Total Up Your Tax Withholding

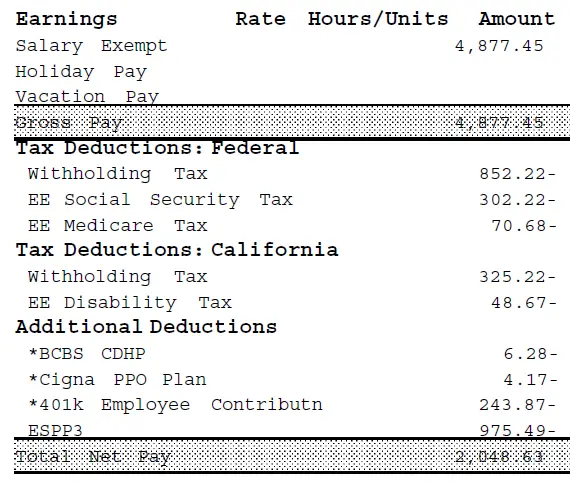

Lets start by adding up your expected tax withholding for the year. You can find the amount of federal income tax withheld on your paycheck stub. Ugh, we know. Its been years since youve looked at your paystub, and you dont even remember how to log in to your payroll system. But this will be worth it!

Lets say you have $150 withheld each pay period and get paid twice a month. That would be $3,600 in taxes withheld each year.

If youre single, this is pretty easy. If youre and both of you work, calculate your spouses tax withholding too. In this example, well assume your spouse has $400 withheld each pay period and receives a monthly paycheck.

Then add the two together to get your total household tax withholding.

How To Calculate Federal Tax Withholding

This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant and a Certified Financial Planner in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.There are 9 references cited in this article, which can be found at the bottom of the page. This article has been viewed 132,799 times.

Calculating federal tax withholding can be surprisingly frustrating even though it’s something the majority of people have to do regularly. Luckily, with the right guidance, this yearly ritual doesn’t have to be a source of stress: each tax has its own set of laws and regulations associated with it, which are clearly outlined by the IRS. Learn how to calculate your federal tax withholding today to save yourself time and energy for years to come.

How To Calculate Your Paid Family And Medical Leave Withholding

To calculate the amount of Paid Family Medical Leave withheld from your paycheck, multiply your gross wages by .6%. You pay 73.22% of that 0.6%.

Note that premiums are capped at the 2022 Social Security Wage Base of $147,000 the maximum premium paid for PFML is $649.32.

You can also visit the Premiums Calculator page on the Washington State Paid Family and Medical Leave website for more information.

