What Is 1099 Income

Freelancer. Independent contractor. Self-employed. 1099 worker. Side hustler. There are many terms used to define workers who are not traditional employees. Regardless of the label, they are treated the same when it comes to taxes.

First things first: When you work for yourself, your employer does not withhold taxes from your paycheck and send them to the IRS. Instead, youâre expected to pay income taxes directly to the government.

Like most things related to taxes, it all starts with paperwork. Instead of a traditional W-2, as a contractor you fill out a W-9. That allows the company that hired you to prove to the IRS that it doesnât owe payroll tax for your employment. Then, come tax season, you will receive an IRS form 1099 from each client, outlining exactly how much 1099 income you earned from that company over the course of the year.1

Tax Trick #: Get Paid Through An S Corp

Think that corporate perks are only available to multi-billion-dollar media conglomerates? Think again!

Letâs check back in with Rasheeda. After a couple more years of hustling, her pet portraits have continued to grow, and now sheâs earning an average of $90,000, net.

At that income level, being smart about her tax deductions still leaves her with bigger income tax payments than sheâd like. So what does a business-savvy woman do? She creates an S corp!

After filing the appropriate paperwork, Purrfect Pet Portraits is now a separate business entity. The business is still earning $90,000, but now Rasheeda sets her personal salary at $75,000, leaving Purrfect Pet Portraits with a net profit of $15,000.

Stay Ahead Of The Irs

If youre not careful and dont proactively plan to set aside your estimated tax liability throughout the year, you can very easily find yourself with the deer in headlights look and gasping for air at the same time when you file your taxes for the first time post-graduation.

If thats the case, you now have an uphill battle of coming up with the money to pay last years taxes and setting aside enough of your earnings to cover your current years tax liability. Add to that the fact that, in your second year of reporting 1099 income, the IRS will now ask you to make estimated tax payments on a quarterly basis to cover your current years tax liability, so you dont get the luxury of having a full year to recover.

Note: the estimated payments, while required, are still voluntarily submitted by the taxpayer. If you fail to pay the estimated tax payment, a penalty will apply when you file and submit your taxes for that year. For more information on this and everything else mentioned in this article, please consult your CPA or other qualified tax professional.

Also Check: How Long To Keep Tax Returns For Business

Offer Benefits For Employees

Receive better tax treatment when you offer benefits for your employees. If you are a self-employed professional who has at least one other employee, you can reduce your tax burden by providing benefits to them. Receive tax benefits for offering health care and contributing to employee retirement benefits.

Read the answers to the most-asked questions about health benefits for the self-employed here.

Instead of offering a raise, it may make sense to offer an increase to what you pay for employee benefits. This results in a tax advantage for your business without increasing your amount of payroll taxes for employees.

Even if you dont hire W-2 employees, dont forget to keep track of what you pay independent contractors, which is also tax deductible.

