Direct Deposit Authorization Form

As an employer, you can pay your employees several different ways: paper check, direct deposit, prepaid debit card, or cash. Direct deposit is often the easiest and most secure way to deliver paychecks, which is why it is by far the most popular. In fact, more than 82% of US workers are now being paid by direct deposit.

An employee who chooses to be paid by direct deposit must fill out a direct deposit authorization form, complete with bank routing numbers and account numbers. The form acts as a permission slip for you to deposit the employees net pay electronically into their bank account.

As part of the verification process, many employers will ask for a voided blank check to confirm the accuracy of the bank account information provided by the employee.

Read Also: How To Find Property Tax Amount

Exemptions On Total Income Tax

- Section 87A Income below Rs. 5 lakh is eligible for a tax rebate of up to Rs. 12,500.

- Section 80C Rebate of up to Rs. 1.5 Lakh in any tax-saver fixed deposits, public provident funds, national savings certificate, unit-linked insurance plans, and equity-linked savings schemes on the interest income.

- Section 80CCD Tax exemption of up to Rs. 2 lakh for money deposited in the national pension system.

- Section 80D Up to Rs. 25,000 tax exemption on medical insurance premium bills. The limit rises to Rs. 50,000 for senior citizens.

- Section 80G Any donations made to charitable organizations is fully exempt from tax calculations.

- Section 80E Interest on education loan enjoys a 100% tax rebate for up to 8 years.

- Section 80TTA/80TTB Interest income from savings accounts is eligible for tax waivers up to Rs. 10,000. For senior citizens, all forms of interest income up to Rs. 50,000 are fully waivered from tax calculations, under Section 80TTB.

- Section 80GG Tax exemption on income spent towards paying house rent

Keeping all such expenditures in mind, individuals can use an online tax calculator available on the official website of Groww.

Apply The Income Tax Expense Formula

Once you have your total taxable income figure and the appropriate tax rate percentage, you can calculate your overall income tax expense. Input the appropriate numbers in this formula:

Taxable income x Tax rate = Income tax expense

For example, if your company had a total taxable income of $1 million and a tax rate of 20%, your income tax expense would be $200,000.

Recommended Reading: How Much Of My Paycheck Goes To Taxes

Maximum Taxable Income 2022

The Social Security Administration sets an annual maximum limit on the amount of any employees wages thats subject to the Social Security tax. This is called the contribution and benefit base, and it changes annually. For 2022, the maximum wage amount subject to Social Security tax is $147,000.

Theres no maximum taxable limit for Medicare tax, so you and the employee would continue to split the 2.9% tax on earnings over $147,000, even though those earnings wouldnt be subject to the Social Security tax.

The wage base subject to federal and state unemployment tax also changes annually. The amount of wages subject to FUTA and SUTA taxes is capped based on the wage base for each.

What Is Income Tax Expense

Income tax expense is a tax levied by the government on both individuals’ and businesses’ taxable income. Businesses usually list this figure on their annual income statement and use it to help determine overall company expenses and profits. As the name suggests, income tax expense only accounts for taxes related to income and not other assets like property. Those are taxed separately, if applicable, based on the state or local municipality’s taxation rules.

Related:

Read Also: Where Can I Find My Tax Return From Last Year

Mandated Withholdings By Law

The most commonly found deductions that are mandated by law include:

- Federal income tax withheld

- Local income tax withheld

Federal income tax withheld

Federal income tax is figured based upon information furnished by the employee on IRS Form W-4. From this form, the employer determines how to figure the employees tax withholding based upon the tax withholding tables provided by the Internal Revenue Service.

Employees should complete W-4s with care. The more people claimed as exemptions on the W-4, the smaller the amount of tax withholdings. This may look great on the paycheck, but it may look rather bleak on the W-2 form when tax time rolls around.

There are certain instances where an employee may qualify to be exempt from federal taxes, however there are strict parameters for qualification of exemption and it is strongly recommended that advice is sought from a tax professional or the IRS before claiming tax-exempt status.

Social Security tax withheld

At the time of this writing Federal Law mandates that 6.2% of an employees taxable wage must be withheld and paid to the government. To this, the employer is required to match the amount withheld from the employees taxable wage and pay to the government as well. This means that a total of 12.4% is paid for each employee.