Also Check: Can Home Improvement Be Tax Deductible

Federal Income Tax : 2019 Or Prior

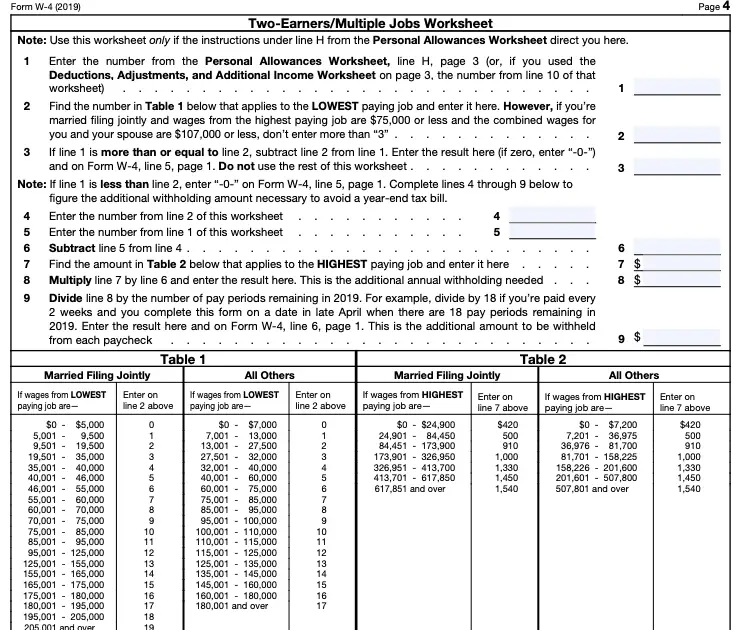

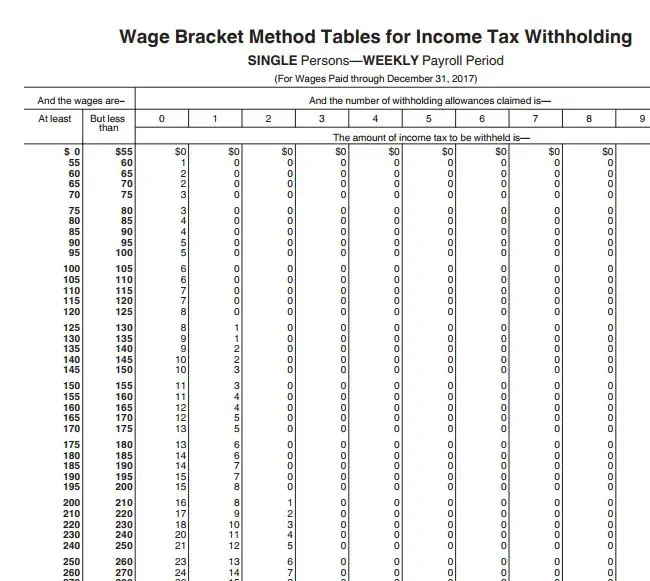

Federal Income Tax is calculated using the information from an employees completed W-4, their taxable wages, and their pay frequency. Based on Publication 15-T , Federal Income Tax Withholding Methods, you can use either the Wage Bracket Method or the Percentage Method to calculate FIT.

We will use the Percentage Method in our example, looking at tables found in the 2022 IRS Publication 15-T PDF file. You can open the file to follow our calculations below.

Using Worksheet 1 on page 5, we will determine how much federal income tax to withhold per pay period.

Step 1. Adjust the employees wage amount

1a) This is the same as gross wages: $2,083.33.

1b) Our employee is paid semi-monthly or 24 times per year.

1c) This should equal your employees annual salary: $2,083.33 x 24 = $50,000

Because we are using the 2019 W-4 form, we now skip to step 1j:

1j) Our employee has claimed 2 allowances

1k) $4,300 x 2 = $8,600

1l) $50,000 $8,600 = $41,400

To continue, you will need to refer to the tax tables on page 10:

Step 2: Figure the tentative withholding amount

2a) This amount is from line 1l, $41,400

2b) We are referring to the table labeled Single or Married Filing Separately on the left . Our employees adjusted annual wage amount is greater than $13,900 and less than $44,475. So, we would enter an amount of $13,900 .

2c) The amount in column C is $995.

2d) The percentage from column D is 12%.

2e) $41,400 $13,900 = $27,500

2f) $27,500 x 12% = $3,300

4a) $0

Choose Your Calculation Method

Once youve gathered all the W-4 and payroll information you need to calculate withholding tax, you need to choose a calculation method. There are two methods you can choose from:

- The Wage Bracket Method:The wage bracket method of calculating withholding tax is the simpler of the two methods. Youll use the IRS income tax withholding tables to find each employees wage range. The instructions and tables can be found in IRS Publication 15-T.

- The Percentage Method: The percentage method is more complex and instructions are also included in IRS Publication 15-T. The instructions are different based on whether you use an automated payroll system or a manual payroll system. The worksheet walks you through the calculation, including determining the employees wage amount, accounting for tax credits, and calculating the final amount to withhold.

Don’t Miss: How To Get Personal Tax Identification Number

When To Check Your Withholding:

- Early in the year

- When the tax law changes

- When you have life changes:

- Lifestyle – Marriage, divorce, birth or adoption of a child, home purchase, retirement, filing chapter 11 bankruptcy

- Wage income – You or your spouse start or stop working or start or stop a second job

- Taxable income not subject to withholding – Interest income, dividends, capital gains, self employment income, IRA distributions

- Adjustments to income – IRA deduction, student loan interest deduction, alimony expense

- Itemized deductions or tax credits – Medical expenses, taxes, interest expense, gifts to charity, dependent care expenses, education credit, child tax credit, earned income credit

Key Actions For Withholding Requirements

For withholding purposes, you need to get the employee’s:

- Total number of exemptions, and

- Any additional withholding amounts the employee requests to have withheld.

You should also withhold income from tips. Tips are considered part of an employee’s pay and must be taken into account when determining withholding. Employees must report tips from any one job totaling $20 or more in any given month to their employers by the 10th day of the following month. You should use this reported amount to calculate withholding by adding the reported tips to the employee’s pay.

Employees must report the above-listed information on a Form M-4 – Employee’s Withholding Exemption Certificate and claim the proper number of exemptions. Employees can change the number of their exemptions on Form M-4 by filing a new certificate at any time if the number of exemptions increases. If the number of exemptions , they need to file a new certificate within 10 days.

If an employee has more than one job, they may claim exemptions only with their principal employer. Employees who receive other income that is not withheld from can ask their principal employer to withhold extra taxes to cover the additional tax that will be due on that income.

