taxes on the inheritance. If the stock pays a dividend, these payments would be taxable to you while holding the shares, but this is not a capital gains tax.

Are You Taxed On Robinhood

Paying Taxes on Robinhood Stocks Only investments youve sold are taxable, so you wont pay taxes on investments you held throughout the year. If you had a bad year and your losses outstrip your gains, you can deduct up to $3,000 from your taxable income as long as you sell any duds by the end of the year.

How To Avoid Tax When Selling Stock

How to avoid capital gains taxes on stocks

How to avoid capital gains tax on stocks?

- One: Using Tax Losses or Loss Harvesting. A well-known strategy for reducing capital gains is to sell other investments at a loss and use those capital losses to balance the

- Two: Spreading Capital Gains Over Several Years.

- Three: Donating Stocks or Assets Instead of Cash.

Recommended Reading: How To Write Off Donations On Taxes

Strategy #: Shelter Your Capital Gains In Real Estate

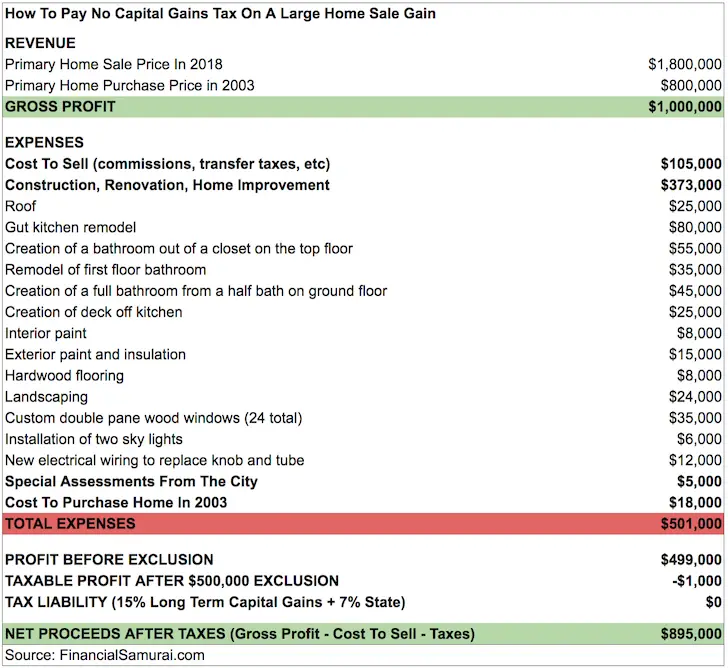

We havent talked about real estate yet. Isnt a house the largest asset most people will own in their lifetime? The government is enthusiastic about the concept of homeownership thats why they give a special exclusion to shelter capital gains when you sell your principal residence. After living in a house for at least two years, single filers can shelter $250,000 in gains, while married filers can double that to $500,000.

Another option to avoid capital gains taxes on real estate is a 1031 exchange, which lets you defer taxes on profits from business property sales used to purchase other properties. However, there are restrictions regarding personal use, so its not an option if the only real estate youre selling is your house.

Harvest Losses To Offset Gains

Capital losses on investments can offset realized short-term and long-term capital gains. Some investors harvest losses proactively when investments go down in value to offset potential future capital gains. Investors may also offset $3,000 in ordinary income yearly if they have excess capital losses.

Recommended Reading: How To Answer Property Tax Lawsuit

Taxation On Short Term Capital Gains

Long-term investors, who invest their savings, enjoy a few more advantages than short-term investors. The capital gains of short-term investors are taxed at a fixed rate of 15%.

To reduce your tax liability on capital gains, however, you may deduct any expenses incurred during the acquisition or sale of the shares, such as commissions. Therefore, the tax calculation for short-term capital gains would be:

Selling Price Buying Price of the Stock Expenses on Purchase or Sale

15% of this equation calculating capital gains will be subject to taxation.

However, long-term investors are taxed differently on capital gains realized on the sale of their shares.