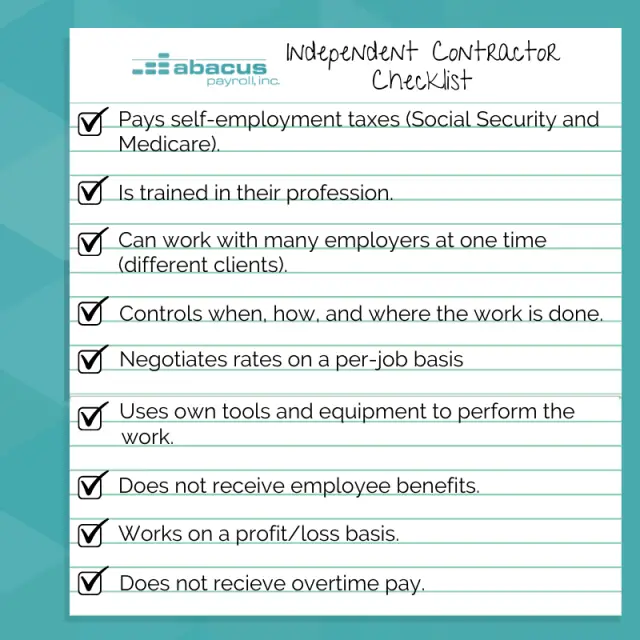

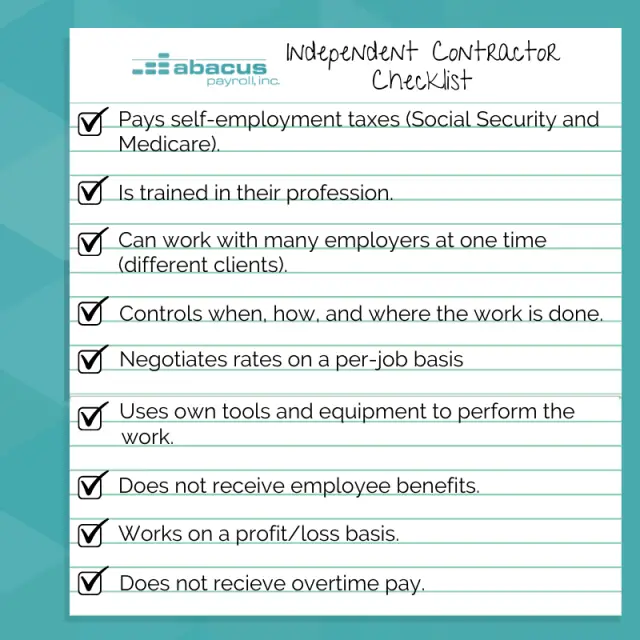

Are You An Independent Contractor :

Before we get into the topic of independent contractor taxes, lets make sure youre in the right place.

If you answer yes to either of these 2 questions, then you should be paying independent contractor taxes:

- Are you self-employed ?

- Have you accurately received a 1099-Misc tax form?

If the answer to either of these questions is yes, then youre in the right place. Well walk you through what you need to do in order to pay taxes as an independent contractor.

Don’t Miss: How To Correct Taxes After Filing

How Can I Avoid Paying Taxes On A 1099

How To Avoid Paying Taxes on 1099-MISCHow An Independent Contractor Can Avoid Paying Taxes. Employees typically have social security taxes and Medicare taxes taken out of their paycheck. Home Office Deduction. Qualified Business Income Deduction. Become an S-Corporation. Its Time To Lower Your Tax Bill!

Estimating An Independent Contractors Federal Tax Liability

Figuring out exactly how much you owe in taxes can be challengingespecially if youre new to working as an independent contractor. Its not as simple as setting aside a specific percentage of your incomesay 25% or 30%because the amount youll ultimately owe depends on your tax bracket and the deductions and tax credits you may be eligible for.

Plus, your estimated taxes need to cover both federal income taxes and self-employment taxes: the independent contractors version of Social Security and Medicare taxes.

You May Like: How To File Sales Tax In California

Make Estimated Quarterly Tax Payments

Once youve estimated your tax liability as an independent contractor, you have to actually make a quarterly tax payment.

You can send a check payment along with the aforementioned Form 1040-ES by mail, or you can pay online, by phone, or from your mobile device using the IRS2Go app.

Lots of tax services like Turbo Tax, HR Block, or your tax preparer also have quarterly options.

Will I Have To Pay Someone Else To Do My Taxes

You might be able to use one of these online business tax preparation services if you have a simple business tax return, with no employees or product inventory.

However, if you choose to do the work yourself, or just want to better manage your business in general, here are some of the best accounting apps for your bookkeeping and tax calculation needs.

Recommended Reading: How To Know If Irs Received My Taxes

Why Should You Consider To Avoid Paying Taxes On Your 1099

When you’re self-employed or a contractor, you’re often paid with 1099 instead of a W-2. This can be beneficial because your income isn’t taxed on the employee side but taxed at your marginal rate as an independent contractor. However, if you receive too much of 1099 income, it can result in a higher tax bill than if you’d been paid as an employee. You need to know this to avoid paying taxes on your 1099 eventually.

First, you earned it. You worked hard for that money. You deserve it. And if you didn’t make it, you don’t deserve it. So unless you have a good reason for how to avoid paying taxes on your 1099 , then there is no reason to avoid them.