Recommended Reading: How Does Withholding Tax Work

How Withholding Is Determined

The amount withheld depends on:

- The amount of income earned and

- Three types of information an employee gives to their employer on Form W4, Employee’s Withholding Allowance Certificate:

- Filing status: Either the single rate or the lower married rate.

- Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld.

- Additional withholding: An employee can request an additional amount to be withheld from each paycheck.

Note: Employees must specify a filing status and their number of withholding allowances on Form W4. They cannot specify only a dollar amount of withholding.

Employees Guide To Income Tax Withholding

When your employer drafts your paycheque, they automatically withhold your Employment Insurance premiums, Canada Pension Plan contributions, and income tax, and they remit those payments to the Canada Revenue Agency .

The CRA calculates CPP and EI payments in a fairly straightforward manner, applying a set percentage to a certain range of earnings. The formula applied to income tax, however, is more complex. In some cases, you may end up either owing money or receiving a refund due to the amount of income tax your employer has withheld. Its important to understand how it all works.

Read Also: How Does Property Tax Work

Everyone Should Check Withholding

The IRS recommends that everyone do a Paycheck Checkup in 2019. Though especially important for anyone with a 2018 tax bill, its also important for anyone whose refund is larger or smaller than expected. By changing withholding now, taxpayers can get the refund they want next year. For those who owe, boosting tax withholding in 2019 is the best way to head off a tax bill next year. In addition, taxpayers should always check their withholding when a major life event occurs or when their income changes.

Withholding Income Tax From Your Social Security Benefits

You can ask us to withhold federal taxes from your Social Security benefit payment when you first apply.

If you are already receiving benefits or if you want to change or stop your withholding, you’ll need a Form W-4V from the Internal Revenue Service .

You can or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V, Voluntary Withholding Request.

When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld. You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes.

Only these percentages can be withheld. Flat dollar amounts are not accepted.

Sign the form and return it to your local Social Security office by mail or in person.

Don’t Miss: How To Report Bitcoin Loss On Taxes

How To Calculate Taxes Taken Out Of A Paycheck

Calculations, however, are just one piece of the larger paycheck picture.

Step : Additional Fit Withholding

The last step in manually calculating FIT is to add any additional withholding to the FIT per pay amount.

- If an employee is using the new W-4, they would indicate this in Step 4c.

- If the employee is using the old W-4, they would indicate this in Line 6.

This amount is already in terms of each pay period, so theres no need to divide by the number of pay periods.

The extra withholding amount is simply added to the FIT per pay amount.

So for example, if Marthas FIT per pay is $236.44 and she wants an additional $20 per pay withheld, her FIT per pay would be $256.44.

Recommended Reading: What Happens If You Pay State Taxes Late

Step : Figure The Tax Withholding Amount

To recap from the previous page, the adjusted annual wages are $69,400.

Lets look at the tax table found on page 6 of IRS Pub 15-T.

Note there are actually six different tables on this page. The one you use depends on the employees filing status, the version of the W-4 they are using, and whether they have checked the multiple jobs box in Step 2 of their new W-4 . Since our example is using the new W-4 and has the Step 2 box unchecked, were going to use the middle table in the left column.

- Looking in the Single or Married Filing Separately table, the employees taxable wages of $69,400 fall between the range of $44,475 to $90,325 . See the highlighted row above.

- We can see in Column C, at least $4,664 in FIT needs withheld for the year. The $4,664 is a total of the following:

- 10% on wages between $3,950 and $13,900

- 12% on wages between $13,900 and $44,475

Here is what the worksheet would look like:

How To Calculate Your Social Security/medicare Withholding

The following guidance pertains to wagespaid on and after January 1, 2022.

To calculate the amount of Social Security and/or Medicare withheld from your paycheck, calculate your Taxable Gross: Gross Pay minus any Pre-TaxReductions for Social Security/Medicare.*

Then, determine your tax:

- Social Security is calculated at 6.2% of Taxable Gross up to $147,00.00. The maximum tax possible is $9,114.00.

- Medicare is calculated at 1.45% of Taxable Gross up to $200,000. Then, Medicare is calculated at 2.35% of Taxable Gross over $200,000 .

*Pre-Tax Reductions for Social Security/Medicare include pre-tax medical insurance, pre-tax dependent care , pre-tax Health Savings Account , pre-tax Medical Flexible Spending Arrangement , pre-tax Limited Purpose Flexible Spending Arrangement , and pre-tax parking.

You May Like: How Much Is Tax In Illinois

How Do I Determine Which Percentage To Elect

Every employee must consider the facts of their own situation and adjust their election accordingly.