Hold Onto Taxable Assets For The Long Term

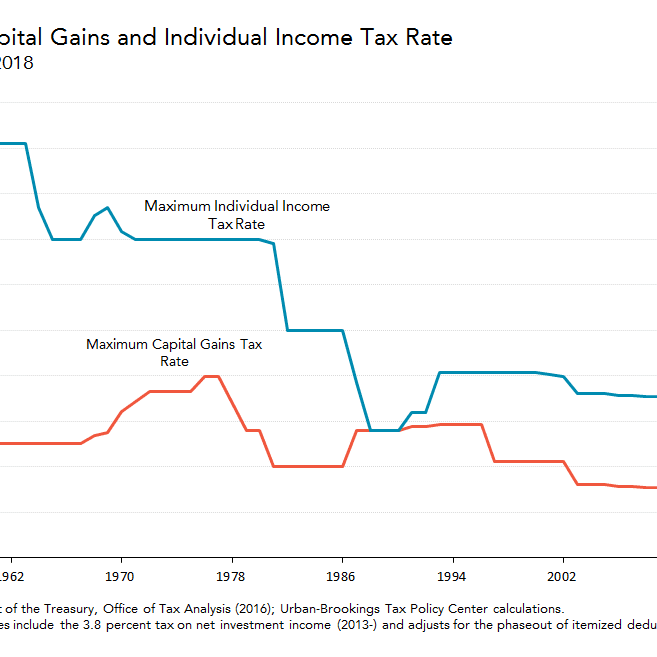

The easiest way to lower capital gains taxes is to simply hold taxable assets for one year or longer to benefit from the long-term capital gains tax rate. While marginal tax brackets and capital gains tax rates change over time, the maximum tax rate on ordinary income is usually higher than the maximum tax rate on capital gains. Therefore, it usually makes sense from a tax standpoint to try to hold onto taxable assets for at least one year, if possible.

You May Like: Can I File Back Taxes Online

How Much Will I Be Taxed On My Shares

Dividends from shares held in a stocks and shares ISA or pension are tax-free. The tax rate you pay on dividends that exceed the allowance depends on your income tax band, which you can work out by adding your total dividend income to your other income: Basic rate taxpayers pay 7.5% Higher rate taxpayers pay 32.5%

Will I Owe Capital Gains Tax If I Sell My Home

If you have less than a $250,000 gain on the sale of your home , you will not have to pay capital gains tax on the sale of your home. You must have lived in the home for at least two of the previous five years to qualify for the exemption . If your gain exceeds the exemption amount, you will have to pay capital gains tax on the excess.

Recommended Reading: When Do You Need To File Taxes 2021

No 2 Donate Stock To Charity

Usually when we think about donating to charity, we often think about donating cash. But donating shares of stock instead can have significant tax advantages. And this includes reducing or eliminating capital gains.

You wont pay capital gains tax at all on shares of stock you donate to a charity. Plus, the value of the shares on the day of the donation can be used as a tax deduction if you are eligible to itemize. If so, donating shares can reduce your taxable income. This leads to a lower tax bill.

Your total itemized deduction must exceed the amount of the standard deduction for the current tax year and your filing status to be eligible.

Take Advantage Of The Home Sale Exclusion

When you sell your home, you get to exclude a certain amount of profit from the sale from your taxable income. That limit is $250,000 for single filers and $500,000 for married couples filing jointly. To qualify, you must have owned the home and used it as your primary residence for at least two of the last five years. You can take advantage of this exclusion once every two years.

Also Check: How Do I File My Taxes With Turbotax For Free

Capital Gain Tax Rates

The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $40,400 for single or $80,800 for married filing jointly or qualifying widow.

A capital gain rate of 15% applies if your taxable income is more than $40,400 but less than or equal to $445,850 for single more than $80,800 but less than or equal to $501,600 for married filing jointly or qualifying widow more than $54,100 but less than or equal to $473,750 for head of household or more than $40,400 but less than or equal to $250,800 for married filing separately.

However, a net capital gain tax rate of 20% applies to the extent that your taxable income exceeds the thresholds set for the 15% capital gain rate.

There are a few other exceptions where capital gains may be taxed at rates greater than 20%:

Note: Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates.

Ways To Defer Or Pay No Capital Gains Tax On Your Stock Sales

Put more into your piggy bank with tax-planning strategies for capital gains.