Medicare tax withheld

Dont Miss: How Soon Can You File Taxes 2021

The Federal Tax Brackets And Rates For 2021

The federal tax brackets and rates are different marginal tax rates charged across the seven tax brackets. They are provided and updated by the International Revenue Service . To standardize them, IRS reviews them annually to account for inflation.

The table below shows the 2020/2021 federal income tax brackets across the four types of households:

How to Calculate the Marginal Tax Rate

When calculating the marginal tax rate, the lowest taxable income bracket is charged at the lowest marginal rate. The remaining taxable income fills the next bracket and is charged at the next marginal tax rate until it is exhausted in the maximum tax bracket.

One concern that many people have is the additional tax liability that arises when their income slides into the next tax bracket. The general misconception is that they will incur heavy taxes due to the higher tax rate. However, only the extra portion of income that slides into the upper tax bracket is taxed.

Practical Example 1

Continuing with the example of a total taxable income of $63,000, here is how to calculate Johns annual tax if he will be filing taxes for a single household.

According to the federal income tax and rates, with a taxable income of $63,000, Johns taxable income will fall within the tax bracket with an income of $85,525, which comes with a tax rate of 22%. It means his total tax liability will be $9,574.

Practical Example 2

Recommended Reading: How To Buy Tax Liens In Florida

How To Calculate Income Tax

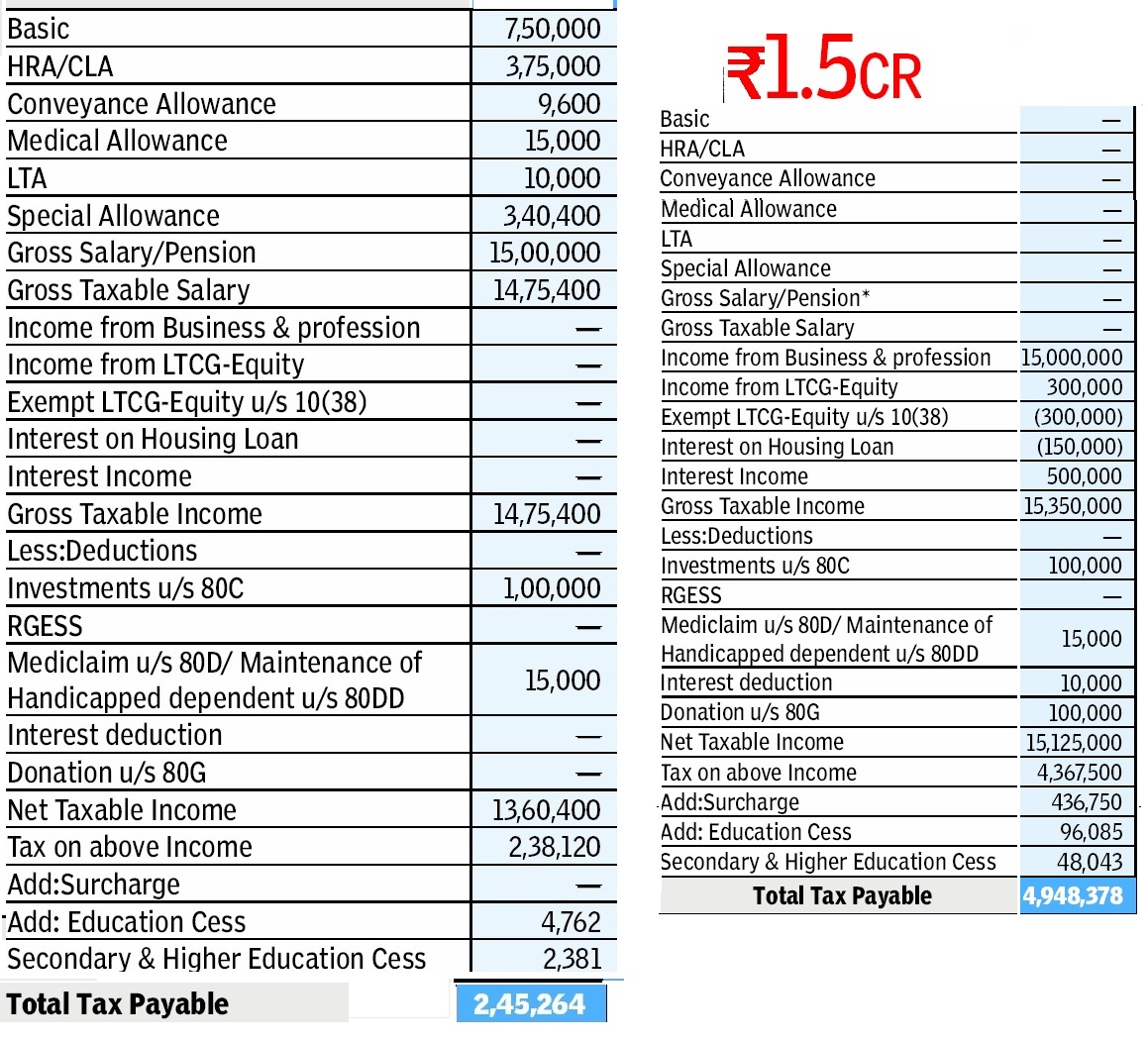

Income tax calculation for the Salaried

Income from salary is the sum of Basic salary + HRA + Special Allowance + Transport Allowance + any other allowance. Some components of your salary are exempt from tax, such as telephone bills reimbursement, leave travel allowance. If you receive HRA and live on rent, you can claim exemption on HRA. Calculate exempt portion of HRA, by using this HRA Calculator.

On top of these exemptions, a standard deduction of Rs 40,000 was introduced in budget 2018. This has been increased to Rs 50,000 in budget 2019.

In case you opt for the new tax regime, these exemptions will not be available to you.

Let’s understand income tax calculation under the current tax slabs and new tax slabs by way of an example. Neha receives a Basic Salary of Rs 1,00,000 per month. HRA of Rs 50,000. Special Allowance of Rs 21,000 per month. LTA of Rs 20,000 annually. Neha pays a rent of Rs 40,000 and lives in Delhi.