Second, the money is yours. If someone wants to give you money, they should be able to do so without going through any red tape. This is especially true if they are giving you the money because they want something in returnlike a service or product that you provide them with. If they don’t want to provide you with their money, that’s fine too because plenty of other people will happily take their money and give them what they want in return . Hence, you can avoid paying taxes on your 1099.

The easiest way to avoid paying taxes on your 1099 is by never receiving one in the first place! However, if your employer does issue one, you have options for reducing its impact on your taxable income. Third, keeping things simple makes everything easier for everyone involved, especially regarding taxes!

Tip #: Take Advantage Of Tax Write

As weve said, self-employed individuals can take advantage of many deductions and drastically lower their tax bills. Even so, many freelancers miss out on great opportunities for write-offs.

Weve already mentioned one of the biggest deductions i.e. the one for the self-employment tax as well as those related to business expenses. But there are others to know about.

Well mention some of the most important ones you may have missed.

Qualified Business Income deduction

One of the newest tax breaks independent contractors can claim is the Qualified Business Income deduction.

This write-off is the one you dont want to miss, as it can take as much as 20% off your taxable income.

To qualify for this type of deduction, your total taxable income not just business income needs not exceed:

- $170,050 for single filers, and

- $340,100 for joint filers.

Even if your income goes above these numbers, you may still qualify but probably wont be entitled to the full 20%.

Health care premiums deduction

As a self-employed person, you need to buy your own health insurance premiums. But, the good news is that you may claim a 100% deduction for medical, dental, and long-term care insurance.

You can also deduct the medical coverage you paid for your spouse or other dependents.

Home office deduction

You are likely to work from home, so its good to know that you can deduct costs related to this space from your tax.

Retirement plan deduction

Don’t Miss: Do You Need Bank Statements To File Taxes

What Is 1099 And What Does It Mean For Your Taxes

In order to understand how you can avoid paying taxes on your 1099, it would help if you go through the basic details of the form beforehand. A 1099 form is a tax document used to report income from independent contractors and other non-employees. If you’re an employee, then you’ll receive a W-2 instead.

The IRS uses these forms to help determine if you should receive a refund or owe extra money at tax time, which is essential to deciding how to avoid paying taxes on your 1009. If you get paid as an independent contractor, you don’t have taxes withheld from your paycheck . So the IRS requires businesses to file Form 1099s with their employees’ Social Security numbers and other identifying information so that they can be taxed at the end of the year. In turn, you know how to avoid paying taxes on your 1099.

If you’ve been issued one of these forms by an employer, they’ve classified you as an independent contractor rather than an employee. This means that they don’t have to withhold federal income tax or Social Security/Medicare taxes from your paychecks like they would for regular employees. It also means that instead of paying FICA taxes on your own as self-employed individuals do, the employer will pay half for both halves of FICA taxes.

Will I Have To Pay Quarterly Estimated Tax

You don’t have a paycheck as a business owner, and you don’t have withholding for federal income tax, state income tax, or self-employment taxes. You must therefore make quarterly estimated payments if your business has a profit, to pay your income taxes on your business income and other income and for self-employment taxes.

Quarterly estimated payments are normally due four times a year: April 15, July 15, October 15, and January 15 of the following year.

Recommended Reading: Where Is The Cheapest Place To Get Taxes Done

Independent Contractor Vs Employee

As an independent contractor, you are not an employee of a business. There are a few key differences between an independent contractor and an employee.

As an independent contractor, you must consider employer laws, taxesand payment schedules. As an employee of a company, you are covered by both federal and state employment laws, as well as labor laws, which is not the case for independent contractors.

Labor laws are considered to be a form of protection against wrongful termination, in favor of being paid minimum wage and a way of keeping overtime rules in place. These do not apply to independent contractors.

Additionally, taxes work a little differently for independent contractors compared to taxes for an employee. For instance, for employees, companies will withhold taxes, including Social Security, income and Medicare.

On the other hand, taxes are not withheld from independent contractors. Instead, independent contractors are expected to pay their taxes on their own. Also, if you are a traditional employee, you are probably used to being paid in alignment with a constant, set payment schedule.