Getty

Lets say you own stock that may generate a big capital gain when you sell it. It could be shares in Apple AMZN that you purchased a long time ago, founders stock in a startup that turned into a hot IPO company, or shares from employee stock option exercises or restricted stock vesting that have appreciated substantially. While most securities held over one year qualify for the favorable rate on long-term capital gains, the total tax can still be significant.

The complex federal tax code provides a few ways, depending on your income, personal financial goals, and even your health, to defer or pay no capital gains tax. If you follow the rules and consult tax experts when needed for the more sophisticated techniques, these tax-planning opportunities below are not tax dodges or loopholes that will get you in trouble with the IRS. Most are considered tax expenditures .

Also Check: What Time Is The Deadline To File Taxes

How To Avoid Paying Taxes On Stocks: Watch Your Tax Bracket

How close are you to the upper reaches of your tax bracket? If youre at the higher end, you might soon advance to the next tax bracket. When that happens, your tax rate will increase.

If youre at that point, youll want to pay close attention to your capital gains. Even though long-term gains come with a lower tax rate, if you realize them, they become part of your adjusted gross income and that could put you in that higher tax bracket before you want to be there.

One strategy to avoid this scenario is to delay selling your stock until a later time. You could also try to bundle deductions into your current tax year to offset the gains tax, keeping you at the lower rate.

What Happens If You Don’t Report Stocks On Taxes

You typically dont have to report that you own shares of a stock on your taxes. You do have to report any income earned from those shares whether from capital gains due to the sale of the shares or from dividends earned while holding the shares.

Failure to report this income and pay the appropriate taxes could be a crime. Brokerage firms will directly report the proceeds from the sale of stock to the IRS. The company issuing the dividend will also report this income to the IRS. If these amounts are not reflected on your tax return, this could be a red flag for the IRS.

Don’t Miss: How Much Is Sales Tax In Ohio

Reinvest In An Opportunity Fund

An opportunity zone is an economically distressed area that offers preferential tax treatment to investors under the Opportunity Act. This was a part of the Tax Cuts and Jobs Act passed in late 2017. Investors who take their capital gains and reinvest them into real estate or businesses located in an opportunity zone can defer or reduce the taxes on these reinvested capital gains. The IRS allows the deferral of these gains through December 31, 2026, unless the investment in the opportunity zone is sold before that date.

How Can I Reduce Capital Gains Tax

You can minimise the CGT you pay by:

Recommended Reading: How To Get California State Tax Id Number

How To Reduce Your Capital Gains Tax

Though the inclusion rate for the capital gains tax is the same for everyone, there are some ways to lower the amount of tax you pay on your capital gains.

- Choose the right time to sell investments.

- Defer the capital gain if you do not expect to receive the money from the sale right away.

- Donate assets to a registered charity or private foundation.

- Those who own a small business, farm, or fishing property can use the Lifetime Capital Gains Exemption .

How Capital Gains Are Computed

A capital gain is computed by subtracting the purchase price of an asset from the selling price. So if you bought a stock for $1,000 and sold it for $2,000, you would realize a capital gain of $1,000. You will owe tax on this $1,000 capital gain during the tax year when you sold the asset.

Put simply: Capital Gain = Selling Price Purchase Price

Note that tax is only owed on capital gains when they are realized, or sold. If you hold onto this stock instead of selling it, you have whats termed an unrealized capital gain. No tax would be due on the gain until you sold the asset.

The rate of tax thats due on capital gains depends on how long you have held the asset. If you hold a stock for one year or longer, your gain will be taxed at the long-term capital gains tax rate. But if you hold a stock for less than one year before selling it, your gain will be taxed at your ordinary income tax rate.

Also Check: Can I Still Do My Taxes

How Long Must Stock Be Held To Avoid Paying Capital Gains Tax

If you sell shares of stock for more than you paid for them, regardless of how long you have owned them, you will be subject to capital gains tax. The gains will be considered short-term if youve owned the shares for less than a year. The shares will be regarded long-term if youve owned them for at least a year. Most taxpayers benefit from paying long-term capital gains taxes since the rates are lower than short-term capital gains taxes.