| Nature |

|---|

To calculate Income tax, include income from all sources. Include:

- Income from Salary

- Income from house property

- Income from capital gains

- Income from business/profession

- Income from other sources

| Nature |

|---|

| Rs 12,500 + Rs 25,500+ Rs 37,500 + Rs 50,000 + Rs 62,500 + Rs 1,77,600 + Rs 14,604 | Rs 3,79,704 |

What are the exemptions/ deductions that are disallowed under the new tax regime?

Individual or HUF opting for taxation under the newly inserted section 115BAC of the Act shall not be entitled to the following exemptions/deductions:

How Tax Brackets Work

The United States has a progressive tax system, meaning people with higher taxable incomes pay higher federal income tax rates.

-

Being “in” a tax bracket doesn’t mean you pay that federal income tax rate on everything you make. The progressive tax system means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

-

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

-

The percentage of your taxable income that you pay in taxes is called your effective tax rate. To determine effective tax rate, divide your total tax owed on Form 1040 by your total taxable income .

-

Example #1: Lets say youre a single filer with $32,000 in taxable income. That puts you in the 12% tax bracket in 2021. But do you pay 12% on all $32,000? No. Actually, you pay only 10% on the first $9,950 you pay 12% on the rest.

-

That’s the deal only for federal income taxes. Your state might have different brackets, a flat income tax or no income tax at all.

Recommended Reading: Where Can You File Taxes Online For Free

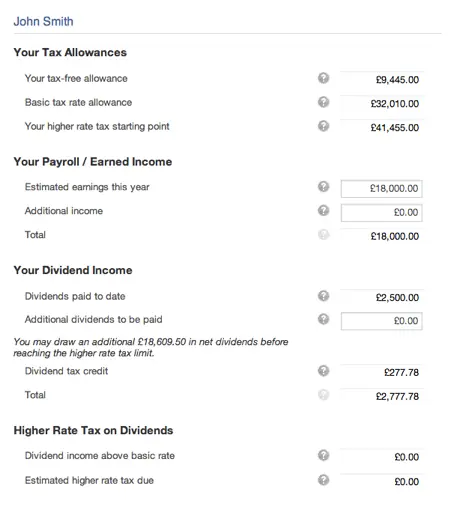

Understanding Your Tax Refund Results

Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. Because tax rules change from year to year, your tax refund might change even if your salary and deductions dont change. In other words, you might get different results for the 2021 tax year than you did for 2020. If your income changes or you change something about the way you do your taxes, its a good idea to take another look at our tax return calculator. For example, you might’ve decided to itemize your deductions rather than taking the standard deduction, or you could’ve adjusted the tax withholding for your paychecks at some point during the year. You can also use our free income tax calculator to figure out your total tax liability.