You are likely paid weekly, bi-weekly or monthly. Independent contractors are typically paid by way of invoices. The pay, as well as the timeline of the invoices, are usually determined prior to the contractor starting the job.

How Are Independent Contractors Taxed

Independent contractor taxes are based on the Internal Revenue Services self-employment tax rates. Therefore, businesses that hire self-employed contractors do not have to withhold taxes from wages.

If you earn $400 or more per year, you must file a Form 1040, Schedule SE, and Schedule C.

Anindependent contractor must also pay self-employment tax quarterly. These contribute to Social Security and Medicare. However, unlike employees whose employers hold taxes, contractors must use their taxes to cover these expenses.

You can report quarterly estimates on a Form 1040-ES, Estimated Tax for Individuals.

A freelancer can submit Form 1099-NEC and Form 1040, Schedule C, to the IRS at the end of the year. This will account for their total tax liability it will also entitle them to any refund from estimated taxes they paid earlier in the year.

Businesses that hire contractors do not pay any taxes on their behalf, and they do not file taxes for them. Therefore, the freelancer must keep accurate financial records to file appropriately.

Recommended Reading: How Much Tax Should I Deduct From My Paycheck

The Complete Guide To Independent Contractor Taxes

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Paying business taxes as an independent contractor can be tricky. You have to file additional forms, make sure youre paying the government enough during the year and pay a self-employment tax.

Make Estimated Tax Payments

Independent contractors are required to remit their own taxes. If you expect to owe more than $1,000 when you file your taxes, youre required to make quarterly tax payments.

If you run a small business on the side while employed somewhere that withholds federal income taxes from your paycheck, avoid quarterly payments by increasing your federal withholding. You can adjust your federal withholding by filling out and submitting a fresh Form W-2 to your employer.

Use Form 1040-ES to calculate and make IRS estimated tax payments. Payment can be submitted online or by mail.

Read Also: How To Get Stimulus Check On Tax Return

Tax Tips For Independent Contractors

- Consider working with a financial advisor to better manage your independent contractor income. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Develop a good record-keeping system for your business. Make sure you have accurate records of both your income and expenses for the year. Consider using an expense app to keep tabs on receipts, charitable donations and other deductible expenses. When you receive your 1099 forms, be sure to check them for accuracy.

- A financial advisor who specializes in tax planning can help lower your 1099 income taxes by harvesting your losses. This means that you will be able to use your investment losses to reduce taxes on 1099 income.

- Figuring out your taxes can be overwhelming. SmartAssets income tax calculators will help you calculate federal, state, and local taxes.

What Are The Tax Implications For An Independent Contractor

Unlike employees, independent contractors are required to pay their own income taxes and self-employment taxes. Self-employment taxes include Social Security and Medicare taxes. The current rate of self-employment taxes is 15.3% of the independent contractors wages, with 12.4% of that rate going towards Social Security and 2.9% going towards Medicare.

Generally, independent contractors should keep back one third of their income to pay these taxes. However, the required withholding could be more or less depending on the individual financial circumstances of the contractor. The IRS provides a worksheet to determine the amount of withholding for the self-employment tax. Individuals also should speak with an experienced tax professional to determine the amount of the withholding.

Independent contractors are required to make estimated tax payments on any income that is not subject to withholding. Individuals who work only part time as independent contractors must pay self-employment taxes on those wages, even if they hold full-time jobs with employers who withhold taxes from their paychecks. Estimated tax payments are made quarterly with specific due dates set by the IRS. Payments not received by the due date may be subject to interest and penalties at the end of the tax year.

DISCLAIMER: This site and any information contained herein are intended for informational purposes only and should not be construed as legal advice. Seek competent counsel for advice on any legal matter.

You May Like: How Much Do Charitable Donations Reduce Taxes 2020

Airbnb Income And State And Local Taxes

Additionally, you may also be liable for state and local taxes related to your rental income. If your jurisdiction requires that you pay Transient Occupancy Taxes , Airbnb will automatically deduct and remit the payment of TOT on your behalf. While you do not have to put aside more of your earnings to cover these taxes, you should just be aware that this money will be taken from your earnings upfront.