If you want to keep your withholding approximately the same as last year, use last year’s federal Form W-2, or your last pay stub, to calculate which withholding percentage to elect. For example, if box 1 of federal Form W-2 shows $40,000 in wages and box 17 shows $1,000 in state income tax withheld, divide box 17 by box 1 to determine your percentage . To keep your withholding the same as last year, choose a withholding percentage of 1.8% and withhold an additional $10.77 per biweekly pay period . Be sure to take into account any amount already withheld for this year.

If you want to withhold more, choose one of the higher percentages or choose to have an additional amount withheld.

Note: Underwithholding can result in you owing tax and/or underpayment penalties when you le your Arizona return at the end of the year.

Income Tax Withholding Tables

2021 federal withholding tables are a bit different than they used to be. The IRS adjusts income threshold every year for inflation. That means the federal income withholding tables change every year, in addition to the tax brackets. These are the 2021 withholding tax table updates:

- Changes in tax rates and brackets

- New computational bridge for 2019 or earlier W-4s

- No withholding allowances on 2020 and later W-4s

- No personal exemptions still in effect

- Supplemental tax rate remains 22%

- Backup withholding rate remains 24%

There are also rate and bracket updates to the 2021 income tax withholding tables. The federal withholding tax table that you use will depend on the type of W-4 your employees filled out and whether you automate payroll. Employers have the option to use a computational bridge to treat 2019 or earlier W-4s as if they were 2020 or later W-4s, specifically for tax withholding purposes. If your employees filled out a 2020 or later W-4, it is important to note that they can no longer request adjustments to their withholding allowances. Instead, there is a standard withholding and a Form W-4, Step 2, Checkbox withholding section.

If youre unsure of which federal withholding tax table to use for an employee, here is an overview:

Read Also: How Can I Find Out Where My Tax Refund Is

Don’t Use This Tool If:

- You have a pension but not a job. Estimate your tax withholding with the new Form W-4P.

- You have nonresident alien status. Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens.

- Your tax situation is complex. This includes alternative minimum tax, long-term capital gains or qualified dividends. See Publication 505, Tax Withholding and Estimated Tax.

Federal Withholding Term Definitions

Before we get into calculations, lets define a couple of key terms related to federal withholding tax tables:

Gross pay: The full amount of your salary before deductions, withholdings, and contributions are taken out of it

Net pay: Your take-home pay, once deductions, withholdings, and contributions are removed from your gross pay

Withholdings: The amount taken out of an employees paycheck to pay their income taxes during that pay period

Deductions: The amount taken out of an employees paycheck to pay for specific benefits/donations the employee has chosen, such as retirement or health care

These are all common terms that have to do with withholding tax, so it is important to understand these definitions as an employer.

Read Also: What Is The Last Day To File Taxes In Texas

Estimate Your Tax Liability

Now that you know your projected withholding, the next step is to estimate how much youll owe in taxes for this year.

The IRS provides worksheets to walk you through the process, which is basically like completing a pretend tax return.

If youre married and filing jointly, for example, and your taxable income is around $107,000 for the 2021 tax year, that puts you in the 22% tax bracket. But you actually wont pay 22% on your entire income because the United States has a progressive tax system. After deductions, your tax liability, or what you owe in taxes, will be about $9,600.

Remember, federal taxes arent automatically deducted from self-employment income. If you have a side business or do freelance work, its especially important to factor that income into your tax equation to make sure you dont end up with a big tax bill at the end of the year.

Review The Employees W

Next, make sure you have the correct form. Youll need to refer to the employees Form W-4 to find the following information relevant to the withholding tax calculations, including their filing status, number of dependents, additional income information, and any additional amounts that the employee requests to be withheld.

Recommended Reading: How To File Taxes For Onlyfans

How To Calculate Withholding Tax: A Simple Payroll Guide For Small Business

Small businesses need to calculate withholding tax to know how much money they should take from employee paychecks to send to the Internal Revenue Service to cover tax payments.

Employers calculate withholding tax by referring to an employees Form W-4 and the IRSs income tax withholding table to determine how much federal income taxes they should withhold from the employees salary or wages.

There are two main methods small businesses can use to calculate federal withholding tax: the wage bracket method and the percentage method.

To calculate withholding tax, youll need the following information:

- Your employees W-4 forms

- The IRS income tax withholding tables and tax calculator for the current year

Small business owners should learn how to calculate withholding taxes to make sure employees are being taxed at the correct rate.

These topics take you through how to calculate withholding tax:

In this article, well cover:

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.