Using these calculators should provide a close estimate of your expected refund or liability, but it may vary a bit from what you ultimately pay or receive. Doing your taxes through a tax software or an accountant will ultimately be the only way to see your true tax refund and liability.

What Type Of Business Do You Have

If your business is a sole proprietorship or partnership, CCA entries are listed on Area A on page 5 of Form T2125 which is included with your T1 personal income tax return.

For incorporated businesses, CCA is entered on Schedule 8, which is part of the T2 corporate tax return.

The procedure of calculating CCA is the same for both forms. When you look at Area A/Schedule 8, you will see a table with eight different columns and a separate chart for Motor vehicle CCA.

To calculate CCA, list all the additional depreciable property your business has bought this year. Then, determine how much of the purchase cost of each property you can claim as an income tax deduction by assigning a CCA class to each type of property. Add these amounts up and apply the total to the CCA balance you may have carried over from last year .

Don’t Miss: Do You Pay Tax On Shipping

Paycheck Calculators To Estimate Your Pay

Here are some calculators that will help you analyze your paycheck and determine your take-home salary.

ADP Salary Payroll Calculator

Free salary reports covering virtually every occupation, as well as information on salary, benefits, negotiation, and human resources issues for U.S. and Canadian markets. Salary negotiation tips, small business solutions, and cost of living comparisons are also available.

Also Check: Efstatus.taxact 2014

How To Understand Income Tax Slabs

The Indian Income-tax works on the basis of a slab system and the tax is levied accordingly on individual taxpayers. Slab implies the different tax rates charged for different income ranges. In other words, the more your income, the more tax you have to pay. These income tax slabs are revised every year during the budget announcement. Again, These slab rates are segregated for different categories of taxpayers. As per the Income-tax of India, there are three categories of individual taxpayers such as:

- Individuals below 60 years of age including residents and non-residents

- Resident Senior citizens 60 to 80 years of age

- Resident Super senior citizens more than 80 years of age

You May Like: How To File Federal Taxes For Free

How Your Paycheck Works: Fica Withholding

In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act. Your FICA taxes are your contribution to the Social Security and Medicare programs that youll have access to when youre a senior. Its your way of paying into the system.

FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2022 is $147,000 . So for 2022, any income you earn above $147,000 doesnt have Social Security taxes withheld from it. It will still have Medicare taxes withheld, though.

There is no income limit on Medicare taxes. 1.45% of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1.45%. If you make more than a certain amount, you’ll be on the hook for an extra 0.9% in Medicare taxes. Here’s a breakdown of these amounts:

- $200,000 for single filers, heads of household and qualifying widows with dependent children

- $250,000 for married taxpayers filing jointly

- $125,000 for married taxpayers filing separately

How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. Its your employers responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

Don’t Miss: Why Do We Get Tax Refunds

How Do I Figure Tax Percentage From Total

To calculate the sales tax that is included in receipts from items subject to sales tax, divide the receipts by 1 + the sales tax rate. For example, if the sales tax rate is 6%, divide the total amount of receipts by 1.06. $255 divided by 1.06 = 240.57 (rounded up 14.43 = tax amount to report.

Concept Of Residence And Taxable Income

Residents

Persons having a domicile in Japan*1 and persons having a residence in Japan*2 for one year or more are termed residents. The worldwide income of residents, regardless of the location of the source of income, is subject to income tax.

Domicile as used in above refers to the principal base and center of ones life. Residence refers to a location in which an individual continually resides for a certain time but which does not qualify as a base and center of his/her life.

Non-permanent residents: Residents having no Japanese citizenship and having a domicile or residence in Japan for five years or less within the period of ten years are non-permanent residents. The scope of taxation for non-permanent residents corresponds to that for residents, but tax will not be assessed in Japan on income sourced outside Japan as long as that income is not paid within Japan or is not remitted to Japan. However, the salary paid based on the work in Japan is applicable to domestic-sourced income even if it is paid outside Japan, and income tax will be assessed summing the salary paid within and outside Japan.

| Type of residence / Category of income | Income other than foreign-sourced income | Foreign-sourced income |

|---|

The tax rates for self-assessed income tax on individual income are as shown below.

| Brackets of taxable income |

|---|

| 45% |

You May Like: How Do Tax Returns Work