Invest For The Long Term

If you manage to find great companies and hold their stock for the long term, you will pay the lowest capital gains tax rate. Of course, this is easier said than done. A companys fortunes can change over the years, and there are many reasons why you might want or need to sell earlier than you originally anticipated.

You May Like: How To Contact Credit Karma Tax By Phone

Capital Gains Tax Rates For 2021 And 2022

Short-term capital gains are taxed at ordinary income tax rates up to 37% . On the other hand, long-term capital gains are taxed at different, generally lower rates. The capital gains rates are 0%, 15%, and 20%, depending on your taxable income. Here’s a breakdown for tax years 2021 and 2022:

| Long-Term Capital Gains Tax Rates for 2021 |

|---|

| Filing Status |

| $41,6751 to $258,600 | Over $258,600 |

Although marginal tax brackets have changed over the years, historically , the maximum tax on ordinary income has almost always been significantly higher than the maximum rate on capital gains.

Not all capital gains are taxed according to the standard 0%/15%/20% schedule. Here are some exceptions where capital gains may be taxed at higher rates than 20%:

- Gains on collectibles, such as artworks and stamp collections, are taxed at a maximum 28% rate.

- The taxable portion of gain on the sale of qualified small business stock is also taxed at a maximum 28% rate.

- The portion of any unrecaptured Section 1250 gain from selling Section 1250 real property is taxed at a maximum 25% rate.

Capital Gains Tax Basics

A capital gain occurs when the sales price you received for an asset is greater than your cost basis in that asset. The basis of an asset may be the price you paid for it. However, if youve made improvements to the asset, the cost of the improvements increases your basis. If youve depreciated the asset, that decreases your basis.

You May Like: What’s The Best Way To Claim Taxes

Make A Donation With Appreciated Stocks

If you plan to make a donation to a charitable organization, dont make it with cash if you have stocks that have appreciated.

Ive made that mistake early on. I wrote donation checks out of my bank account instead of the smarter, tax-advantage way of making a stock donation.

You are able to take a tax deduction on the market value of the stocks donated.

If you donate 100 shares with a market value of $10,000, you can deduct $10,000 from your taxable income.

This is very powerful for me. I have stocks which have gone up over 10 times in 20 years.

Take Apple for instance. I acquired Apple at about $30 a share a decade ago. The stock price has gone up to over $300 today.

If I decide to sell 100 shares of Apple, my proceeds at $300/share come out to $30,000. It would be great if I can pocket the entire $30,000.

But there is this little organization called the Internal Revenue Service which wants its cut.

Since the gain is $27,000 I have to pay about $9,400 in long term capital gains tax .

My net proceeds after taxes are $20,600 .

If I then donate the $20,600 in cash to charity, I can deduct $20,600 from my income. At a marginal tax rate of 50%, I save $10,300 in taxes.

Now, by donating the 100 shares of Apple directly to the charitable organization, I can deduct $30,000 from my income. At a marginal tax rate of 50%, I save $15,000 in taxes.

You can set up a donor-advised fund with a brokerage company to start your donation of appreciated stocks.

Avoid Capital Gains Tax On Shares By Giving Appreciated Stock To Anyone

Second, the Internal Revenue Service allows you to give away a certain amount of money each year to anyone. And the individual or individuals do not have to be qualified charities.

Yes, you can give appreciated stock to a child, parent, friend, or total stranger. And you can do so for as many people as you choose.

As of the date of this post, the annual amount is $16,000. However, tax laws generally increase this value over time.

As a result, you the donor will pay no capital gains tax.

But the recipient will inherit your cost basis. Thus, when they go to sell, they may have to pay capital gains tax.

This is an especially desirable financial result if you give the stock to someone who has little or no income. Because they may qualify for the zero capital gains tax rate. See point number 1 above.

Regular readers know that Im a long-term investor. Since I like to buy and hold my dividend stocks forever. Maybe this next point takes my investment philosophy a little too far.

I dont know. Thats for you to decide.

However, its another way to avoid tax on stock gains

Recommended Reading: Where To File Taxes For Free